Tower Resources has provided an update on operations on the Thali block, offshore Cameroon, financing and its intention to raise interim finance via a Bridging Loan Facility.

Cameroon Update

Tower is in the final stages of planning the NJOM3 well, which will be drilled to a total depth of 1,100 metres intersecting at least three reservoir zones already identified by the NJOM1B and NJOM2 discovery wells drilled on the Njonji structure by the previous operator Total. The well is designed to confirm the greater reservoir thicknesses observed on the reprocessed 3D seismic in the up-dip area of the structure and also evaluate additional reservoirs that were not present in the areas where Total's wells are located. The NJOM3 well is designed to supplement Total's well data with a suite of measurement and logging tools and drill stem test ('DST') flows to surface. The Company's intention is then to suspend the well with a view to subsequent completion as one of four initial production wells on the structure, as envisaged in the Reserve Report prepared by Oilfield International Limited ('OIL') on 31 October 2018. This first phase of development envisaged by the Reserve Report, aiming to exploit the 2C contingent resources (Pmean 18 million barrels oil, gross) already identified in the structure, aims to provide significant production to Tower in 2020.

Map source: Tower Resources

Since the Company's last update, the following operational progress has been made:

- The Topaz Driller, the Vantage rig which Tower has contracted to drill the NJOM3 well, is currently expecting to complete operations for its current charterer in Gabon in mid-May, which should make it possible to spud the NJOM3 well in the last week in May 2019;

- The final location of the NJOM3 well has been agreed with Société Nationale des Hydrocarbures ('SNH');

- A full drilling team is now in place and operating from the Company's offices in Douala and the AMT logistics base there;

- All long lead items have now been acquired and all services contracted on the basis of a late-May spud date, though this date is still subject to slippage depending on the operations of the current charterer of the Topaz Driller;

- A debris survey and other site preparation work are underway; and

- Anticipated cost of the well remains in previously disclosed ranges of around $10 million dry hole cost and around $14 million including well planning and testing.

As previously disclosed, the Company is planning to use a combination of bank financing and own or partner equity to fund the first phase of development at Njonji, including the proposed NJOM3 well. The Company has for several months been discussing a loan facility with a prominent African bank, for the Njonji development of US$15 million which could be extended to US$50 million, and the Company is still hopeful that such a facility may be in place by mid-May. With or without such a facility, the Company has also been holding discussions with several possible partners for the Thali license, which the Company also hopes may be concluded in that time frame. Any one of these options, or a combination of them, could provide the additional funds required to complete the current well.

Proposed Bridging Loan Facility

In the meantime, the Company requires additional working capital whilst the above discussions are completed and today announces its intention to raise short term financing of up to US$750,000 via a Bridging Loan from a funder on terms to be confirmed including the expected issue of warrants to the lender.

Thali block

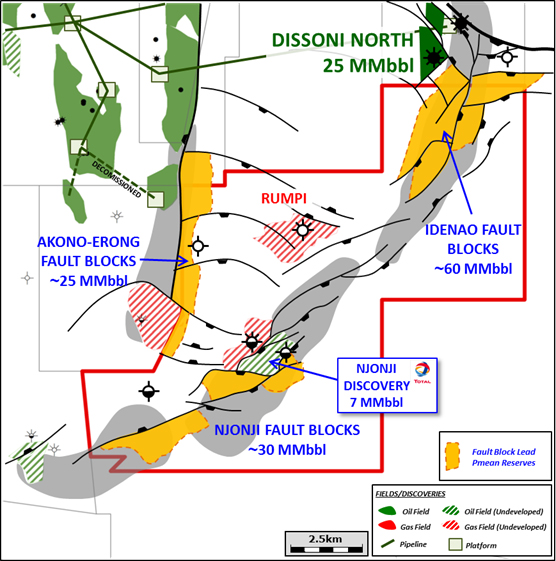

Tower Resources Cameroon S.A, a wholly-owned subsidiary of Tower Resources plc, holds a 100% interest in the shallow water Thali (formerly known as "Dissoni") Production Sharing Contract (PSC), in the Rio del Rey basin, offshore Cameroon. Tower was awarded the PSC on 15 September 2015 for an Initial Exploration Period of 3 years, which has been extended for a further year ending 15 September 2019.

The Thali PSC covers an area of 119.2 km², with water depths ranging from 8 to 48 metres, and lies in the prolific Rio del Rey basin, in the eastern part of the Niger Delta. The Rio del Rey basin has, to date, produced over one billion barrels of oil and has estimated remaining reserves of 1.2 billion barrels of oil equivalent ("boe"), primarily within depths of less than 2,000 metres. The Rio del Rey is a sub-basin of the Niger Delta, an area in which over 34.5 billion barrels of oil has been discovered, with 2.5 billion boe attributed to the Cameroonian section.

An independent Reserve Report conducted by Oilfield International Limited (OIL) has highlighted the contingent and potential resources on the Thali licence and the associated Expected Monetary Value (EMV) as follows:

- Gross mean contingent resources of 18 MMbbls of oil across the proven Njonji-1 and Njonji-2 fault blocks;

- Gross mean prospective resources of 20 MMbbls of oil across the Njonji South and Njonji South-West fault blocks;

- Gross mean prospective resources of 111 MMbbls of oil across four identified prospects located in the Dissoni South and Idenao areas in the northern part of the Thali licence;

- Calculated EMV10s of US$118 million for the contingent resources, and US$82 million for the prospective resources, respectively.

KeyFacts Energy Cameroon country page l Link to Tower Resources Cameroon country profile

KEYFACT Energy

KEYFACT Energy