Bowleven, the Africa focused oil and gas exploration Group traded on AIM, today announces its unaudited interim results for the six months ended 31 December 2019.

HIGHLIGHTS

- Continued progress on Etinde development options and working with joint venture (“JV”) partners towards agreeing Final Investment Decision (“FID”) in late 2020

- Lead contractor appointed to manage the Front End Engineering Design (“FEED”) process

- TechnipFMC are expected to commence project activity in early April, with a planned duration of five to eight months

- Letter of Intent (“LOI”) signed between Victoria Oil & Gas Plc (AIM: VOG) and New Age (African Global Energy) Ltd ("New Age"), for the supply of gas from the Etinde Field, offshore Cameroon

- Ongoing market volatility, caused by the COVID-19 global pandemic and the recent fall in global oil prices could potentially have an adverse effect on the Etinde project timeline

Operational

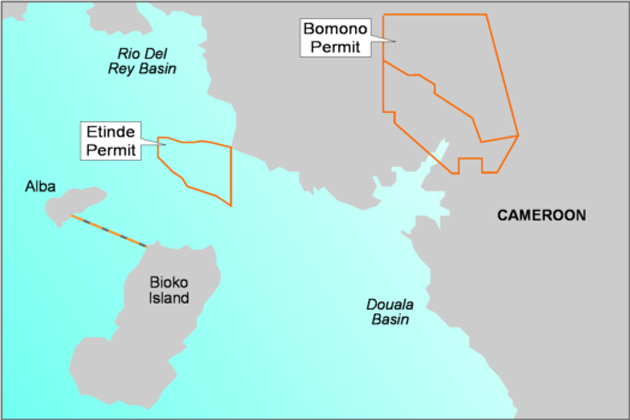

Map source: KeyFacts Energy

Etinde

The JV partners are proceeding with:

- FEED related processes

- Continuing commercial activities focused around a liquids-based development alongside discussion of sales terms with potential gas, condensate and Liquefied Petroleum Gas (“LPG”) off-takers

- Preparatory steps for raising development finance, potentially on a jointly funded basis, to implement the Etinde development project

- Reprocessing seismic data relating to the IE/ID/IB/IC areas of Etinde Bomono

- Discussions with the Government of Cameroon and Société Nationale des Hydrocarbures (“SNH”) to finalise the closing position and return the licence to the State are ongoing

Corporate

- Group cash balance at 31 December 2019 was circa $10.9 million with a further $2.3 million held in financial investments with no debt and material financial commitments

- A bank guarantee relating to the deposit of $0.5 million is due to end shortly and we expect this amount will be added to our free cash resources shortly

- Bowleven considers the value of cash and investment of $13.7 million to be sufficient to meet the Group’s financial requirements until FID on Etinde is reached

- The loss for the six month period was $1.4 million compared to $1.4 million in the equivalent period last year

Eli Chahin, Chief Executive Officer of Bowleven plc, said:

“During the period, we were pleased with the progress made towards achieving FID at Etinde. We advanced a number of important project related work streams, including; appointing a lead FEED contractor, assessing commercial arrangements for the produced condensate and gas, and reviewing potential financing options for the project.

At a time of considerable market turbulence, we are fortunate to benefit from a robust financial position, with in excess of $10 million of cash on the balance sheet and no debt. Coupled with our low cost base, we are well funded to reach FID, after which we will receive $25 million from the JV partners.

Despite the solid progress Bowleven has been making, recent macro conditions have the potential to impact the timing of the Etinde project. As a business, we will continue to work towards achieving FID before year-end and we look forward to keeping all of our stakeholders appraised on progress over the coming months.”

Etinde Exploitation, Offshore Cameroon (25% equity interest)

FEED

Following the completion of an Expression of Interest request, the JV partners commenced a competitive tender process in January 2020 to appoint a contractor(s) to lead Front End Engineering and Design studies alongside New Age’s existing Drilling advisors. The FEED contractor reports to and will be manged by a multi-disciplinary team comprising both New Age and JV partner staff.

Ten international specialist organisations submitted bids to the JV by the end of January 2020 deadline. The JV evaluation process commenced in February 2020 and TechnipFMC was selected as the preferred bidder and awarded the contract. The Operator is finalising the contractual terms for the FEED contract and the associated contract delivery documentation to finalise the contract in early April 2020.

Subject to confirmation from the FEED studies, the JV partners have agreed that Phase 1 of the revised field development plan for Etinde will be focussed on the existing IM discoveries utilising an onshore processing facility for the gas condensate with a single well head platform utilising a field gathering and onshore pipeline. The onshore facilities will be designed on an expandable modular basis to produce condensate, LPG, propane and natural gas. The onshore development will include all necessary storage facilities to enable both onshore use and export of condensate. Whilst commercial discussions continue, the LPG and dry gas products are expected to be sold, at least initially, on the domestic market.

The design concept is expected to include compression and offshore pipeline facilities to enable dry gas to be reinjected into suitable reservoirs to enhance condensate recovery, which creates higher initial levels of production than would be possible. Export of gas remains of special interest to the JV partners and is being actively assessed with the relevant stakeholders.

The JV partners are in the preliminary stages of creating an integrated project development team, which includes representation from all JV partners to support the FEED and Drilling contractors. One key deliverable of this consolidated effort is to create a revised field development plan for submission to and approval by SNH and the Government of Cameroon.

The JV partners currently forecast that the FEED project as a whole, including JV staff, will cost around $10 million in total, the majority of which will be spent over the next 5 to 9 months.

KEYFACT Energy

KEYFACT Energy