WTI (Dec) $60.48 +33c, Brent (Dec) $64.92 +52c, Diff -$4.44 +19c

USNG (Dec)* $3.80 -2c, UKNG (Nov) 79.80p -0.05p, TTF (Dec)* €31.98 +€0.08

*Indicates expiry of November contracts

Oil price

Following on from the FOMC decision, which was entirely as expected but the Powell speech unsurprisingly left a sour taste in the mouth, came the meeting between leaders Trump and Xi with regard to tariffs. As far as I can see the result is good without being perfect, a number of areas have been left in abeyance such as advanced chips but it seems to be ok.

Ahead of the Opec+ meeting on Sunday the inventory stats were important, what a surprise that the teenage scribblers on Wall Street got it so wrong… After a big draw from the API the EIA were even higher and with the key data point, the refinery runs number, being miscalculated (it was down two full point against forecast of +0.2%) product numbers drew hard as well. Crude drew 6.858m b’s, gasoline -5.941m and distillates -3.362m.

Shell has beaten the Whisper with a creditable set of numbers, BP follow next week…

Hunting

Report on a visit to Flexible Engineered Solutions Holdings Limited (FES)

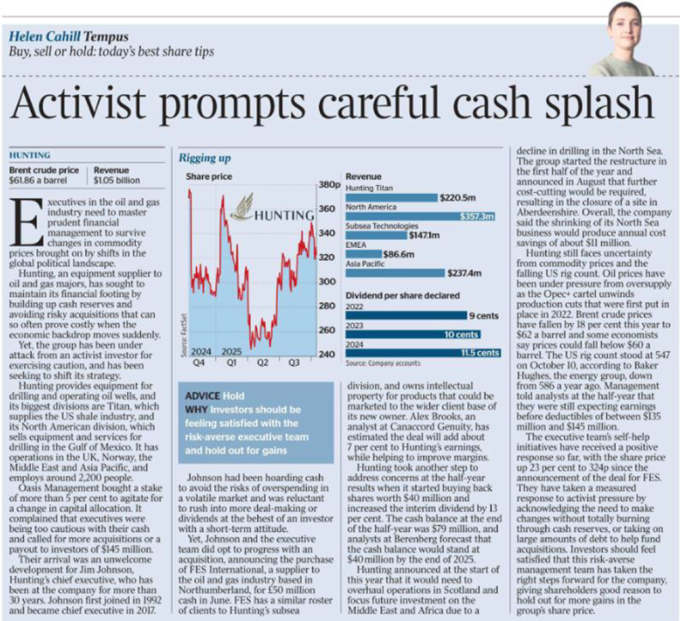

I have recently visited FES, the business acquired by Hunting in June 2025. Hunting paid £50m in cash for FES which is highly cash generative and earnings and margin accretive in the first full financial year of ownership. In 2024 FES had revenues of £31.3m with CAGR of 11.5%, with EBITDA of £6.2m and margins of 23% and the acquisition was completed on an EV/EBITDA multiple of 7.5x historic actual and 6.2x on a forward basis. The company is highly cash generative with c.£7.1m FCF in 2024.

FES had an order book of £11.8m at completion but perhaps more exciting is that it has a substantial bid pipeline of some £100m which has a 50% probability of conversion. Given the strong margin profile at FES the projects are individually profitable aided by the very low overheads and stringent cost control.

Based in Ashington, Northumberland and founded in 1997 FES is a highly specialist provider of complex subsea intervention solutions with technically engineered fluid transfer products that support complex operations, optimising safety, reliability and efficiency across all major offshore regions worldwide.

I met with Ian Latimer, former owner and current consultant, Mark Latimer, Business Services Manager and Mark Stokes the General Manager. A measure of how experienced Mark Stokes is was demonstrated by his vast industry experience including some 20+ years at Wellstream which was a business I really admired.

FES is based over two sites in Ashington with the headquarters at Merchant Court where design, project management, QHSE, sales, assembly and testing takes place and at the Jubilee facility which houses the fabrication and welding operations as well as NDE, assembly and testing. The Jubilee facility was acquired when space ran out at Merchant Court and has a great deal of spare land around the operations on that site.

FES has a unique turnkey offering, it is full life cycle with kit either from the FES product range or custom made by approved sub-contractors to the client’s concept. All assembly and testing, welding and fabrication capacities are achieved in-house at FES which cuts out the need to carry a great deal of inventory.

With the company operating a coordinated process that ensures efficiency, reliability and as a result timely delivery, FES also provide on-site support and that includes customer training and after sales well beyond delivery dates.

I was allowed access to all the facilities and would like to thank Mark Stokes for spending so much time with me, it was a privilege to see around such state of the art factories and with direct access to the operations at FES. I was able to see the main floor at Merchant Court which is a state of the art facility, when there I saw three separate testing areas working on client kit and some of the pieces are substantial. I also visited the adjacent dedicated test facility which houses a number of test rigs designed to simulate loads during installation and operation.

