WTI (Mar) $76.78 -$1.23, Brent (Mar) $82.40 -$1.15, Diff -$5.62 -8c

USNG (Mar)* $2.05 -44c, UKNG (Feb) 69.50p +0.5p, TTF (Mar)* €28.47 +€0.32

*Denotes expiry of February contract

Oil price

A bit of profit taking yesterday after a bit more than 5 bucks in the last few days, probably ahead of the Opec meeting later in the week but the Middle East situation hasn’t gone away believe me. News that the three soldiers who died in Jordan was alleged to have been in a US logistics centre used for military ops won’t help the Democrats back at home but what do expect with a Middle East policy and an oil policy that is a total shambles…?

Diversified Energy Company

Diversified has announced it is trading in line with expectations and provides the following update on its business activity for the year ended December 31, 2023.

Delivering Reliable Results

- 2023 average net daily production: 821 MMcfepd (136.8 Mboepd)

- 4Q 2023 average production of 777 MMcfepd (129.5 Mboepd)

- December 2023 exit rate production of 775 MMcfepd (129.2 Mboepd)

- Maintained peer-leading consolidated corporate production decline rate of ~10%(a)

- Marketed 100% of our produced natural gas with our internal marketing team, utilizing industry delivery, settlement, compliance, and confirmation standards while providing improved margins

- Estimated Adjusted EBITDA(b) of $540 to $545 million

- Adjusted Operating Cost per Unit of $1.69/Mcfe ($10.14/Boe)(c) down 3% versus FY22

- Adjusted EBITDA Margin(d) of 51%

- Free Cash Flow Yield of ~21%(e), including the impact of working capital changes

- Declared Q3 2023 dividend of $0.875 per share (adjusted for 20 for 1 share consolidation), payment date of March 28, 2024

Executing Strategic Objectives

- Completed ~$240 million in liquidity and value-enhancing divestitures at accretive multiples(f)

- Reduced debt outstanding by ~15% (~$233 million) versus 2023 Interim (Q2) results

- Fall borrowing base redetermination resulted in $50 million increase to $435 million

- 100% approval from 14-bank lending syndicate

- $305 million adjusted borrowing base to reflect recently announced $200 million asset sale

- Maintained leverage ratio of 2.4x(g)

- Current Liquidity of ~$135 million

- Increase of 31% ($32 million) versus 2023 Interim (Q2) results

- Commenced trading on the New York Stock Exchange, expanding access to US investors and improving trading liquidity

- Affirmation by Fitch of all five ABS rated notes as BBB or higher (Investment Grade)

Creating Value Through Stewardship

- Won ESG Report of the Year from ESG Awards 2023

- Awarded Oil & Gas Methane Partnership 2.0 (OGMP) Gold rating for the second year

- Increased MSCI sustainability rating to AA leadership status

- Conducted over 246,000 leak detection surveys using industry-leading and proven detection equipment, attaining a zero emissions rate of 97.75%, proving the positive impacts of our commitment to eliminate methane leaks

- Completed leak detection surveys for 100% of Central Region upstream assets and continued leak detection surveys for all Appalachian upstream assets

- Continued proactive, voluntary leak detection program for Appalachian midstream assets using industry-leading and proven aerial LiDAR from Bridger Photonics

- Retired a total of 384 wells through the Company’s Next LVL asset retirement business

- Achieved goal of retiring 200 Diversified wells in 2023; significantly exceeding state agreements

- Retired 184 wells for outside parties, including 148 for state and federal orphan well programs

- Generated revenues from third-party well retirement projects to offset the Company’s internal well retirement costs

Commenting on the results, CEO Rusty Hutson, Jr. said:

“I am pleased to report our strategic progress and solid financial performance for Diversified, highlighting, once again, the consistency and resilience of our strategy and business model. This resilience has allowed us to maintain our peer-leading production decline rate, and our continued focus on operational efficiencies delivered 51% margins, resulting in meaningful cash flow generation. Despite a challenging commodity price environment, we generated strong full year results, including growing EBITDA to a record level that exceeded consensus expectations.

