As part of our 'at-a-glance' guide to company global operational activity, we feature Parkmead Group.

From small private operators through to multi-national companies, KeyFacts Energy's database includes over 600 ‘first-pass’ preliminary review profiles, available on request.

Parkmead Group

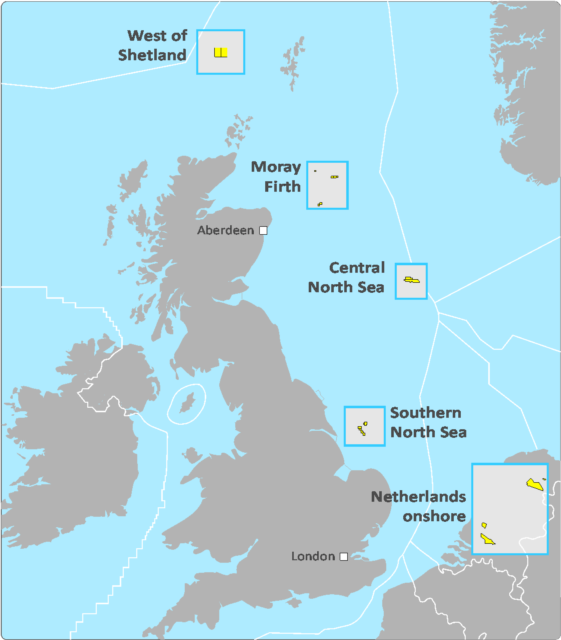

The Parkmead Group is an independent, UK and Netherlands focused energy business with four business areas. Its shares are listed on the AIM market of the London Stock Exchange. The Group currently produces gas from a portfolio of four fields across the Netherlands and holds significant oil and gas interests spanning 24 exploration and production blocks under licence. Parkmead also has access to renewable energy opportunities within its portfolio.

The Group also holds interests in a portfolio of exploration prospects alongside leading international partners.

Parkmead is continually expanding its portfolio of high quality assets covering the three main areas of E&P operations; exploration, development and production.

UNITED KINGDOM

Parkmead has an important part to play in the UK’s oil and gas energy mix going forward, with major projects in the Central North Sea including the Greater Perth Area and Skerryvore, and in the Southern North Sea with Platypus and Blackadder. Parkmead also holds highimpact exploration blocks in the West of Shetland area which includes three large prospects named Davaar, Sanda North and Sanda South.

Greater Perth Area (GPA)

This is one of the North Sea’s largest undeveloped oil projects with three core fields that have been fully appraised. 13 wells have been drilled with an estimated 400 million barrels of oil-in-place. Parkmead is in discussions with operators in the vicinity of the GPA as well as internationally-renowned service companies in order to progress the development and unlock the large potential value that this project holds.

Skerryvore

Skerryvore sits in a highly prospective area of the Central North Sea, with stacked potential in three reservoirs; at the Mey Sandstone Member and the Ekofisk and Tor formations. The Mey is analogous to the neighbouring Talbot discovery where appraisal drilling is planned for 2021. The prospects have an estimated 157 million barrels of recoverable oil equivalent on a P50 basis. Additional prospectivity is found in the Jurassic and Triassic underneath Skerryvore, similar to the recent Isabella discovery, operated by TotalEnergies. Parkmead is currently reprocessing 507sq km of 3D seismic to further improve seismic image quality and further refine resource estimates.

Platypus

Containing 2P reserves of 106bcf, the Platypus development is projected to reach FID in 2021, with first gas potentially less than two years after. It is an important project for Parkmead as it will provide substantial upside to the group’s net production in coming years. Parkmead have two JV partners on this project that are committed to enhancing development efficiency in order to reduce upfront CAPEX and increase overall commercial viability. There is also significant potential upside from the 50 bcf, low-risk Platypus East prospect.

Blackadder

Located in the prolific Southern Gas Basin, the Blackadder gas prospect is estimated to contain 107bcf of recoverable resources. Parkmead is currently undertaking studies across the licence to better understand reservoir effectiveness. Further upside can be achieved on the licence with the addition of the Teviot discovery located on the southeast of the licence.

West of Shetland

Parkmead holds a 100% interest in both the P.2296 and P.2406 licences which contain three large prospects Davaar, Sanda North and Sanda South. These prospects all target the Paleocence Vaila Formation. This is the same formation that provides the reservoir for the nearby Foinaven, Schiehallion, Laggan and Tormore fields. P50 prospective resources are 307mmbbls in the combined Sanda prospects and 225mmbbls in the Davaar prospect. There is potential for the three anomalies to be one combined field, giving a resource potential of up to 1.1 billion barrels.

32nd UKCS Licensing Round

In the UK 32nd licensing round awards, Parkmead was offered four offshore blocks and part blocks spanning three new licences.

The first of these provisional licence awards covers Blocks 14/20g & 15/16g (Parkmead 50% and operator) situated in the Central North Sea, adjacent to Parkmead’s extensive Greater Perth Area (“GPA”). These blocks contain two undeveloped oil discoveries, Fynn Beauly and Fynn Andrew, as well as an oil prospect in the Piper Formation.

