In the third quarter of 2019 Kosmos Energy generated net income of $16 million, or $0.04 per diluted share. When adjusted for certain items that impact the comparability of results, the Company generated adjusted net income(1) of $17 million or $0.04 per diluted share for the third quarter of 2019.

"Kosmos continued to build momentum in the third quarter with strong free cash flow delivery and exploration success" said Andrew G. Inglis, chairman and chief executive officer. "At current oil prices we expect to deliver the 2019 free cash flow we set out at our capital markets day in February. Our 2019 drilling program in Mauritania and Senegal has increased the gas initially in place to the top end of our 50-100 Tcf range. Furthermore, our first infrastructure-led exploration well in Equatorial Guinea was successful and we expect this to further enhance the value of our Equatorial Guinea acquisition."

It should be noted that beginning with the first quarter 2019, the results include the impact of proportionately consolidating the Equatorial Guinea results. Prior quarters exclude this impact and only include the minority interest gain or loss in the bottom line. In addition, the prior year quarter includes only a partial quarter from the Gulf of Mexico acquisition, which did not close until mid-September 2018.

THIRD QUARTER 2019 HIGHLIGHTS

- Net cash provided by operating activities - $178 million; free cash flow1 (non-GAAP) - $70 million

- Sales - 6.0 million barrels of oil equivalent (boe)

- Revenues - $357 million

- Realized oil and gas revenues, excluding the impact of hedging program - $59.13 per boe.

- Production expense - $96 million, or $15.83 per boe

- General and administrative expenses - $25 million, $15 million cash expense and $10 million non-cash equity based compensation expense

- Depletion and depreciation expense - $147 million, or $24.29 per boe

- Exploration expenses - $23 million

- Capital expenditures - $107 million

At quarter end, the Company was in a net underlift position of approximately 1.2 million barrels of oil.

Third quarter results included a mark-to-market gain of $27 million related to the Company's oil derivative contracts. As of the quarter end and including recently executed hedges, Kosmos has approximately 15.1 million barrels of oil hedged covering 2019 through 2020 including Brent, WTI, and LLS based hedges.

Kosmos exited the third quarter of 2019 with approximately $704 million of liquidity, total debt of $2.15 billion, and $1.93 billion of net debt.

OPERATIONAL UPDATE

Total net production in the third quarter of 2019 averaged approximately 68,800 barrels of oil equivalent per day (boepd)(2).

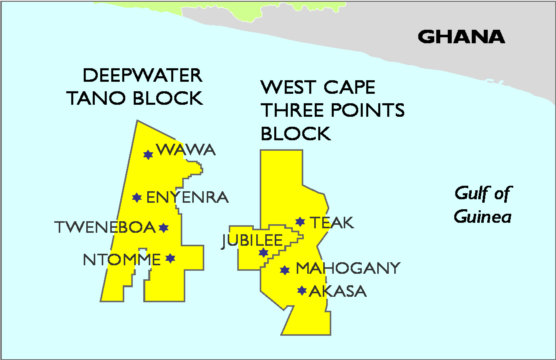

Ghana

During the third quarter of 2019, net production from Ghana averaged approximately 31,500 barrels of oil per day (bopd). As forecast, Kosmos lifted three cargoes from Ghana during the third quarter. The Jubilee gas enhancement work program originally scheduled for the fourth quarter of 2019 has been deferred by the operator to the first quarter of 2020.

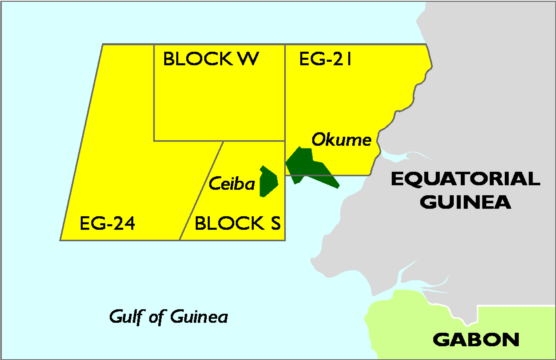

Equatorial Guinea

Production in Equatorial Guinea averaged approximately 11,500 bopd net in the third quarter of 2019 and Kosmos lifted the forecast one cargo from Equatorial Guinea during the quarter.

