- First 2025 Jubilee well onstream with better net pay than expected

- Strong strategic momentum with realisation of $300 million Gabon proceeds

- Focused on delivering our key strategic priority of refinancing our capital structure

Tullow Oil, the independent oil and gas exploration and production group, announces its Half Year Results for the six months ended 30 June 2025.

Richard Miller, Chief Financial Officer and Interim Chief Executive Officer, Tullow Oil plc, commented:

"Our 2025 strategic priorities remain clear: refinancing our capital structure, optimising production, increasing reserves, and completing the sale of our Kenyan assets, having already realised $300 million proceeds from the sale of our portfolio of assets in Gabon.

"In Ghana we have already taken actions to address the recent underperformance at Jubilee, with further optimisation potential identified. We have recommenced drilling and have successfully completed and brought onstream the first of two planned 2025 production wells at Jubilee, with better than expected net pay during drilling. The high quality 4D seismic data acquired at the start of the year is now being used to generate improved models that will directly inform the well-planning process and will be further supported with the capture of an Ocean Bottom Node (OBN) seismic survey in the fourth quarter this year.

"We achieved a key milestone by signing a MoU in Ghana to extend our production licences for both Jubilee and TEN to 2040, which is expected to increase reserves and unlock significant value from these fields.

"In the second half of the year we are focussed on refinancing our capital structure, production optimisation activities and continuing to optimise our cost base, which combined with the progress in the first half of the year will help unlock Tullow's intrinsic value."

2025 FIRST HALF RESULTS

- First half Group working interest oil and gas production 50.0 kboepd (1H24: 63.7 kboepd). Excluding Gabon, 40.6 kboepd (1H24: 53.5 kboepd).

- Revenue of $524 million (1H24: $759 million); realised oil price of $69.0/bbl after hedging (1H24: $77.7/bbl), gross profit of $218 million (1H24: $460 million); loss after tax of $(61) million (1H24: profit after tax of $196 million). Excluding Gabon, revenue of $411 million (1H24: $666 million); realised oil price of $69.7/bbl after hedging (1H24: $77.0/bbl), gross profit of $165 million (1H2024: $387 million); loss after tax of $(80) million (1H24: profit after tax of $106 million).

- Net G&A of $23 million (1H24: $31 million).

- Capital expenditure of $103 million (1H24: $157 million) and decommissioning spend of $13 million (1H24: $9 million). Excluding Gabon of $78 million (1H 2024: $130 million)

- Free cash flow of $(188) million in 1H25 (1H24: $(126) million), in line with expectations based on timing of tax payments, lifting schedule and costs associated with Jubilee maintenance in 1H25.

- Net debt at 30 June 2025 of $1.6 billion (30 June 2024: $1.7 billion); cash gearing of 1.9x net debt/EBITDAX (30 June 2024: 1.4x); liquidity headroom of $0.2 billion (30 June 2024: $0.7 billion). Excluding Gabon, cash gearing of 2.1x net debt/EBITDAX (30 June 2024: 1.6x).

Strategic priorities

The first half of 2025 has seen significant progress towards delivery of our strategic priorities for the year to realise Tullow's potential, including:

- On 29 July, Tullow completed the sale of Tullow Oil Gabon SA for a total cash consideration of $300 million net of tax.

- On 21 July, Tullow entered into a sale and purchase agreement for the sale of Tullow Kenya BV for a cash consideration of at least $120 million. Completion and receipt of the first two milestone payments, totalling $80 million, are expected during 2025.

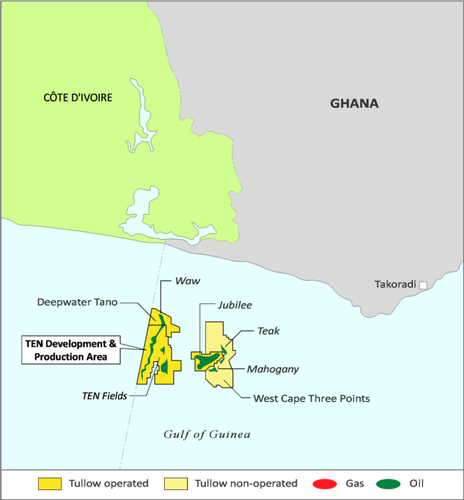

- On 4 June, Tullow and its JV partners announced a Memorandum of Understanding (MoU) with the Government of Ghana to extend the West Cape Three Points (WCTP) and Deep Water Tano (DWT) licences to 2040; the MoU includes a commitment to work to increase gas supply to c.130 mmscf/d and a guaranteed reimbursement mechanism for gas sales. As a result of the licence extensions the JV partners expect to realise a material increase in gross 2P reserves.

- In January the International Chamber of Commerce Tribunal determined that Branch Profit Remittance Tax (BPRT) in Ghana is not appliable to Tullow Ghana and therefore it is not liable to pay the $320 million assessment.

2025 FULL YEAR OUTLOOK

- 2025 Group working interest production guidance is expected to average 40-45 kboepd, including c.6 kboepd of gas, reflecting the sale of the Gabonese assets effective from the start of the year.

- Full year capex and decommissioning guidance, both updated to reflect the Gabonese sale, of c.$185 million and c.$20 million, respectively.

- Ghana drilling campaign recommenced with the J72-P well, the first of two Jubilee production wells in 2025, which was brought onstream at the end of July having encountered better than expected net pay during drilling operations.

