WTI (Mar) $64.36 +81c, Brent (Apr) $69.04 +99c, Diff -$4.68 +18c

USNG (Mar) $3.14 -28c, UKNG (Mar) 80.00p +3.75p, TTF (Mar) €33.57 +€0.775

Oil price

Oil is up slightly this morning as the recent strength is maintained by the the US advising US flagged shipping should ‘steer clear’ of the Iran side of the Straits of Hormuz and the Gulf of Iran. Talks are apparently continuing so this is merely jousting and Iran themselves has again warned the US that any attack on them would see retaliation against US air bases in the Gulf, good luck with that…

API stats later and should be getting back to normal, certainly LNG is rebuilding very quickly after Winter storm Fern so maybe only a modest build, EIA tomorrow.

BP results today and whilst Meg doesn’t start until April, I see her finger prints all over this release as she starts to repair the damage done by fifteen years of appalling management. Stopping the share buy-back pro-tem looks smart, next stop dispose or close all the renewables rubbish accumulated by previous management and swiftly followed by clearing out all the atrocious decisions associated with recent leadership.

Europa Oil & Gas

Europa has announced its intention to raise up to £3.5 million via a placing of new ordinary shares of 1 pence each in the Company to institutional and other investors at a price of 1.2 pence per new Ordinary Share. The Placing Price represents a discount of approximately 20 per cent. to the closing bid price of an Ordinary Share on 9 February 2026 (being the latest practicable date prior to this announcement).

Investors in the Fundraising will receive one warrant for every four Placing Shares. The Warrants have an exercise price of 2 pence and will expire 2 years after the date of the Placing Shares’ admission to trading on AIM.

Europa greatly values the support of its retail shareholders and considers it important that existing Shareholders who are not participating the in the Placing are given an opportunity to acquire new Ordinary Shares at the Placing Price. As such, the Company also intends to offer its existing eligible retail shareholders the opportunity to participate in a retail offer, via the Winterflood Retail Access Platform (“WRAP”), details of which will be announced shortly.

For the avoidance of doubt, the Placing is separate from and does not form part of the WRAP Retail Offer and completion of the Placing is not conditional on the completion of the WRAP Retail Offer.

The issue of the Placing Shares and the Warrants pursuant to the Fundraising is conditional upon, inter alia, the approval of shareholders at a general meeting of the Company (the “General Meeting”) to be convened on or around 27 February 2026 and upon admission to trading on AIM (“Admission”) of the Placing Shares becoming effective. A further announcement confirming details of the General Meeting and the posting of a circular to shareholders will be made in due course. When issued, the new Ordinary Shares will rank pari passu with the existing ordinary shares of the Company, including the right to receive future dividends.

Tennyson Securities (a trading name of Shard Capital Partners LLP) are sole bookrunner of the Placing (the “Bookrunner”).

The proceeds will extend the Company’s cash runway to ensure that the Barracuda prospect is drilled and provide additional financial resources for the Company’s ongoing working capital needs. Proceeds of around £1.5 million will be used to fund the Company’s 42.9% share of funds required by Antler Global Limited (“Antler”) to progress it’s 40% interest in the EG-08 licence in Equatorial Guinea to drilling (expected to be in late 2026) and testing of the 893 BCF Barracuda prospect, and proceeds of around £2.0 million will provide general working capital to support working commitments on Europa’s other licence interests.

IF THE RESOLUTION TO BE PROPOSED AT THE GENERAL MEETING REGARDING THE ISSUE OF THE PLACING SHARES AND ANY SHARES TO BE ISSUED UNDER THE WRAP RETAIL OFFER IS NOT PASSED, THE COMPANY WILL NOT HAVE SUFFICIENT FUNDS TO MAINTAIN ITS CURRENT INTEREST IN ANTLER (AND THEREFORE THE EG-08 LICENCE) NOR TO CONTINUE ITS OTHER OPERATIONS AND THERE WOULD BE A MATERIAL UNCERTAINTY OVER THE COMPANY’S ABILITY TO CONTINUE AS A GOING CONCERN.

