Westwood’s latest report for Offshore Energies UK (OEUK) examines offshore infrastructure trends and the challenges of early closure of infrastructure on the UK Continental Shelf (UKCS). Here’s a summary of the key insights.

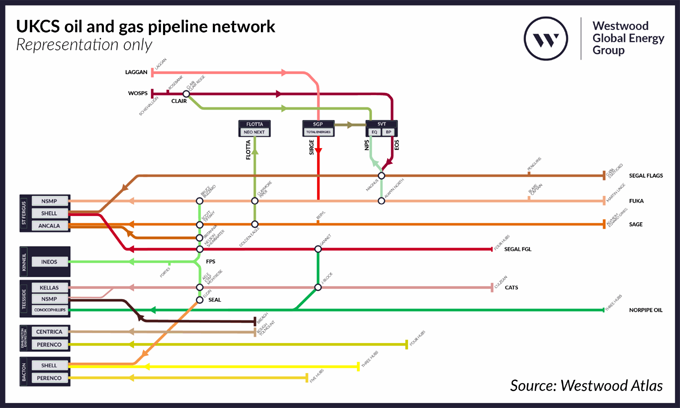

The UKCS oil and gas pipeline network is a highly interconnected system that has evolved over nearly six decades. Originally designed to transport much higher volumes than today’s declining production, it now resembles a web of routes – much like the London Underground (Figure 1). Decisions affecting one pipeline can ripple across the entire network, making interdependency a critical factor in managing the energy transition.

Figure 1: UKCS oil and gas pipeline network (representation only). Excludes hubs expected to cease production before 2028 and pipelines with no UK field input. Note that not all UK pipelines are shown and some fields export liquids via shuttle tankers. EQ = EnQuest. Source: Westwood Atlas

The pipeline network supports 67 operating hubs, each typically requiring export routes for both oil (liquids) and gas. The top 10 hubs, based on projected 2025 production, account for around 46% of total UK output. Five of these rely on the Forties Pipeline System (FPS) for liquids export, yet none share identical routes for both oil and gas. This diversity adds resilience – but also complexity.

The jeopardy: One closure triggers many

When a hub shuts down, fewer contributors remain to cover the operating costs of the pipeline system, raising the cost burden for remaining hubs. If a pipeline becomes uneconomic and closes, other hubs can lose their export routes, forcing early shutdowns. This happened in 2018 with the closure of the Theddlethorpe Terminal, triggering the early cessation of several Southern North Sea fields. Because of the interconnectivity of pipeline systems, the closure of a liquids export route could have a knock-on effect on neighbouring gas export routes, potentially triggering a chain reaction.

Early hub closures risk stranded resources, job losses and premature decommissioning, all with implications for the taxpayer. Premature cessation also removes the option to repurpose oil and gas infrastructure for carbon storage or hydrogen projects. The government is committed to funding a proportion of oil and gas decommissioning activity. Instead of maximising economic recovery, early closures will bring forward the point at which government decommissioning liability exceeds tax revenue – an important balance for public finances.

To avoid the domino effect, the investment environment must enable companies to commit to developing potential upside to counteract declining production.

The opportunity: Unlocking upside

Despite the UKCS being a mature basin, upside opportunities exist that could support hub longevity. Westwood estimates total potential resources within 50 km of active hubs is c. 16 billion barrels of oil equivalent (boe), including c. 1.3 billion boe in potentially commercial discoveries, c. 4.9 billion boe in technical discoveries (53% licensed) and c. 9.7 billion boe in prospectivity (24% licensed).

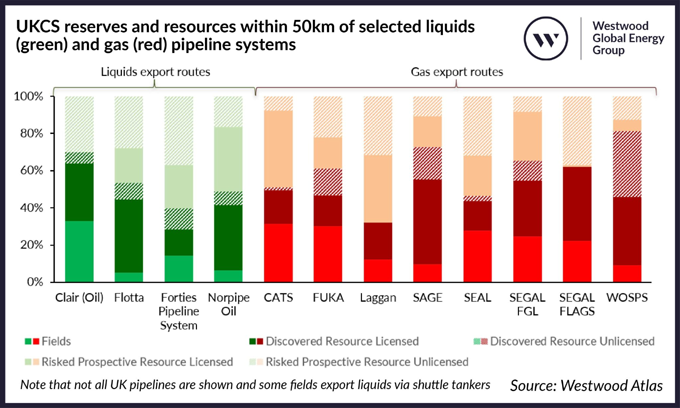

Only 12% of reserves and resources surrounding liquids export routes, and 21% for gas are currently sanctioned (Figure 2). Substantial upside exists in unlicensed acreage, with over half of liquids resources and over a third of gas resources currently unlicensed. Every pipeline included in Westwood’s study, except one, had more than a quarter of resources (discoveries and prospects) in unlicensed acreage, demonstrating the substantial potential that could be left stranded should Labour restrict future licensing.

Figure 2: UKCS reserves and resources within 50 km of selected liquids (green) and gas (red) pipeline systems. Note that not all UK pipelines are shown and some fields export liquids via shuttle tankers. Not all discoveries are currently considered economically viable for development. Source: Westwood Atlas

Unlocking upside is not just about supporting oil and gas, it also preserves infrastructure that could later support carbon storage or energy storage solutions. Even modest additions to throughput can extend economic life of an entire system, enabling a more orderly transition. For companies to realise this potential, there needs to be significant improvements to the investment landscape – and quickly.

Why a managed transition is essential

Labour has set ambitious targets to double clean energy jobs by 2030. But if the oil and gas sector enters an accelerated decline, the growth in renewables is unlikely to absorb the impact, risking disruption to the domestic supply chain, job losses, and future contracts moving overseas. A managed decline gives companies time to plan for the transition of business strategies from oil and gas to renewables.

This requires a more supportive investment environment, built on:

- A continued mechanism for licensing, ensuring that opportunities can be moved into the right hands

- A stable and globally competitive fiscal regime, removing the Energy Profits Levy before 2030

- Faster approvals process for new developments and licence awards

- Pragmatic decarbonisation policy that supports project viability and encourages investment

Delivering a managed transition would preserve infrastructure longevity, protect jobs, delay taxpayer exposure to decommissioning costs, and enable a more orderly shift to cleaner energy. The interconnectivity of UKCS systems means this cannot be achieved piecemeal. It requires co-ordinated action across licensing, fiscal regime and policy while the renewables sector grows, to ensure the basin remains resilient through the transition. The hope from the industry is that Labour’s Autumn Budget on 26 November 2025 will provide some much-needed clarity and a stable path forward on which to base future investments.

Download the free Westwood OEUK Licensing and Infrastructure Report, here.

Matthew Belshaw, Senior Analyst – Northwest Europe

mbelshaw@westwoodenergy.com

Original article l KeyFacts Energy Industry Directory: Westwood Global Energy

KEYFACT Energy

KEYFACT Energy