By Kathryn Porter, Watt-Logic

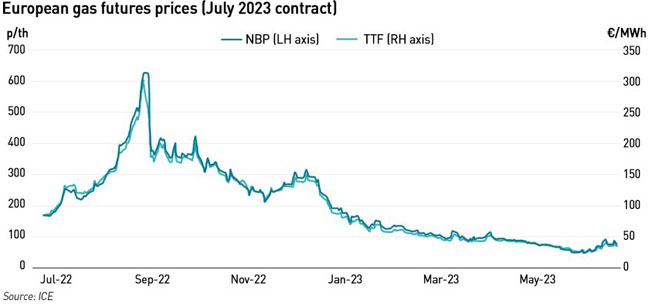

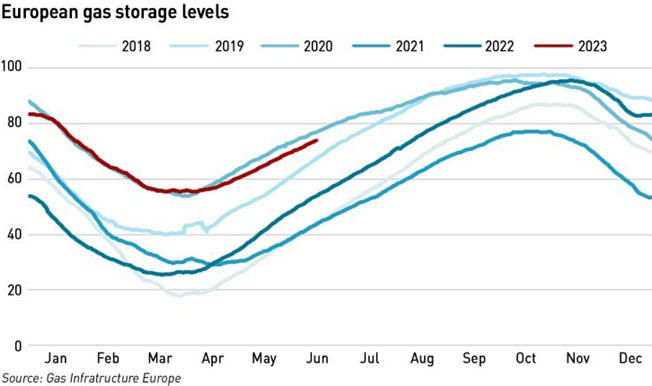

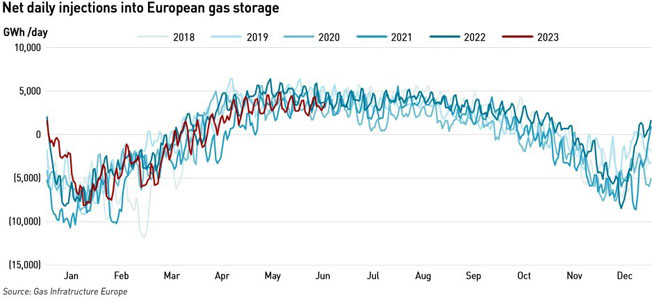

The past couple of weeks have seen unusually high levels of gas price volatility across European gas markets. Prices have declined significantly from their highs last August, and the market has coped well with the dramatic reduction in Russian pipeline gas coming into Europe, securing a large increase in LNG imports through the rapid deployment of new re-gas capacity. Gas inventories are comfortable for the time of year, although injections have slowed recently.

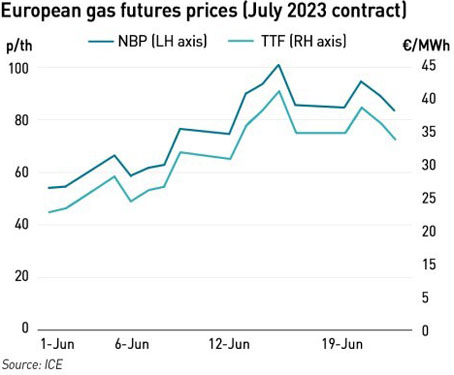

From the beginning of June, the long decline in prices since mid-December, began to reverse, with prices slowly starting to rise. However, the real drama started on 12 June when TTF declined to €31.036 /MWh due to strong Norwegian flows and higher LNG sendout ahead of the arrival of additional cargoes. On 13 June, the heatwave in Europe got underway, and the market became aware that key Norwegian infrastructure would be out of action for longer than expected causing prices to jump.

Maintenance outages at the Ormen Lange and Aasta Hasteen fields and the Nyhamma gas processing plant were extended by almost a month to 15 July, with a total affected output of 129.8 mcm/day. According to ICIS, over 100 mcm/day of Norwegian capacity would remain offline until 4 July, and close to 90 mcm/day until 15 July. Three LNG cargoes are expected into Dutch terminals by the end of the month with a further cargo expected at Gate on 1 July. Over the same period last year only one cargo was delivered.

Prices rose again on 14 June, jumping by more than 28% by mid-day on 15 June, following unconfirmed reports that the Groningen gas field was to be permanently closed in October 2023. The Dutch cabinet is expected to make an official decision on the closure later this month.

The closure had previously been planned by October of next year depending on the geopolitical situation, but there has been political pressure due to the earthquakes caused by extracting gas from the declining field.

TTF closed at €41.145 /MWh on 15 June, but corrected the following day, with the front month contract falling by 20% to close at €35.008 /MWh. Traders told journalists that the market was still overvalued with further reductions expected, and indeed, prices fell again, ending last week at €32.507 /MWh.

But it sems the drama may not be over: TTF opened at €34.250 /MWh this morning, and traded up to almost €37 /MWh although it has since given up its gains since the open, and fallen back to €32.890 /MWh at the time of writing.