Placing Highlights

- Europa has a 42.9% interest in Antler which holds a 40% working interest in the EG-08 PSC following a binding Farm-out Agreement (“FOA”) signed in December 2025 with Fuhai (Beijing) Energy Limited (“Fuhai”). Under the terms of the FOA Fuhai will fund 95% of the costs of the Barracuda well up to a cap of $53m for the total well cost. Antler shall fund the remaining 5% of the total well cost. Any cost over-runs above the $53m cap will be shared equally between Fuhai and Antler. The deal remains subject to regulatory approvals in both Equatorial Guinea and China, both of which are expected in Q1 2026.

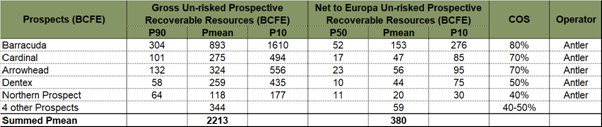

- Europa believes that the EG-08 block contains 2.213 TCF (Pmean), with the primary prospect being Barracuda which is estimated to be 893 BCF (Pmean) as detailed in the following table:

- Europa’s net interest in EG-08 is 17.16%

- Barracuda is expected to be drilled in late 2026 at a gross cost of $53 million to test 893bcf with 80% COS.

- Europa’s internal DCF assessment of the Barracuda field indicates a Pmean base-case gross NPV10 of $1,823m, based on forecast sales of hydrocarbons of 154 million boe. Indicative CAPEX of $3.76/boe and OPEX of $5.84/boe have been assumed under a four-well development concept utilising existing export infrastructure, with commodity price assumptions of $10/mmscf, for gas $65/bbl for condensate and $42/bbl for NGLs. This excludes any upside associated with additional hydrocarbon-bearing structures, including Arrowhead, Cardinal, Dentex and other satellite prospects.

Following a successful exploration well on Barracuda the well will be suspended as a producer and could subsequently be quickly tied back to the nearby Chevron operated Alen platform and monetised through the EG LNG facility located on the nearby Bioko Island

- The Placing will be conducted by way of an accelerated bookbuild which will be launched immediately following the release of this announcement. In the event of excess demand, the Company reserves the right to increase the size of the Placing at its sole discretion.

Application will be made to the London Stock Exchange for the new Ordinary Shares to be admitted to trading on AIM. It is expected that Admission will become effective and that dealings in respect of the new Ordinary Shares will commence at 08:00 on 3 March 2026.

William Holland, CEO of Europa, said:

“I am delighted to announce this fundraising, which will allow Europa to fund its ownership interest in Antler Global, thereby ensuring that the Barracuda prospect is drilled and providing Europa shareholders with exposure to this high-impact exploration asset. With 80% COS, this is a transformational growth opportunity for the Company and provides our shareholders with a world-class risk/reward value proposition.”

Assuming this raise gets shareholder approval at a GM shortly this is very good news for EOG and its shareholders, note the rather frightening note in the RNS about the need to pass the resolution ‘AND THERE WOULD BE A MATERIAL UNCERTAINTY OVER THE COMPANY’S ABILITY TO CONTINUE AS A GOING CONCERN’.

I’m sure that this won’t happen, the company has already announced that it has conditionally raised the amount of £3.5m and the retail offer is underway. The raise is at 1.2p which is a full 20% discount and includes a 1:4 warrant offer at 2p and given that the shares are down some 31% on the month makes one think that it was expected.

But the good news is that longer-term performance has been good enough to make a little weakness palatable, up 84% on 6 months and 77% over a year shows that like me, investors believe that the Equatorial Guinea project has every chance of being a game-changer for EOG.

The company are using the funding to drill the Barracuda appraisal well, EOG has a 17.16% net interest in EG-08 and the well is expected to be drilled later this year. It has an 80% COS, will cost a gross $53m but the company is largely funded, under the terms of the FOA Fuhai will fund 95% of the costs of the Barracuda well up to a cap of $53m for the total well cost.

The target is to test 893bcf which has an indicated Pmean base-case gross NPV10 of $1,823m based on forecast sales of hydrocarbons of 154 million boe. The plan is for a four-well development concept utilising existing export infrastructure, with commodity price assumptions of $10/mmscf, for gas $65/bbl for condensate and $42/bbl for NGLs.