“Throughout the year, we have continued to focus our strategic initiatives on cash flow generation, capital discipline, and balance sheet management. Continued investment in our asset base resulted in substantial emissions reduction and operational efficiency gains. We continue to evaluate opportunities to successfully execute our growth and return of capital strategies moving forward, as highlighted by our successful listing on the New York Stock Exchange – a key milestone that will deliver future value.

“Next LVL Energy, our asset retirement team, completed its first full year of operations and successfully delivered on its strategic and financial objectives. I am very proud of the significant investments we have made to lower our methane intensity, and I am confident that we will deliver continued improvements that we will highlight in our formal year-end reports.

“Our dedicated employees are key to the Company’s success, and I would like to thank all our teams, subcontractors, lenders, and other partners for their continued work and dedication to benefit our communities and our shareholders. We remain confident in our business strategy and are proud of our position within the energy industry and the important part we are playing in responsibly providing the energy demands for our communities, our country, and the world. Diversified continues to grow as a solutions-based business, making it the Right Company at the Right Time.”

Given the state of the market in DEC in recent weeks this is exactly the correct response, a very solid statement with numbers that beat the whisper pretty much and more importantly provided solid reassurance to very patient shareholders.

Production of 136.8 boe/d with industry beating 10% decline rate meant that 2023 turned out very well and met or beat expectations across the board. EBITDA margin at 51% was up two points, boosting cash flow which is impressive and with prices up a tad and costs down again, against some expectations this is a fantastic result.

With disposals reducing debt, the recent one at a very high multiple indeed, helped considerably so RBL and ongoing debt is being paid down. I am confident that this will carry on and they will keep delivering the goods and beating their peers through 2024.

I also like the success of the Next LVL Energy asset retirement team which has completed its first full year of operations and successfully delivered on its strategic and financial objectives. Lot’s of pluses on lowering methane intensity and emission reductions and well retirements all join up to make for a ‘strong ESG message’.

To round up I am delighted to see DEC do a bit of kicking of its own and has come out fighting in the only way possible, by delivering the goods – again. And what is more I am expecting more of the same in 2024, more action across the board to enhance liquidity, taking advantage of opportunities and hence creating growth for the company and hence the shareholders, with innovative ways of funding M&A activities.

Operations and Finance Update

Production

The Company delivered 2023 average net daily production of 821 MMcfepd (136.8 Mboepd), a record for average annual production and 1% greater than the 2022 average (811 MMcfepd; 135.2 Mboepd). In 2023, Diversified maintained a peer-leading, consistent and resilient production decline profile of ~10%(a), as measured from 4Q22 to 4Q23, adjusted to exclude the effect of intraperiod acquisitions or divestitures. Legacy Appalachia assets continue to produce at a reliable level, with natural declines in this region of approximately 5% annually. Across our operating footprint, the Smarter Asset Management (“SAM”) approach continues to provide opportunities to improve current production profiles, drive efficiency gains, and extend well life. The Company exited the year with December 2023 average daily production of 775 MMcfepd (129.2 Mboepd).

Margin and Total Cash Expenses per Unit

Adjusted EBITDA Margins(d) of 51% (41% unhedged) represent Diversified’s 6th consecutive annual period with margins of ~50% or more, again demonstrating Diversified’s resilient cash flow profile throughout commodity price cycles. During the year, Adjusted EBITDA Margins benefited from the continued strategic application of the Company’s robust hedging strategy, combined with the impact of diligent expense control measures and price-linked reductions in certain third-party gathering and transportation costs and production taxes.