- Interpretation of the 4D seismic data acquired in the first quarter continues, with a further four firm Jubilee wells planned for 2026.

- Cost base optimisation savings of c.$10 million expected to reduce 2025 annual net G&A to $40 million, with Group targeted savings of c.$50 million over the next three years compared to 2024.

- Full year free cash flow guidance is adjusted to $300 million at $65/bbl, reflecting 1H25 Jubilee production performance resulting in one lifting moving into 2026. Guidance is inclusive of $380 million of disposal proceeds, $35 million of 2024 Gabonese cash taxes paid in 1H25 which are not reimbursed through the transaction and c.$50 million of overdue gas payments in Ghana.

- Year-end net debt guidance is unchanged at c.$1.1 billion with gearing of c.1.3x (net debt/EBITDAX1).

- Following completion of the sale of Tullow Oil Gabon SA, Tullow applied part of the proceeds to repay in full and simultaneously cancel the $150 million Revolving Credit Facility (RCF).

- Tullow remains focused on further deleveraging and reaching net debt of less than $1 billion and cash gearing of less than 1x in the near term.

Operational update

Production

In the first six months of 2025, Group production averaged 50.0 kboepd (40.6 kboepd excluding Gabon), including 7.1 kboepd of gas. 2025 Group production guidance is expected to be at the lower end of the 40-45 kboepd range (previously 50-55 kboepd), reflecting the removal of Gabonese production from the start of the year and including c.6 kboepd of gas.

Ghana

During the first six months of the year, operational efficiency remained high, with average facility uptime across the Ghana FPSOs at 97% and a combined average oil production rate of c.32.8 kbopd net and an average gas production rate of 6.2 kboepd net.

Gross oil production from the Jubilee field averaged 60.9 kbopd (net: 23.7 kbopd) in the first half of the year, inclusive of a 15 day planned maintenance shutdown conducted safely and on budget. During the first half of 2025, Jubilee has been affected by higher than expected water cut from certain wells, which has impacted riser stability on the eastern side of Jubilee. Riser base gas lift has now been introduced on the east side of the field, which restored and stabilised production in June. Riser base gas lift for the western side of Jubilee, which will provide further uplift to production and reserves, has been sanctioned and will be implemented in the coming years.

Voidage replacement was greater than 100% in the first half of the year, but water injection levels were lower than expected due to planned maintenance taking longer than expected and a fault with the sea water lift system. Tullow anticipates being able to restore water injection rates closer to capacity of 300 kbw/d in the second half of 2025 to provide increased pressure support and reduce declines. Additionally, we expect a further uplift in production from the J72-P well, which encountered better than expected net pay and was brought onstream in July.

When the rig recommences drilling in the fourth quarter of the year, after a break for maintenance, the next well is planned to be a Jubilee producer (J73-P), to come onstream around the end of the year. A further four firm Jubilee wells are then planned for 2026. Processing of the 4D seismic, shot in the first quarter, is currently ongoing and will help validate the locations for the later wells in the campaign. Tullow will further enhance this data set with the capture of an Ocean Bottom Node (OBN) seismic survey in the fourth quarter of 2025, which will underpin infill drilling across Jubilee and TEN.

Gross oil production from the TEN fields averaged 16.4 kbopd (net: 9.0 kbopd) in the first half of the year. This was above expectations supported by opening a previously shut-in production interval in Enyenra and water injection optimisation activities. The TEN FPSO flare tip was replaced in May, which has allowed a further c.50% reduction in routine flaring from July 2025 onwards.

As part of the Memorandum of Understanding (MoU) relating to the extension of the WCTP and DWT licences in Ghana, a number of principles are included that underpin the continued development of both TEN and Jubilee. These include a commitment to work to increase the supply of gas to c.130 mmscf/d (from current level of c.100 mmscf/d), a reduced gas price for Jubilee associated gas, and a guaranteed reimbursement mechanism for gas sales. The MoU describes the intended further development plans for Jubilee, which includes the right to drill up to 20 additional wells in the Jubilee field, representing investment of up to $2 billion in Ghana over the life of the licences. As a result of the licence extensions to 2040 the JV partnership expects to realise a material increase in gross 2P reserves.

Non-operated and exploration portfolios

Tullow completed the $300 million sale of its non-core Gabon assets to the Gabon Oil Company on 29 July 2025.

In Côte d'Ivoire, Tullow continues to work with the operator of the Espoir field to optimise the strategy for the asset point forwards.

As part of continued portfolio rationalisation, the Group has taken the decision to exit exploration licences in Cote d'Ivoire (CI-524 and CI-803) and the MLO 114 and MLO 119 licences in Argentina. Tullow continues to focus efforts on infrastructure-led exploration activities in Ghana.

Kenya

Tullow entered into a sale and purchase agreement for the sale of its Kenya assets to Auron Energy E&P Limited, an affiliate of Gulf Energy Limited on 21 July 2025 for a total consideration of at least $120 million. In addition, Tullow will be entitled to royalty payments subject to certain conditions and retains a no-cost back-in right for a 30% participation in future development phases. The company expects completion with receipt of the first two payments, totalling $80 million, during 2025.

KeyFacts Energy: Tullow Ghana country profile

KEYFACT Energy

KEYFACT Energy