With the well suspended as a producer it can be quickly tied back to the nearby Chevron operated Alen platform and monetised through the EG LNG facility located on the nearby Bioko Island. So, assuming all resolutions are passed, and it is clearly in shareholders interests to do so, EOG will be looking in a very good place with a great deal of potential upside.

Europa has announced that it has conditionally raised gross proceeds of approximately £3.5m, before expenses, through the conditional placing of 291,667,000 new Ordinary Shares of 1 pence each at an issue price of 1.2 pence per share.

In addition, one warrant will be issued for every four Placing Shares (“Placing Warrant”) with an exercise price of 2 pence and an expiry date 2 years after the date of the Placing Shares’ admission to AIM.

The issue of the Placing Shares and the Placing Warrants is conditional, inter alia, on shareholder approval at a General Meeting of the Company which will take place on or around 27 February 2026.

The proceeds will extend the Company’s cash runway to ensure that the Barracuda prospect is drilled and provide additional financial resources for the Company’s ongoing working capital needs.

Sunda Energy

Sunda has announced that it has entered into an unsecured loan agreement with Dr Andy Butler, CEO of the Company, for up to £1.5 million with an initial draw down of £400,000 being used to fund the transaction costs associated with a proposed acquisition and to provide additional working capital for Sunda’s business activities. The Company also provides an operational update on its activities in Timor-Leste and the Philippines.

Proposed Acquisition and Director Financing

As previously announced, Sunda is actively pursuing opportunities to strengthen and diversify its upstream portfolio, with the goal of taking the Company to a more robust position from which it can deliver on the potential of its existing assets and provide additional growth options for investors.

One of these new business initiatives has now advanced, with Sunda having entered into an exclusivity agreement with a third party (the “Seller”) with respect to the proposed acquisition of a portfolio of oil and gas production, development and exploration assets (the “Proposed Acquisition”).

The Company is conducting confirmatory due diligence and negotiating a binding sales and purchase agreement (the “SPA”) with the Seller. The Proposed Acquisition remains subject to, amongst other things: (i) satisfactory completion of due diligence by Sunda; (ii) the execution of the SPA; (iii) the necessary financing being in place to fund the Proposed Acquisition; and (iv) approval by shareholders of Sunda at a general meeting.

Discussions on the Proposed Acquisition are at an advanced stage and the Company’s board of directors is hopeful of a satisfactory outcome. However, there can be no certainty that the SPA will be executed or that the Proposed Acquisition will complete, nor the terms or timing of either thereof.

The Company will provide further information on the Proposed Acquisition in due course.

To provide the funds required to progress the Proposed Acquisition and to provide additional working capital, the Company has agreed the unsecured Facility with the Director. An initial amount of £400,000 has been drawn down, which can be increased up to a maximum of £1,500,000 during the term of the loan. It is anticipated that future drawdowns will be put towards funding for the Proposed Acquisition. The Facility matures on 9 February 2027 (the “Repayment Date”) and has an interest rate of 12% per annum, accruing daily and payable on the Repayment Date. The Company can elect to repay amounts outstanding under the Facility, in part or in full, subject to a 12% early redemption fee.

Related Party Transaction

Dr Andy Butler is a director of the Company. Therefore, Dr Andy Butler is deemed to be a related party pursuant to the AIM Rules for Companies (the “AIM Rules”). The Facility between the Director and the Company constitutes a related party transaction in accordance with Rule 13 of the AIM Rules. Accordingly, the independent directors (being Rob Collins, Gerry Aherne, John Chessher and Keith Bush), consider, having consulted with Allenby Capital Limited, the Company’s nominated adviser, that the terms of the Facility are fair and reasonable insofar as Shareholders are concerned.

Operational Update

Timor-Leste TL-SO-19-16 PSC (Sunda 60% interest

The Company’s wholly owned subsidiary SundaGas Banda Unipessoal, Lda. (“SundaGas”) is operator of the TL-SO-19-16 Production Sharing Contract (the “PSC”), offshore Democratic Republic of Timor-Leste, in partnership with its government-owned joint venture partner TIMOR GAP Chuditch Unipessoal Lda (“TIMOR GAP”). The PSC area includes the Chuditch gas field, on which Sunda is preparing to drill the Chuditch-2 appraisal well (“Chuditch-2”).

