Savannah Energy provides the following operational and financial update for the nine months to 30 September 2025. All figures are unaudited.

The Company also announces a proposed fundraising, a conditional share buyback arrangement and a warrant cancellation agreement, further details on which are included below.

Andrew Knott, CEO of Savannah, said:

"2025 has been a year of strong progress against the nine focus areas we set out at the beginning of the year. These include increasing our rate of cash collections in Nigeria, with performance remaining on track; advancing the refinancing of our principal Nigerian debt facilities, which we expect to complete by year-end; and successfully completing the acquisition of 100% of Sinopec International Petroleum Exploration and Production Company Nigeria Limited in March.

We have also commenced the Stubb Creek expansion project, continued to advance our arbitral processes, and begun site construction ahead of the planned drilling of our Uquo development and exploration wells. In Niger, discussions on the R3 East development are progressing, while in the power sector we have refined our business model to align with future growth opportunities. Finally, we continue to pursue further value-accretive acquisitions across both the oil and gas and power sectors, with the Norfund transaction already announced and several other opportunities under active discussion.

Additionally, earlier in the year, the Company reported a 21% 2P Reserves upgrade on its Uquo gas field and a 29% upgrade on its Stubb Creek oil field 2P Reserves. Collectively, these developments demonstrate the strong operational momentum within the Group and our continued focus on disciplined execution across all parts of the business.

We are also pleased to welcome NIPCO Plc ("NIPCO" or the "New Investor"), a diversified Nigerian energy conglomerate, as a potential new investor in the Company, who we expect to own approximately 19.4% of the Company following completion of their primary investment and certain secondary share transactions. The proceeds of the New Investor's primary investment are expected to enable, among other things, the advancement of certain business development opportunities currently under consideration. Coupled with the imminent completion of the primary investment I committed to in March 2025, a series of secondary transactions, which are expected to occur today, are anticipated to increase my shareholding in the Company to approximately 12.6%, demonstrating my continued strong faith in the Company's future potential.1

In addition, we are pleased to announce that should we see a significant improvement in cash collections- and/or receive meaningful proceeds from the arbitral processes we are engaged in, it is the Board's present intention to consider returning a portion of such funds to shareholders through a tender offer or share buy-back, subject to prevailing capital requirements and shareholder and regulatory approvals. In this vein, today we are also announcing the signature of a conditional off-market share buyback agreement for approximately 6.8% of the Company's enlarged share capital, to acquire shares prior to 31 March 2026. We are also announcing the proposed cancellation of warrants over approximately 101 million shares.

I would also like to take this opportunity to extend my thanks to all those who contributed to our successes this year - my incredibly dedicated and passionate colleagues, our host governments, communities, local authorities and regulators, our shareholders and lenders, and our customers, suppliers and partners. Thank you all."

Highlights

Funding

- Intention to complete a fundraising by way of subscription of 161,061,510 new Ordinary Shares at 7 pence per new Ordinary Share to raise approximately £11.3m before expenses;

- Completion of the final tranche of the March 2025 fundraising of 138,977,614 new Ordinary Shares at 7 pence per new Ordinary Share expected imminently, with the final approximate £9.7 million in subscription funds to be received; and

Planned introduction of a new strategic shareholder, NIPCO, a diversified Nigerian energy conglomerate, onto Company's register.

Conditional Share Buyback

- Proposed share buyback agreement expected to be signed to acquire up to 143,565,582 existing Ordinary Shares from certain shareholders at 7 pence per share during the period ending 31 March 2026 (conditional upon the approval of Shareholders, expected to be sought shortly).

Warrant Cancellation

- The Company intends to acquire and cancel warrants over 101,113,992 Ordinary Shares in the Company.

Operational

- 9M 2025 average gross daily production of 20.1 Kboepd (9M 2024: 23.0 Kboepd), of which 85% was gas (9M 2024: 88%)2. Following completion of the SIPEC Acquisition in March 2025, we commenced an 18-month expansion programme that has already increased current Stubb Creek gross daily production to 3.3 Kbopd, approximately 24% above the 2024 average;

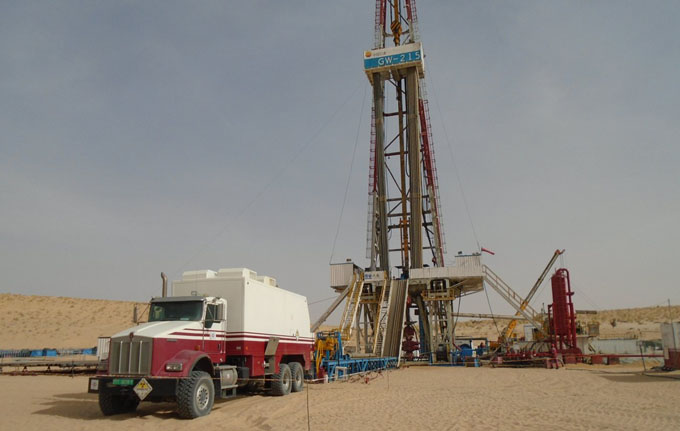

- Well site construction is currently ongoing for the Uquo NE development well. This follows the earlier signing of a turnkey drilling contract for a planned two-well drilling campaign on the Uquo Field, scheduled to commence in January 2026, with first gas targeted by the end of that quarter;

