On 9th December 2025, the NSTA announced the UK’s second carbon storage licensing round. There are 14 offshore locations on offer, with a mixture of potential CO2 stores from depleted hydrocarbon fields to saline aquifers. I was at the GESGB’s CCS4G symposium the same week as the round announcement, and whilst no one in the room was shying away from the (largely political) challenges facing the UK’s nascent CCS industry, the reception to new offered acreage was overwhelmingly positive. I’m sure a lot of CCS geoscientists will have returned from their Christmas break with extremely long to-do lists! If that sounds like you, then by all means get in touch as the Merlin team are always ready to help.

So what is everyone looking at? Many of the 14 locations offered in this round double-down on existing CCS hubs in the Southern North Sea (SNS) and East Irish Sea (EIS), the latter hugging tightly to Spirit’s Morecambe Net Zero project. Further locations are also offered in the Central and Northern North Sea (CNS and NNS respectively), again close to current CCS licenses. Interestingly, a large swath of acreage is also offered in the English Channel, which would be virgin territory for CCS but close to industrial emitters in the south of the UK and mainland Europe.

Overview of CCS locations offered in this round (pink areas) with selected existing CCS projects labelled (blue areas).

English Channel

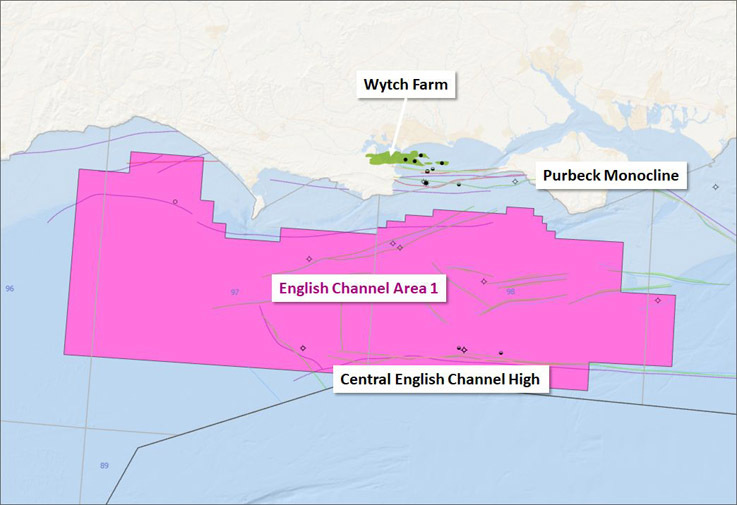

It’s interesting to see such a large area offered for CO2 storage in the English Channel area. The primary storage unit in here is likely to be the Triassic Sherwood Sandstone, which is known for its excellent reservoir quality. Jurassic Bridport Sands are also present across much of the region and whilst their distinctive vertical alternations of cemented vs non-cemented beds would be highly efficient at storing CO2, injecting into such a configuration may prove too challenging. The English Channel is also challenged by a paucity of subsurface data compared to the UK’s main hydrocarbon provinces. Wells are scarce and seismic is largely 2D and of an early vintage, although some might say that this lack of subsurface data is compensated for by the excellent field-trip opportunities to view outcrops along the south coast! Check out Merlin’s guided field-trip service if a few days outdoors looking at some exceptional cliffs is what your team needs for 2026!

Trips to the seaside aside, as far as it’s possible to tell on a sparse 2D seismic database, structures to the south of the Purbeck Monocline are limited. The locations on offer span a basin which rises to the south over the Central English Channel High and the Purbeck Monocline to the north. The English Channel area may therefore lend itself more to unstructured aquifer style trapping.

Large CCS location offered in the English Channel.

Faults lineaments from “OGA_LR_Reg_Geological_Maps_2019”

Jurassic Bridport sands

Southern North Sea

New CCS locations offered in the Southern North Sea. Pink areas are locations on offer in this round and blue areas are existing CCS licenses. Faults lineaments from “OGA_LR_Reg_Geological_Maps_2019”

In the SNS, the NSTA are offering locations which extend the existing CCS licensed areas around the Endurance, Viking and Poseidon projects. Those located near to the Endurance project could make use of analogous dry structures in the Bunter Sandstone, however, they will need to share the pressure space of the Silverpit Basin with neighbouring projects. Understanding permeability and how this impacts both the local and regional pressure response will be key to maximising storage efficiency across the jigsaw of potential CO2 stores in the Bunter.

Rotliegend stores are also available in the SNS, in the form of depleted gas fields and structured (and unstructured) aquifers. In 2025, the Poseidon project team successfully injected 3500 t CO2 into their Rotliegend store (across 15 injection cycles) and proved commercial injection rates could be achieved. Together, the Poseidon and South Viking projects are vanguards for Rotliegend CO2 storage in the SNS. Both projects plan to store in legacy gas fields and therefore benefit from geological knowledge built up over decades of production. To reach net zero, we will have to use all our geoscience skills to extrapolate this knowledge to the wider region, particularly locations offered further south in Quad 53, where data is sparse because hydrocarbon exploration efforts were unsuccessful.

