Midway Resources International (MRI) is a pan-Africa focused upstream oil and gas venture with existing projects in Nigeria (shallow water offshore – oil) and Kenya (onshore / transition zone- gas).

Its strategy is to create value through the development of upstream E&P opportunities in Africa with an initial focus on discovered resources with early cash-flow and upside potential.

Value creation and risk management is provided by a strong African-biased operating capability, local stakeholder support and it is planned to crystallize liquidity through an IPO or merger with an already listed entity.

Midway Resources International is a private Cayman Islands limited liability company with supportive shareholders and a very strong Board and Management Team.

Operations

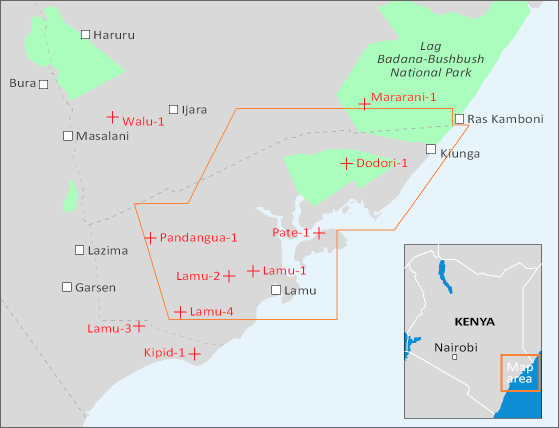

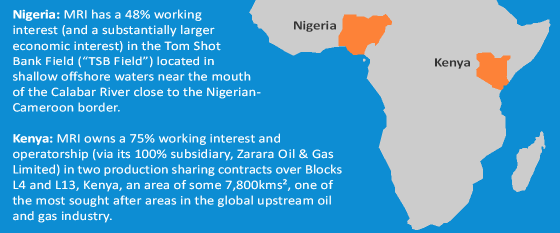

Kenya: MRI owns a 75% working interest and operatorship (via its 100% subsidiary, Zarara Oil & Gas Limited) in two production sharing contracts over Blocks L4 and L13, Kenya, an area of some 7,800kms², one of the most sought after areas in the global upstream oil and gas industry.

Nigeria: MRI has a 48% working interest (and a substantially larger economic interest) in the Tom Shot Bank Field (“TSB Field”) located in shallow offshore waters near the mouth of the Calabar River close to the Nigerian-Cameroon border.

Business Development: Additional opportunities are under active assessment in Kenya and Nigeria and elsewhere within known hydrocarbon basins in Africa.

Kenya

MRI, through its wholly owned subsidiary Zarara Oil and Gas Limited, holds a 75% working interest and is the Operator of Blocks L4 and L13, predominantly located onshore Kenya. The residual working interests, both free-carried until final approval of planned commercial production, are held by CH-Swiss Oil Holdings International at 15% and the National Oil Company of Kenya at 10%. MRI has negotiated a legally binding heads of agreement for the eventual acquisition of the 15% interest of CH-Swiss Oil Holdings.

Blocks L4 and L13 are sizeable exploration blocks with the L4 block being approximately 5,630km² in area and the L13 block being approximately 2,180km² in area. They are located in the highly prospective gas prone Lamu basin located on the northern coast of Kenya.

Map source: KeyFacts Energy

The drilling and development strategy is to prove up the resources, which have a Mid Case aggregate gross resource estimate of approximately 1,115 Bcf and through a gas to power development deliver electrical power for sale into the Kenyan national grid. Zarara is currently planning a drilling campaign for 2017, in which it will drill two wells: namely a well to ‘twin’ the Pate 1 well which was drilled by a Shell and BP consortium in 1971 and discovered gas in the Pate field; and, assuming technical success, a long reach deviated well to further appraise the field.

The project will be developed in a number of phases, expanding as national demand for power grows and as the gas resource is proved up. Phase 1 comprises development of an early production facility requiring two wells and small gas handling and processing facilities designed to feed locally sited electricity generation modular units. Subsequent phases will involve drilling more wells and building additional gas processing and power generation facilities to allow for increased production to meet growing electricity demand.