The factories are interesting in that whilst there are quite a number of pieces of kit around they are generally in the process of being tested, some items are even sent back to FES for testing and validating. It means that the company doesn’t carry a huge inventory keeping costs down and margins up.

FES has a diversified product range, divided into three groups, fluid handing, subsea and marine, within that there are many individual products that have become synonymous with the company. These include fixed and disconnectable turret systems, hydraulics, pressure balanced weak link couplings and their industry leader the diverless bend stiffener connector (DBSC). They also have a number of other subsea products including manifolds and control panels as well as pipeline equipment and bespoke engineering. They are also in the market leading space for hoses, intake systems, valves and couplings.

One of the best things about FES is that it has a huge list of blue chip clients, within the oil majors and shipyards they work for Shell, Exxon, Total, Petrobras and Equinor as well as Seatrium and Hanwha Ocean. In SURF contractors and installers they number Subsea 7, Saipem, McDermott, Technip FMC, Baker Hughes and SLB. And in OEMS they work for Oceaneering, NOV and Prysmian. This is only a small representation of the client base.

This is only a part of the full list but it shows that the company has significant global reach which includes Guyana where they work for Exxon, Brazil, the North Sea, Africa, the Middle East, the Far East, Australia and New Zealand.

Having said that it is much easier to understand what a perfect fit that FES is for Hunting. In a nutshell it comes down to cross-selling and product bundling opportunities but there is more than that. Firstly, in recent years Hunting has been increasing its product coverage in subsea in general and in deep water and ultra deepwater markets in particular.

The existing FES product range will broaden that range and can fill in gaps to provide a full market solution, this may be in DBSC’s for connection of dynamic risers alongside TSJ for fixed risers. In Guyana both firms could work for Exxon in the different depth that their fields are operating for example.

In this respect the blue chip nature of both company’s relationships with offshore operators. Where both have overlaps and new opportunities are presented for each of them to advance. Are the building blocks of potential shared significant international growth.

This makes for plenty of bundling opportunities. It is clear that there is a natural fit, both FES and Hunting products can provide synergies for shared clients and FES can be a provider of a wealth of opportunities.

Finally on fit, I can see why and how there is so much of a cultural alignment between the two companies. Having seen both companies operations, the nature of FES’s project-focused, precise engineering-led team supremely complements Hunting’s values of safety, innovation and customer focus.

Since the acquisition in June the two teams have moved fast to establish ways of ensuring that the integration planning goes ahead smoothly and swiftly. There have been key appointments as Leadership, Support and Group leads identified across FES and Hunting’s Subsea Technologies team which are already succeeding in ensuring that there is quick and efficient integration across key areas.

This has already borne fruit, early focus and commitment amongst these key personnel has in only a few months allowed quick wins in finance, accounting, sales and marketing amongst others. Likewise synergies in the supply chain and manufacturing operations are already being explored and work is underway to harmonise quality and compliance across the two businesses.

On the commercial front there is already proof that global sales channels are being leveraged in order to accelerate growth and of course cross-selling opportunities for both FES and existing Hunting products including areas where FES have previously been established.

Maybe of all the cross fertilisation processes, activities in the personnel area have proved to be significantly valuable. There is a clear shared set of values and strong cultural fit when you visit FES. Making for a smooth integration which is clearly working in both directions.

Having followed Hunting for many years one of the key takeaways is the family nature of the business, it is to be seen here at FES which is why I am confident that the companies together will achieve a stronger market position, create access to new markets and enable the delivery of the Hunting 2030 strategy.

In conclusion, a highly valuable visit which confirmed my views that Hunting has something very special here, I just hope that there are more like it to be found. FES is a company with a great IP protected portfolio, with opportunities to grow both physically at the Jubilee site and through cross fertilisation of products and clients.

Costs are tightly controlled, low inventories create a very positive free cash flow and I like the earnings visibility. The combination has a great platform for growth with a shared footprint and a strengthening and growing subsea revenue profile.

At only £50m and on that historic p/e of 7.5x and prospective of 6.2x, I think that this is a great deal that I wish could be found again. Recent robust financial performance gives the necessary comfort to Hunting in one of its key growth divisions.

Hunting remains in a very strong position, generating a lot of cash and with a balance sheet that gives plenty of scope for other high margin, positive cash flow and very complimentary businesses and I would expect more acquisitions in the future.

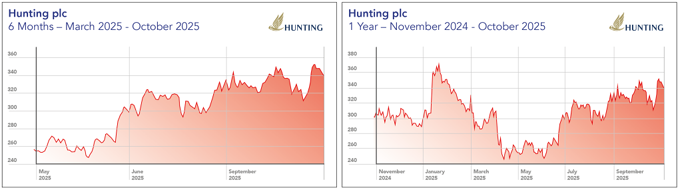

My Target Price for Hunting stays at 500p, recent strength, up 35% in the last six months and 20% y/y only reflects a small part of the company’s potential in its specialist, subsea and deep water operational areas.

Original article l KeyFacts Energy Industry Directory: Malcy's Blog

KEYFACT Energy

KEYFACT Energy