Meren Inc. (formerly Africa Oil) is a leading independent, full-cycle E&P with production and development assets in deepwater Nigeria, a leading carried position in the Orange Basin across Namibia and South Africa, and operated licences in Equatorial Guinea.

The Company is focused on delivering a total shareholder return business model through sustainable growth and capital returns to its shareholders and for the benefit of all its stakeholders. During 2023 and 2024, the Company executed a number of strategic transactions to simplify and strengthen the Company’s fundamental business proposition, including streamlined asset ownership and greater control of its core assets and value drivers. These efforts culminated in the completion of the amalgamation in March 2025 to consolidate full control and ownership of Prime Oil & Gas Coöperatief U.A (Prime) in Meren.

This strategic transaction has been transformational for the Company by doubling its reserves and production, and substantially increasing its earnings, and cash flows. Meren has gained direct control over Prime’s cash flows, providing greater financial flexibility.

OVERVIEW OF OPERATIONS

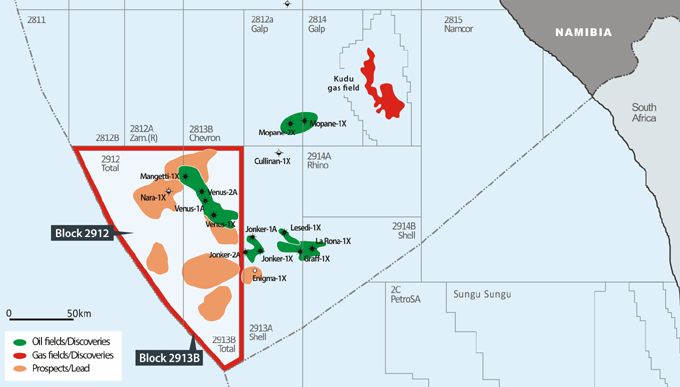

NAMIBIA

Block 2912 & 2913B

Meren has indirect interests in these blocks through a 39.5% shareholding in its investee company Impact Oil & Gas Limited (“Impact”), which has a 9.5% interest in each Block 2912 and Block 2913B. These blocks are operated by TotalEnergies (47.2% in Block 2912 and 50.5% in Block 2913B). Other partners include QatarEnergy (28.3% in Block 2912 and 30% in Block 2913B) and NAMCOR (15% in Block 2912 and 10% in Block 2913B).

Block 2913B contains the world class Venus light oil and associated gas field that was discovered by the Venus-1X well drilled in 2022, which encountered high-quality light oil-bearing sandstone reservoir of Lower Cretaceous age. Three follow-on appraisal wells have de-risked the field with the results supporting the Venus development case – with FID targeted for 2026.

Operational update

The Venus Field is expected to be the first development area in Block 2913B. The Venus development plan is for up to 40 subsea wells tied back to a floating production, storage and offloading (“FPSO”) platform that can handle peak output of 160,000 barrels per day of oil.

Key near-term project preparation and decision-making processes are:

- Front-End Engineering Designs (“FEED”): Q2 – Q4 2025

- ESIA submission to authorities: Q4 2025

- Final Investment Decision (“FID”) could be made during H1 2026

The latest exploration drilling campaign was completed on April 25, 2025, with the drilling rig demobilized. The Company expects the next drilling campaign to commence during Q4 2025 and notes that TotalEnergies has publicly identified Olympe-1X, on Block 2912, as a possible target for this campaign.

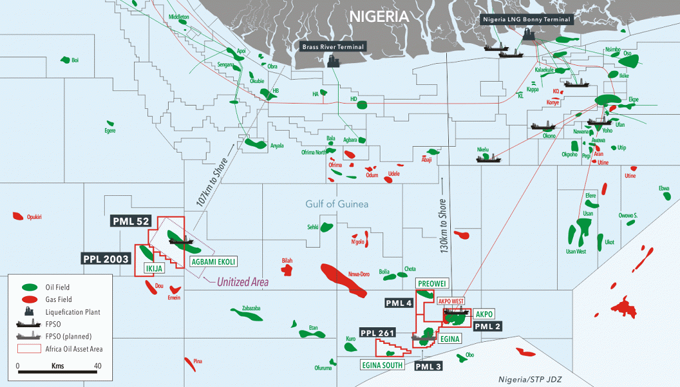

NIGERIA

PML 2, PML 3, PML 4 and PML 52

Following the completion of the Amalgamation Agreement with BTG in March 2025, the Meren group has a direct interest in producing assets in Nigeria’s deepwater Niger Delta Basin, operated by Chevron and TotalEnergies..

The main assets of Meren are a direct 8% WI in PML 52 and a direct 32% WI in PMLs 2, 3 and 4 as well as PPL 261. PML 52 is operated by affiliates of Chevron and covers part of the producing Agbami field.

