Major Offshore Acreage Expansion Creates New Growth Platform in the Gulf of Thailand

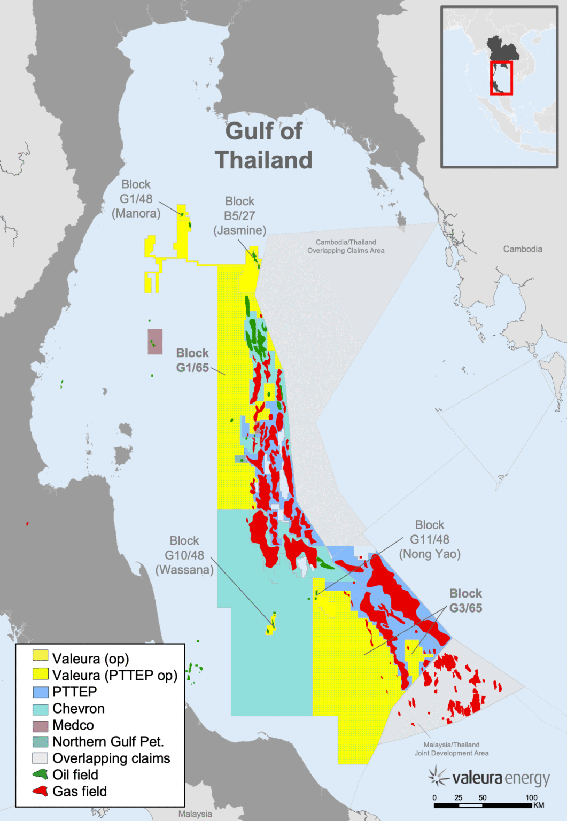

Valeura Energy has entered into a Farm-in Agreement with PTT Exploration and Production (“PTTEP”), through its subsidiary, PTTEP Energy Development Company to earn a 40% interest in Blocks G1/65 and G3/65, in the offshore Gulf of Thailand

Key Highlights

- Strategic Partnership: Farm-in Agreement with PTTEP, the largest oil and gas explorer, producer, and operator in Thailand;

- Substantial Acreage Expansion: Increases Valeura’s gross acreage position in Thailand from 2,623 km² to 22,757 km²;

- Prime Location Adjacent to Major Infrastructure: The Blocks are strategically positioned next to some of Thailand’s largest producing gas fields and Valeura’s oil fields;

- Discoveries: 15 oil and gas discoveries on the Blocks, supported by 27 wells which encountered oil and gas pay;

- Infrastructure-Led Growth: Existing discoveries and exploration prospects that the Company believes can be tied back quickly to existing oil and gas infrastructure; and

- Immediate Activity: Exploration and appraisal work already underway with 3D seismic acquisition planned to commence in the coming months.

Dr. Sean Guest, President and CEO commented:

“The spirit of collaboration between Valeura and PTTEP is strong, and we are excited to begin work on this vast swath of prospective acreage in the Gulf of Thailand with the potential for both near and long-term natural gas and oil developments. PTTEP has an unparalleled depth of knowledge in Thailand and a proven track record of exploration and development success both in Thailand and throughout the Southeast Asia region.

Acquiring an interest in these Blocks increases our acreage in the offshore Gulf of Thailand substantially, and provides us with existing discoveries and attractive exploration prospects immediately adjacent to several world class gas fields and our producing oil assets. Both Blocks already contain existing discoveries, and new exploration drilling has commenced in 2025, aimed at confirming sufficient gas and/or oil volumes for installation of new platforms that can be tied back to existing infrastructure. While our initial focus is on pursuing these near-term development opportunities, there are also higher-risk/higher-reward prospects which we plan to explore, with the objective of building out a pathway for longer-term growth.

Our intent is to both expand and diversify our business both organically and inorganically. This Farm-in furthers that goal by layering in low cost, infrastructure-led exploration, while also adding gas developments within a welcoming jurisdiction that has prioritised energy development to fuel its growing economy. We see this Farm-in and strategic partnership with PTTEP as an excellent opportunity to drive further value generation for our stakeholders.”

Farm-in

Under the terms of the Farm-in, Valeura is entitled to earn a 40% working interest in the Blocks, with PTTEP holding the remaining 60% and continuing to operate. The parties have agreed to a work programme for 2025 that includes drilling four exploration wells (all recently completed) and acquiring just over 1,200 km² of new 3D seismic data. To earn its interest, Valeura will pay 40% of actual back costs (US$14.7 million to June 30, 2025). These costs include the recently completed four-well 2025 drilling programme, geological and geophysical studies, PSCs signature bonuses, and general and administrative costs incurred since the Blocks were awarded in March 2023. Valeura will also carry PTTEP on an additional seismic acquisition (requested by Valeura) of approximately 165 km² on Block G3/65, located to the northeast of the Nong Yao field – capped at US$3.7 million (gross). For costs thereafter, each of PTTEP and Valeura will pay their respective pro rata share.