Fynn Beauly is a very large heavy oil discovery which extends across a number of blocks. The entire discovery is estimated to contain oil-in-place of between 602 and 1343 million barrels. Blocks 14/20g & 15/16g contain a section of the discovery to the south, with oil-in-place of between 77 and 202 million barrels. The second discovery, Fynn Andrew, is wholly contained on the offered blocks and holds 50 million barrels of oil-in-place on a P50 basis.

The addition of these blocks to Parkmead’s portfolio would add 34.4 million barrels of 2C resources to the Group.

Two further licences have been offered to Parkmead as part of the 32nd Round. Block 14/20c (Parkmead 100%) is located in the Central North Sea and contains extensions to the Lowlander oil field and the Fynn Beauly oil discovery. Block 42/28g (Parkmead 100%) is situated in the Southern North Sea near the Tolmount gas discovery.

NETHERLANDS

The Parkmead portfolio includes producing gas fields with a very low operating cost. This profitable gas production from the Netherlands provides important cash flow to the Group.

Netherlands highlights

- Gross production at the Group’s Netherlands assets for the financial year ended 30 June 2020, averaged 38.3 million cubic feet per day (“MMscfd”), which equates to approximately 6,608 barrels of oil equivalent per day

- Low-cost onshore gas portfolio in the Netherlands produces from four separate gas fields with an average field operating cost of just US$9.9 per barrel of oil equivalent, generating strong cash flows

- The Brakel field was brought back to full production during the period following the completion of a work programm

- Concept selection planning at the Papekop oil and gas discovery has begun, a proven field with 24.2 million barrels of oil-in-place and 39.4 billion cubic feet (“Bcf”) of gas-in-place

- Multiple further opportunities exist around Diever West, such as Boergrup and De Bree, both of which contain stacked targets with similar characteristics to Diever West

- Boergrup well permitting and planning is underway

- A new seismic reprocessing project began in Q4 2019, which will help define and high-grade the extensive prospects around Diever West

- Dynamic reservoir modelling suggests Diever West held initial gas-in-place of approximately 108 Bcf, more than double the post-drill static volume estimate of 41 Bcf

In July 2021, Parkmead agreed to purchase a historic royalty associated with the Group’s existing interests in the Drenthe IV, Drenthe V and Andel Va licenses in the Netherlands from Vermilion Energy. These licences contain the Grolloo, Geesbrug and Brakel onshore gas fields, respectively.

This royalty was previously held by NAM (a Shell and ExxonMobil joint venture) and came with the licences when they were acquired by Parkmead. The consideration for this acquisition is €565k and will be satisfied through a part cash payment of approximately €150k with the balance being paid from part of the remaining 2021 net revenue from Parkmead’s working interest in the Geesbrug gas field. The acquisition removes the royalty associated with the existing producing gas wells.

Through this acquisition, Parkmead will increase its net gas production from these wells, doubling the Group’s effective financial interest from 7.5% to 15% (in line with Parkmead’s working interest in the licences). It is also expected that this step will extend the producing life of these fields through greater partner alignment. The Drenthe VI licence, containing the large Diever West gas field, is not affected by this royalty.

Renewable Energy

In August 2019, Parkmead acquired the entire issued share capital of Pitreadie Farm Limited, a company owning extensive farmland and sites in Scotland with significant renewable energy potential.

Potential has been identified for the installation of numerous wind turbines, a solar farm and a biomass production facility on the acquired land, totalling some 2,320 acres.

The renewables sector is a natural expansion of Parkmead’s energy operations and is fully in line with the Group’s strategy to increase the balance of Parkmead’s portfolio.

Parkmead recognises the transition that is taking place in the energy market, supported by legislation, from fuels with a higher carbon content to lower carbon alternatives such as natural gas and renewables. Natural gas and renewables play key roles in the generation of electricity.

In light of these important energy market factors, Parkmead transitioned to a gas-only producer in January 2016 and the Group has increased its gas production almost tenfold since 2014.

Parkmead remains of the strong belief that oil and gas will have a very important role to play in the energy mix in future years. This is evidenced by a range of forecasts showing robust and increased demand for oil and gas going forward.

The Group believes that now is the optimum time to broaden Parkmead’s low-cost, low-carbon operations. The renewables sector is a natural expansion of Parkmead’s operations and is fully in line with the Group’s strategy to increase the balance of Parkmead’s portfolio.

Board

Thomas Cross Executive Chairman

Ryan Stroulger Finance Director

Guy Stroulger Director Business Development & Commercial

Nick Allan Subsurface Manager

Donald Wilson Group Financial Controller

Henry Steward Financial Analyst

Contact

The Parkmead Group plc., Group Headquarters

4 Queen's Terrace, Aberdeen, AB10 1XL

Tel: 01224 622200 l Email: enquiries@parkmeadgroup.com

Link to Parkmead Group UK country profile l KeyFacts Energy: Company Profile

KEYFACT Energy

KEYFACT Energy