By Kathryn Porter, Watt-Logic

On the 4th November 2022, National Gris ESO officially launched the Demand Flexibility Service it announced in its Winter Outlook after Ofgem approved the scheme. It will run from today until 31 March 2023 allowing both businesses and households to be paid for reducing demand in times of system need. This is the first scheme of its type to include domestic consumers, although households will only be able to participate through their suppliers, and only if they have a smart meter that works in smart mode.

On the 4th November 2022, National Gris ESO officially launched the Demand Flexibility Service it announced in its Winter Outlook after Ofgem approved the scheme. It will run from today until 31 March 2023 allowing both businesses and households to be paid for reducing demand in times of system need. This is the first scheme of its type to include domestic consumers, although households will only be able to participate through their suppliers, and only if they have a smart meter that works in smart mode.

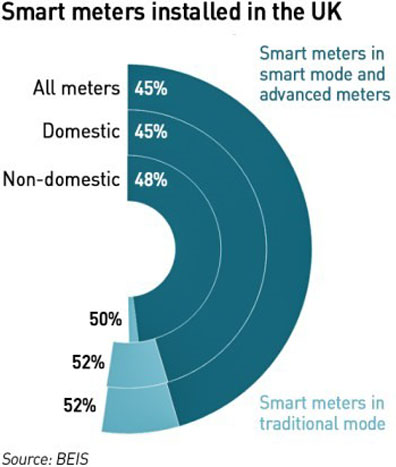

According to Government data, at the end of June 2022, the latest period for which data are available, 52% of households have a smart meter, with 45% of households having a smart meter which works in smart mode. This means that 1.7 million households with smart meters working in traditional mode will be unable to participate in the scheme, with 14.0 million households having operable smart meters and 13.0 million households with traditional, non-smart electricity meters.

There will be 12 of the demonstration events throughout the winter – two for each provider in the first month they participate, followed by two tests a month for the duration of the service. Each will take place over a one hour period usually around the evening peak (4-7pm). The service is open to half-hourly metered assets of between 1 MW and 100 MW (can be aggregated) that are able to respond for a minimum of 30 minutes, instructed on a day-ahead basis.

Assets that are dispatchable in the Balancing Mechanism, that participate in ancillary or DNO flexibility services or have a Capacity Market contract will not be able to participate. Participants will be rewarded on a pay-as-bid basis, and while there is no minimum bid level, NG ESO has guaranteed a minimum price of £3 /kWh.

Ofgem has approved the scheme noting that it has been developed in a very short space of time, and that it is a “relatively novel and untested service”. It also acknowledges that NG ESO views the service as providing a last resort security of supply function, and that as a tool which increases system security at times of tight system margins could contribute to overall consumer welfare by reducing the risk of blackouts. However, the regulator is also mindful that consumers may act in ways which are harmful to themselves, particularly in light of the cost of living crisis.

“We recognise that individual consumer welfare of those contributing to this service during this period is also critical. To that end, we expect the ESO to provide clear and transparent communication to participating suppliers and wider industry. This includes communications which provide clarity for consumers around the implications of their involvement in the service and any other information deemed appropriate… We will continue monitoring the progression of these actions to ensure all processes are clear for market participants. We expect the ESO to remain mindful of its duties to operate the system economically and efficiently,”

– Ofgem

Most large suppliers are expected to take part, although some, such as Shell Energy, have indicated that they will not. It is thought that the price of the service had to increase from the initial indications of 52 p/kWh due to low levels of interest from suppliers. Some suppliers such as EDF appear to be pre-selecting which households will be able to participate – the company said it has “selected a small group of customers” to take part and will notify them later in November, apologising that not all customers would be able to sign up.

Expected requirement for the service

NG ESO expects the requirement for the DFS is most likely to be during weekday evenings between 16:00 – 21:00, which is wider than the conventional peak hours. It also believes there could be some need over the morning peak, with the service being called for 1-3 hours.

Base case

Under the base case, capacity across all providers (generation, storage, interconnection etc) is assumed to be available in line with Capacity Market commitments (with interconnectors being in import mode, which is not a specific Capacity Market requirement. Under these conditions, NG ESO expects it might need the DFS on 0 to 5 days this winter, with a typical requirement of around 1,000 MW (and up to 1,500 MW). The service is not expected to be needed when demand is below 40 GW.

Scenario 1 – Reduced electricity imports from Europe

In this scenario NG ESO assumes there are no interconnector imports from France, Belgium or the Netherlands (which provide a de-rated capacity of 3.9 GW in the Base Case). This scenario also assumes that 1.2 GW of imports continue to be available from Norway and that GB exports 0.4 GW to Northern Ireland and Ireland. Under these conditions, the DFS might be needed on 10-35 days over the winter, with a typical requirement of around 2,000 MW (and up to 5,500 MW). Even with a reduction in interconnector imports of around 5 GW, NG ESO would not normally expect to need the service if demand is lower than 35 GW.

Scenario 2 – Reduced electricity imports from Europe combined with insufficient gas supplies

In this scenario NG ESO assumes the same interconnector flows as Scenario 1, but with around 10 GW of CCGTs being unavailable for two weeks in January due to gas supply disruptions. In this case, rolling blackouts might be needed and the DFS could be required on an additional 10-14 days above the scenario 1 requirement, with around 3,500 MW (and up to 12,000 MW) being sought. With 10 GW less CCGT availability, demand would need to fall below 25 GW for there to be no need for the service.