|

FY23 |

|

FY22 |

|

|

||||||

|

|

|

$/Mcfe |

|

$/Boe |

|

$/Mcfe |

|

$/Boe |

|

% |

|

Average Realized Price1 |

|

$ 3.48 |

|

$ 20.87 |

|

$ 3.43 |

|

$ 20.60 |

|

2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Operating Cost per Unit(c) |

|

FY23 |

|

FY22 |

|

|

||||

|

|

|

$/Mcfe |

|

$/Boe |

|

$/Mcfe |

|

$/Boe |

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease Operating Expense2 |

|

$ 0.64 |

|

$ 3.84 |

|

$ 0.59 |

|

$ 3.51 |

|

9% |

|

Midstream Expense |

|

0.23 |

|

1.40 |

|

0.24 |

|

1.44 |

|

(3)% |

|

Gathering and Transportation |

|

0.32 |

|

1.93 |

|

0.40 |

|

2.39 |

|

(19% |

|

Production Taxes |

|

0.21 |

|

1.23 |

|

0.25 |

|

1.50 |

|

(18)% |

|

Total Operating Expense2 |

|

$ 1.40 |

|

$ 8.40 |

|

$ 1.47 |

|

$ 8.84 |

|

(5)% |

|

Employees, Administrative Costs and Professional Fees(h) |

|

0.29 |

|

1.74 |

|

0.26 |

|

1.56 |

|

12% |

|

Adjusted Operating Cost per Unit2 |

|

$ 1.69 |

|

$ 10.14 |

|

$ 1.73 |

|

$ 10.40 |

|

(3)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA Margin(d) |

|

51% |

|

49% |

||||||

1 FY23 excludes $0.09/Mcfe ($0.57/Boe) and FY22 excludes $0.03/Mcfe ($0.19/Boe) of other revenues generated by Next LVL Energy; includes the impact of other revenue and gain on land sales during the respective periods

2 FY23 excludes $0.07/Mcfe ($0.43/Boe) and FY22 excludes $0.03/Mcfe ($0.20/Boe) of expenses attributable to Next LVL Energy

Results of Hedging and Current Financial Derivatives Portfolio

Diversified ended 2023 with an annual average realized price of $3.48/Mcf, 27% higher than the average settled price for NYMEX Henry Hub during the year(i), demonstrating the benefit of the Company’s hedging strategy in mitigating the impact of the commodity price environment during the year. Having proactively established its 2024 hedge portfolio with a weighted average floor price of ~10% higher ($3.09/MMBtu) than the current strip(j), Diversified continues to focus on layering additional hedges to 2025 and beyond, where forward natural gas prices remain strong.

GULFSANDS PETROLEUM

This month marks another sobering milestone for the Syrian people and for Gulfsands.

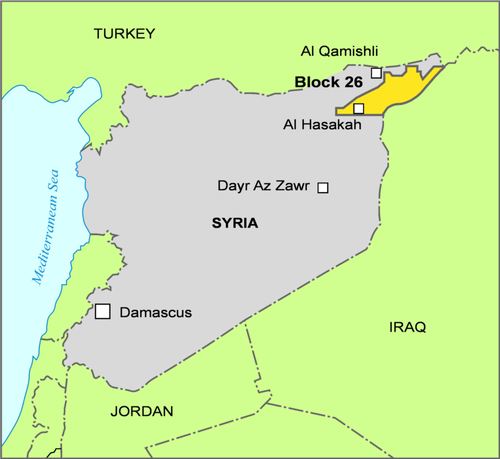

It is now seven years since Gulfsands was informed that its Block 26 fields in North-East Syria, currently under force majeure in order to comply with UK sanctions, had been returned to significant and regular production – unlawfully.

Map source: KeyFacts Energy

It is now common knowledge that the perpetrators of this illicit production were, and continue to be, entities affiliated with the Autonomous Administration of North and East Syria (the “AANES”), Peoples Defence Unit (“YPG”), Syrian Democratic Forces (“SDF”) and Syrian Democratic Council (“SDC”).

We call on this unlawful production to stop immediately.