The development benefits from being onshore, having close proximity to a connection to the national electricity grid and potential for a phased development to meet demand. These features allow for greater flexibility, better capital discipline and substantially lower recoverable volumes (<30 Bcf) to be commercially viable. As such, successful appraisal of and production from Pate-2 and 3 wells could have sufficient commercial volumes to proceed to the Phase 1 development of a small power plant (50MW-200MW).

Pate-2: In March 2019, Zarara announced preliminary results of drilling of the Pate-2 well on Blocks L4 & L13. The well was drilled to a total depth of 4,307 meters and penetrated the primary Lower Tertiary Kipini objective.

The well results successfully confirmed a working petroleum system in the Pate sub-basin of the Lamu Basin. In addition to any further appraisal activity with respect to Pate-2 well, Zarara will now focus its further exploration activity within a Kipini play fairway that Zarara believes exists within Blocks L4 and L13.

Technical summary: The Pate field was discovered in 1971 by a Shell and BP consortium while drilling the Pate-1 well which encountered over-pressured gas-charged sands in the Basal Kipini reservoir at 4,175 metres MD. During drilling, the well kicked and flowed gas from an uncased hole section. The well was eventually brought under control after flowing for some 2-3 days, and then plugged with cement and abandoned, as the consortium’s primary objective was to discover oil.

The consortium had previously drilled Dodori-1 well in 1964, which is located 30km to the northeast of Pate-1, in Block L13. Dodori-1 was drilled to a depth of 4,159 metres and gas shows were also present but flowed at uncommercial rates exceeding 2 mmscf/day.

The two blocks were subsequently relinquished by the consortium and licensed out by the Ministry of Energy and Petroleum to Swiss Oil Holdings International (‘SOHI’) on 3rd September, 2008 under two separate Production Sharing Contracts (‘PSC’). On 4th April 2011, SOHI farmed out a 75% interest and operatorship in each licence to Zarara, a private exploration company, in return for fulfilling the blocks’ licence commitments. Zarara was acquired by a subsidiary of Midway Resources International on 1st May 2012.

Geological overview: Pate-1 is located in the NW corner of the Pate island, 70km SW of the Kenyan-Somali border and 32km NE of Lamu. The well is located approximately 30km SW of Dodori-1 and approximately 35km NE of Lamu-1. Further SW is the Kipini-1 well.

Pate-1 was drilled to a depth of 4,175 metres MD on a closed culmination of the SW extension of the Mararani-Dodori anticlinal trend. The well was intended to test Lower Tertiary and Upper Mesozoic strata and was a follow up of Dodori-1, drilled in 1964, which encountered small shows and traces of bitumen in the Paleocene.

Pate-1 encountered a 10 metre thick porous sand of probable Lower Eocene age at 4,175 metres MD. The well kicked and the open hole was cemented to control the well. As the primary hydrocarbon objective was oil the well was subsequently abandoned by Shell and BP. The gas-bearing sands were not logged or tested. A gas sample was recovered and assayed by Shell at its Mombasa Refinery and evidences relatively lean natural gas relatively free of noxious elements.

The gas discovery by Pate-1 critically proves a working hydrocarbon system. The objective of the appraisal and delineation phase is to assess the connected volume to that well and determine its sustainable production. Longer term, Blocks L4 and L13, covering approx. 7,810 sq km, offer considerable additional exploration potential.

Nigeria

Tom Shot Bank Field

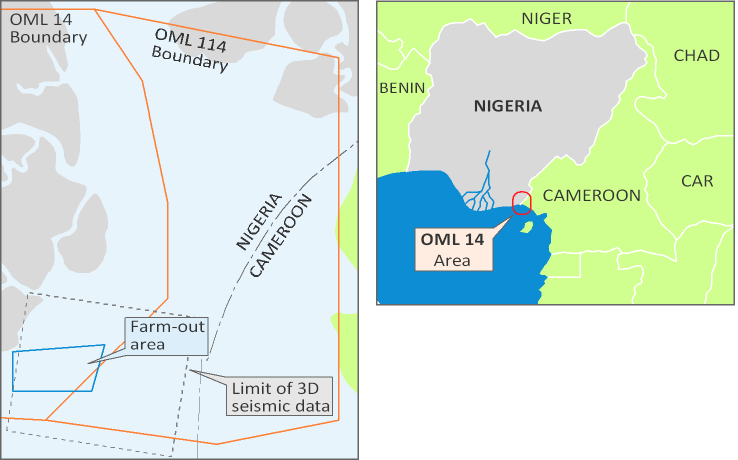

In July 2016, MRI farmed-in to acquire a 48% working interest (and a substantially larger economic interest) in the Tom Shot Bank Field (“TSB Field”) located in shallow offshore waters near the mouth of the Calabar River close to the Nigerian-Cameroon border.

