By Phil Damjanovic, Senior Trader at Antimo LLC

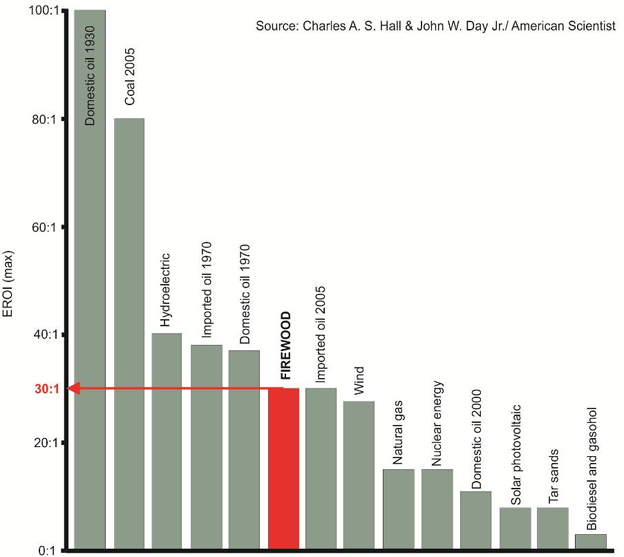

EROI stands for energy return on (energy) invested. The concept was originally developed by Charles A. S. Hall in the 1980s [https://www.esf.edu/EFB/hall/] as a way of comparing the values of different energy sources. It’s defined as the number of units of energy received from a given type of energy source for every unit of energy spent. Obviously, the higher the EROI, the better. It’s akin to calculating a profit margin, but instead of using a monetary value as the unit of measurement, we use Btus or some similar energy-based unit of measurement.

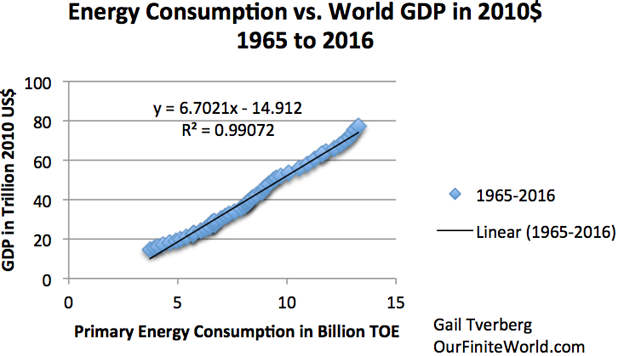

Since all economic activity requires 1) heat and/or 2) movement, both of which require use of an energy source, this means that all economic output has embedded in its value a measure of the energy inputs required to produce it. Any given good or service is a representation of the value of the energy inputs used to make it. If money is a tool used to effect the exchange of and measure the value of goods and services, it follows then that:

i) Money is just a call on energy in the form of work, which is embodied in goods and services.

ii) Debt-money is a promise for delivery of goods and services in the future, with interest, which in turn is a promise of delivery of a greater quantity of energy in the future than is available today.

iii) Investment return or profitability of energy producers measured in monetary terms is a good proxy for their investment return or profitability measured in energy terms, since money is a representation of energy.

a. High value energy products will be able to support paying taxes on their sale and production, because there is enough surplus energy in the product for everybody to take a cut, including government. Low value energy products do not produce enough surplus to go around and cannot support taxation, or even worse, could be in chronic need of subsidies and state support. This is economic cannibalism.

iv) If a prerequisite for any economic activity is the availability of ordered energy in order to do work, then economic output of goods and services is necessarily a subset of a larger, all-encompassing energy economy. The range of realities, the range of “what’s possible” in our world, is determined by the available surplus energy base. Note that this can vary somewhat based on efficiencies in the use of the aforementioned energy base, although there are often hard physical limits to efficiencies too, for example for a given design of gas turbine or battery. Furthermore, there could be constraints on economic possibilities that come from further downstream from the energy base and that have to do with other resources, such as water or metals.

v) As a corollary, diminishing returns in energy products are then tied to diminishing returns in the economy. Examples:

a. 1945-1973 in the United States represented a period of concurrent high EROI on domestic energy production (and indeed global production), a large energy surplus, high wages and widespread affluence, a positive net investment position, and low debt.

