Project pipeline grows, but policy uncertainty slows progress

- New CCSA research shows the UK has made significant progress in advancing its carbon capture, utilisation and storage (CCUS) industry, with the first five major projects now having reached financial close and entering construction in Teesside and the North-West and Wales.

- More than 100 projects that will capture 77Mt of CO2 per year, and 22 CO2 storage licences are in development across the UK. Together they would more than meet Government ambitions for CO2

- While 27 projects have been paused or delayed in the past 2 years, the majority of the UK’s CCUS projects remain active, highlighting the strong underlying demand for this industry that needs to be unlocked.

- Developers remain committed to the UK, but 75% warn they may redirect investment overseas unless the Government provides clear direction and a defined route to market.

New research from the Carbon Capture and Storage Association (CCSA) reveals that the UK now has its strongest ever pipeline of projects developing carbon capture, usage and storage (CCUS), but policy uncertainty is slowing progress, stalling projects and risking investment.

The report provides the 2025 update to the CCSA’s Delivery Plan series and shows that significant momentum has been achieved. The first five major CCUS projects have now reached financial close and entered construction in Teesside and the North-West and North Wales. They are creating local jobs and protecting and future-proofing the UK’s core industries including; cement, energy from waste and low carbon power.

However, there are over 100 other projects in development across the UK, that together than capture and store 77 million tonnes of CO2 per year – equivalent to roughly the annual emissions of the entire country of Austria. This puts the UK on course to meet ambitions in the Government’s Carbon Budget and Growth Delivery Plan and the Climate Change Committee’s Seventh Carbon Budget, which make clear that there is no credible route to decarbonisation without CCUS.

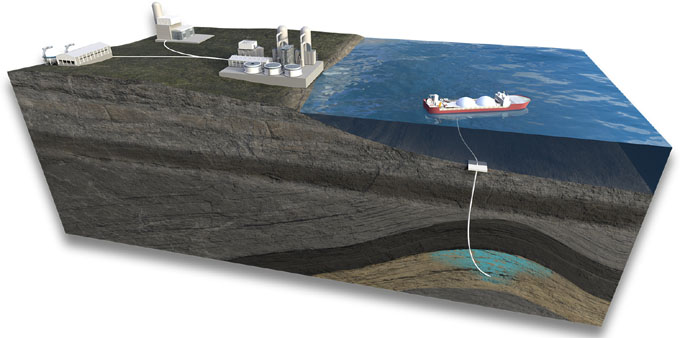

Over 18 million tonnes of this – equivalent to about the same as 4 million cars driving for a year – will be from carbon removals technologies. These are technologies that remove existing carbon out the atmosphere and store it safely and permanently in geological formations such as depleted oil and gas fields, 1-3km deep below the seabed. These technologies are essential to offset the residual emissions from industries such as agriculture and aviation, that cannot alone reduce their CO2 emissions to zero.

The research highlights growing challenges. Since 2023, 27 capture projects have been cancelled or paused. Almost all remaining projects have experienced delays averaging 2 years, with 75% of developers saying they may redirect investment overseas without clearer government policy. Developers point to slow decision-making, delayed funding allocations and a lack of a route to market for projects outside government committed clusters.

To avoid further investment leaving the UK, the CCSA stress the importance of delivery in 2026 and urge the Government to set out a route to market for the next projects by; establishing a clear allocation framework for all CCUS project and clusters and accelerating policies that unlock markets for low-carbon products, carbon removals and CO₂ storage. Unlocking these revenue streams will enable the sector to transition to a self-sustaining market.

Without timely action, the UK risks losing not only vital CCUS projects but also the significant economic benefits they underpin. This includes unlocking private investment in our foundation industries, enhancing energy security, delivering a predicted £94 billion boost to the UK economy, and supporting more than 50,000 jobs by 2050.

Speaking at the launch, Minister McDonald emphasised that CCUS will help secure the long-term future of industries such as glass and chemicals. He underlined the Government’s commitment to “getting on with the job of building this new industry,” which is expected to support thousands of jobs across the supply chain.

The Minister noted that construction is already underway on key projects, mentioning in particular Heidelberg Materials’ Padeswood cement facility and the Protos Energy Recovery Facility (ERF) at Ellesmere Port that both reached final close in September. Looking ahead to the next wave of deployment, the Minister confirmed that the Government is working closely with both the Acorn Project and Viking CCS to reach financial close in this parliament, and will soon identify additional projects to connect to the East Coast Cluster.

Following the release of the Delivery Plan, Olivia Powis, CEO of the CCSA, said:

“CCUS represents one of the UK’s greatest industrial, economic and decarbonisation opportunities. This research shows the sector is primed for growth, but only if we create the conditions that allow developers to invest and deploy. With the right decisions in 2026, we can unlock billions in private investment, protect industrial jobs and secure our pathway to net zero. Without that clarity, we risk losing projects and investment to other markets.”

Read the Delivery Plan here: CCUS Delivery Plan Update 2025

KeyFacts Energy Q&A with Olivia Powis, CEO of the CCSA l KeyFacts Energy Industry Directory: CCSA

KEYFACT Energy

KEYFACT Energy