- Record annual oil and gas production up 31%

- Extending consistent 15-year growth track record

- More than 85% drill bit success

- Acquisition of key Colombian Llanos 34 interests

GeoPark Limited, a leading independent Latin American oil and gas explorer, operator and consolidator with operations and growth platforms in Colombia, Peru, Argentina, Brazil and Chile, announces its operational update for the three-month period ended December 31, 2018 (“4Q2018”).

All figures are expressed in US Dollars and growth comparisons refer to the same period of the prior year, except when otherwise specified.

Fourth Quarter 2018 Highlights

- Oil and Gas Production: Hits and Exceeds Targets

- Annual 2018 average production up 31% to 36,027 boepd, hitting 35,500-36,500 boepd guidance

- Record 2018 exit production of 39,600 boepd, exceeded guidance of 38,000-39,000 boepd

- Consolidated oil and gas production up 26% to 38,741 boepd (up 4% compared to 3Q2018)

- Oil production increased by 30% to 32,859 bopd (up 5% compared to 3Q2018)

- Gross operated production in Llanos 34 block (GeoPark operated, 45% WI) surpassed 70,000 bopd

- Gas production increased by 11% to 35.3 mmcfpd

Operations: Capital Efficiency and Execution

- GeoPark’s 2018 work program included a total of 33 gross wells drilled (30 operated with a success rate of over 85%), including development, appraisal and exploration wells, as part of its $140-150 million capital expenditure plan

- In Colombia: eight new wells were tested and put on production in the Llanos 34 block, adding 7,000 bopd gross from new wells. Llanos 34 flowline on schedule and on budget

- In Brazil: Praia dos Castelhanos 1 exploration well was drilled in the REC- T-128 block (GeoPark operated, 70% WI) and will be completed and tested in 1Q2019

- Portfolio Growth: Acquisition of LGI’s Interests in Colombia and Chile

- Acquired LGI’s 20% equity interest in GeoPark’s Chilean and Colombian subsidiaries, which expanded the Company’s participation in the valuable Llanos 34 block, and contributed with significant corporate synergies and bottom-line benefits

- Divested high-cost, non-core La Cuerva and Yamu Colombian assets for up to $20 million

Catalysts: 1Q2019

- Testing five drilled wells and drilling five new wells, including development, appraisal and exploration wells across the pan-regional portfolio in Colombia, Argentina, Brazil and Chile

- Flowline in the Llanos 34 block expected to be operational in 1Q2019

- New independent reserves certification by DeGolyer and MacNaughton (D&M) underway and expected to be released in early February 2019

Oil and Gas Production Update

Overall oil and gas production grew by 26% to 38,741 boepd in 4Q2018 from 30,654 boepd in 4Q2017, due to increased production in Colombia and new production from the recent Argentina acquisitions. Oil represented 85% of total reported production compared to 83% in 4Q2017.

Colombia:

Average net production in Colombia grew 26% to 30,641 boepd in 4Q2018 compared to 24,378 boepd in 4Q2017, reflecting continued successful appraisal and development drilling in Tigana and Jacana oil fields in the Llanos 34 block, which represented 96% of Colombian production in 4Q2018.

By end-December 2018, the Llanos 34 block surpassed the 70,000 gross bopd milestone, extending seven years of production growth and operating momentum, and setting a solid base for continued growth during 2019.

Llanos 34 block 4Q2018 operational results:

Exploration drilling:

- Tigui Sur 1 well, located south of the Tigui 1 exploration well, next to the southern border of the Llanos 34 block, was successfully tested during 4Q2018. Tigui oil field (including Tigui 1 and Tigui Sur 1 wells) is currently producing 1,900 bopd with a 6% water cut.

- The Company is currently drilling Tigui 2 appraisal well, located 870 meters east of Tigui 1 well, to continue delineating the size and distribution of the reservoir.

Development and appraisal drilling:

- Seven new wells were tested and put on production, including Tigana 5, Tigana Norte 10, Tigana Norte 11, Tigana Norte 12, Tua 11, Jacana 14 and Jacana 19, which are currently producing approximately 6,800 bopd gross.

