The new Gas Year is fast approaching along with the associated gas sales contract awards and renewals. This year will be more complicated than normal for the UK following Ofgem's announcement on 28th May 2020 of the introduction of the long awaited ' Postage Stamp' NTS transportation charging regime effective from 1st October 2020. Parties will be looking to include the impact of this in new gas sales contracts or in the amending of existing contracts. In addition, the optional commodity charge ( 'Short-haul Tariff') is no longer available to NTS users and this will have a detrimental impact on premiums offered by gas buyers at UK gas terminals and in particular Bacton & Teesside terminals.

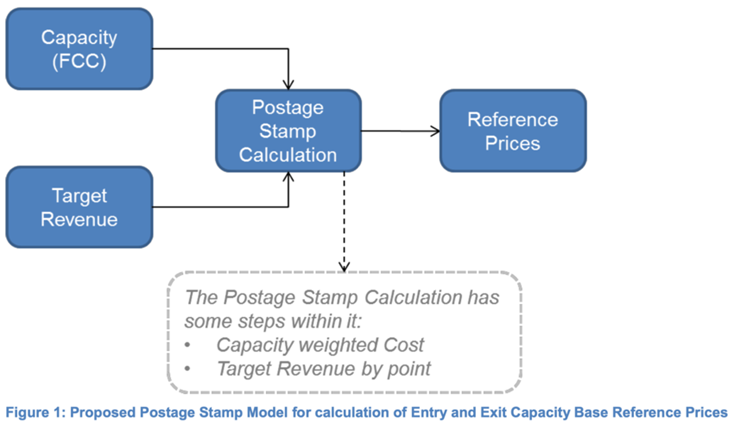

The new entry capacity regime will see National Grid ('Grid') recovering NTS operating costs more directly via a capacity charge rather than the current method of recovery via the commodity charge process. This will result in a greater emphasis on producers ensuring they have sufficient capacity available to meet its expected production levels. The Capacity Reserve price published for October 2020 to March 2021 has been set at 2.1p/therm and the additional Non-Transmission Charge levied will add a further 0.375p/therm to the transportation costs. Users will no longer be able to benefit from free interruptible capacity with the discount on such capacity limited to only 10%.

The new regime will bring much greater focus on overrun costs with potential penalties of 8 times the capacity reserve price applied when delivered gas quantities exceed booked capacity. In a low-price environment this could easily result in the penalty exceeding the gas price applicable to any overrun quantity. The 8x multiplier is being reviewed and could be potentially revised downward at some future point in time.

Grid has the further option to levy a Revenue Recovery Charge ('RRC') if the revenues it is receiving via capacity charges are not covering or not expected to cover its costs. This could be potentially imposed as early as November or December 2020 once Grid has a clearer indication of revenues being achieved in the Gas Year under the new regime.

Capacity purchased prior to April 2017 ('Existing Contracts') will not be impacted by the new capacity reserve price providing holders of existing capacity with a significant potential savings on capacity costs. Existing Contracts will also be ring-fenced from any potential RRC levied by Grid as long as it is not sold/transferred to another entity. Capacity can still be purchased via the various annual and monthly auction processes, but producers will need to work closely with their gas buyers in establishing a clear strategy for the purchasing and on-going management of entry capacity.

There are various ongoing discussions (UNC Mod 0728) regarding a possible alternative Short-haul Tariff but any replacement is unlikely to be introduced before October 2021 and indeed there is a chance that Ofgem will push back on any such introduction. The loss of this benefit will have a particular impact on gas traders' ability to utilise the interconnector arbitrage for gas delivered into the Bacton terminal. For Teesside users the opportunity to use this option to deliver gas to local industrial users without incurring full NTS usage costs has also been removed. Where existing contracts reflect such benefits then gas buyers will be urgently seeking to renegotiate the premiums offered prior to the 1st October. Grid estimate the potential value of gas transmission charges that would be redistributed as a result of any discount to be between £80-180m and therefore the cost impact on potential beneficiaries and the remaining users of the NTS are not insignificant.

HEA can offer further support to gas producers seeking clarity on the new entry capacity regime and in establishing capacity purchasing strategies as well as providing support in gas sales tendering/negotiation processes.

Andy Giles, Commercial Director, HEA

KeyFacts Energy Industry Directory: Holt Energy Advisors

KEYFACT Energy

KEYFACT Energy