Since 2017, over 47 million barrels of oil have been unlawfully produced with a value of over US$3.3 billion(*). In the last year alone, we estimate that approximately 5.8 million barrels of oil have been unlawfully produced with a value in the region of US$480 million (at the average 2023 Brent oil price of $82.5 per barrel). The illicit production and ongoing losses continue to be monitored and measured at www.gulfsands.com.

This illicit production from Gulfsands’ Block 26 continues at a rate of approximately 20,000 barrels of oil equivalent per day (“boepd”), but this is just a small portion of the total theft in the northeast region of Syria. It is widely reported that production in North-East Syria is currently estimated to be around four times this amount, at around 80,000 barrels of oil per day (worth over US$6 million per day at today’s oil prices).

The Syrian people, however, see the benefits of only a small proportion of this value. The unlawful oil trade takes place on the black market, away from regulation and oversight, meaning prices are depressed and the potential for corruption is high. The biggest beneficiaries of this illegal production are illicit actors – not the Syrian people.

This also leads to unsafe, unregulated, and hugely environmentally damaging oil field practices which have a catastrophic effect on the health of local communities.

Examples of Environmental Devastation from Unsophisticated Oil Field Practices

The United Nations’ OCHA reports that 16.7 million Syrians are currently in need of humanitarian aid, up from 15.3 million in 2023. The agency also reports that 90% of Syrians now live below the poverty line. 2023’s UN humanitarian appeal for Syria sought US$5.4 billion – the world’s largest such appeal – but only 33% of this has been funded, leaving a shortfall of US$3.62 billion.

The international community has not formally recognised or taken action against this illicit production and this oversight is costing Syria – profits from its national resource endowment could be used to help fill the funding gap in aid. Furthermore, the actions of illicit actors in unlawfully extracting and selling this oil contravenes international law, sanctions and the principles of UNSCR 2254

Project Hope

There is a desperate need for humanitarian and early recovery assistance in Syria.

The devastating earthquakes in early 2023 have only made the situation more acute, as shown in the statistics above.

Gulfsands continues to advocate for a humanitarian and economic stimulus initiative which would pave the way for international energy companies (which have all declared force majeure as result of international sanctions) to return to operations in North-East Syria, with allocated revenues from oil sales disbursed to finance early recovery, humanitarian, economic (including youth employment) and security projects across the country. This initiative is designed to be in line with UNSCR 2254 and to allow all Syrian people to benefit from their country’s national resource endowment to build self-sustainability and resilience for the future, and contribute to the counter terrorism effort in Syria.

We call this initiative Project Hope.

With investment and expertise, we estimate that production in North-East Syria could be increased from 80,000 boepd to around 500,000 boepd and generate in the region of US$15-20 billion per annum. This dwarfs the UN Humanitarian Aid funding shortfall for 2023, and the total funding contributed by the UK’s FCDO to Syria since the crisis began in 2012, (this figure stood at £3.8 billion in September 2022 according to “UKAid Syria Crisis Response Summary – February 2023” and is estimated to be around £4 billion as of today).

Gulfsands continues to work with partners in the international community to raise the profile of this issue and generate support for Project Hope.

Today, Gulfsands reminds us, as it does every January, about the vast quantities of oil that are being unlawfully and unsafely produced in Northeast Syria, with minimal benefit to the Syrian People.

John Bell, Gulfsands’ Managing Director has been, a stalwart supporter, even driver behind this wonderful project for many years. He has always kept me in touch and I am happy to cover the situation at Project Hope.

They report that another US$480m of value has been lost during 2023, taking the total since 2017 to over $3.3 bn. One wonders what good this money could have done, had it been channelled appropriately.

Gulfsands also highlights the environmental devastation caused by the unsophisticated, unsafe and unregulated oil field practices being employed, and the catastrophic effect this has on the health of local communities.

Gulfsands, proposes an alternative approach, Project Hope, where international energy companies (which have all declared force majeure as result of international sanctions) are allowed to return to operations in Northeast Syria, with allocated revenues from oil sales disbursed to finance early recovery, humanitarian and economic stimulus projects across the country.