b. Post the oil price spikes of the 1970s and up to about 2005, we see high-EROI conventional oil production peak out in the U.S. and focus shift to lower-EROI offshore deep water developments. The return to energy isn’t as high now (EROI <=20), so neither can be the economic returns nor the returns to labor. Incomes stagnate first for workers at the bottom of the economic chain and over time for more and more workers. Income inequality starts to grow rapidly, as does wealth inequality. Debt comes into greater and greater use in order to try and maintain growth and standards of living in the present, on an ongoing, rolling-over basis, meaning that it can’t be extinguished because the future goods and services promised against that debt cannot be delivered against a backdrop of declining per-capita net energy surplus. Debt must be paid off with new debt issued at ever-lower interest rates so that debt outstanding can continue to grow in order to offset net energy surplus that continues to shrink. I am convinced that the growing total debt position of the U.S. since it became an oil importer in the 1970s would be a mirror image of the decline in EROI, adjusted for any gains in efficiencies.

c. This era terminates with a bang in 2008 with oil prices rocketing to $147 and the concurrent Great Financial Crisis. This was a call to bring to market new hydrocarbon energy sources, albeit again at a step-change lower EROI (8 or less), and so began the era of light tight oil and heavy oil sands. As a financial mirror to this, we saw the beginning of the era of debt monetization, with major central banks pumping money directly into economies to try and prop up growth and asset prices. Any attempts to pull back on QE, raise interest rates, or liquidate balance sheets were met by hard and sharp market selloffs. Interest rates, which had been steadily trending down since 1982, now get stuck close to the 0% boundary and in real terms interest rates are often negative in most of the world. Those who own assets or can borrow cheap capital prosper, while most others stagnate. The gap between haves and have-nots grows further. We now live in a sort of economic Twilight Zone of extreme diminishing returns, where one hand of government buys debt in huge amounts from the other hand in order to try and fund growth in economic output, but every dollar of incremental debt created creates less than a dollar of growth. There are more billionaires and millionaires per capita than ever before, especially in areas like Tech, but this wealth is on paper only and not supported by output in the underlying real economy (in other words, valuations are extreme). The natural mirror-like relationship between energy and money becomes distorted by central bank financial manipulations of money. Central banks do it in an attempt to maintain the status quo, while seemingly missing the point that economies run on energy, not on money. This means that in the long run, their mission is doomed to failure. You may have heard pundits talking about how an advanced economy decouples from energy use, but this is only true for individual economies engaging in offshoring, whereby they outsource a part of their energy consumption and associated economic output to another country. Globally, energy consumption is tied to GDP growth one-for-one and this relationship is hard and fast and cannot be broken for reasons grounded in the laws of physics.

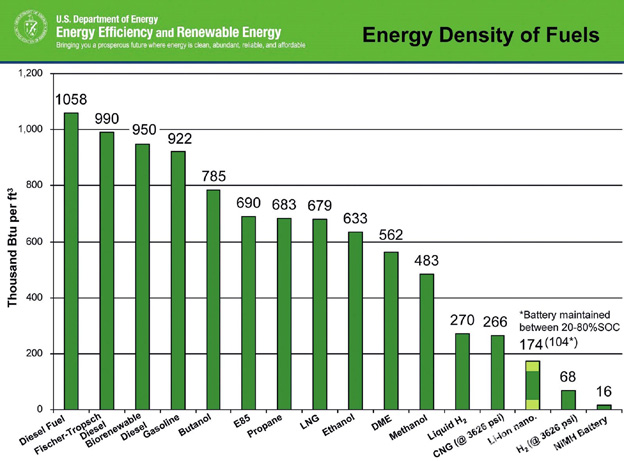

Energy density

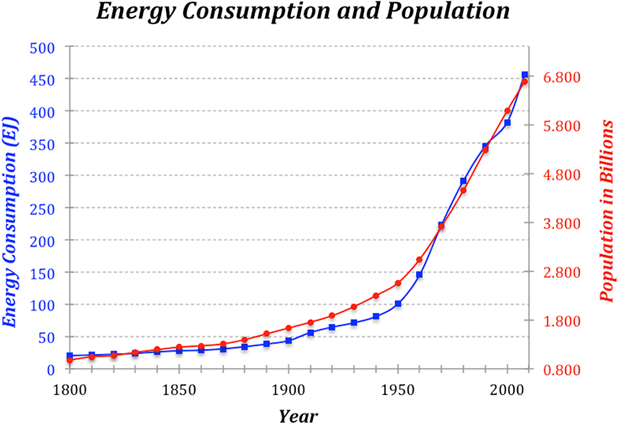

If EROI is analogous to a profit margin, then energy density is analogous to revenue. There has been a linear historical progression where humanity exploits ever-denser energy sources in order to be able to increase the total energy base available for a given volume of three-dimensional space, as long as EROI on the new, denser energy source is high enough to support a given society’s current needs.

