WTI (Sep) $66.29 -$1.04, Brent (Oct) $68.76 -91c, Diff -$2.47 +13c

USNG (Sep) $2.93 -15c, UKNG (Sep) 84.12 +0.52p, TTF (Sep) €34.19 +€0.57

Oil price

Oil remains flat, down a bit today on a fairly quiet news day. We are back into US/Russian territory with threats to India thrown in for good measure. With India still taking Russian crude to resell, Trump is threatening further tariffs on India but right now they seem ‘reluctant’ to agree…

Genel Energy

Genel Energy plc – Unaudited results for the period ended 30 June 2025

Paul Weir, Chief Executive of Genel, said:

“The Tawke PSC has delivered robust production into consistent domestic market demand in the first half of 2025. Taken together with the cost reductions undertaken in 2024, the core business has generated underlying free cash flow.

Following the successful refinancing of our bond debt in April, our significant cash holding has now increased to $225 million. This strong balance sheet provides both optionality and the funding necessary for the acquisition of new production assets and geographical diversification, which remains a strategic priority for the business.

We are excited to have started work on Block 54 in Oman, and plan to begin testing of the discovered hydrocarbon pay zones around the start of next year, with results expected towards the end of the first quarter of 2026. These results will then determine the best approach for assessing the further potential of the licence for value realisation over the next 3 years.

Over a two-day period in July, the oil operations of a number of international oil companies in the Kurdistan Region of Iraq suffered drone attacks, with Tawke being one of the licences impacted. We are pleased to report that no people were hurt. Recent events in the Middle East had already resulted in a heightened state of security alert in Kurdistan and site manning was minimised. The operator is assessing both the impact and the appropriate forward production plan, with work ongoing to assess damage, minimize presence of staff on location, enhance safety protocols, and carry out repairs necessary for a full restart. We expect the impact of the damage and the deferred production on our cash position to be mitigated by continued focus on control of spend and insurance cover held for incidents such as these. We continue to guide no significant change in net cash at the end of the year.

We continue to work with peers and governments towards the resumption of Kurdistan oil exports, and are encouraged by the increased level of engagement between interested parties in recent weeks. We note that detailed discussions are taking place in relation to several key issues which could pave the way for an agreement that is acceptable to all parties.”

This was another good interim by Genel who held a positive analysts meeting this morning and have an Investor Meet tomorrow with a full presentation to be given. The numbers were better than expected, particularly on free cash flow where pretty consistent production performance was a credit to the Tawke operator DNO who, without any new wells delivered 19,600 b/d WI.

Recently there have been drone attacks in the area and whilst there has been some inconvenience there have been no fatalities and the way the costs equation works out there should be a decent mitigation of costs applied.

As for talks regarding opening up exports again, they are going on at very senior level and whilst this means nothing yet if the political will is there it may actually go ahead. I suspect as normal it will depend on how the deal cuts up…

So that FCF has lead to a ‘significant cash holding’ of $225m and that number is guided to be around the same at the year end. Obviously Genel has indicated that it is keen to make further acquisitions and are also open to returning to the dividend list at some stage. The board will discuss this regularly and weigh up paying a dividend or keep that pool ready for an acquisition, along with refinancing the bond which they did recently taking the opportunity to buy back some thus reducing interest costs.

Oman is interesting, the first piece of work is scheduled for the end of the year where they will be retesting an existing well. Early stages here but I consider Oman to be an acquisition with potential to add resources in due course.

So Genel is in a strong position, it has a strong balance sheet which can keep all options open for a long time. Clearly production is subject to usual problems bringing in cash but with a political will I can see a robust future and worthy of inclusion in the Bucket List.

Results summary ($ million unless stated)

| H1 2025 | H1 2024 | FY 2024 | |

| Average Brent oil price ($/bbl) | 72 | 84 | 81 |

| Average realised price per barrel | 33 | 34 | 35 |

| Production (bopd, working interest ‘WI’) | 19,600 | 19,510 | 19,650 |

| Revenue | 35.8 | 37.6 | 74.7 |

| Production costs | (9.4) | (8.2) | (17.6) |

| EBITDAX1 | 25.3 | 13.3 | 1.1 |

| Operating loss | (2.5) | (13.6) | (52.4) |

| Cash flow from operations | 19.2 | 36.4 | 66.9 |

| Capital expenditure | 13.2 | 15.9 | 25.7 |

| Free cash flow2 | 4.7 | 8.5 | 19.6 |

| Cash | 225.0 | 370.4 | 195.6 |

| Total debt | 92.0 | 248.0 | 65.8 |

| Net cash3 | 134.4 | 125.5 | 130.7 |

| Basic LPS from continuing operations (¢ per share) | (1.3) | (7.9) | (22.5) |

| Dividend (¢ per share) | – | – | – |

- EBITDAX is operating loss adjusted for the add back of depreciation and amortisation, exploration expense, net write-off/impairment of oil and gas assets and net ECL/reversal of ECL receivables

- Free cash flow

- Reported cash less debt reported under IFRS

Summary

- Tawke generated predictable production with consistent domestic sales demand, resulting in working interest production of 19,600 bopd in H1 2025 (H1 2024: 19,510 bopd)

- Domestic sales price averaged $33/bbl for the period (H1 2024: $34/bbl), with all cash due for domestic sales received before the end of the period

- After the end of the period, there were drone attacks on a number of Kurdistan oil operations, including Tawke where production was temporarily stopped as a result of damage caused. The operator is assessing the damage and is working on an appropriate plan to increase production.

