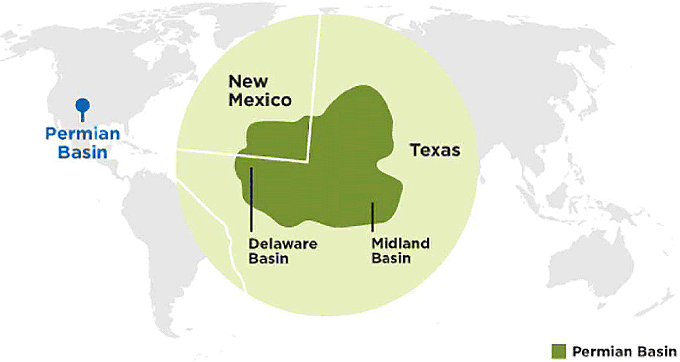

With a long history in the region, Chevron leverages the opportunities and upsides of its varied positions across the Permian Basin

The Permian Basin is essential to U.S. energy security, economic growth and technological innovation. It’s estimated that the region has produced nearly 30 billion barrels of oil since the 1920s, supporting energy needs across the United States.

And for Scott Neal, getting the chance to work for Chevron in the region has been a career highlight.

“It’s a world-class basin that we’ve been exploring and developing for a long time,” said Neal, director of growth and portfolio for Chevron’s shale and tight business. “It’s very meaningful to see the impact of what we do and what it means to have such a strategic asset for the whole of the U.S.”

The company’s return on investment was more than 10% higher than the Permian peer average between 2020 and 2024. (Peers included APA Corp., Coterra Energy, Devon Energy Corp., EOG Resources, Diamondback Energy, Matador Resources Company, Ovintiv Inc., Occidental Petroleum Corp., Permian Resources Corp., and SM Energy Company.) Through 2026, Chevron’s reinvestment rate is expected to be approximately 20% lower than 2024 figures.

Chevron’s history in the Permian

In 1871, the Texas & Pacific (T&P) Railway was chartered to construct the Southern Transcontinental Railroad. It was granted surface land rights and mineral rights—rights to the natural resources beneath the land’s surface—in exchange for each mile of track laid.

But when the T&P went bankrupt years later, its 3.5-million-acre land grant was put in a trust. In 1962, Texaco bought 2 million of these acres to explore and then produce oil and gas from. After Chevron acquired Texaco, this acreage transformed Chevron’s mineral rights ownership across the Permian Basin.

During a period of declining production in the 1980s and 1990s, other companies left the region. Stacked layers of oil had been discovered, but accessing this oil economically was not technologically possible. Chevron made the decision to stay, with a focus on long-term results.

In the 2010s, the shale revolution revitalized the basin. New technologies—led by horizontal drilling and hydraulic fracturing—made trapped resources available. Land positions became premium assets, and holders of mineral interests began to unlock value from active development in the basin.

By the end of the decade, the shale revolution helped the U.S. shift from being a net importer of oil to a net exporter.

Benefits of basin-wide visibility

Today, Chevron has a revenue interest in one of every five Permian wells, giving the company visibility into operations and data across the basin. Leveraging technology and artificial intelligence (AI), Chevron unlocks insights from this data to improve decision-making and performance. Linking AI to this broad presence allows for:

- Improved well design and execution

- Reduced costs

- Enhanced decision-making

“We’ve taken a strategic approach to developing our Permian Basin assets,” said Bruce Niemeyer, Chevron’s president of shale and tight. “The scale we’ve established diversifies risk and provides key insights we can leverage to improve efficiency and performance.”

Chevron’s legacy in the Permian began in the 1920s with vertical wells drilled across the Delaware and Midland basins

An advantaged portfolio

Legacy mineral rights, joint ventures and operated assets across its more than 2-million-acre footprint make Chevron’s position in the Permian uniquely valuable.

This is due in part to its distinct royalty advantage. This means that Chevron pays lower royalty rates on oil and gas produced from this land. Or in the cases where Chevron owns mineral rights, it receives payment or barrels for associated royalty interests. Royalty barrels account for 15% of total production, making Chevron the largest pure royalty producer in the region.

A key to Chevron’s competitive playbook is balancing the trifecta of ownership, partnerships and control in one of the most important oil-production regions in the world.

- Operated assets: These assets represent approximately 50% of Chevron’s Permian production. Operated wells benefit from Chevron’s repeatable, scalable factory model.

- Non-operated joint ventures: Chevron holds an interest in non-operated joint ventures (NOJVs) across the Permian. Operating companies provide NOJV reports to Chevron for more than 10,000 wells. This provides Chevron with an information advantage.

- Mineral rights: Chevron earns a portion of production revenue from land it holds mineral rights to without having to operate or invest in drilling the wells.

“It’s not just our long-standing legacy. It’s a strategic asset where we leverage our experience and advantages to generate long-term value for shareholders,” Neal said. “Our factory model approach and technological innovation enable us to deliver safe, reliable and efficient production.”

Unlocking value

Chevron is shifting from growth to cash generation in the Permian Basin. The company aims to maintain production at 1 million barrels of oil-equivalent (BOE) per day through 2040. (The linked article is subject to a paywall restriction.)

Through the years, a wide range of technologies has reduced costs and decreased cycle times. A recent example is hydraulically fracturing two—or three—Permian wells simultaneously.

As Chevron has grown operations in the Permian, it continues to get more from the region by:

- Increasing production at a lower capital expenditure, focusing on free cash flow and efficiencies that support higher returns. For example, using advanced drilling techniques and high-pressure gas lifts can help Chevron get more from its assets.

- Growing with 40% fewer rigs than Chevron’s plans contained a few years ago.

- Driving higher estimated ultimate recoveries (EURs) per well by optimizing well spacing, landing zones and completion designs, resulting in an approximately 53% increase in EURs over the past 10 years.

KeyFacts Energy: Chevron US country profile

KEYFACT Energy

KEYFACT Energy