An example of the major milestones in this progression are going from animal/human labor -> biomass -> wind and water (sails and mills) -> coal -> oil -> hydroelectric (an upgrade of the watermill) -> nuclear, with nuclear being the most recent (circa 1940s) crowning achievement. Uranium, not shown in the graph above, packs a whopping 47 million times as much energy as gasoline, in the same volume!

None of the energy sources later on in the line of progression completely displaced the ones before it; instead, they added on to the existing energy source mix and allowed for a greater total energy base which in turn produced more humans living at a higher standard of living, and unlocking new technological possibilities. We still burn about as much firewood today as we did in 1800. There can be feedback and interplay between these different sources/storage methods too. A watermill and a hydroelectric powerplant operate on the same principle – gravity moving water – but the latter is more complex and productive and only became a possibility inside of a fossil fuel-based paradigm created by an already-existing energy source, coal. Hydro plants can’t be used to create more hydro plants, so this source of energy production can only exist when supported by another energy source.

Likewise, batteries have existed for a couple of centuries (if not thousands of years) and the lead-acid batteries of the 19th century were vastly less efficient than modern batteries, but today’s batteries were only able to be realized inside of an economic production system that had already been “leveled-up” to the next level of complexity by the energy density available in the existing energy mix that was in use when modern batteries went into production (mostly fossil fuels).

Also note that humanity has never gone from displacing a given energy source or storage method with a less-dense one, and certainly not with one that is both less dense and has a lower EROI; this would be analogous to earning less revenue AND less profit margin in a new business (see graph below). If a move into a denser energy source creates a parallel increase in population density and higher living standards, then a move to a mix of less-dense energy sources will create a shift to lower population density and/or lower living standards.

Energy density is correlated to technological progression. A denser energy source packs more punch and allows for the conceptualization and implementation of new technologies that can take advantage of all that newly available energy. However, the caveat is that the EROI must meet some minimum threshold. For example, there would be no point in finding and mining dilithium crystals (Star Trek, anyone?) that can deliver huge amounts of energy for society to use if the energy cost of doing so is greater than the energy output, which would be an EROI < 1.

The State of Today

Useful energy sources are critical to sustaining modern civilization. I define useful as a combination of energy density, EROI, and a handful of miscellaneous secondary characteristics. Energy density is related to the total energy available, the aggregate sum, a measure of what can be accomplished. EROI can be thought of as the measure of how much payoff there is in pursuing a given resource. As an example, firewood has a pretty high EROI around 20-30, which is better than shale oil, tar sands, wind or solar, but no one is building cars that run on burning wood because there is not enough energy in wood to move a two-ton vehicle at 60mph. An EROI of ~8 is generally thought to be the minimum needed to sustain modern industrial society. Most energy sources trade off density and EROI in some fashion, and one quality can indeed compensate for a relative deficiency in the other.

The secondary characteristics consist of things like portability (it’s got to be easy to move around and carry), demandability (it’s no use if it’s not available when consumers need it), and scalability (can it be manufactured as needed, or is it limited by geography or some other input?)

As one looks through the charts above and thinks about which energy sources check the necessary boxes it becomes obvious that there are some that work well, there are some that have worked well but won't work as well in the future, and then there are some that really don’t work well and aren’t capable of contributing more than a nominal percentage to the global energy production pie chart. Unfortunately, it seems that EROI for the global energy mix has been declining for some decades now, while as of more recently we seem to be collectively attempting to push into using more of energy products that have poor energy densities. This is not a formula for continuation of life as we've known it for the past 200-300 years. If one is looking to the future, say the next 50+ years, the obvious option I see in the list that has high energy density, acceptable EROI that is both high enough and steady over time, can provide energy on demand, can be built wherever needed, and can be scaled up and down is nuclear power.

Just remember: if the calories of energy to feed all the mouths in the world are available, they will be, and if not…they won’t.

Phil Damjanovic

Senior Trader at Antimo LLC

KEYFACT Energy

KEYFACT Energy