WTI (Jan) $58.95 +31c, Brent (Feb) $62.67 +22c, Diff -$3.72 -9c

USNG (Jan) $5.00 +16c, UKNG (Jan) 72.27 -0.8p, TTF (Jan) €27.76 -€0.015

Oil price

Firstly, apologies as yesterday’s blog was lost to gremlins, I repeat the Deltic note and the Corcel update today.

Oil is up today after the EIA stats revealed a build of just 574/- barrels although products built rather against odds especially as there is a cold snap on the way in the US. It is also worth watching the US retail gasoline prices, at a blended $2.985 per gallon it has come back to a 2 handle for the first time in a long while.

Corcel

Yesterday the board of Corcel gave a detailed presentation on Investor Meet which was timely as the company updated the market on the substantial progress made this year as well as detailing the work that is going on at KON-16.

It has been a very busy year as this chart shows and those early birds have certainly done very well but readers know that having been on Corcel’s case from the start I consider that there is much more to come.

The company have said that the seismic equipment is already mobilised to Angola and operations are being prepared at KON-16. With 2D seismic soon underway, which should last until February next year and all being well the data will be processed in the spring and leads identified for drilling prospects soon after that.

Onshore Angola has a great deal of potential, originally drilled by legacy wells in the 50’s and 60’s with limited data but Corcel is looking at a known and proven system which with new, state of the art kit should reveal drilling prospects. This kit, primarily 2D seismic will reduce the lines from a width of 15km to nearer 2.5km and mean a more accurate representation of the subsurface.

The Corcel story is only just beginning, with this portfolio and a well managed and currently fully financed potential drilling programme it is a good story for next year. It already has a good partner in Sintana with whom they are effecting ongoing studies and jointly preparing for the future.

Longer term Corcel are building up sustainable value through its current portfolio and with eyes on strategic expansion and of course potential acquisitions, maybe to secure cash flow and depending on Angola they may indeed bring partners into the process.

I remain bullish on Corcel, with its position in the conjugate margins and spread across Angola and Brazil they have good long term positions to create much more value. My TP is still 2p which I feel is achievable given the current circumstances.

Deltic Energy

On 30 June 2025, the boards of Viaro Bidco and Deltic announced that they had reached agreement on the terms of a recommended cash offer for the entire issued and to be issued ordinary share capital of Deltic, to be implemented by way of a Court-sanctioned scheme of arrangement under Part 26 of the Companies Act 2006 which was approved by Deltic shareholders on 28 August 2025.

Completion of the Acquisition remains subject to outstanding conditions, which include, inter alia, the consent of the North Sea Transition Authority (the “NSTA”) to a change in control of the North Sea exploration licences held by Deltic. The NSTA is the UK regulator focused, among other areas, on oil and gas exploration and production activities in the UK’s North Sea.

Deltic has been informed by the NSTA that it requires further representations from Viaro Bidco and Deltic in order to reach a definitive conclusion in relation to concerns it has, which will affect whether it will grant the proposed change of control of the licences held by Deltic. The NSTA has requested this information be provided to it by 22 December 2025.

In light of this delay, Deltic and Viaro Bidco have agreed to extend the long stop date by which the Scheme must complete from 31 December 2025 to 31 March 2026.

The Board of Deltic remains of the opinion that the Acquisition remains in the best interests of Deltic Shareholders and wider stakeholders and is disappointed with the continuing delays in the regulatory process.

A further announcement will be made in due course.

This delay in the approval process for the deal is regrettable, especially as the NSTA say that they are delaying it as it ‘requires further representations from Viaro Bidco and Deltic in order to reach a definitive conclusion in relation to concerns it has which will affect whether it will grant the proposed change of control of the licences held by Deltic’.

The NSTA has requested this information be provided to it by 22 December 2025, with the result that the long stop date has been pushed back to the end of March 2026. They have also said that it ‘requires further representations from Viaro Bidco and Deltic in order to reach a definitive conclusion in relation to concerns it has which will affect whether it will grant the proposed change of control of the licences held by Deltic’.