SundaGas is continuing in its efforts to secure a rig to drill Chuditch-2, although the planned contracting of a jack-up rig by the end of 2025 was unfortunately not achieved. The Company has several ongoing initiatives in parallel to secure suitable drilling rigs, in consultation with TIMOR GAP and upstream regulator Autoridade Nacional do Petróleo (“ANP”) and is hopeful that it can report positive progress and provide more information in the near future.

The procedure for issuances of an environmental licence for drilling Chuditch-2 has taken longer than anticipated, owing to extensive feedback and clarification requests arising from various iterations between ANP and Sunda’s HSE and operations teams of the key Environmental Impact Statement (“EIS”) and Environmental Management Plan (“EMP”) documents. The Company has been liaising closely with ANP, resulting in the latest versions of the EIS and EMP having been submitted and these documents will today be uploaded onto the Company’s website. Following this resubmission, the evaluation committee established by ANP will convene and then have 5 regulatory working days to complete their assessment of the EIS and EMP, after which ANP will complete the final processes for award of an environmental licence, for which regulations permit up to 25 business days.

Further information concerning operational preparations will be provided in due course.

In parallel to operations planning and as previously disclosed, SundaGas continues to discuss a revised Farm-In Agreement (the “Farm-In”) with its partner TIMOR GAP, along the lines of the Farm-In Agreement announced on 24 April 2025 (and subsequently terminated as announced on 16 June 2025). If executed, the Farm-In is expected to be on similar terms to the April 2025 agreement and to include provisions for accelerated funding to assist the Company in all its contracting preparations for the drilling of Chuditch-2. The timing of a Farm-In is expected to be aligned with the execution of a rig contract and to support Sunda’s broader, ongoing efforts to secure funding for the drilling of Chuditch.

More broadly, the Company notes the highly encouraging progress being made by the government of Timor-Leste towards the development of offshore gas resources in Timor-Leste, including the joint exploration studies announced by Petronas Carigali, TIMOR GAP and ANP, the acceleration of discussions between the parties involved in the Greater Sunrise project and the push to establish onshore and offshore gas infrastructure, which will be key to future Chuditch gas exports.

Philippines Sulu Sea, Service Contracts 80 and 81 (Sunda 37.5% non-operated in both)

Service Contracts 80 and 81 (“SC 80” and “SC 81” respectively) were issued to Sunda and its joint venture partners on 8 October 2025, with an effective date of 24 September 2025. Since that time, operator Triangle Energy (TEG.AX) has been compiling all available data, assisted by Sunda’s technical team, and making preparations for 3D seismic data reprocessing. This reprocessing project is expected to commence shortly and is intended to delineate effectively the existing discoveries and cast a much clearer light on the overall prospective resources across the two blocks.

The Company is pleased with the level of incoming industry interest already received in the Sulu Sea project, reflecting the quality and potential of the fairway covered by SC 80 and SC 81. Sunda looks forward to sharing further updates as this exciting and impactful exploration project progresses.

Gerry Aherne, Chairman of the Sunda board of directors, commented:

“I believe the Company can look forward to an exciting and successful 2026, commencing with the targeting of a quality acquisition that, if completed, will put the business in a stronger position, with additional optionality and opportunity for growth. It will also help deliver on its material gas asset in Timor-Leste and exciting exploration potential in the Philippines.

I thank the management team for their tireless efforts and especially Andy Butler for his demonstrated commitment to take Sunda to a more sustainable level.”

Dr Andy Butler, CEO, commented:

“Diversifying Sunda’s portfolio and strengthening our financial position through our planned acquisition will enable us to more effectively develop all areas of our business for the benefit of shareholders and host country stakeholders. Getting the Timor-Leste project back on track after the postponed Chuditch-2 campaign has proved challenging, but the team remains focussed on securing a new rig and progressing as quickly as possible towards drilling. We look forward to being in a position to making further announcements soon, but in the meantime, I thank our shareholders for their ongoing patience and support as we transition Sunda’s business for a robust future.”

