WTI (Aug) $66.38 -14c, Brent (Sep) $68.52 -19c, Diff -$2.14 -5c

USNG (Aug) $3.55 +3c, UKNG (Aug) 84.38p +1..78p. TTF (Aug) €35.0 +€0.075

Oil price

Another quiet day in paradise, oil is up small time as tariffs remain in the frame and inventories were better than expected. After the debacle of the API the EIA announced a 3.859m draw in crude but builds in both gasoline (3.399m) and distillates (4.177m) showed that product markets are still dodgy.

Zephyr Energy

Following the recent completion of a £10.5 million equity placing, Zephyr has provided updates on its flagship operated project in the Paradox Basin, Utah, U.S. and on its proposed acquisition of working interests in accretive production and development assets in core Rocky Mountain basins, U.S.

Paradox Project

Following the recent successful production test on the State 36-2 LNW-CC-R well (the “36-2R well”), as announced on 7 May 2025, Zephyr continues work to deliver the first stage of gas infrastructure for the project. This includes equipping the pad for production, reinstatement of the 6-inch pipeline gathering system, the deployment of gas processing infrastructure to Zephyr’s pre-existing gas plant footprint, as well as planning for tie-in to the adjacent 16-inch gas export pipeline.

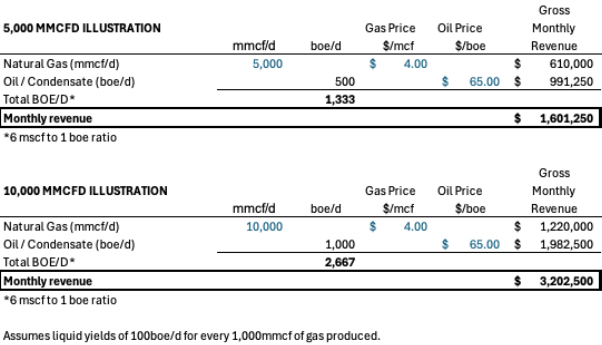

Zephyr’s operations team is working with the provider of the gas processing units to develop the optimal initial processing capacity. At present, the initial processing capacity is envisaged to handle 5-10 million cubic feet of natural gas per day while also enabling the sale of valuable liquid streams consisting of both condensate and NGLs (Natural Gas Liquids). The light condensate (52-60° API) produced is expected to sell at a premium to other crudes as it can be blended with lower quality waxy crudes adding value in the refining process. As an illustration and for context, at current commodity prices, this level of processing would enable gross (100% share) gas and oil revenues of circa US$1.6-US$3.2 million per month (excluding NGL sales), as outlined below:

The initial range of processing capacity is below the peak production potential of the 36-2R well, which the Company believes is an optimal range for first operations. Over time, the scale of processing capacity is expected to increase in steps as existing wells (including the State 16-2LN-CC and Federal 28-11 wells) are tied-in and additional wells are drilled.

In parallel, the Company is in advanced discussions with respect to the export of the processed gas volumes via the nearby 16-inch export pipeline. The proposed pipeline tie in point is 70 metres from Zephyr’s gas plant site, and the export pipeline currently has a considerable excess capacity that can accept both initial processed gas volumes and a meaningful expansion in gas production. While conversations with other gas off-take solutions (including cryptocurrency miners and compressed natural gas operators) are also ongoing, the Company’s top priority is achieving exported gas sales, with associated condensate and NGL volumes trucked from site to end user buyers. A combination of gas off-take solutions may be utilised if commercially and economically viable.

In addition to the ongoing infrastructure engineering work, the Company has commissioned third-party reserve engineer, Sproule, to prepare an updated Competent Person’s Report (“CPR”) on the Paradox project. Results from the updated CPR are expected to be published in the third quarter of 2025, although timing is dependent on the delivery of the report from Sproule.

The Company has also commenced discussions with potential industry and finance partners about farm-in opportunities on the Paradox project, with a structured and formalised process to start shortly. Given the strong production test results to date, it is Zephyr’s intention to find a partner to accelerate the next phase of drilling as quickly as possible.

EnerCom presentation

Zephyr’s management will be presenting an overview of the Paradox project at EnerCom’s 30th Annual Energy Investment Conference at 4:00 p.m. MT on 18 August 2025. The conference is widely attended by industry operators and investors, and an updated version of the Corporate Presentation will be provided by the Company on its website after the conference.

Proposed Acquisition update

Zephyr is currently completing all remaining confirmatory environmental, title and operational due diligence ahead of its proposed US$7.3 million acquisition of working interests in accretive, mature PDP production assets in core Rocky Mountain basins (the “Proposed Acquisition”).