- New compression system at the Uquo Central Processing Facility ("CPF") completed and fully commissioned. This project, which was delivered safely and approximately 10% under the original US$45 million budget, is expected to allow us to maximise the production from our existing and future gas wells;

- Gas contract extension agreed with the Central Horizon Gas Company Limited ("CHGC") to end December 2026 for up to 10 MMscfpd;

- Progressing our previously announced proposed acquisition of indirect interests in three East African hydropower projects, including the 255 MW Bujagali power plant, with a 13-year operating and payment track record, and two advanced-stage development projects, marking Savannah's planned entry into five new countries - Uganda, Burundi, the Democratic Republic of the Congo (the "DRC"), Malawi and Rwanda;

- Continuing to progress our existing priority Power Division projects, including the up to 250 MW Parc Eolien de la Tarka wind farm project in Niger and the up to 95 MW Bini a Warak hybrid hydroelectric and solar project in Cameroon;

- Subject to a satisfactory agreement being reached with the Government of Niger, our subsidiary is considering commencing a four-well testing programme and/or a return to exploration activity in the R1234 PSC contract area in 2026/27; and

- Actively reviewing opportunities in both the thermal and renewable power sector, with the expectation of announcing transaction(s) currently under consideration over the course of the next 24 months in the African power space.

Financial (unaudited)

- 9M 2025 Total Revenues3 of US$185.2 million, up 9% (9M 2024: US$169.3 million) and 9M 2025 cash collections of US$241.6 million, an increase of 5% (9M 2025: US$229.3 million);

- As at 30 September 2025, cash balances were US$101.8 million (31 December 2024: US$32.6 million) and net debt stood at US$629.9 million (31 December 2024: US$636.9 million). Gross debt as at 30 September 2025 was US$731.7 million of which only US$41.4 million (6%) was recourse to PLC;

- The Trade Receivables balance as at 30 September 2025 was US$493.3 million, a 9% improvement on year-end 2024 (31 December 2024: US$538.9 million);

- Agreements signed with a consortium of five Nigerian banks in respect of an increase in the Accugas debt facility from NGN340 billion (approximately US$222 million) to up to approximately NGN772 billion (approximately US$500 million) (the "Transitional Facility"). It is expected that the Transitional Facility will be utilised to enable the remaining outstanding balance of the Accugas US$ Facility to be repaid by end 2025; and

- Term sheet agreed between Savannah's wholly owned subsidiary, Savannah Energy EA, and a major African based financial institution for a new US$37.4 million debt facility to provide funding for our planned acquisition of a 50.1% interest in Klinchenberg BV ("Klinchenberg"), which holds indirect interests in three East African hydropower projects.

Employee Benefit Trust

- Intended sale of Ordinary Shares by the Company's employee benefit trust ("EBT") and issue of new Ordinary Shares to the EBT.

Reasons for the Potential Funding and Use of Proceeds

The Company intends to conduct a fundraising of approximately £11.3 million at a price of 7 pence per new Ordinary Share, to be subscribed in full by NIPCO, a diversified Nigerian energy conglomerate. Accordingly, 161,061,510 new Ordinary Shares are expected to be issued pursuant to the Financing.

In addition, the New Investor intends to acquire, for £7.9 million, 113,378,685 Ordinary Shares issued as part of the Company's March 2025 fundraising and expects to acquire a further £9.5 million, 135,674,944 Ordinary Shares through a series of secondary market trades, representing a total investment of approximately £28.7 million in the Company and an expected pro forma holding of around 19.4% of the Company's enlarged share capital (as enlarged by the various proposed share issues referred to in this announcement).

The Company's CEO Andrew Knott also intends to: (1) imminently acquire 25,598,929 new Ordinary Shares for £1.8m as part of the March 2025 fundraising; (2) acquire a further 32,202,738 existing Ordinary Shares for a total consideration of £2.3m through a secondary market trade; and (3) acquire 63,690,129 existing Ordinary Shares from the EBT for a total consideration of £4.5m. Post these transactions Mr Knott is expected to have a pro forma holding of around 12.6% in the Company's enlarged share capital.

In reaching its decision to proceed with the Financing, the Board considered the proposed introduction of NIPCO to be beneficial to shareholders as a whole, bringing onto the Company's share register a diversified Nigerian energy conglomerate with deep industry expertise. The Board believes that the New Investor's intended investment will strengthen the Company's balance sheet, broaden its shareholder base, and support the next phase of the Company's growth. Accordingly, the Board considers the Financing to be in the best interests of the Company and its shareholders. The net proceeds of the equity issuance are expected to be used, inter alia, to enable the acceleration of certain potential near-term business development opportunities and for general corporate purposes.

The Financing was discussed on a wall-crossed basis with shareholders representing approximately 50% of the Company's enlarged share capital, each of whom has provided written confirmation of their support for the Financing.

KeyFacts Energy: Savannah Petroleum Niger country profile l Savannah Energy Nigeria country profile

KEYFACT Energy

KEYFACT Energy