It is obviously good to see such a big commitment from the CEO and when we know about the proposed acquisition we will be able to judge it. With the company trying to secure a rig for the Chuditch appraisal that also looks promising.

The company are ‘diversifying and strengthening’ which is good after such a long wait, shareholders will now be hoping for tangible signs of the progress indicated in this statement.

Sound Energy

Sound has announced that a Shareholder Circular with proposals in relation to a share capital reorganisation and consolidation, is available on the Company’s website at https://www.soundenergyplc.com and has been posted to shareholders today.

The General Meeting is to be held on 26 February 2026 at 11.00 a.m. at Sound Energy plc, 20 St Dunstan’s Hill, London EC3R 8HL.

Proposed Share Capital Reorganisation and Consolidation

The Company is proposing to consolidate 10 Ordinary Shares into one New Ordinary share (excluding the Sanctioned Holding Shares[1]). The share consolidation will reduce the number of existing Ordinary Shares of 1.0 pence per share in issue from 2,080,622,679 Ordinary Shares to 207,844,268 Consolidated Ordinary Shares of 10 pence per share and 2,180,000 Sanctioned Holding Shares of 1.0 pence per share (‘the Sanctioned Shares’) see note 1.

In addition, the Directors believe that the nominal value of the current existing Ordinary Shares of 1.0 pence each is no longer optimal and unduly restricts the Company’s flexibility as it seeks to execute its growth strategy. The Company is not permitted by law to issue new ordinary shares at a price which is below their nominal value. The Company’s current share price of 0.9 pence is below the current nominal value of 1.0 pence per ordinary share (“Ordinary Share”). Accordingly, in order to create a lower nominal value for each Ordinary Share, the board of directors (the “Board” or the “Directors”) are proposing that each Consolidated Ordinary Share (excluding Sanctioned Holding shares) will be subdivided into one New Ordinary Share of 0.1 pence each (the “New Ordinary Shares”) and one deferred share of 9.9 pence each (the “New Deferred Shares”) (the “Share Capital Reorganisation”). The proposed Capital Reorganisation is a technical and financially prudent measure and is intended to align the Company’s share capital structure with prevailing market conditions and enhance the Company’s financial and corporate flexibility over the short to medium term. The Board considers this step to be consistent with good corporate governance and the interests of all shareholders.

Each New Ordinary Share will carry the same rights as each existing Ordinary Share under the Company’s articles of association (the “Articles of Association”) and CREST accounts updated in respect of any entitlement to New Ordinary Shares and share certificates will be issued in respect of New Ordinary Shares.

Each New Deferred Share will have very limited rights and will effectively be valueless. CREST accounts of Shareholders will not be credited in respect of any entitlement to New Deferred Shares, and no share certificates will be issued in respect of New Deferred Shares.

The New Deferred Shares will have the rights and restrictions as set out in the Articles of Association in respect of deferred shares, which do not entitle their holders to receive notice of or attend or vote at any general meeting of the Company or to receive a dividend or other distribution and provide the Company with the authority to transfer them at effectively nil consideration per New Deferred Share to a custodian nominated by the Company. The New Deferred Shares will not be admitted to trading on AIM or any other exchange.

Following the passing of all the resolutions at the GM, the Company will implement the Share Capital Reorganisation and make an application for admission of the 207,844,268 New Ordinary Shares of nominal value 0.1 pence each to trading on AIM at 8:00 a.m. on 27 February 2026.

The New Ordinary Shares will continue to carry the same rights as those attached to the existing Ordinary Shares, save for the change in nominal value. The New Ordinary Shares will have the following ISIN number GB00BVP8H932 and SEDOL code BVP8H93. The Company’s TIDM, SOU, will remain unchanged.

The Sanctioned Holding shares will remain within the current 1.0 pence Ordinary Share ISIN, which will remain active solely for this purpose.

No comment from the CEO here but this seems to be a sensible move, shareholders are clearly happier with fewer shares in issue and of course as long as the share price is below the nominal value the company are unable to raise further funds at least via equity…

Original article l KeyFacts Energy Industry Directory: Malcy's Blog

KEYFACT Energy

KEYFACT Energy