Ben Warren, EY Global Power & Utilities Corporate Finance Leader

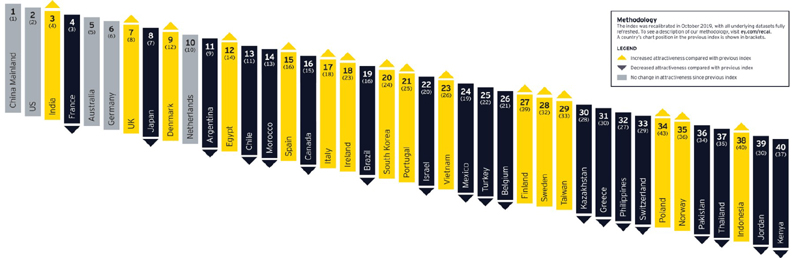

The latest and 54th edition of the Renewable Energy Country Attractiveness Index (RECAI) report ranks 40 countries on the attractiveness of their renewable energy investment and deployment opportunities.

EY teams’ index rankings give you access to the latest country movements at a glance. The index was recalibrated in October 2019, with all underlying datasets fully refreshed.

Image source: EY

Matching capital with capacity in the low-carbon transition. Putting a cost on the low-carbon transition is enormously challenging, and open to enormous dispute. Earlier this year, then-UK Chancellor Philip Hammond estimated the cost to the UK would be £1tn (US$1.3tn) by 2050 – and was roundly attacked for looking only at the costs and ignoring the benefits.

In the US, on the other hand, Alexandria Ocasio-Cortez, the left-wing Congresswoman promoting a Green New Deal designed to tackle climate change and reduce inequality, has said it will cost at least US$10tn. The Green New Deal’s critics put the price tag at US$93tn.

There are, however, parts of the low-carbon jigsaw that are easier to cost, namely the decarbonisation of the world’s electricity systems.

To meet the Paris Agreement’s climate change goals, the International Renewable Energy Agency estimates around US$26t will need to be invested in low-carbon power generation by 2050.

This is a significant sum. Fortunately, the apparently insatiable appetite of large institutional investors for physical assets generating predictable yields suggests that the capital does exists. The challenge is matching these massive pools of capital with the developers and utilities building out the clean energy systems which we will need to address climate change. In the latest edition of the RECAI, EY teams consider how a new twist on the yieldco model could help bring utilities and investors together.

To meet the Paris Agreement’s climate change goals, the International Renewable Energy Agency estimates around US$26t will need to be invested in low-carbon power generation by 2050.

Summary

Of course, one person’s cost is someone else’s revenue. The low-carbon transition presents a gigantic set of opportunities for electric transportation, renewable heating and cooling, a green hydrogen economy and an electricity grid fit for distributed, digitalised supply and demand. EY teams examine how the power and utilities sector can begin to grasp the opportunities presented by commitments to move to net-zero, and what obstacles need to be overcome.

Link to video to hear from EY Global Power & Utilities Corporate Finance Leader, Ben Warren

KEYFACT Energy

KEYFACT Energy