The Blocks are governed by the terms of Production Sharing Contracts (“PSCs”) granted by the Thailand Government through the Ministry of Energy which set out fiscal terms including a royalty payable to the Thailand Government at 10% of gross revenue, provisions for cost recovery up to 50% of gross revenue, and profits thereafter shared 50% government / 50% contractor. The corporate income tax rate on contractor net profit is 20%.

The PSCs provide for a six-year exploration period, during which a total of eight wells must be drilled (five on G1/65 and three on G3/65), and 800 km2 of 3D seismic must be acquired (500 km² in G1/65 and 300 km² in G3/65) before the end of the exploration period in May 2029. A three-year extension to the exploration period may be provided thereafter. Fields developed under the PSC regime are given a 20-year production period, with a potential 10-year extension thereafter.

Closing of the Farm-in is subject to the approval of the Government of Thailand.

Block G1/65

Block G1/65 comprises a gross area of 8,487 km² immediately south of Valeura’s B5/27 block (Jasmine/Ban Yen fields, 100% Valeura interest) and west of PTTEP-operated large gas fields (Erawan, Platong, and Benchamas, currently producing 900 mmcf/d, 27 mbbls/d condensate, and 23 mbbls/d oil, respectively, based on May 2025 production data disclosed by Thailand’s Department of Mineral Fuels). The block is approximately 240 km long covering the north-western flank of the Pattani basin, the most prolific basin in the Gulf of Thailand, and encircles the Rossukon oil field (2% Valeura gross royalty interest). The block includes eight oil and gas discoveries, supported by 12 wells which encountered oil and gas pay, as well as several undrilled prospective trends. PTTEP and Valeura have high-graded two focus areas on Block G1/65 which will guide their initial work programme.

- The Jarmjuree South area: A liquids-rich gas and oil-bearing structural trend between the producing Benchamas and Platong fields. The Company believes that the area has been substantially de-risked by four wells which confirmed the accumulation of both oil and gas in multiple stacked reservoir intervals. PTTEP has just completed a three-well appraisal drilling campaign in the Jarmjuree South area to further delineate the opportunity, and to date, one well has been disclosed by the Department of Mineral Fuels to have encountered gas pay. Valeura anticipates that field development planning will follow in the near term, and after closing of the Farm-in, the Company intends to provide further detail on the next steps towards the commercialisation of this area.

- The Maratee-Bussaba area: Located immediately south of the Rossukon oil field, contains a three-way closure structure as well as several combined structural/stratigraphic traps which have been identified as drilling candidates, based on existing 3D seismic data over the area. Based on nearby producing fields and discoveries in the vicinity, the Company expects the trend to be an oil-prone fairway. The planned 3D seismic acquisition on Block G1/65 will focus on the western portion of the Maratee-Bussuba area to better image the reservoir to support further exploration drilling in this area.

Block G3/65

Block G3/65 comprises a gross area of 11,647 km², bounding Valeura’s G11/48 block in the north (Nong Yao field, 90% Valeura working interest) and is immediately west of the large PTTEP-operated Bongkot gas field, which currently produces 850 mmcf/d gas and 24 mbbls/d condensate, based on May 2025 production data disclosed by Thailand’s Department of Mineral Fuels. The block is approximately 200 km long covering the northwest flank of the North Malay basin, and has seven identified oil and gas discoveries, supported by 15 wells with oil and gas pay. Two key focus areas have been identified on Block G3/65 which will guide the initial work programme.

- The Nong Yao North-East area: Believed by the Company to contain an oil-bearing fairway between the Company’s Nong Yao field and the undeveloped Ubon oil field to the north. The area is expected to be covered with 3D seismic in 2025 to accurately define the prospects and thereafter Valeura anticipates the start of exploration and appraisal drilling. Given this new opportunity, the Company’s objective is to determine whether this area, or the recent Nong Yao-D discovery by Valeura in 2024, are better placed as the next tie-back development to Valeura’s operated processing infrastructure on the Nong Yao Field.

- The Bussabong-Angun area: Located immediately west of PTTEP’s Bongkot gas field, is thought to contain extensive gas accumulations, as substantiated by multiple existing gas discoveries. PTTEP recently drilled an exploration well to fully validate the Bussabong opportunity, which has been disclosed by the Department of Mineral Fuels to have encountered gas pay. The Bussabong discovery is a prime candidate for a fast-track gas development, potentially resulting in Company’s first gas reserves in Thailand. Valeura is optimistic that development planning will progress at pace, and after completion of the Farm-in, the Company intends to provide further disclosure on next steps for the Bussabong gas accumulation.

KeyFacts Energy: Valeura Energy Thailand country profile l PTTEP Thailand country profile

KEYFACT Energy

KEYFACT Energy