Under the terms of the Proposed Acquisition, Zephyr will acquire a working interest in a portfolio of over 400 wells, 21 of which will be operated by the Company. The non-operated wells, in which the Company will own a minority working interest, are operated by top-tier operators. At completion of the Proposed Acquisition, the acquired assets are expected to add an estimated 600,000 barrels of oil equivalent of 2P producing reserves (management estimate) and 400 barrels of oil equivalent per day, net to Zephyr, of current production (85% oil). Zephyr’s working interests in the portfolio will average 7% and represents an equivalent of 31 net wells.

The acquisition offers strategic entry into key Rocky Mountain basins within Zephyr’s area of interest, including the Powder River Basin (Wyoming) and the Denver-Julesburg Basin (Colorado). In addition to adding current production, the Proposed Acquisition offers significant potential drilling upside opportunity for the Company. Zephyr has been notified of an initial 13 wells scheduled to be drilled imminently, with net CAPEX of approximately US$2.5 million which will potentially be funded through the Company’s US$100 million strategic partnership funding (as announced on 13 May 2025).

In preparation for the completion of the Proposed Acquisition, Zephyr has applied for regulatory approval to become an operator of record in the states of Colorado, Wyoming and North Dakota. The Proposed Acquisition is currently on track to complete in the near term, with an effective date of 1 June 2025.

Colin Harrington, Zephyr’s CEO commented:

“Following the completion of our successful fundraise, we continue to make strong progress across our asset portfolio. We look forward to a prolonged period of positive news flow as we complete the Proposed Acquisition and move towards first production on the Paradox project.”

Lot’s of good news here for Zephyr shareholders as the company announces infrastructure works at the Paradox project. This includes equipping the pad for production, reinstatement of the 6-inch pipeline gathering system, the deployment of gas processing infrastructure to Zephyr’s pre-existing gas plant footprint, as well as planning for tie-in to the adjacent 16-inch gas export pipeline.

It is worth looking at the paragraph with tables that details the optimal initial processing capacity, more than anything else it gives an idea of just how big and efficient the project is going to be and quite why the share price is honestly laughable. Plenty of natural gas as well as both NGL’s and condensate which sells at a premium as it is in demand locally.

And to start with the economics look good, the initial range of processing capacity is below the peak production potential of the 36-2R well, which the Company believes is an optimal range for first operations. Over time, the scale of processing capacity is expected to increase in steps as existing wells (including the State 16-2LN-CC and Federal 28-11 wells) are tied-in and additional wells are drilled. The upside speaks for itself, starting with very decent production from the existing wells then more to build up.

Also shareholders will look forward to the CPR which Sproule has been commissioned to produce and also the fact that the company has ‘commenced discussions with potential industry and finance partners about farm-in opportunities on the Paradox project, with a structured and formalised process to start shortly. Given the strong production test results to date, it is Zephyr’s intention to find a partner to accelerate the next phase of drilling as quickly as possible’.

As I said, the share price is laughable and I stick with my 20p Target price.

Pharos Energy

Pharos has provided the following Trading and Operations Update ahead of the Company’s Interim Results on 24 September 2025. The information contained herein has not been audited and may be subject to further review and amendment.

Katherine Roe, Chief Executive Officer, commented:

“We have had a strong first half of the year with stable production and healthy free cash flow generation against a backdrop of volatile macro conditions. This reflects our high-quality asset base and strict approach to capital discipline. First half performance allows us to reiterate our full year guidance, and our commitment to sustainable shareholder returns with the payment of the 2025 final dividend.

“Preparations are fully underway for our Vietnamese infill and appraisal drilling campaign, now expected to commence in late 3Q, which includes four TGT and two CNV wells. This is a material and important work programme designed to maximise the value of our existing assets by sustaining current production levels and appraising new areas of our blocks. On success, we could see material incremental volumes from 2026 onwards from current production levels and a de-risking of additional development opportunities. Allocating capital responsibly in our core assets will provide growth and longevity to our business.

“The recent approval by the Vietnamese Government of the two-year extension of Blocks 125 & 126 has strengthened our position as we progress farm-out discussions for these important exploration assets.

“In parallel, consolidation negotiations in Egypt continue and we are making steady progress towards the finalisation of improved PSC terms. Once concluded, we will benefit from an immediate uplift in the value of our assets along with a self-funded work programme aimed at increasing production volumes.

