Wentworth, the AIM listed independent, East Africa-focused oil & gas company, announces its audited results for year ended 31 December 2018.

HIGHLIGHTS

Corporate

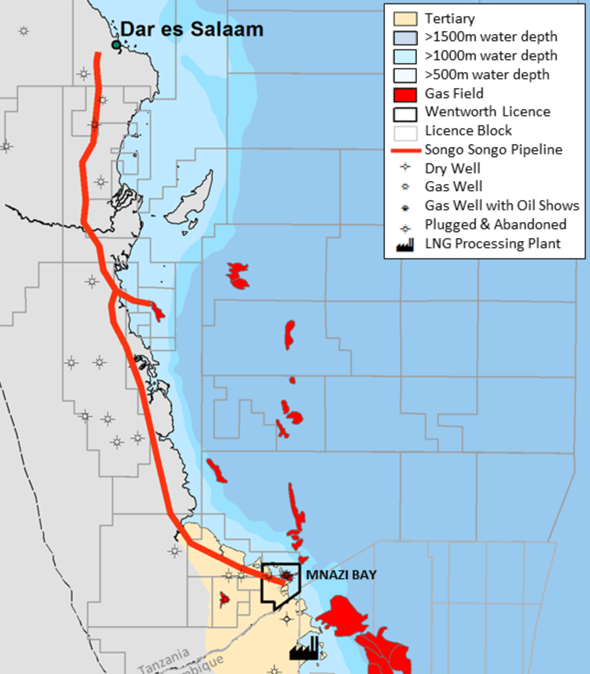

- Mnazi Bay, core producing gas asset in Tanzania, produced at an average 2018 rate of 4,425 boepd net W.I.

- 2P Reserves of 99.7 Bscf (16.6 MMboe), valued at $106 million (after-tax NPV15)

- Completed corporate transition to the UK - completed Oslo Børs delisting, resulting in a simpler transactional platform, driving efficiencies into the business model

- UK based management team in place from June 2018 following relocation of corporate headquarters from Canada, with Calgary office closed at the end of 2018 and Maputo office closed in March 2019

- Refreshed UK based Board as of November 2018

- Strong and supportive institutional shareholder register

Financial

- Milestone Mnazi Bay gas sales revenue of $16.2 million (2017: $13.4 million)

- Adjusted earnings ("EBITDAX") of $8.3 million (2017: $5.3 million) excluding non-recurring expenses of $76.6 million. Non-recurring expenditures include: Mozambican exploration impairment provision $41.6 million; one-off re-structuring and redomicile costs of $2.3 million comprising recruitment, severance, travel, legal and professional charges; Tanzanian tax assessments of $1.0 million for the years 2013 to 2016, provision against Tanzania Government receivables $5.0 million; and deferred tax write-downs of $26.7 million

- Net loss of $75.2 million (2017: $0.7 million)

- Net cash at year-end of $0.8 million, compared to net debt of $13.9 million at 31 December 2017

- Cash and cash equivalents on hand at year-end of $11.9 million (2017: $3.75 million)

- Reduced outstanding long-term loans by $7.3 million to $8.6 million (2017: $15.3 million)

Operational

- Average gross daily gas production for the period increased 70% to 83.2 MMscf/d from 49.1 MMscf/d in 2017; above annual 2018 guidance of 65-75 MMscf/d

- Exited 2018 with an average daily production rate 92.5 MMscf/d in December, a new Company record

- Continued operating cost reduction to $0.44 / Mscf (2017: $0.84 / Mscf), leveraging increased production volumes

- Total cash receipts of $36.2 million from gas sales and recovery of long-term government receivables during 2018

- On track to relinquish Tembo block in Northern Mozambique ahead of the end of the current appraisal term on 15 June 2019

Eskil Jersing, CEO, commented:

"2018 saw us make material progress in simplifying our business and portfolio. On our core Mnazi Bay asset, we achieved record average production levels of 4,425 boepd and associated gas revenue of US$16.2mm, ending the year with a 56.8% improvement in our EBITDAX of US$8.3mm and cash of US$11.9mm.

We continue to work diligently with all our Tanzanian stakeholders in unlocking the latent value of the Mnazi Bay. Wentworth will continue to improve its fundamentals through 2019; and the Board of Wentworth remains focused on its stated strategy of revenue stream diversification and maximising returns for shareholders."

KeyFacts Energy Tanzania country page l Link to Wentworth Tanzania country profile

KEYFACT Energy

KEYFACT Energy