As the statement says, the Deltic board is disappointed by the continuing delay in the regulatory process and that is a sentiment that I wholly agree with, I’m not surprised but let’s hope that it can be sorted sooner rather than later in the new year.

Eco (Atlantic) Oil & Gas

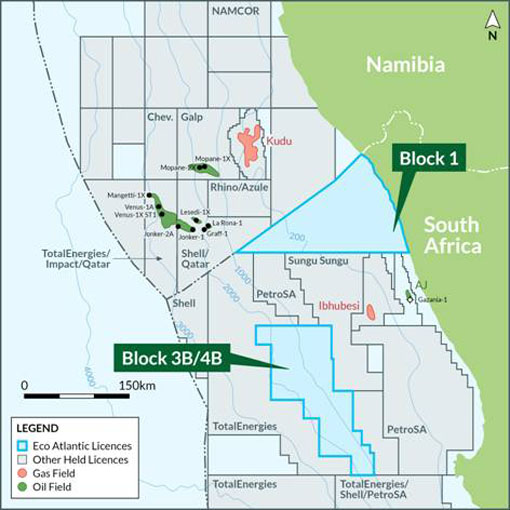

Eco has announced the Company has entered into a binding Framework Agreement, the Orinduik Option and the Block 1 CBK Option with Navitas Petroleum LP, an international oil and gas exploration and production partnership with a portfolio of established North American and Falkland Islands oil and gas assets.

As part of the Strategic Partnership, Navitas shall pay Eco Atlantic US$2,000,000 to enter into an exclusive option agreement to farm-in to the Orinduik Block offshore Guyana (the “Orinduik Block”) (the “Orinduik Option”) and Block 1 CBK offshore South Africa (“Block 1 CBK”) (the “Block 1 CBK Option” and together, the “Options”). The Orinduik Option, which may be exercised within twelve months and upon payment of US$2,500,000 to Eco, enables Navitas to farm-in to the Orinduik Block to acquire an 80% working interest and operatorship, and will carry Eco in respect of the work to be performed in the Orinduik Block, which may include drilling an exploration well or appraising the Jethro-1 and Joe-1 existing heavy oil discoveries for potential development and commercialisation. The Block 1 CBK Option, which may be exercised within six months and upon payment of US$4,000,000 to Eco, enables Navitas to acquire up to a 47.5% working interest and operatorship and will carry Eco’s share of the exploration work programme in Block 1 CBK. The amounts carried by Navitas will be repaid via Eco’s share of proceeds from future production.

|

Transaction Highlights:

Offshore South Africa - Block 1 CBK Option On 3rd December 2025, Eco, though its subsidiary Azinam South Africa Limited ("Azinam SA") signed an exclusive option agreement with its local partner OrangeBasin Energies (Pty) Ltd ("OrangeBasin Energies"), (formerly Tosaco Energy (Pty) Ltd), to acquire a further 20% participating interest in Block 1 CBK for a cash and shares consideration as set out below. Under the Block 1 CBK Option Navitas has the right to acquire 50% of this option, which is exercisable at Eco's and Navitas' mutual consent at any point throughout the term of the initial exploration period expiring in February 2028.

