Opportunity Highlights

Petro Australis Energy Limited (PAE), a private Australian company, has been operating in Cuba since 2018, working to identify, develop, and produce oil fields in the central region of the country.

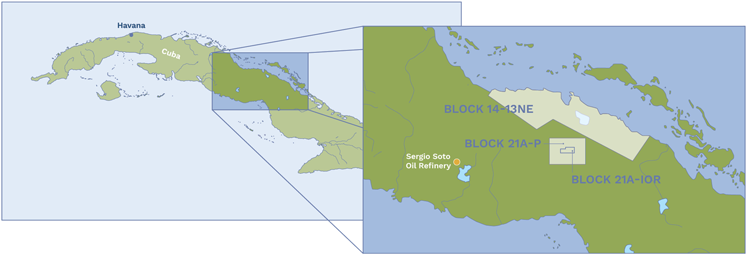

PAE is the operator with 100% WI in three onshore Cuban blocks: 21A-IOR (Incremental Oil Recovery), 21A-P, and 14/13NE. Blocks 21A-IOR and 21A-P are in the northern part of the Central Basin, and Block 14/13NE on the north coast.

Block 21A-IOR encompasses the Pina and Brujo fields over a 14.6 sq km area. Pina, characterised by medium to light oil quality (up to 40°API) as shallow as 650m below ground level and with a known oil column below of over a kilometre, is only partly, and very poorly developed. Last drilled in 2001, PAE has identified a further 151 low-risk undrilled well locations which provide a large growth opportunity via full-field development of up to 200 million barrels targeting production of 30,000 BOPD and yielding US$270 million cash flow per annum.

PAE is initially seeking investors to complete the import of drilling and completion equipment to enable the drilling, completion and tie-in of the first five production wells, deploying its own established operations crew, to deliver self-funded continuous drilling capability thereafter.

These are low-cost simple wells (US$2.5 million each) with production tied into existing infrastructure within eight weeks of spud.

This opportunity offers immediate access to production with up to 50% equity available through a staged farm-in.

In addition to this immediate production ramp-up opportunity, significant exploration upside has been identified within the surrounding PAE operated Block 21A-P PSC. Encompassing an area of 448 sq km as well as three additional shallow discoveries, the block contains the Pina Deep prospect; two large stacked thrusted carbonate sheets with certified mean Prospective Resources of almost 400 million barrels of oil.

Pina Project

Pina was discovered by Cupet in 1990, brought on stream in November 1990, and achieved peak oil rate in September 1995 at over 4,300 BOPD. The last well was drilled in 2001 and production from the part of the field drilled by Cupet has since fallen to ~200 BOPD.

The Pina Field includes two proven oil-producing formations, the volcanic Tuff, and the immediately underlying but much larger and less well developed Efusivos.

- Tuff reservoir - estimated 436 million barrels STOIIP (ERCE mean case)

- Efusivos reservoir - estimated 2 billion barrels STOIIP (ERCE mean case)

- Less than half the field, and only at the shallowest level, historically developed (and with very poor practices)

- ~ only 9 milllion barrels produced to date (~2% recovery)

- API gravity ranges from 12° to 41°

- >1000m of vertical meters of oil column

- Porosity 5-30%

- Perm range from fractions to 10s of mD

- Highly naturally fractured

PAE owns and operates a fracking spread in-country, with over 70,000 hours of safe operations already performed by its experienced Canadian operations team. This crew will manage the drilling, fracking, completion and tie-in of the first wells to be drilled in over 20 years - new wells targeting both the Tuff and Efusivos reservoirs.

In the mid-1990s, a small subset of 15 of the 77 Pina wells was fracked and field production markedly increased from 500 to 4,300 BOPD. Further, recent fracking by PAE of some of the existing, though now highly depleted, wells also resulted in significant flow rate increases per well. These operations confirmed the essential requirement for both modern drilling and fracking practices to properly develop the Pina Field at both the Tuff and Efusivos levels.

From the Tuff reservoir alone, ERCE estimates Technically Recoverable Resource of 182,000 barrels/well (mid-case) and an initial flow rate of 255 BOPD/well from the first ten planned wells. The much larger and immediately underlying Efusivos reservoir (proven to flow and tagged by some 50 wells) and which PAE intends to drill and complete along with the Tuff, has the capacity to potentially triple this outcome per well.

Including a risked type curve for the Efusivos reservoir, PAE estimates there is potential for a full-field development of up to 200 million barrels targeting production of 30,000 BOPD through phased development in as little as 3 years.

Pina Deep

Within the 21A-P PSC, two fractured carbonate prospects exist directly below the Block 21A-IOR area at more conventional depths of 2,500 and 3,500m. These carbonates are of Cretaceous age, and regional reservoir analogues include the shallow water Varadero oil field (11 billion barrels in place) and Melbana’s onshore Alameda discovery.

ERCE has certified 391 million barrels of Mean Unrisked Prospective Resources in the two stacked targets.

The Proposed Trade

- The proposed trade for participation in Block 21A-IOR is:

- A first investment tranche of US$25 million allocated (i) to the purchase of drilling and completion equipment, transportation to Cuba, and (ii) the balance to the drilling, completion and tie-in of five production wells to earn 30% participation.

- A second optional tranche is for US$25 million for the drilling of 10 additional production wells to earn an additional 20% participation.

The total targeted investment under this agreement is US$50 million to earn 50% participation in 21A-IOR.

The proposed trade for patricipation in Block 21A-P, the Pina Deep exploration play, requires the farminee to fund 80% of the drilling and testing of one exploration well to earn 50% equity. Estimated investment cost to the farminee is US$13 million.

Participation in Block 14/13NE is subject to a mutual investment agreement.

The cumulative targeted investment defined above is US$63 million, to earn 50% in Block 21A-IOR and 50% in Block 21A-P.

Licence Terms

Block 21A-IOR PSC was awarded to PAE in October 2018 and is in effect for a 25-year period. The contract is currently in the exploitation period, whereby approved expenditure is cost-recovered against incremental production that results from PAE’s work programmes.

Block 21A-P surrounding Block 21A-IOR, was awarded to PAE in October 2018, and is in effect for a 25-year period. The contract is currently in the second exploration sub-period with a commitment to drill a shallow, Tuff exploration well before May 2024. PAE and CUPET have agreed the second exploration sub-period will be extended to May 2025 and are currently formalising this agreement.

Block 14/13NE was signed on 23 October 2020 and is in the first exploration sub-period. The PSC allows for a 30-year development period for oil and 35 year development period for gas. Current commitments to be completed before October 2023 include reprocessing and interpretation of 192 km of 2D seismic data.

Data Room & Timing

Petro Australis invites expressions of interest from a suitably qualified company, or group of companies. Potential farminees will be granted access to a VDR upon signing of a Confidentiality Agreement. Parties executing a CA will be invited to an online Management Presentation. Workstation projects will be made available for review in a physical data room upon request by potential farminees.

Contact

If you would like more details and visit the dataroom please get in touch with Moyes & Co.

Ian Cross, MD, Moyes

icross@moyesco.com l +44 7398 815690

KeyFacts Energy Industry Directory: Moyes & Co

KEYFACT Energy

KEYFACT Energy