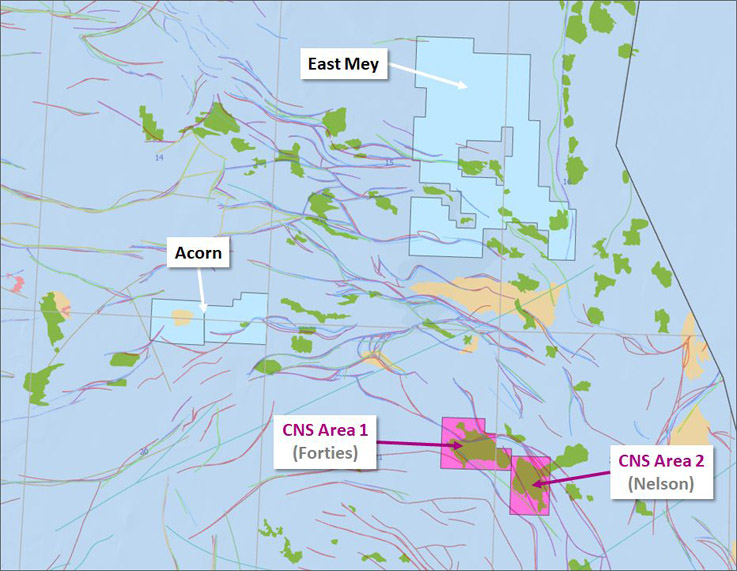

Central North Sea

The Central North Sea was an early leader in the UK’s journey to CO2 storage, with the Acorn project first conceived in 2005. Sadly, changes in political motivations over the years have slowed Acorn’s progress to a crawl and, with Storegga looking to sell their stake, it remains to be seen whether Acorn will achieve its targeted FID in 2029.

New CCS locations offered in the Central North Sea. Pink areas are locations on offer in this round and blue areas are existing CCS licenses. Faults lineaments from “OGA_LR_Reg_Geological_Maps_2019”

Nevertheless, the political will of today (and hopefully longer term!) is encouraging for the CNS locations on offer in this licensing round. CO2 storage opportunities in the depleted Nelson and Forties fields are available for application. Both fields are approaching decommissioning and have produced oil from the excellent quality Paleocene Forties Sandstone. Rock physics and 4D seismic have proved pivotal for maximizing hydrocarbon recovery in Nelson and Forties, and perhaps the same will be true for monitoring injected CO2. Using rock physics techniques to assess the feasibility of seismic monitoring for CCS projects as well as optimising reservoir characterization is a soap-box of mine, so get in touch if you’d like to hear more on how to get the most out of your existing well and seismic datasets!

Northern North Sea

The locations offered in the NNS utilize legacy Jurassic oil fields which are approaching decommissioning, including Brent, Ninian and Dunlin. Merlin’s Phil Copestake has published widely on the stratigraphy of North Sea Jurassic reservoirs and has experience applying his stratigraphic skills to address connectivity questions for Norwegian CCS projects. If carbon storage in the Jurassic is your thing, then Phil is the stratigraphic expert to ask!

The existing CCS licenses in the NNS focus on depleted Jurassic reservoirs in Thistle and Magnus. The project team at Veri Energy are aiming to gain FID for Phase 1 for their Thistle project in 2030. Whilst the geology here is favourable, the NNS is distant from emitters, so Veri intend for CO2 to be shipped to their Shetland terminal and then taken to the subsurface stores by adapting the existing pipeline for CO2. Clearly, more CO2 storage projects developing in this area would provide improved economics for all CCS operators in the NNS. Every little helps when it comes to making CCS a viable commercial opportunity – government funding is not something that future projects will all be able to rely upon.

New CCS locations offered in the Northern North Sea. Pink areas are locations on offer in this round and blue areas are existing CCS licenses. Faults lineaments from “OGA_LR_Reg_Geological_Maps_2019”

The Future

CCS remains a relatively young industry and so it is logical that the early projects should be the simplest. But what happens once all the straight-forward projects are taken? The NSTA describes a deficit in the number of carbon storage projects required for net zero, which is expected to appear from the 2040s onwards. To fill that gap, the NSTA intend to hold regular carbon storage licensing rounds. This places the onus on us, as geoscientists, to find increasingly creative ways of safely storing CO2 in the subsurface. That could mean more interventions to secure well integrity through densely penetrated reservoirs, a more aggressive attitude towards storage in unstructured aquifers or even diversification away from siliciclastic storage units. The starting whistle has been blown and, at least with regard to the UK’s second carbon storage licensing round, we’ve only got until 24th March 2026 to submit bids!

Eleanor Oldham is a geophysicist specialising in the quantitative side of seismic interpretation, from rock physics to depth conversion. She has an MSc in Exploration Geophysics from the University of Leeds and has been working in the oil and gas industry since 2009.

Eleanor has been with Merlin Energy Resources since graduating, during which time she has worked on a wide variety of exploration and development projects from around the world.

Eleanor is a member of the Society of Exploration Geophysicists, European Association of Geoscientists and Engineers and the Petroleum Exploration Society of Great Britain.

KeyFacts Energy Industry Directory: Merlin Energy Resources l KeyFacts Energy news: Carbon Capture and Storage

KEYFACT Energy

KEYFACT Energy