Strategic Rationale

- Omega has executed a binding agreement to acquire a 19.43% equity interest of Elixir Energy Limited for $13.9 million via an unconditional placement of new shares using Elixir’s placement capacity at a price of $0.041 per share (Tranche 1 Placement)

- Omega, along with Nero Resource Fund, to invest a further combined $2.68 million (Omega share $0.68 million) in a conditional Tranche 2 Placement, subject to Elixir shareholder approval

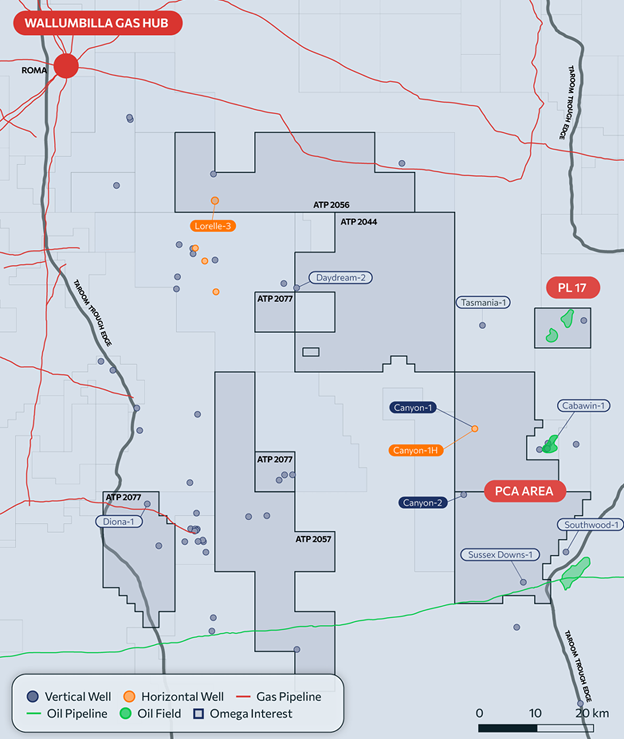

- Omega obtains significant exposure to the western flank of the Taroom Trough, additional data to enhance our basin knowledge, exposure to a potentially significant near-term well, and significant rights and controls - including up to two directors, participation rights, secondee rights and technical committee representation to assist Elixir in executing their plans(1)

- Cost-effective transaction to expand Omega’s footprint, gain synergies and influence within the Taroom Trough, a province which Omega believes is likely to significantly increase in value during 2026, and where Omega aspires to become the industry partner of choice

- Omega now has exposure to various play types within the Taroom Trough on both the eastern and western flanks – all of which will be further tested by drilling during 2026

- With our investment, Elixir is now funded to drill a horizontal section in the Lorelle-3 well in January 2026, providing the potential for significant value uplift. Horizontal wells have demonstrated their effectiveness in unlocking the potential of the unconventional oil and gas-bearing sands in the Taroom Trough and Omega brings highly relevant operating experience from our own wells to this activity

- Omega’s investment requires Elixir to use the funds for horizontal well activities, including flow testing on ATP 2056 and other permit work commitments

- Omega’s key focus and value driver remains our 100% owned Canyon Project in the prospective, oil and gas-bearing eastern Taroom Trough

- Planning is well underway for Omega’s extensive 2026/27 appraisal drilling program, with Omega in exclusive negotiations with H&P for three firm wells and four optional wells scheduled to commence in May 2026

(1) Subject to agreed confidentiality conditions

Key Transaction Terms

- Equity acquired: 19.43% of Elixir’s issued share capital, unconditional and not subject to shareholder approval

- Form: Subscription for new fully paid ordinary shares via a placement, amounting to $13.9 million at a price of $0.041 per share

- Board rights: Subject to Omega continuing to hold voting power of at least 15% in Elixir, Omega is entitled to nominate up to two directors

- Technical Committee: To be established for the purposes of Omega receiving technical information and consulting with Elixir on Elixir’s projects

- Equity participation right: Subject to the ASX Listing Rules and Omega continuing to hold a 10% shareholding, Omega will have the right to participate in all future capital raisings