“We have strategically strengthened our portfolio through improved terms and self-funded active drilling campaigns with a view to maximising value. Our debt free balance sheet and cash generative assets provides shareholders with both a robust platform for inorganic opportunities and exciting near term growth potential.”

There is no doubt that this has indeed been a very strong half and given the exciting potential of the short and medium term outlook for Pharos, that is very good news for shareholders. Today’s trading update shows 1H production of 5,642 boepd (5,851) with an increase in Egypt and a modest decline from Vietnam. As a result of this guidance for the year remains unchanged at 5-6,200 boepd.

This gives interim revenue of $65.3m ($65m) with net cash up to $22.6m (Dec’24 $16.5m) after receivables in the period of some $5.5m and of $1m post the period end. With such a strong financial situation Pharos are well prepared for the short term drilling and also longer term preparation.

In Vietnam this means that preparations are underway for the drilling of the appraisal well 18X at TGT’s western area with rig contracts recently secured and three infill wells now expected to commence in late 3Q. At CNV there will be an appraisal well 5X-L1 ‘unlocking’ the northern part of the field and one infill well expected for a 4Q start. In both cases 3D seismic reprocessing continues and expected to be complete by the end of this month. Finally we heard that a two year extension had been received for blocks 125 and 126 during the period meaning the end date is now 8th November 2027.

In Egypt East Saad-1X is on production after its commercial discovery in February and at North Beni Suef (NBS) ongoing processing of 3D seismic data is expected to complete in 3Q, with mapping and interpretation to follow. Finally discussions on the consolidation of the El Fayum and NBS concessions continues……

Finally, and back to the strong financial position the company has made another dividend award, a final payment of 0.847p per share adds to the interim of 0.363p making 1.210 for the year. All in all Pharos is set very fair, with a great deal of seismic and drilling in 2H and beyond and hopefully the Egypt consolidation surely not far away, the company looks in a very promising situation.

Highlights

- Group working interest 1H production was 5,642 boepd net. Group working interest 2025 production guidance of 5,000 – 6,200 boepd net remains unchanged

- Vietnam 1H production 4,183 boepd. Vietnam FY25 production guidance 3,600 – 4,600 boepd net

- Egypt 1H production 1,459 bopd. Egypt FY25 production guidance 1,400 – 1,600 bopd

Vietnam:

- TGT: Preparations underway for drilling of appraisal well 18X, targeting the block’s western area, with rig contracts recently secured and three infill wells now expected to commence in late 3Q

- CNV: Planning continues for the drilling of one appraisal well 5X-L1, unlocking the northern part of the field, and one infill well expected to commence in 4Q

- 3D seismic reprocessing on both assets continues, with expected completion by the end of July

- Blocks 125 & 126: Approval received from the Vietnamese Government for the two-year extension of the PSC Exploration Period (from 9 November 2025 to 8 November 2027)

Egypt:

- El Fayum: East Saad-1X well on production from 1 July following commercial discovery in February

- North Beni Suef (NBS): Ongoing processing of 3D seismic data expected to complete in 3Q, with mapping and interpretation to follow

- Discussions with EGPC in relation to the proposed consolidation of the El Fayum and NBS concessions continue to progress positively following the signing of the MOU, with all parties committed to concluding negotiations as soon as possible

- Group 1H revenue of c. $65.3m1 (1H 2024: $65.0m)

- Cash balances at 30 June 2025 of $22.6m (31 Dec 2024: $16.5m); continued debt-free position

- Egypt receivable balance at 30 June 2025 of $33.5m (31 Dec 2024: $29.5m), having received $5.5m in the six months to 30 June and an additional $1m in July 2025

- Forecast full year cash capex for the Group remains unchanged between $33m and c.$40m with an additional c.$17m expected to fall into early 2026

- 25% of the Group’s 2H entitlement production is hedged with average floor and ceiling prices of $61.3/bbl and $84.5/bbl, respectively

- Approval by shareholders at the 2025 AGM of a final dividend in respect of the year ended 31 December 2024 of 0.847 pence per share, amounting to approximately $4.7m and to be paid on 18 July 2025. Including the payment of the interim dividend of 0.363 pence per share on 22 January 2025, the full year 2024 dividend will be 1.210 pence per share, amounting to $6.5m in total

- Appointment of João Saraiva e Silva as Non-Executive Chair on 26 June 2025, succeeding John Martin

1 Egyptian revenues are given post government take including corporate taxes.

Original article l KeyFacts Energy Industry Directory: Malcy's Blog

KEYFACT Energy

KEYFACT Energy