At the same time, Asian LNG prices rose a three-month high in mid-June, with high temperatures in north-east Asia increasing cooling demand. The average LNG price for August delivery into north-east Asia LNG-AS jumped by 50% from the previous week to US$ 13.50 /mmBtu, its highest level since mid-March. Prices have since fallen, but remain 33% up from the lows seen earlier in June. The average LNG price for August delivery into north-east Asia LNG-AS fell by 11% from the previous week to US$ 12.00 /mmBtu.

“Volatility set in…with news of (Norwegian) outages which caused a rally in European prices and naturally Asian prices followed suit. While spot offers might reflect that, demand still isn’t there and we will see other players turn away until congruence on demand,”

– Toby Copson, global head of trading at Trident LNG

Alex Froley, LNG analyst at ICIS said that competition between Europe and Asia has re-ignited as Asian buyers return to the market to take advantage of this year’s lower prices, while European buyers need to ensure sufficient cargoes to continue storage injections. In the first 22 days of June, China imported as much LNG as it did in the entire month last year, and imports in the three month from March to May were up 13% – 18% on last year, although they remain below the record levels seen in 2021.

Another analyst at ICIS, Robert Songer, said “it is almost like seeing a re-run of last year, when spiking European prices would feed into higher Asian prices…news about the closure of Groningen was not unexpected but appeared to feed into a mood and probably reflected an element of short-covering in European gas markets.”

LNG freight rates have increased significantly as vessel availability starts to tighten ahead of the winter, with Atlantic spot rates reaching a new high since January.

Market volatility indicates risks remain as we move towards next winter

According to Bloomberg, “huge price swings caused by a series of small outages at gas facilities in Norway and the planned shutdown of a key production site in the Netherlands have provided a glimpse of how fragile the market is to any threat of disruption to the region’s supply”. Despite higher than normal inventory levels, the past few weeks have seen unusually high gas price volatility, indicating an underlying lack of confidence in the market.

Ongoing hot weather adds to these concerns, boosting demand for cooling and risking a renewed drought which would restrict deliveries of coal to power stations, driving increased gas demand (lower river levels mean barges cannot carry such large loads, interrupting deliveries to power stations, particularly in Germany). The Rhine — a vital artery for Germany and other parts of inland Europe — is already seeing water levels low enough to restrict trade.

While cost pressures have declined from their peaks last summer, they still are damping industrial activity, with analysts suggesting that some demand could be permanently lost since many manufacturers that slowed production have yet to return to normal. Net zero policies are contributing to these concerns as they signal higher energy prices going forward, and we have seen this feeding though into the weakening of some EU climate initiatives. Germany in particular has been pushing for action on energy prices to prevent businesses from relocating into regions with cheaper energy prices.

“This was a taster of the potential risk to come. Whilst this may convince large industrials to keep lower production or sites mothballed, which will ease any demand increase, all eyes are on supply,”

– Nick Campbell, director at Inspired Energy

Analysts do not expect to see a return to the levels of volatility seem last year. Despite much lower levels of Russian gas in Europe, gas inventories are healthy not just in the EU, but also in Japan and South Korea, with Japanese nuclear re-starts contributing to lower gas demand. However, traders are nervous that even relatively small reductions in imports could make the European market uncomfortably tight, with unplanned disruptions leading to price spikes. According to Massimo Di Odoardo, a senior gas researcher at Wood Mackenzie, the extended shutdown of key gas plants in Norway “could easily shave off another [billion cubic meters] of supply over the next few months…It only really takes 5 bcm less… to make the market a lot tighter.”

Investment bank Morgan Stanley raised its price estimates last autumn for LNG in 2023 and 2024, citing Europe’s soaring demand intensifying global competition for supplies, which could create a crunch during this year. The bank expected Asian LNG prices to average US$ 39.50 /mmBtu in 2023, up by almost a third from US$ 30.00 /mmBtu before. The 2024 price forecast was raised by 57% to US$ 34.50 /mmBtu.

“We see a rising deficit next year. We see the need for prices to remain elevated for longer to continue constraining demand,”

– Morgan Stanley

Morgan Stanley analysts believe that Europe’s need for LNG could increase by almost 50 million tons in 2024, while China may need an additional 10 million tons, a 14% increase in demand, which will partially offset lower purchases from some other Asian importers. While there is a consensus that the market has eased after a mild European winter, analysis from Rystad Energy suggests that global gas prices will likely remain at or above US$12/mmBtu on average for the foreseeable future, and that above this level many Asian nations will continue to be priced out of the market. There is significant unmet demand from countries such as Pakistan and Bangladesh which saw imports drop by 18% and 17% respectively in 2022 due to affordability challenges. The company cited concerns that a cold winter in Europe would push up prices drawing more spot cargoes to Europe.

This broadly reflects wider market concerns. While gas inventories are currently healthy, the slowdown in injections and the potential for increased competition for LNG cargoes from Asia present risks. Recent price volatility indicates the fragility of the situation, with traders feeling that small changes to supplies could have very significant implications for the gas balance heading into the winter and next year. The key message is that there is no room for complacency.

Original article l KeyFacts Energy Industry Directory: Watt-Logic

KEYFACT Energy

KEYFACT Energy