Contacts

Petroseychelles

1st Floor, Seypec Building

New Port, Victoria

Mahe

Seychelles

Tel: (248) 4324422

Petroseychelles

1st Floor, Seypec Building

New Port, Victoria

Mahe

Seychelles

Tel: (248) 4324422

In 1984 the Seychelles Government established a national oil company, currently PetroSeychelles, to strengthen its capabilities to deal with exploration and other activities related to the development of the petroleum potential of the State.

The main policy objectives are to promote petroleum exploration in Seychelles EEZ by putting in place fiscal and regulatory incentives that will attract oil companies, expedite exploration and have an early commercial discovery. A discovery will provide the country with its indigenous energy source and as the population is small only a small quantity of the hydrocarbon produced will end up in domestic consumption. The international oil company will have the large balance for export.

Promoting interest in petroleum exploration among the international oil companies will be at the highest level of priority of the policy objectives. In order to meet the policy objectives, Government created a national oil company, PetroSeychelles, to implement the petroleum policy and strengthen Government capabilities in dealing with the exploration for, the exploitation of, or other activities related to enhancing the value of the petroleum resources in Seychelles.

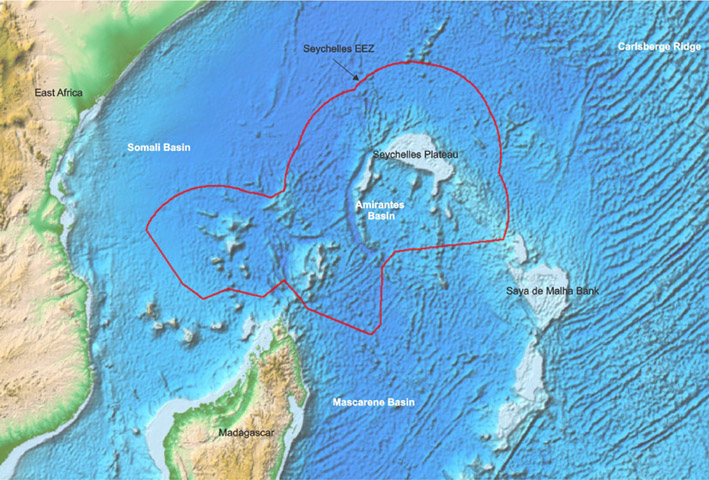

The Seychelles lies just south of the Equator in the Southwest Indian Ocean and at the northwestern part of the “boomerang” shaped Mascarene Ridge. It comprises over 115 islands of a total land area of 445 sq. km spread in an Exclusive Economic Zone (EEZ) of approximately 1.33 million sq.km.

Economic & Fiscal

Seychelles operates under concession type contracts as opposed to Production Sharing types of agreement common in neighbouring countries.

The economic and fiscal package comprises three principal revenue sharing mechanisms and these are summarized below:

Royalty

Petroleum Income Tax

Petroleum Additional Profits Tax (PAPT)

PAPT is a resource rent tax levied on cash flows. Currently the Model Petroleum Agreement provides for a two-tier structure for PAPT. The first tier of PAPT will become due once the Company has earned a particular threshold rate of return on its investment. The second tier of PAPT will be due after the company has earned an even higher post-tax rate of return.

PAPT is ring fenced field by field, and is calculated on cash flows denominated in US dollars.

The two threshold rates of return which trigger payment of the PAPT, as well as the rates of the taxes payable are as follows

Tier 1: Rate of 25% when ROR 15% is achieved

Tier 2: is negotiable at the time of negotiations of the Petroleum Agreement and companies can submit their Tax Rates and ROR in the proposal.

The Seychelles Revenue Commission (SRC) is the local body that will audit and collect tax revenues on hydrocarbon production and they operate on a self assessment principle.

Seychelles Blocks Licensing Scheme

The new blocks licensing system in operation in the Seychelles has been termed “Open File” system. Under this scheme, companies may submit proposals for open areas on a first come first served basis.

Upon receipt of a proposal PetroSeychelles and its partners in Government will undertake due diligence to verify that the company is technically and financially competent to undertake the work program proposed. This will be followed by publication of the intent to allow other interested companies to submit competing proposals, for the same area, within a 90 day period. All proposals received will then be evaluated and the selected company will be invited to negotiate a Petroleum Agreement.

KEYFACT Energy

KEYFACT Energy