Sustaining production from existing infrastructure remains the key driver for North Sea exploration but five years of drilling has only replaced 15% of production. There is ongoing appetite for high impact drilling, despite a success rate of only 12% for this type of exploration in the period.

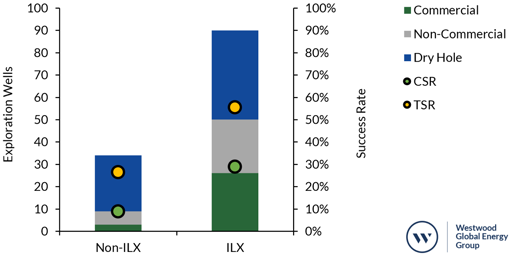

Between 2015 and 2019, there were 124 exploration wells drilled in the UK and Norway North Sea, delivering 1,060 mmboe commercial resources from 29 discoveries and replacing 15% of reserves produced over the period. Total exploration drilling spend of US$5.2 billion gives a drilling finding cost of US$4.85/boe (Figures 1 and 2).

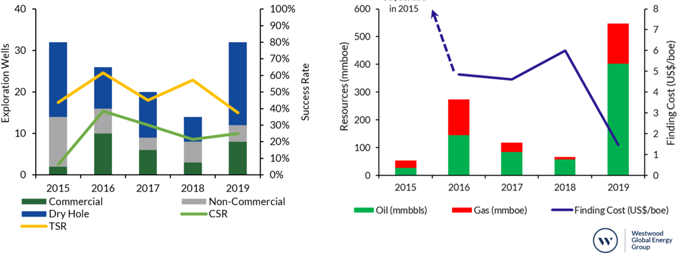

Figure 1: Well results with commercial and technical success rates per annum in the North Sea. Source: Westwood Wildcat

Figure 2: Commercial oil and gas resources discovered and finding costs per annum in the North Sea. Source: Westwood Wildcat

Exploration performance improved from a low in 2015, with just a 6% commercial success rate (CSR) from 32 exploration wells drilled, to an average of 23% over the five-year period. Exploration budget cuts following the late 2014 oil price crash led to reduced drilling between 2016 and 2018, but improved prospect selection delivered higher success rates. In 2019, drilling levels rebounded whilst commercial success rates were sustained at 25%.

Sustaining production from existing infrastructure remains the key driver for North Sea exploration. There were 90 infrastructure-led exploration (ILX) wells which delivered 26 discoveries between 2015 and 2019 at a CSR of 29%. ILX drilling added around 750 mmboe to existing production hubs which is equivalent to about six months of production over the period. In contrast, non-ILX wells delivered only three commercial discoveries at a 9% CSR (Figure 3), only one of which is large enough post-drill to be a standalone development.

Figure 3: Well results with commercial and technical success rates for North Sea ILX and non-ILX wells, 2015 – 2019. Source: Westwood analysis

The statistics show that for ILX drilling, ownership of the infrastructure gives the explorer a distinct advantage. The CSR for the 77 wells operated by companies with equity in the adjacent infrastructure was 32%, compared to only 8% for the 13 wells operated by a company with no interest in the production hub.

A total of 25 high impact (HI) prospects, where company reported pre-drill resources were ≥100 mmboe, were drilled in the North Sea between 2015 and 2019, including 13 in 2019. Five of these 25 wells tested frontier plays in which a commercial discovery had yet to be made. Only one of these 25 wells, Aker BP’s Liatårnet well in Norway, made a >100 mmboe discovery and was also the only new play opening well. CNOOC’s Glengorm well in the UK was the only other discovery >100 mmboe, however this was not a HI prospect pre-drill. Glengorm is the only new potential hub that has emerged from exploration since 2015. Resources in both discoveries are still uncertain and subject to confirmation by appraisal drilling.

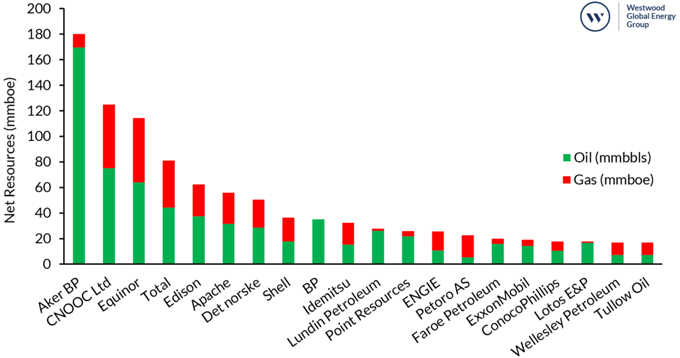

85 companies participated in exploration drilling between 2015 and 2019, including 68 companies with production and 17 exploration-only companies with no production. 41 companies made one or more commercial discoveries, including 20 companies which found net commercial resources of over 10 mmboe (Figure 4). Performance by the 17 exploration-only companies as a group was poor, with just two commercial discoveries from 33 exploration wells (6% CSR).

Figure 4: Companies that discovered net resources of >10 mmboe. Source: Westwood Atlas

The five years reviewed in this study were framed by two oil price crashes, which came in late 2014 and early 2020. Exploration performance has improved since 2015 however overall success rates remain mediocre and overall finding costs are high. An increase in high impact and frontier drilling in the last five years shows companies still have an appetite for risk, despite limited success in these wells. The planned pool of wells for the next 18 months includes 12 high impact wells, suggesting risk appetite remains despite current low oil prices.

Dave Moseley, Senior Analyst NW Europe

dmoseley@westwoodenergy.com

KEYFACT Energy

KEYFACT Energy