Overall, the Demand Flexibility Service might be need from anything from zero up to 49 days.

Value of the Demand Flexibility Service

According to National Grid, a typical household could earn £100 if it participates in all of the 1-hour demonstration tests of which there are likely to be 12. I think this does not align with NG ESO’s base case scenario of 0-5 days:

- An average house consumes 3,100 kWh of electricity per year, of which about 48% is between November and March inclusive. This gives a daily consumption of around 10 kWh during these winter months. Across the five hours between 16:00-21:00 a household might use 25% of its daily consumption (an estimate using Elexon transmission system data which includes industrial as well as domestic demand). That means a typical household could earn 2.5 kWh x £3 /kWh = £7.50 in a day using this service.

- When NG ESO says households could earn up to £100 over the winter, this implies the service would be required on around 13 days or 10.5 days after the 12 1-hour tests are taken into account, which is more than double the amount NG ESO says it expects to need under its base case. Under the base case, excluding the test periods, a typical house could probably expect to earn up to £37.50 which would pay for 110 hours of electricity use at the level of the Energy Price Guarantee (34p /kWh).

Based on these numbers it is not obvious that the scheme will be worthwhile for participants – the numbers are still small for households, and businesses have other schemes such as the Demand-Side Response service they can participate in.

Octopus Energy has been a pioneer of flexible tariffs for households, but it’s unclear if it has been able to make any money from them. Industry gossip suggests its Agile tariff has never been profitable, and the company’s latest financial accounts for the year ending 30 April 2021 state that the basis of the going concern preparation relies upon a parent company guarantee:

“The Company has received a letter confirming ongoing financial support from its immediate parent company that underpins the going concern position.”

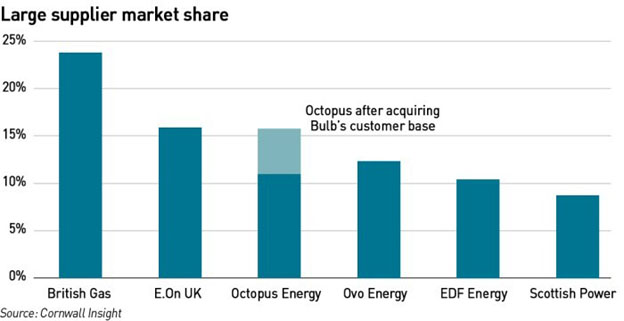

In the year to 30 April 2021, Octopus Energy made a gross profit of 4.8%, this compares with an operating profit for British Gas Energy of 11.3% for the year ending 31 December 2021 and 12.7% in the previous year. Octopus Energy had an operating loss of 4.5% in 2021, compared with operating profits of 1.6% (2021) and 1.2% (2020) for British Gas. During the year in question, Octopus had around one third of the market share of market leader British Gas – the acquisition of Avro Energy’s customers after being appointed their Supplier of Last Resort and now the acquisition of Bulb more or less doubles Octopus Energy’s market share. These numbers and the reliance on a parent guarantee as the basis of the going concern determination are not particularly encouraging. Absorbing the Bulb acquisition will be a major test for the business.

In addition to its employees and founding shareholders, Origin Energy, Tokyo Gas and Generation Investment Management have all invested in the company, however, it’s hard not to see it as a large experiment that may yet fail.

The 2021 accounts were signed at the end of October 2021. The company has until the end of December this year to file its 2022 accounts and it will be interesting to see how its position has changed. Presumably the accounts are being updated to reflect the Bulb acquisition as a material post year-end event.

Will the DFS be worth the effort?

The Demand Flexibility Service is clearly experimental, put together at short notice to manage potential system tightness this winter. However there are serious questions for National Grid ESO to answer around why the service has been designed at short notice when winter market tightness has long been foreseen by many analysts. The hurried rollout means that the number of potential contributors is limited – some suppliers will not participate at all, and some will restrict participation to pre-selected households. The 1.7 million consumers with smart meters that operate in dumb mode will also be unhappy at being excluded through no fault of their own.

The pricing of the scheme is also still quite low relative to overall energy costs, so it’s unclear how households will respond in practice…they may simply decide it’s not worth the effort. And if there is a serious risk of shortages, NG ESO may opt for a wider voluntary scheme covering all households, under which consumers would be asked to move demand out of the peak periods in order to avoid blackouts. Similar appeals were used in California and Texas this summer.

While businesses will be able to earn more under the DFS, many businesses with flexible loads already participate in various demand response schemes, so again, the additional response that could be achieved under DFS may not be significant in practice.

Clearly, as the energy transition progresses and more consumers have access to smart appliances, electric cars and heat pumps, demand response could play a key role. But the market is not ready for this yet with fewer than half of businesses and households being equipped with suitable meters, and still fewer having the appliances which would allow these schemes to operate automatically. The DFS will require households to manually adjust consumption, if they can be bothered. And the day-ahead notification will limit the available benefits.

We will have to wait and see if the service is needed this winter and how much it delivers, but NG ESO needs to look much harder at winter preparedness in the future.

Original article l KeyFacts Energy Industry Directory: Watt-Logic

KEYFACT Energy

KEYFACT Energy