PMLs 2, 3 and 4 and PPL 261 are operated by affiliates of TotalEnergies and contain the producing Akpo and Egina fields. The three fields in these PMLs are located over 100 km offshore Nigeria.

All three fields have high quality reservoirs and produce light to medium sweet crude oil through FPSO facilities. Akpo and Egina also export associated gas which feeds into the Nigerian liquified natural gas plant, whilst Agbami associated gas is mostly reinjected.

Akpo Field (PML 2)

The Akpo field is a major offshore oil and gas field located approximately 200 km off the coast of Rivers State, Nigeria, in water depths ranging from 1,100 to 1,700 meters.

- Field development began in 2005, with a total of 44 wells planned (22 production, 20 water injection, 2 gas injection).

- First production achieved in March 2009.

- The Akpo West tie-back project started up in early 2024, adding 14,000 barrels of condensate production per day.

Egina Field (PML 3)

- The Egina oil field is a significant ultra-deepwater oil field located approximately 150 kilometers off the coast of Nigeria in the Gulf of Guinea.

- The field is situated at water depths ranging from 1,150 to 1,750 metres.

Preowei Field (PML 4)

- The Preowei field was discovered in 2003 through the Preowei-1 well, which encountered three main hydrocarbon-bearing reservoirs.

- The approved Field Development Plan proposes a two-phase development with 16 wells in Phase 1 (8 producers, 8 injectors) and 12 additional wells in Phase 2.

Agbami Field (PML 52)

The Agbami Field is a major offshore oil and gas field located in deepwater Nigeria, approximately 70 miles (113 km) off the coast of the central Niger Delta region.

- Discovered in 1998 and began production in 2008.

- The $3.5 billion development is one of Nigeria’s largest deepwater projects.

Operational update

The Company remains focused on working with its JV partners to sustain and enhance production through targeted drilling and optimisation initiatives on its three producing fields in deepwater Nigeria.

At Egina, two producers were drilled in Q1 2025 with both expected to come onstream in Q2 2025. On Akpo, a well intervention and the drilling of one development well are planned for Q2 2025. A planned break to the rig campaign is planned from Q4 2025 to allow for interpretation of the available 4D seismic data and drilled well results to enable maturation of future infill drilling candidates.

The Company’s Nigerian portfolio includes infrastructure-led exploration assets that in case of commercial discovery success, could potentially present attractive short cycle, high return investment opportunities that would benefit from the existing facilities. One such opportunity, which is being progressed towards drilling is the Akpo Far East prospect with an unrisked, best estimate, gross field prospective resource volume of 143.6 MMboe. The targeted hydrocarbons are predicted to be light, high gas-oil ratio (“GOR”) oil equivalent to those found in the Akpo field. If successful, initial production could be achieved from existing production manifolds with the potential to materially increase reserves on the Akpo Field.

At Agbami, further planned maintenance including a full field shutdown in Q4 2025, is expected to support long-term performance with 4D seismic interpretation continuing in support of the upcoming drilling campaign. Rig and well long lead items contracting is underway, alongside the placement of orders for subsea trees, in preparation for the commencement of the infill drilling campaign in 2027.

For Preowei, studies of the fast-track seismic data are continuing to further derisk the identified upside opportunities to enhance recoverable volumes. In parallel, the reengagement of the front-end engineering and design (“FEED”) contractor is planned in order to carry out additional evaluation aimed at optimizing the Preowei engineering, procurement, construction and installation (“EPCI”) phase costs.

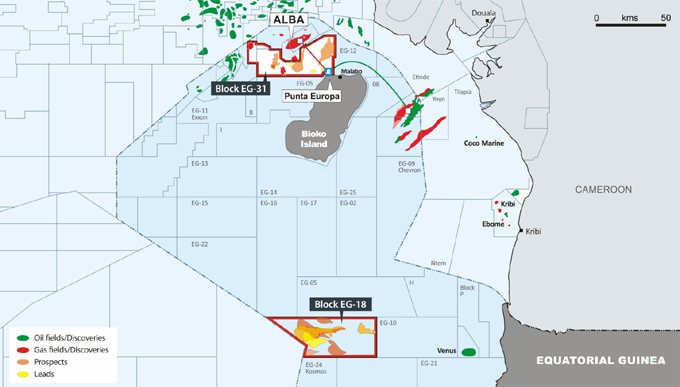

Equatorial Guinea

Blocks EG-18 and EG-31

In February 2023 the Company, through its wholly owned subsidiaries Africa Oil Alpha B.V and Africa Oil Beta B.V., entered into two new PSCs for Offshore Blocks EG-18 and EG-31 in the Republic of Equatorial Guinea.

The Company holds 80% operated interests in each block, with the balance to be held by GEPetrol, the national oil company of Equatorial Guinea. GEPetrol can acquire an additional 15% participating interest in each block. GEPetrol is carried during the exploration phase.