- Net cash of $134 million (31 December 2024: $131 million)

- Significant cash balance of $225 million (31 December 2024: $196 million)

- Bond debt of $92 million due in 2030 (31 December 2024: $66 million)

- Exits from the Sarta, Qara Dagh and Taq Taq licences have been approved by the KRG with minimal residual liability exposure. We have also exited the Lagzira licence in Morocco.

- Both receivables and payables balances with the KRG have reduced as a result of the exit from Sarta, Qara Dagh and Taq Taq, with the net balance of receivable of around $50 million

- A socially responsible contributor to the global energy mix:

- Portfolio carbon intensity under 14 kgCO2e/bbl, below the industry average target

- The Genel20 Scholarship programme has entered its third year, where Genel is providing university tuition funding for undergraduates from the Kurdistan Region of Iraq

Outlook

- Following the impact of the drone attack on Tawke production, the operator is developing a plan to expedite the resumption of optimal production in a safe and efficient way, with work ongoing to determine and test the best plan for production ramp up

- We expect the impact on cash of damage caused and lost production to be mitigated by judicious cost control and insurance cover

- On Block 54 in Oman, following the Royal Decree granted in May, there will be some direct capital investment this year as we work towards the first phase, testing previously discovered hydrocarbon pay zones

- We reiterate our guidance of net cash at year-end expected to be about the same as the start of the year.

- On access to exports, talks between the Kurdistan Regional Government and Federal Government of Iraq and Ministry of Oil regarding the Iraq-Türkiye Pipeline are ongoing, with the timing of the resumption of exports on acceptable terms uncertain

Serica Energy

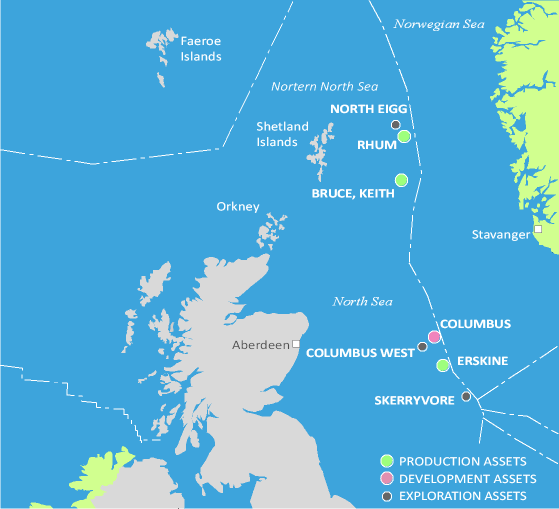

Serica has announced its unaudited financial results for the six months ended 30 June 2025. The results are included below and copies are available at www.serica-energy.com and www.sedar.com.

Chris Cox, Serica’s CEO, stated:

“Serica has felt like a coiled spring in the first half of 2025. The resilience of our gas production from the Bruce Hub and strong Q1 gas prices, coupled with a robust contribution from our other producing assets, helped deliver a creditable financial performance despite the downtime at the Triton FPSO. With the ramp up from Triton progressing, we should soon return to production levels of around 50,000 boepd, with more to come as new wells at Guillemot and Evelyn come onstream. Optimisation work by the Serica team at the Bruce Hub is also beginning to deliver results, and will boost production in the second half of the year.

We continue to make progress on advancing future production opportunities. Subsea tie-in work on Belinda is progressing well, and this new field will come onstream at the start of 2026. As we plan future drilling programmes across our wider asset base, we will look to replicate the success of the five well drilling campaign at Triton. This achieved tremendous subsurface results that are of material size to Serica, and was delivered ahead of schedule and under budget. Our future drilling plans have the potential to offset natural field declines into the next decade.

The expected increase in production compared to the last 12 months is set to provide material cash generation, funding organic growth and sustained dividends while we continue to seek to create shareholder value through disciplined M&A.”

If that was a performance without Triton then we should be frightened to see what this company can do when ‘new’ Triton comes onstream fully. 1H production of 24.7kboepd was just over half of last years 43.7 and included a slower than expected ramp up which don’t forget included add-ons by way of upgrades and repairs which will increase and extend production.

This performance has led to an actual increase in cash at the year end where the results registered $174m ($148m) which shows a very decent increase in the period and again despite nothing from Triton since January. It was however boosted by the receipt of the $71m cash tax refund in June 2025 which shows adept management in the Treasury function too.