- Pursuant to Elixir’s farm-in obligations Omega can request Elixir to elect to execute a horizontal section from the Lorelle-3 vertical well by 1 February 2026

- A detailed summary of agreement terms is provided in Appendix A

- Omega notes that there is a second placement tranche taking the total investment up to $14.6 million, assuming Omega pro-rata participation to retain 19.43% equity interest. This is conditional and subject to shareholder approval

Strong Balance Sheet and Well-Funded

- Following the transaction, Omega remains well capitalised and expects to have access to over $55 million of funds available to support our 2026/27 Canyon Project appraisal and growth program

Trevor Brown, Omega’s Chief Executive Officer and Managing Director, commented:

“This investment is a further step toward achieving our goal to be the partner of choice in the Taroom Trough, a highly prospective basin we understand well. Omega is very favourably positioned with exposure to multiple opportunities across the Taroom Trough, Australia’s most prospective onshore gas and liquids province. Our interest in Elixir provides a low-cost entry into complementary acreage. With the Lorelle-3 well planned for early 2026, Omega shareholders gain exposure to a significant near-term exploration catalyst.”

Omega Oil and Gas has entered a binding term sheet to acquire a 19.43% equity interest in Elixir Energy via a placement of new shares, using Elixir’s existing placement capacity amounting to $13.9 million (“Tranche 1 Placement”).

Tranche 1 Placement

The Tranche 1 Placement will be conducted at an issue price of $0.041 per share and summary of the material terms of the placement agreement between Omega and Elixir for the Tranche1 Placement is provided in Annexure A.

Tranche 2 Placement

Subject to completion of the Tranche 1 Placement, Omega and Nero Resource Fund have agreed to subscribe for a combined $2.68 million at the Issue Price per share for approximately:

- 48.8 million new shares to Nero Resource Fund to raise $2 million; and

- 16.6 million new shares to Omega to raise $0.68 million (which maintains Omega’s 19.43% interest in Elixir), via a tranche 2 placement conditional on Elixir shareholder approval to be sought at an extraordinary general meeting, expected to be held in January 2026.

This investment progresses Omega’s growth strategy and strengthens the Company’s acreage position and influence within the Taroom Trough. The Taroom Trough continues to demonstrate significant resource potential, and with the level of drilling activity in the region increasing the next 12 to 18 months are poised to be pivotal. This transaction allows Omega to expand its position at a very low cost.

The transaction enhances basin-wide optionality and enables accelerated value creation across a highly prospective gas and liquids basin in Queensland.

The drilling and flow testing of the Lorelle-3 well on the western flank of the Taroom Trough horizontal section has the potential to be highly impactful and provide important technical information required to understand the commercial potential of this play.

Elixir has commenced preparations for the Lorelle-3 horizontal section, scheduled to commence drilling in January 2026. Funds raised under the Placement will be applied to:

- Lorelle-3 horizontal well activities on ATP 2056 Figure 1), including drilling, fracture stimulation and flow testing; and

- Additional permit work commitments

On the eastern flank of the Taroom Trough, our 100% held Canyon Project remains our core focus area and key value driver. Our extensive 2026/27 appraisal program focuses on the unconventional Permian play comprising five reservoir layers including one tested and four untested.

Figure 1

Next Steps

- Omega will work closely with Elixir to finalise completion of the Tranche 1 Placement, with settlement due to occur on 2 December 2025

- Omega will participate in the planning of the upcoming Lorelle-3 well, scheduled to commence in January 2026 using H&P FlexRig 648

- Elixir to hold a General Meeting in January 2026 seeking approval for the Tranche 2 Placement

- Omega will execute the Canyon Project appraisal program comprising at least three vertical wells and options for multiple follow-up horizontal sections. Horizontal sections will be able to be drilled from any of the vertical wells

- H&P FlexRig 648 scheduled to commence Omega program in May 2026 following other wells in the basin

KeyFacts Energy: Elixir Australia country profile

KEYFACT Energy

KEYFACT Energy