Tap Oil has undertaken a review as of 30 June 2020 of the carrying values of its assets in accordance with the Company’s accounting policies and accounting standards.

As a result, Tap’s financial statements for the half-year ended 30 June 2020 are expected to, subject to audit, recognise a non-cash pre-tax impairment of US$4.84million in respect of the carrying value of the Manora Oil Field asset, offshore Thailand.

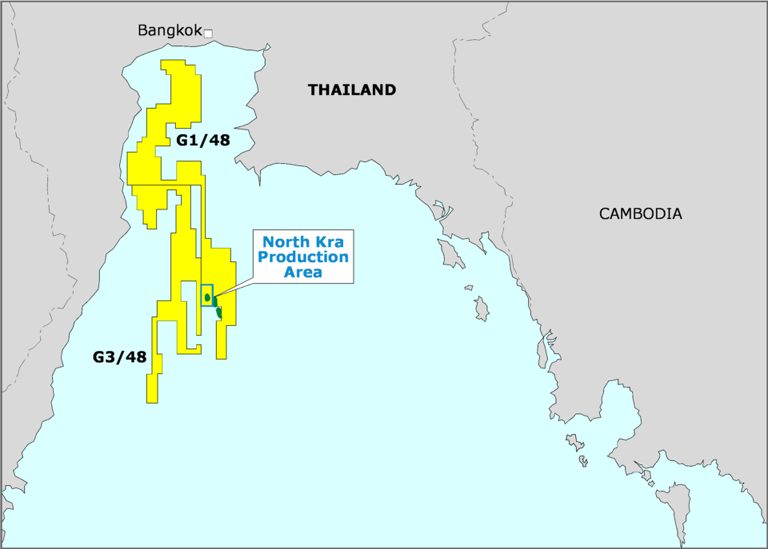

Map source: KeyFacts Energy

The decision to book this impairment is due to the significant current and consensus forecast reduction in oil prices versus those used to assess carrying values at 2019 year end. Additional contributors are increased longer term demand uncertainty impacted by the COVID-19 pandemic, elevated global crude oil stock levels, macroeconomic dynamics and the accelerating decarbonisation trend.

In addition, Tap has revised its provision for restoration costs attributable to Manora from US$12.81 million to US$16.45 million.

Tap’s provision for restoration costs represents the present value of the Directors’ best estimate of the future sacrifice of economic benefits that will be required to remove plant and equipment and abandon producing and suspended wells in the Manora Oil Field.

The revision to the restoration cost provision is due to a number of factors including an increase in the number of wells to be decommissioned, an increase in costs following an updated estimate from the field Operator and the Boards prudent application of a higher contingency following consultation with independent

The Company’s working capital and liquidity are not materially impacted by these changes.

The outcome of the impairment and the revisions to the restoration costs provisions is subject to review by the external auditor, and will be formalised in the Company’s financial statements for the half-year ended 30 June 2020 where full detail will be provided.

Tap’s Executive Chairman, Mr Chris Newton commented that “while the non-cash impairment is disappointing, Taps 2019 Annual Report to Shareholders released in March 2019 and the May 2019 AGM presentation both noted that sustained lower oil prices would have an impact on the carrying value of capitalised development expenditures so this should not come as a surprise to investors. The increase in the decommissioning provision is largely due to an enhanced contingency that the Board considered prudent until more detailed studies expected to be completed in 2021 provide great clarity on expected costs”.

KeyFacts Energy: Tap Oil Thailand country profile

KEYFACT Energy

KEYFACT Energy