This cash generation is expected to be ‘material’ in the second half, which will be a fantastic second interim as forecast in a sparkling investor presentation this morning and which firmly put the disappointments behind them. Mark my words the company are quite rightly full of exciting, confident of better times ahead and a step-change in performance.

One of the things that is increasing production is from the Bruce Hub where well optimisation work and resumption of production at Keith is delivering solid results and an increase in production post-period end which averaged 21,600 boepd in July compared to 16,700 boepd in H1 2025.

So, in conclusion it would be fair to say that this has been, despite its operational problems, a first rate half and will lead to an excellent full year. The Triton drilling programme was delivered 25 days ahead of schedule and c.$31m net to Serica under budget. The company suggest that the results from the new wells promise to take Serica production above 50,000 boepd once Triton is ramped up and with the Belinda tie-in now expected at the start of next year, another beat in the statement.

The EnQuest deal didn’t go ahead for whatever reasons, I’m not upset about that but the company are looking at other options across the sector but when the base camp is so powerful and the portfolio offering huge potential growth then inorganic growth can be very selective as organic growth here is very strong.

The shares are up 6%, 23% and 38% over 1,6 and 12 months so it can be seen that the market likes what is going on at Serica as do I. The board has decided to move the quote to the main market, which carries with it the potential for inclusion in the FTSE 250, which would clearly bring with it passive funds and massive further exposure. The company remains a favourite in The Bucket List and will continue with so much good news in the pipeline.

Highlights

Positive subsurface performance set to boost production

- Production of 24,700 boepd net to Serica in H1 2025 (H1 2024: 43,700 boepd), impacted materially by the shut-in of the Triton FPSO from 28 January to the end of the period

- Work to increase production from the Bruce Hub is starting to deliver results, with well optimisation work and the resumption of production at Keith leading to an increase in production post-period end, which averaged 21,600 boepd in July compared to 16,700 boepd in H1 2025

- The completion of the BE01 well on the Belinda field (Serica 100%), which delivered rates of 7,500 boepd on test, brought to an end the highly successful five well drilling programme at Triton

- All five wells delivered positive results which met or exceeded pre-drill estimates

- The programme was delivered 25 days ahead of schedule and c.$31 million net to Serica under budget

Cash position remains robust, providing optionality over capital allocation

- Cash of $174 million (31 December 2024: $148 million), an increase since year end 2024 despite the ongoing capital expenditure programme and no production from Triton since January

- Cash was boosted by the receipt of the $71 million cash tax refund in June 2025, the result of Group relief in 2024 leading to an overpayment of cash tax in 2024 under the Instalment Payment Regulations

- Capital expenditure on a cash basis of $138 million in H1, as work continued on the Triton drilling campaign

- Net debt reduced by $26 million in the period to $57 million

- Strong financial capacity maintained with the redetermination of Reserves Based Lending facility ('RBL') completed in June, with the Borrowing Base set at $490 million, of which $231 million is drawn down

- Liquidity of $433 million as at 1 July 2025

- Interim dividend of 6p declared today (2024 interim dividend: 9p), in line with the previously announced rebalancing of the final dividend

- The interim dividend is payable on 20 November 2025 to shareholders registered on 24 October 2025, with an ex-dividend date of 23 October 2025

Organic growth potential, actively exploring value-accretive M&A

- Serica's low net debt and robust liquidity position underpins the Company's continued ability to make targeted organic growth investments and to remain both competitive and opportunistic in M&A

- Serica continues to progress plans to convert material 2C resources into reserves, should the appropriate fiscal and regulatory environment allow

- Following the identification of over 20 potential infill targets around the Bruce Hub, considerable further work and planning has been undertaken with a high-graded list of optimal targets being matured for a possible future drilling campaign

- The Company continues to aim for FID of the Kyle redevelopment (Serica 100%) in H1 2026 Front-end design work tenders have been issued and the procurement of long lead items is underway

- A Request for Information has been sent out for a semi-submersible rig to carry out a potential drilling campaign across Bruce and Kyle

- Serica continues to analyse multiple M&A opportunities, largely focused on the UK North Sea

Outlook and guidance - material cash generation expected

- Production in the second half of 2025 is expected to be materially higher than H1, due to significantly increased Triton FPSO uptime, contribution from new wells at Triton, and the continuation of the production increase following the reinstatement of low-pressure wells at the Bruce Hub

- Production guidance for FY 2025 of 33,000-35,000 boepd

- Capital expenditure expected to be around the top end of the $220-250 million range given the relative strength of Sterling against the US Dollar, and work to progress Belinda towards production at the start of 2026 moving forward at pace, accelerating spend from 2026 into 2025

- Opex guidance unchanged at c.$330 million

- Work is progressing well regarding the move from the AIM to the Main Market of the London Stock Exchange early in Q4 2025

Original article l KeyFacts Energy Industry Directory: Malcy's Blog

KEYFACT Energy

KEYFACT Energy