Map source: KeyFacts Energy

Originally the TSB Field was located within OML 14 and licensed to Nigerian National Petroleum Company ("NNPC") (55%) and a Shell /Agip/Elf consortium (45%). The field was then farmed out pursuant to a farm out agreement dated 27th April 2004 under the Nigerian marginal field program to Associated Oil and Gas Services Limited (“AOGSL”) as 51% working interest holder and Operator and Dansaki Petroleum Limited (“DPL”) as 49% working interest holder. Subsequently, Shell Agip and Elf relinquished their interests in OML 14 and the area reverted to the Nigerian Government.

In 2012, Mira Resources Corporation (“Mira”) a company listed on the TSX Venture Exchange, farmed into the licence and became the Technical Service Provider. It funded the re-entry of TSB-1 well, re-logged the well and completed a DST, which flowed 41 degree API crude. After operational difficulties forced abandonment of further drilling and testing operations, Mira became financially distressed and its farm-in interests were eventually terminated and reverted to AOGSL and DPL.

AOGSL and DPL have formed an unincorporated joint venture with AOGSL as Operator (TSB Field JV) to appraise, develop and produce the field. MRI has acquired its 48% working interest from both parties pro rata such that, and subject to Ministerial consent, the new ownership will be as follows:

AOGSL 26.5 % (Operator)

DPL 25.5 %

MRI 48.0 %

MRI will provide technical, managerial and financial leadership to the TSB Field JV over the life of the field under the terms of a Technical and Management Support Agreement agreed between the parties. MRI also has hydrocarbon off-take and lifting rights. The appraisal, development and production operations will be managed and controlled by MRI on behalf of the Operator until its financial support and investment rewards are fully recovered. The recovery of its financial support and investment rewards is fully secured against the interests of AOGSL and DPL and their shareholders.

In August 2012, RPS Energy (“RPS”) prepared an independent assessment of the resources associated with the TSB Field and identified 22 mmbbls of gross 2C contingent resources from 99.8 mmbbls oil initially-in-place (“OIIP”). In February 2013, Schlumberger PetroTechnical Services was asked to provide Mira with a review of the RPS work based on the additional information available and whilst agreeing the reservoir OIIP” for the largest reservoir interval U7, overall they concluded that for the 5 main sand intervals the OIIP was 93.6 mmbbls, similar to an assessment by RPS of 99.8 mmbbls.

Technical Summary: TSB Field is a shallow offshore field located in water depths of approximately 15 metres. TSB was discovered by Shell Petroleum during the 1980’s and encountered 130 metres of gross hydrocarbon pay.

The TSB Field reservoirs are Upper Miocene in age and are located at a depth between 1050-2500 metres TVDSS. The interval of interest in TSB-1 is in the Biafra Member of the Agbada Formation. The reservoir formations are the U-sandstone reservoirs.

There are approximately 13 sand reservoirs identified in the logs. These are a mixture of typical Niger Delta channels and sand bars as well as more laminated sequences towards the deeper horizons.

LEADERSHIP / CONTACT

Peter Worthington Chief Executive Officer

Dr Mark Bristow Chairman

Dr Kwame Nyantekyi-Owusu Deputy Chairman

Patrick Barr Chief Financial Officer

Austen Titford Chief Operating Officer, Kenya

Joe Attueyi President MRI Nigeria

Anish Airi Subsurface Manager

Peter Nduru Country Manager, Kenya

Alawy Azein Community Liaison Officer, Kenya

Abdulswamad Twalib Basheikh Deputy Community Liaison Officer, Kenya

MRI Management Company LLP

15 Half Moon Street

London, W1J 7DZ

United Kingdom

Tel: +44 (0)20 7495 7072

Midway Resources International

Registered Office:

Ugland House, South Church Street, PO Box 309GT

George Town, Grand Cayman, Cayman Islands

KEYFACT Energy

KEYFACT Energy