Under the option agreement, if exercised in full by Eco, OrangeBasin Energies will receive US$500,000 on exercise and US$500,000 on completion and US$3,800,000 on completion which Eco will have the right to settle in cash or Common Shares at the Company's sole discretion. The number of Common Shares to be issued will be calculated by reference to the prevailing share price at the time of exercise. If Navitas elects to participate in such option, Navitas will reimburse Eco for its proportion of the exercise cost. If exercised (in part or in whole) with shares, they will be subject to a lock up agreement period of 6 months. On completion, OrangeBasin Energies' remaining 5% retained interest will be carried by Eco and Navitas for the exploration right period including drilling up to 2 contingent exploration wells. Strategic Alliance - Additional and Future Assets Option As part of the Strategic Partnership Navitas has an Additional Assets Option to review the rest of Eco's portfolio on an individual asset commercial terms basis. Subject to agreement on terms to be negotiated at the relevant time, Navitas can acquire working interests of at least 25% and, to the extent possible, Operatorship in the rest of the petroleum assets held by Eco including PEL97, PEL99 and PEL100 offshore Namibia and shares in Azinam Limited which holds Block 3B/4B offshore South Africa. The Navitas option to participate in the Additional Assets is for a period of at least five years which can be extended up to 10 years should Navitas enter into the Orinduik Option and/or the Block 1 CBK Option. In addition, Eco and Navitas have aligned their vision through a Future Asset Option, enabling Navitas to join new ventures and targeted acquisitions identified by Eco on a 50:50 basis. Under this arrangement, Navitas will have the option to directly acquire an interest equal to at least 50% of Eco's acquired interest, on the same terms, ensuring balanced participation and mutually beneficial growth. |

|

Offshore South Africa – Block 1 CBK Option

On 3rd December 2025, Eco, though its subsidiary Azinam South Africa Limited (“Azinam SA”) signed an exclusive option agreement with its local partner OrangeBasin Energies (Pty) Ltd (“OrangeBasin Energies”), (formerly Tosaco Energy (Pty) Ltd), to acquire a further 20% participating interest in Block 1 CBK for a cash and shares consideration as set out below. Under the Block 1 CBK Option Navitas has the right to acquire 50% of this option, which is exercisable at Eco’s and Navitas’ mutual consent at any point throughout the term of the initial exploration period expiring in February 2028.

Under the option agreement, if exercised in full by Eco, OrangeBasin Energies will receive US$500,000 on exercise and US$500,000 on completion and US$3,800,000 on completion which Eco will have the right to settle in cash or Common Shares at the Company’s sole discretion. The number of Common Shares to be issued will be calculated by reference to the prevailing share price at the time of exercise. If Navitas elects to participate in such option, Navitas will reimburse Eco for its proportion of the exercise cost. If exercised (in part or in whole) with shares, they will be subject to a lock up agreement period of 6 months. On completion, OrangeBasin Energies’ remaining 5% retained interest will be carried by Eco and Navitas for the exploration right period including drilling up to 2 contingent exploration wells.

Strategic Alliance – Additional and Future Assets Option

As part of the Strategic Partnership Navitas has an Additional Assets Option to review the rest of Eco’s portfolio on an individual asset commercial terms basis. Subject to agreement on terms to be negotiated at the relevant time, Navitas can acquire working interests of at least 25% and, to the extent possible, Operatorship in the rest of the petroleum assets held by Eco including PEL97, PEL99 and PEL100 offshore Namibia and shares in Azinam Limited which holds Block 3B/4B offshore South Africa.

The Navitas option to participate in the Additional Assets is for a period of at least five years which can be extended up to 10 years should Navitas enter into the Orinduik Option and/or the Block 1 CBK Option.

In addition, Eco and Navitas have aligned their vision through a Future Asset Option, enabling Navitas to join new ventures and targeted acquisitions identified by Eco on a 50:50 basis. Under this arrangement, Navitas will have the option to directly acquire an interest equal to at least 50% of Eco’s acquired interest, on the same terms, ensuring balanced participation and mutually beneficial growth.

Gil Holzman, President and Chief Executive Officer of Eco Atlantic, commented:

“This strategic partnership with Navitas, a multi-billion-dollar company with a strong record in acquiring, financing, and developing high-impact oil and gas projects, is truly transformational for Eco Atlantic. The proposed Guyana and South Africa farm-ins, together with our understanding that this is a long-term collaboration, significantly enhances our ability to accelerate growth across our portfolio. Navitas’ excellent leadership team, technical strength, operational expertise, and financial capacity provide exactly the strategic support needed to unlock the full potential of our assets in South Africa and Guyana.

