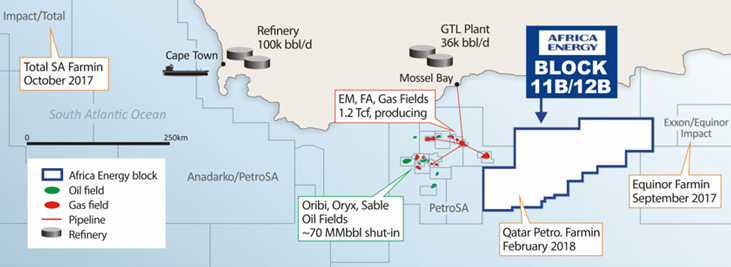

Africa Energy announces the signing of definitive agreements to increase its effective interest in Block 11B/12B offshore South Africa from 4.9% to 10%.

Garrett Soden, the Company's President and CEO, commented:

"Block 11B/12B offshore South Africa contains one of the most exciting oil and gas exploration plays in the world today. In anticipation of the Luiperd-1X well results expected later this year, we have agreed with Impact and Arostyle to simplify and consolidate Main Street's 10% interest in Block 11B/12B under Africa Energy."

Africa Energy currently holds 49% of the shares in Main Street 1549 (Proprietary) Limited, which has a 10% participating interest in Block 11B/12B. Total E&P South Africa B.V. is operator and has a 45% participating interest in Block 11B/12B, while Qatar Petroleum International Upstream LLC and CNR International (South Africa) Limited have 25% and 20% participating interests, respectively, in Block 11B/12B.

The Company is pursuing two transactions by which Africa Energy will first secure the indirect financial interest held by Impact Oil & Gas and then obtain an option from Arostyle Investments, which holds 51% of the shares in Main Street, to acquire the entire Participating Interest after drilling the Luiperd-1X well. Following the Impact Transaction and exercise of the Arostyle Option, subject to various consents and approvals, Africa Energy will directly hold the Participating Interest, and both Impact and Arostyle will be significant shareholders of Africa Energy.

Impact Transaction

Africa Energy has entered into an investment agreement with Impact and Impact Oil & Gas whereby Africa Energy will subscribe for new shares and thereby obtain control of Impact 11B/12B, a wholly-owned subsidiary of Impact, whose sole asset is the Arostyle Loan Agreement that provides for an indirect financial interest in Main Street. Impact has also entered into a subscription agreement with Africa Energy to subscribe for 509,092,771 common shares of Africa Energy that is subject to completion of the Investment. The Subscription Shares will be issued shortly after closing of the Investment.

The Investment Agreement provides Impact with the right, for so long as it holds not less than 10% of the common shares of Africa Energy, to appoint one (1) nominee to the board of directors of Africa Energy. The Investment Agreement also provides for certain orderly market covenants in respect of any dispositions by Impact of the Subscription Shares, customary standstill provisions for a period of 12 months and certain restrictions on the issuance of Common Shares (or securities convertible into Common Shares) by Africa Energy prior to closing of the Impact Transaction.

The Impact Transaction is independent of the Arostyle Transaction and is subject to Africa Energy disinterested shareholder approval and TSX Venture Exchange approval. Closing of the Impact Transaction is expected to occur in October 2020.

KeyFacts Energy: Africa Energy South Africa country profile l Impact South Africa country profile

KEYFACT Energy

KEYFACT Energy