Infrastructure update:

- The flowline to connect the Llanos 34 block to the Oleoducto de los Llanos (ODL), one of Colombia’s principal pipelines (with a capacity of 314,000 bopd) is on budget and on schedule and is expected to be operational in 1Q2019. The project will support future production growth (with a capacity of up to 100,000 bopd) and reduce transportation and operating costs.

Sale of La Cuerva and Yamu non-core assets:

- In November 2018, GeoPark signed an agreement with Perenco Oil and Gas to divest the La Cuerva and Yamu blocks for $18 million plus a contingent payment of $2 million based on future oil prices.

- GeoPark will continue operating the La Cuerva and Yamu blocks until the closing of this transaction, expected in 1Q2019.

Peru

During 4Q2018, GeoPark successfully concluded the last round of workshops with local communities. The Company is currently waiting for additional comments from Servicio Nacional de Certificación Ambiental para las Inversiones Sostenibles, which is the last step of the Environmental Impact Assessment approval process.

The Morona block (GeoPark operated, 75% WI) contains the Situche Central oil field, which has been delineated by two wells that tested combined production rates of 7,500 bopd of light oil with identified upside potential of more than 200 mmbo. As of December 2017, D&M certified gross proven and probable (2P) reserves of 42.1 mmbo and 3P reserves of 83.0 mmbo for the Situche Central oil field.

Argentina

Average net production in Argentina totaled 2,383 boepd in 4Q2018 (67% oil, 33% gas) corresponding to the acquisition of the Aguada Baguales, El Porvenir and Puesto Touquet blocks (GeoPark operated, 100% WI) in the Neuquen basin. Net production levels in 4Q2018 increased by 3% compared to 3Q2018, due to an ongoing secondary recovery optimization project that included a low-cost well intervention campaign initiated in August 2018.

Testing activities in the El Porvenir block (GeoPark operated, 100% WI):

- Site preparation and installation activities completed during 4Q2018 to test a tight gas play in the Challaco Bajo 1001 well. Testing expected to begin in January 2019.

Exploration drilling in the CN-V block (GeoPark, 50% WI):

- Initial testing activities in the Rio Grande Este 1 exploration well were unsuccessful. The joint venture is currently evaluating subsequent steps.

Brazil

Average net production in the Manati field (GeoPark non-operated, 10% WI) decreased by 13% to 2,894 boepd in 4Q2018, compared to 3,328 boepd in 4Q2017, due to lower gas demand for power generation as a result of increased hydroelectric power availability.

Exploration drilling in the REC-T-128 block:

- Praia dos Castelhanos 1 exploration well was drilled to a total depth of 8,431 feet. Testing activities expected during 1Q2019.

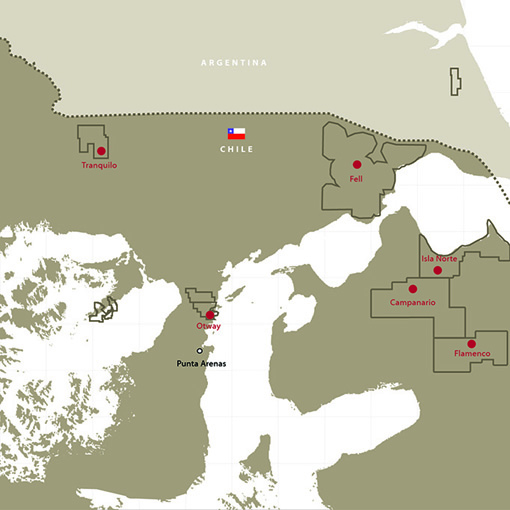

Chile

Average net oil and gas production in Chile decreased by 4% to 2,823 boepd in 4Q2018 compared to 2,932 boepd in 4Q2017, but increased 7% compared to 3Q2018 due to the recent discovery of the Jauke gas field. The production mix during 4Q2018 was (74% gas, 26% light oil vs. 66% gas, 34% light oil in 4Q2017). The Fell block (GeoPark operated, 100% WI) represented 100% of Chilean production in 4Q2018.

During 4Q2018, surface facilities optimization resulted in an increase of overall gas production levels. The Fell block is currently producing 3,000-3,100 boepd (80% gas, 20% light oil).

Link to GeoPark country profile

KEYFACT Energy

KEYFACT Energy