Hartshead Resources today announced an upgrade in the Contingent Resources of the Anning and Somerville gas fields to Reserves following an independent technical audit of the Phase I Development Plan by ERC Equipoise Limited (ERCE). The technical and commercial audit has resulted in the compilation of a new Competent Persons Report (CPR) for the Phase I Development of the Anning and Somerville gas fields which are now designated as “Justified for Development” and therefore assigned Reserves in accordance with the June 2018 Petroleum Resource Management System (PRMS) framework of the reporting and classification of hydrocarbon reserves and resources.

- Anning and Somerville gas field development classified as Reserves following an independent Technical and Commercial Audit conducted by ERC Equipoise of Hartshead’s Phase I Development Resources.

- Competent Persons Report (CPR) published with Phase I Field Development 2P Gas Reserves of 301.5 Bcf (52 MMboe).

- Anning and Somerville fields classified as Justified for Development and accordingly assigned sales gas volumes based on 1P, 2P and 3P Reserves.

- Upgrade of Anning and Somerville fields to certified Reserves adds value as the company progresses potential industry partnering and project financing.

- Development reserves expected to substantially increase project value with recent UK North Sea transaction multiples exceeding US$8 per boe of combined 2P reserves and 2C contingent resources.

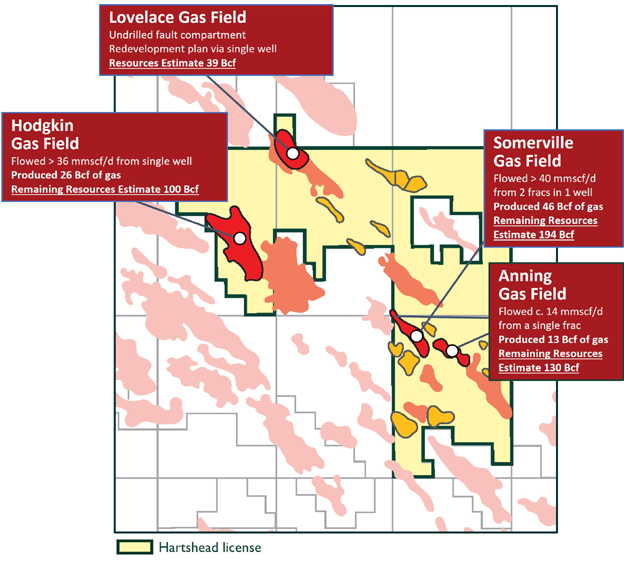

- The technical and commercial audit of the Phase II and Phase III developments will follow in the coming months as we aim to establish audited resources of up to 0.8 Tcf (138 MMboe) of very high quality gas.

CEO of Hartshead, Chris Lewis, commented:

“Delivering reserves in license P2607 affirms Hartshead’s core strategy that aggregating high quality, discovered gas volumes, close to infrastructure and delivered to a very strong gas market, demonstrates commercial value and justifies the development of these fields. Having this confirmed by ERCE adds significant value to Hartshead Southern Gas Basin portfolio. After sixteen months work by the Hartshead team in refining and identifying the best development concept the confirmation that the project has this certainty of being developed is tremendous news.”

Summary

The evaluation of the Phase I Development Plan for the Anning and Somerville gas fields was prepared with an effective date of 1 June 2022 and follows the submission of the Phase I Development Concept Select Report (CSR) to the North Sea Transition Authority (NSTA) previously announced on 30 May 2022. The Company intends to commence the Phase I Front-End Engineering & Design (FEED) study prior to the submission of a Field Development Plan (FDP) with Final Investment Decision (FID) planned for Q2 2023.

ERCE have reviewed and evaluated the selected development concept which consists of six production wells from two wireline capable Normally Unmanned Installation (NUI) platforms at Anning and Somerville. These platforms will then connect via a subsea pipeline to third party infrastructure for onward transportation and processing to entry into the UK gas network and provide the basis for determining the economic sales gas volumes or reserves assigned to the Anning and Somerville gas fields. Raw gas production forecasts have been adjusted for backout of third party gas volumes, shrinkage, fuel and flare and an Economic Limit Test (ELT) to yield a sales gas volume on which to base the Reserves with any associated liquids production being summarised as condensate reserves.

Based on an assessment by ERCE, using the PRMS sub-classification framework, the Reserves associated with the Anning and Somerville fields are classified as Justified for Development given the project is considered to be sufficiently mature to be developed subject to securing the required project financing and an approved FDP and therefore have been assigned a 100% chance of development.

Certification of the Phase I development as reserves substantially increases the project value given recent UK North Sea corporate and asset based transactions have demonstrated average exit multiples exceeding US$8 per boe based on combined 2P reserves and 2C contingent resources.

Production Forecasts – Anning and Somerville Fields

The volumetric estimates used to derive the Reserves have been made by combining probabilistically derived estimates of initial in place gas volumes (GIIP) with assumptions regarding the gas recovery factors from analogous fields, such as the Clipper South and Babbage gas fields located in the UK Southern Gas Basin, to generate low, best and high case recoverable volumes.

Frac stimulation and well bore deliverability modelling conducted by Fenix Consulting Delft (Fenix) and Hartshead have been applied to dynamic reservoir models to generate raw gas production profiles which are then adjusted for backout, shrinkage, fuel and flare reductions and an economic limit test (ELT) applied to yield an estimate of Reserves or Sales Gas.

KeyFacts Energy: Hartshead UK country profile

If you would like a complimentary 7-day trial to our Energy Country Review resource, free access to our daily news alert service, details of marketing opportunities or if you would like to contribute to KeyFacts Energy, click here. We can provide access, sign you up, send full details or set up a quick online meeting to review our services in more detail.

KEYFACT Energy

KEYFACT Energy