I believe that this innovative initiative is worthy of attention.

This illicit production from Gulfsands’ Block 26 continues at a rate of approximately 20,000 barrels of oil equivalent per day (“boepd”), but this is just a small portion of the total theft in the northeast region of Syria. It is widely reported that production in North-East Syria is currently estimated to be around four times this amount, at around 80,000 barrels of oil per day (worth over US$6 million per day at today’s oil prices).

The Syrian people, however, see the benefits of only a small proportion of this value. The unlawful oil trade takes place on the black market, away from regulation and oversight, meaning prices are depressed and the potential for corruption is high. The biggest beneficiaries of this illegal production are illicit actors – not the Syrian people.

This also leads to unsafe, unregulated, and hugely environmentally damaging oil field practices which have a catastrophic effect on the health of local communities.

Examples of Environmental Devastation from Unsophisticated Oil Field Practices

The United Nations’ OCHA reports that 16.7 million Syrians are currently in need of humanitarian aid, up from 15.3 million in 2023. The agency also reports that 90% of Syrians now live below the poverty line. 2023’s UN humanitarian appeal for Syria sought US$5.4 billion – the world’s largest such appeal – but only 33% of this has been funded, leaving a shortfall of US$3.62 billion.

The international community has not formally recognised or taken action against this illicit production and this oversight is costing Syria – profits from its national resource endowment could be used to help fill the funding gap in aid. Furthermore, the actions of illicit actors in unlawfully extracting and selling this oil contravenes international law, sanctions and the principles of UNSCR 2254

Project Hope

There is a desperate need for humanitarian and early recovery assistance in Syria.

The devastating earthquakes in early 2023 have only made the situation more acute, as shown in the statistics above.

Gulfsands continues to advocate for a humanitarian and economic stimulus initiative which would pave the way for international energy companies (which have all declared force majeure as result of international sanctions) to return to operations in North-East Syria, with allocated revenues from oil sales disbursed to finance early recovery, humanitarian, economic (including youth employment) and security projects across the country. This initiative is designed to be in line with UNSCR 2254 and to allow all Syrian people to benefit from their country’s national resource endowment to build self-sustainability and resilience for the future, and contribute to the counter terrorism effort in Syria.

We call this initiative Project Hope.

With investment and expertise, we estimate that production in North-East Syria could be increased from 80,000 boepd to around 500,000 boepd and generate in the region of US$15-20 billion per annum. This dwarfs the UN Humanitarian Aid funding shortfall for 2023, and the total funding contributed by the UK’s FCDO to Syria since the crisis began in 2012, (this figure stood at £3.8 billion in September 2022 according to “UKAid Syria Crisis Response Summary – February 2023” and is estimated to be around £4 billion as of today).

Gulfsands continues to work with partners in the international community to raise the profile of this issue and generate support for Project Hope.

Today, Gulfsands reminds us, as it does every January, about the vast quantities of oil that are being unlawfully and unsafely produced in Northeast Syria, with minimal benefit to the Syrian People.

John Bell, Gulfsands’ Managing Director has been, a stalwart supporter, even driver behind this wonderful project for many years. He has always kept me in touch and I am happy to cover the situation at Project Hope.

They report that another US$480m of value has been lost during 2023, taking the total since 2017 to over $3.3 bn. One wonders what good this money could have done, had it been channelled appropriately.

Gulfsands also highlights the environmental devastation caused by the unsophisticated, unsafe and unregulated oil field practices being employed, and the catastrophic effect this has on the health of local communities.

Gulfsands, proposes an alternative approach, Project Hope, where international energy companies (which have all declared force majeure as result of international sanctions) are allowed to return to operations in Northeast Syria, with allocated revenues from oil sales disbursed to finance early recovery, humanitarian and economic stimulus projects across the country.

I believe that this innovative initiative is worthy of attention.

KeyFacts Energy Industry Directory: Malcy's Blog

KEYFACT Energy

KEYFACT Energy