Block EG-31

From the existing data, the Company has already identified several potential gas-prone prospects in shallow water depths of less than 80 meters and close to existing infrastructure, including the offshore Alba gas field and the onshore Punta Europa Liquefied Natural Gas Terminal.

Block EG-18

From the existing data set the Company has already identified a potentially large and highly prospective basin floor fan prospect of Cretaceous age that is similar to those within the Company’s exploration portfolio in Namibia and South Africa and will continue to work this prospect as part of the initial exploration phase.

Operational update

The Company is in active dialogue with industry parties to attract farm in parties on both blocks, with the aspiration of completing the exercise by the end of Q3 2025.

If the Company is successful in attracting farminee partner(s) for these blocks, subject to customary consents and approvals including governmental and regulatory permissions, the Company anticipates that newly formed JVs could plan for exploration drilling in late 2026 or during 2027. However, there is no guarantee the Company can secure farminee partners on acceptable terms and it does not intend to undertake exploration drilling on a sole risk basis if it is unsuccessful in its farm down campaign.

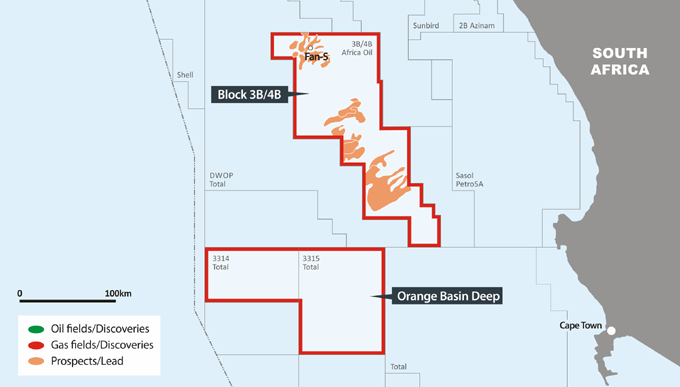

South Africa

In July 2019, the Company through its wholly-owned subsidiary, Meren SA Energy Corp., entered into a definitive farmout agreement with Azinam Limited to acquire a 20.0% participating interest and operatorship in the Exploration Right for Block 3B/4B, offshore South Africa.

The farmout was fully completed in February 2020 with Meren becoming the Operator for the block. The Block was awarded on March 27, 2019, for an Initial Period having a term of three years. An application to extend the Block 3B/4B license and to move into the first extension period of 2 years was approved on October 27, 2022. Following two transactions announced in 2024, Meren currently holds a direct non-operated 18.0% interest in Block 3B/4B. This block is operated by TotalEnergies with a 33.3% interest. Other partners are QatarEnergy with a 24.0% interest, Ricocure (Proprietary) Ltd. with a 19.8% interest and Azinam (a subsidiary of Eco Atlantic) with a 6.3% interest.

Block 3B/4B

Block 3B/4B covers an area of 17,581 km2 within the Orange Basin offshore of the Republic of South Africa.

Orange Basin Deep

Meren has an indirect interest in this block through a 39.5% shareholding in its investee company Impact Oil & Gas Limited (“Impact”) with a 22% working interest.

Impact was awarded the Orange Basin Deep TCP in December 2016 with Total joining as Operating partner in September 2017.

The license lies 220km west of Cape Town in water depths between 2,800 to 4,200 meters.

Operational update

Following the granting of an Environmental Authorization for exploration activities (drilling of up to 5 exploration wells) by the Department of Mineral Resources and Energy for the Republic of South Africa on September 16, 2024, the legislative notification and appeals process continues to progress with the relevant regulatory agencies. The operator has stated that with the approval process progressing the current plan is to drill the first exploration well on Block 3B/4B in 2026 and has identified Nayla, a prospect that lies in the northwest of the license area as the potential drilling target.

LEADERSHIP / CONTACT

Huw Jenkins, Chairman of the Board

Roger Tucker, President, CEO and Director

Aldo Perracini, Chief Financial Officer

Joanna Kay, Chief Legal Officer and Corporate Secretary

Oliver Quinn, Chief Commercial Officer

Craig Knight, Chief Operating Officer

Meren Energy Inc.

c/o Suite 2500, 666 Burrard Street, Vancouver B.C. Canada V6C 2X8

Meren Services Limited

50 Pall Mall, London, SW1Y 5JH

t. +44 20 8017 1511

e. info@mereninc.com

KeyFacts Energy: Meren South Africa country profile l Namibia l Equatorial Guinea l Nigeria

If you would like to discover more about KeyFacts Energy, contact us today and we can arrange a 15-minute online meeting to review our database of over 2,600 continually updated 'country-specific' oil and gas and renewable energy profiles from a selection of 144 countries. Find out how you can instantly identify companies with operational activity in your chosen country, 'fine-tune' your news or company selection based on industry category, energy type or regional location and additionally benefit from one to one contact with us to ensure maximum online and social media exposure for your company.

KEYFACT Energy

KEYFACT Energy