In late October, the S-5 well was drilled to target depth, encountering approximately 39 meters of net oil pay in good-quality Santonian reservoir. The S-5 well was fast-tracked based on new 3D seismic acquired in 2018 and was Kosmos' first infrastructure-led exploration (ILX) well drilled in Equatorial Guinea. The well is located within tieback range of the Ceiba FPSO and work is currently ongoing to establish the scale of the discovered resource and evaluate the optimal development solution. The well was drilled in approximately 800 meters of water to a total measured depth of around 4,400 meters.

U.S.Gulf of Mexico

U.S.Gulf of Mexico production averaged approximately 25,800 boepd net (82% oil) during the third quarter, exceeding the high end of the guidance range despite experiencing downtime from Hurricane Barry equivalent to approximately 1,500 boepd for the quarter. The strong third quarter production was driven primarily by Odd Job, capitalizing upon spare capacity aboard Delta House, as well as initial production from Gladden Deep, the first successful well in the 2019 ILX program in the basin.

The Moneypenny prospect was drilled in Mississippi Canyon Block 214 in late October 2019 and was unsuccessful. The well, which was targeting net resources of approximately 9 million barrels of oil equivalent, was designed as an inexpensive exploration tail of the Odd Job development well and cost around $3.5 million.

Kosmos was an active participant in U.S. Gulf of Mexico Lease Sale 253 in August, and was subsequently awarded the four deepwater blocks upon which it was previously deemed to be the high bidder.

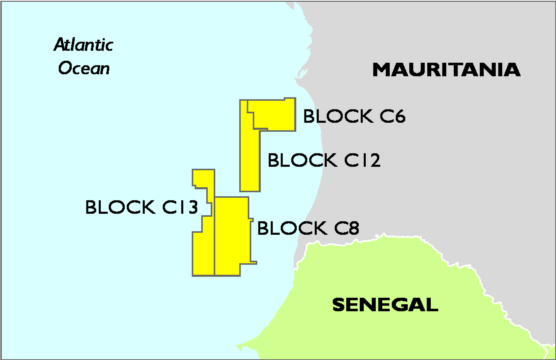

Mauritania & Senegal

The Greater Tortue Ahmeyim project located offshore Mauritania and Senegal remains on track with progress being made across all Phase 1 project areas including subsea, FLNG vessel, HUB Terminal, and FPSO vessel. Overall, Phase 1 of the Tortue project is approximately 15 percent complete. Pre-FEED work is ongoing for Phases 2 and 3 and these next phases are expected to expand capacity of this hub to almost 10 MTPA of LNG for export.

In September, Kosmos announced that the Yakaar-2 appraisal well encountered approximately 30 meters of net gas pay in similar high-quality Cenomanian reservoir to the Yakaar-1 exploration well. The results of the Yakaar-2 well underpin Kosmos' view that the Yakaar-Teranga resource base is world-scale and has the potential to support an LNG project that provides significant volumes of natural gas to both domestic and export markets. Development of Yakaar-Teranga is expected in a phased approach with Phase 1 providing domestic gas and data to optimize the development of future phases. It will also support the country's "Plan Emergent Senegal" launched by the President of Senegal in 2014.

In October, Kosmos announced that the Orca-1 exploration well made a major gas discovery offshore Mauritania in the BirAllah area. The results continue the 100 percent success rate from nine wells targeting the inboard gas trend in Mauritania/Senegal. The Orca-1 well, which targeted a previously untested Albian play, exceeded pre-drill expectations encountering 36 meters of net gas pay in excellent quality reservoirs. In addition, the well extended the Cenomanian play fairway by confirming 11 meters of net gas pay in a down-structure position relative to the original Marsouin-1 discovery well, which was drilled on the crest of the anticline. The location of Orca-1, approximately 7.5 kilometers from the crest of the anticline, proved both the structural and stratigraphic trap of the Orca prospect, which we estimate has a mean gas initially in place (GIIP) of 13 TCF. In total, we believe that Orca-1 and Marsouin-1 have de-risked up to 50 TCF of GIIP from the Cenomanian and Albian plays in the BirAllah area, more than sufficient resource to support a world-scale LNG project. In addition, a deeper, untested Aptian play has also been identified within the area and surrounding structures.

(1) A Non-GAAP measure, see attached reconciliation of non-GAAP measure

(2) Production means net entitlement volumes. In Ghana and Equatorial Guinea, this means those volumes net to Kosmos' working interest or participating interest and net of royalty or production sharing contract effect. In the Gulf of Mexico, this means those volumes net to Kosmos' working interest and net of royalty.

KEYFACT Energy

KEYFACT Energy