Sterling Energy today issued its results for the year ended 31 December 2019.

OVERVIEW

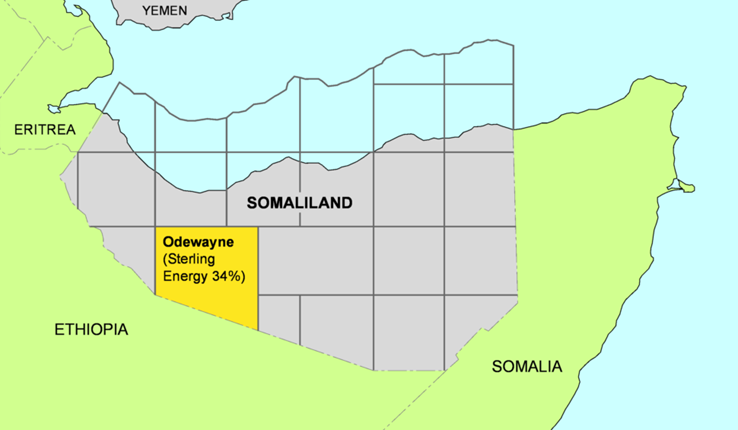

Sterling Energy, together with its subsidiary undertakings, is an upstream oil and gas company listed on the AIM market of the London Stock Exchange. The Company is an experienced operator of international exploration and production licences, with a primary geographic focus on emerging markets including, Africa and the Middle East, although the Board would consider other regions for material opportunities. The Group has a high potential exploration asset in Somaliland and an active strategy to deliver shareholder value through disciplined, exploration and production projects; leveraging the Company’s experience, with an emphasis on securing near term cash flow generative opportunities.

Map source: KeyFacts Energy

2019 SUMMARY

Operations

- Government of the Republic of Somaliland granted a continued extension to the current period of the Odewayne production sharing agreement (‘PSA’).

- Throughout 2019: Odewayne block, Somaliland - Sterling continued to support the Operator in progressing the technical understanding of the block.

Corporate

- Continued merger and acquisition (‘M&A’) mandate for transformational growth (asset and corporate options).

- Screened over fifty separate opportunities globally over 2019 and engaged with five of these to the point of indicative offer.

Financial

- Cash resources net to the Group at 31 December 2019 of $44.9 million (2018: $46.3 million).

- The Group remains debt free and fully funded for all commitments.

- Adjusted EBITDAX: loss for the Group of $917k (2018: $1.5 million loss).

- Ongoing focus on capital discipline, cash general and administrative overheads (‘G&A’) expenses reduced by 15% to $2.6 million (2018: $3.0 million).

- Proactive focus on treasury management, with interest received totaling $1.1 million (2018: $1.0 million).

OPERATIONS REVIEW

Since late 2015, the Company implemented a strategic mandate of exiting non-core exploration portfolio assets, and reducing outstanding liabilities, to provide a simpler and rejuvenated platform for M&A led growth. The Group’s remaining African exploration focused Odewayne block provides fully carried exposure to a frontier basin that has the potential to deliver material hydrocarbon reserves.

SOMALILAND

Somaliland offers one of the last opportunities to target an undrilled onshore rift basin in Africa. The Odewayne block, with access to Berbera deepwater port less than a 100km to the north, is ideally located to commercialise any discovered hydrocarbons. A 2D geophysical survey acquired in 2017 and reprocessed in 2019, along with potential field data and legacy geological field studies, are the focus of the company’s 2020 work programme to determine if a Mesozoic sedimentary basin is present in the block.

Odewayne (W.I. 34%) Exploration block

This large and unexplored frontier acreage position comprises an area of 22,840km², the equivalent of ca. 100 UK North Sea blocks. Exploration activity prior to the 2017 regional 2D seismic acquisition program has been limited to the acquisition of airborne gravity and magnetic data and surface fieldwork studies, with no wells drilled on block.

The Odewayne production sharing agreement was awarded in 2005. It is in the Third Period, with a minimum work obligation of 500km of 2D seismic. The Third Period has been further extended, through the 8th deed of amendment, and its minimum work obligation was met in 2017 when the Somaliland Government (Ministry of Energy and Minerals) contracted BGP (Geophysical contractor) to undertake a 1,000km (full fold, 1,076km surface) 10km by 10km 2D seismic campaign. The minimum work obligation during the optional Fourth Period of the PSA, which has also been extended by 2 years, is for 1,000km of 2D seismic and one exploration well.

The Company’s wholly owned subsidiary, Sterling Energy (East Africa) Limited (‘SE(EA)L’), holds a 34% working interest in the PSA. SE(EA)L originally acquired a 10% position from Petrosoma Limited in November 2013 and an additional 30% from Jacka Resources Somaliland Limited in two transactions during 2014.

In April 2017, the Company agreed to revised farm-out terms to reduce the staged contingent consideration payments due to Petrosoma and reduce SE(EA)L’s interest in the Odewayne asset by 6%. The farm-out agreement was amended such that the parties cancelled the $8.0 million contingent consideration in return for: (i) a payment by SE(EA)L to Petrosoma of $3.5 million; and (ii) a transfer from SE(EA)L to Petrosoma of a 6% interest in the PSA. Post Government of Somaliland approval, SE(EA)L holds a 34% interest in the Odewayne Block, fully carried by Genel Energy for its share of the costs of all exploration activities during the Third and Fourth Periods of the PSA.

In early 2018, following encouraging results from an integrated geoscience review in late 2017 of the basic post-stack processed 2D dataset provided by the Operator Genel Energy, Sterling undertook a highly focused and rigorous processing effort, independent of the Operator. The first phase deliverables were a full PSTM dataset, consisting of 3 lines of ca. 235km and were received in May 2018. These reprocessed lines showed significant improvements in subsurface imaging and were shared with the joint venture (‘JV’) partners in order to assist the decisions on forward work programs.

In parallel to Sterling’s efforts, the Operator undertook a number of studies to support the interpretation of the 2D seismic dataset. This included the integration of the 2D seismic data with the potential fields data in the form of a 2D gravity modeling study, alongside an updated review of the regional geology of the Odewayne basin. These studies led to the development of a number of geological models that were used to interpret the seismic data which in the Company’s view help support the likely presence of a sedimentary basin. Following this work, the JV partners agreed that reprocessing of the seismic data was needed to further improve the understanding of the prospectivity of the Odewayne Basin.

Outlook

Following the various tests performed by both Sterling and the Operator, in 2019 the Operator undertook the reprocessing of the whole 2D seismic data set to pre-stack time migrated data. An interpretation dataset was made available by the Operator in November 2019 and final products were delivered in January 2020.

Sterling will review this newly reprocessed 2D seismic data set in Q2 2020 and will update its technical assessment and outlook on block prospectivity accordingly. Alongside the seismic reprocessing, a surface seep study focused on areas highlighted by the seismic as most likely to be situated above migration pathways from potential hydrocarbon kitchens. It is anticipated that the above work will aid the JV partnership in developing an appropriate forward work program to further evaluate the prospectivity of the licence.

KEYFACT Energy

KEYFACT Energy