“Following a joint visit by our teams to Guyana later this month, we expect to gain clarity on our work programme and appraisal plan for Orinduik. We believe this partnership paves the way for our planned exploration and appraisal programmes on the block towards commercialisation, which will be carried and operated by Navitas, and will serve as a high-impact catalyst for the Company.

“For our team, this collaboration is energising, and I would like to express my sincere thanks to our long-term shareholders for their continued support, patience and belief in the management team. Their confidence has been instrumental in positioning Eco for this next phase of growth. This is a major step forward for the Company and transformational catalyst for our future.

“I would also like to extend my deep appreciation to Gideon Tadmor and the entire Navitas team for their constructive engagement, close collaboration, and commitment to advancing this partnership and Eco’s oil and gas assets. Their professionalism and shared vision have been central to bringing this agreement together in such a focused and effective manner.

“On behalf of the Board, I would like to dedicate this transaction to Colin Kinley.”

This is indeed a significant deal bringing a strategic partner of high calibre for Eco, Navitas bring cash and great technical expertise not forgetting a fantastic record in recent transactions. Navitas themselves are genuinely an amazing company who have a reputation for doing the impossible and enjoy picking up developments that no one else can do. Think Shenandoah, think Sea Lion and now a share in highly prospective Guyana and South Africa.

The details are in the announcement but Eco get cash now, more when Navitas trigger the South African option plus carries in both Guyana and South Africa and of course 50% of any deal done by Eco in the meantime. Eco last night upped their share in CBK by 20% and are now very well placed with their excellent portfolio, also with this backing no one will mess with Eco again…

I will write more in due course but for today this is just the deal I, and many others have been waiting for for so long. I will obviously interview Gil shortly but I’m sure he is delighted, perhaps more importantly Colin would be very proud of his team.

Prospex Energy

Prospex has provided an update from the Selva Malvezzi production concession in Italy following the publication by Po Valley Energy Limited. Po Valley Operations Pty Limited (“PVO”), a wholly owned subsidiary of PVE is the operator of the Selva Malvezzi production concession, which has a 63% working interest, while Prospex has the remaining 37% working interest.

Highlights

- Successful completion of the 3D geophysical acquisition campaign over the Selva Malvezzi Concession area in Italy on 27 November 2025.

- The programme which covered approximately 140 square kilometres will be instrumental in fine tuning the Joint Venture’s four well development programme on this concession.

- 3D seismic survey data acquisition commenced on 13 November 2025 and completed on 27 November 2025 having recorded 5,052 vibration points, with only three hours of weather standby. The contractor laid out 8,380 wireless geophones and used single sweeps from four Vibroseis trucks operating simultaneously in separate quadrants.

- The acquired data is being collated and will undergo time-domain volume processing over the coming months in order to deliver a high-resolution three-dimensional subsurface model in support of future field development planning and potential resource upgrades.

- The Operator will carry out the subsequent interpretation of the data in-house with results expected to be announced in Q2-2026.

Mark Routh, Prospex’s CEO, commented:

“I am very pleased to report that Po Valley Energy has completed this ambitious work programme safely and efficiently. With the benefit of an unusually dry November the survey has been completed on budget and ahead of schedule.

“The Po Valley team in Italy are to be congratulated for delivering an excellent project whilst co-ordinating the two contractors Geofizyka Toruń, on the data acquisition and Geotec in support of the complex permitting process throughout every phase of the project.

“The processed results will be interpreted in-house by the Po Valley team with the dual objective of optimising the subsurface drilling targets of the four new wells to be drilled on the Selva Malvezzi concession and delivering an upgrade to the certified gas resources.”

3D completed is good news but until 2Q next year and the processing is complete it’s no time to get too excited…

Original article l KeyFacts Energy Industry Directory: Malcy's Blog

KEYFACT Energy

KEYFACT Energy