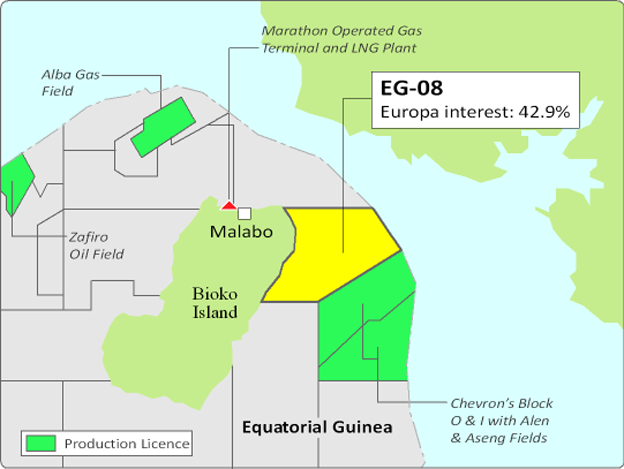

Europa Oil & Gas, the AIM quoted West Africa, UK and Ireland focused oil and gas exploration, development and production company, announces that its associated company, Antler Global Limited (“Antler”), has signed a binding Farm-out Agreement (“FOA”) with Fuhai (Beijing) Energy Limited (“Fuhai”), a wholly owned subsidiary company of the privately owned Fuhai Group New Energy Holding Co., Ltd (“Fuhai Holding”) to farm-out a 40% interest in the EG-08 production sharing contract ("PSC”) in offshore Equatorial Guinea.

Map source: KeyFacts Energy

The key features of the FOA include:

- Fuhai will acquire 40% working interest in EG-08 in return for funding 95% of the costs (the “Fuhai Carry”) of the Barracuda well, up to a cap of $53 million for the total well cost (“Total Well Cost”). Antler shall fund the remaining 5% of the Total Well Cost

- Well costs include drilling and testing of the 893 BCF Barracuda prospect

- Antler will retain operatorship of EG-08

- Any cost over-runs above the $53 million cap will be shared equally between Fuhai and Antler • Upon commercial hydrocarbon sales Fuhai will have a preferential recovery right to recover the Fuhai Carry

- 45% of the Fuhai Carry will accrue interest, capped at 5% per annum, which will accrue from funding until full recovery from asset cashflows. Interest will be cancelled if the Barracuda prospect does not result in a commercial discovery

The deal remains subject to approval from the Ministry for Mining and Hydrocarbons Department of Equatorial Guinea (“MMHD”) and Overseas Direct Investment (“ODI”) approval from the Shandong Provincial government.

Europa has a 42.9% equity interest in Antler which, as a result of the FOA, holds a 40% working interest in the EG-08 PSC, with 40% held by Fuhai and the remaining 20% held by GEPetrol (Guinea Equatorial de Petróleos), the national oil company of Equatorial Guinea, representing the State’s interest.

Fuhai Holding (www.fuhaikonggu.com) is a large-scale energy and chemical business that integrates petrochemicals, logistics and distribution and ranks as one of the top 500 businesses in China. Its operations include:

- Crude oil processing capacity of 10 MT/A

- 2,000 hazardous chemical transportation vehicles with a capacity of 20 MT/A

- 800 petrol stations

- PX production of 1.5 MT/A

- PTA production of 2.5 MT/A

- Oil production from the Kenli Block in Bohai Bay, China

- 2024 Revenue of US$12.7 billion

Following further geophysical analysis of the EG-08 block the prospective volumes have remained broadly in line with previous iterations whereby Antler now believes that the block contains 2.213 TCF (Pmean), with the primary prospect being Barracuda which is estimated to be 893 BCF (Pmean), as detailed in the following table:

The net attributable percentage to Europa is 17.2%(1)

As a result of the FOA Antler intends to drill Barracuda at the earliest opportunity, which is expected to be during 2026.

As EG-08 PSC is pre-production, Europa recognised a loss of £2,000 in its 2024 Annual Report relating to its interest in Antler, reflecting minor pre-operational costs.

William Holland, Chief Executive Officer of Europa, said:

“This is a significant milestone for Europa, and I am delighted to have entered into this agreement with Fuhai, who are undoubtedly an excellent partner and completely aligned with Antler’s ambition to drill and develop the Barracuda prospect at pace. Although the deal is still subject to MMHD and ODI approval, we are confident that this will be secured within the coming months and as such have now entered a period of detailed engineering and procurement in order to spud the well as soon as possible.

The signing of the Farm-Out Agreement with Fuhai is the culmination of three years of hard work to first identify the opportunity at EG08 and then, working as one team with Antler, to work up the prospectivity of the EG08 block, and then to secure an excellent partner to carry us through drilling. The farm-in is without question a great result for Europa and equates to a 2.38 for 1 carry which reflects the quality of the asset, namely the high chance of success and the size of the resource potential.

2026 is going to be a pivotal year for Europa, and I look forward to updating the market as we secure the necessary approvals to conclude the transaction and continue to make progress with our plans to spud the Barracuda well.”

(1) Europa hold 42.9% of the shares in Anter, and Antler now has a 40% interest in EG-08 (0.429 x 0.4 = 17.2%)

KeyFacts Energy: Europa Oil & Gas Equatorial Guinea country profile l KeyFacts Energy: Farm-in agreements

If you would like to discover more about KeyFacts Energy, contact us today and we can arrange a 15-minute online meeting to review our database of over 2,600 continually updated 'country-specific' oil and gas and renewable energy profiles from a selection of 144 countries. Find out how you can instantly identify companies with operational activity in your chosen country, 'fine-tune' your news or company selection based on industry category, energy type or regional location and additionally benefit from one to one contact with us to ensure maximum online and social media exposure for your company.

KEYFACT Energy

KEYFACT Energy