Soma Oil & Gas was founded in early 2013 expressly with a view to exploring in Somalia. This revives exploration in a territory where, prior to 1991, a number of International Oil Companies were granted licences before declaring Force Majeure.

The Board and Management of Soma Oil & Gas are working with the Federal Government of Somalia and the Ministry of Petroleum and Mineral Resources to open up the Somalia oil & gas industry.

Soma Oil & Gas Exploration Limited and Soma Management Limited are wholly owned subsidiaries of Soma Oil & Gas Holdings Limited.

OVERVIEW OF OPERATIONS

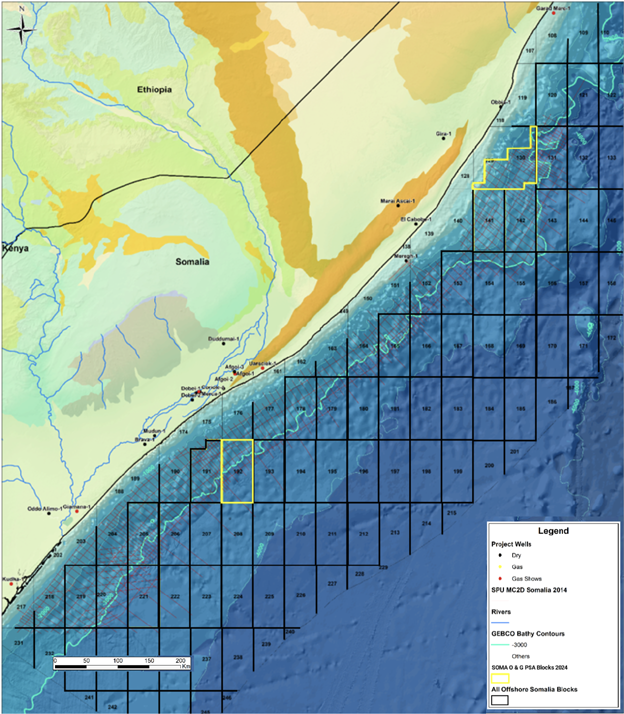

SOMA’s strategy in offshore Somalia was to acquire acreage within which a diverse portfolio of drillable assets could be generated, guided by the results of two major studies on the available regional data.

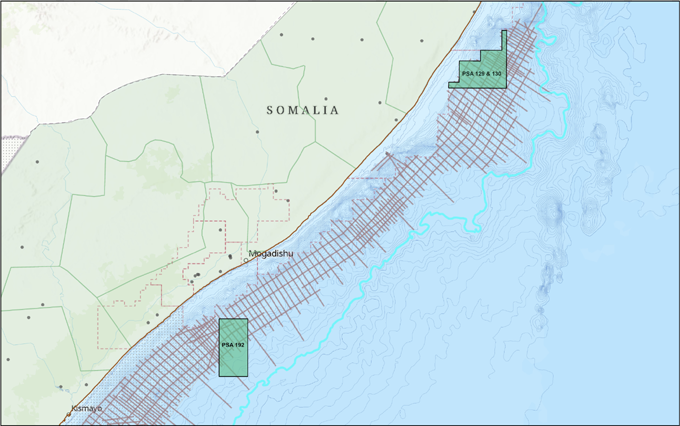

Esri, USGS,OpenStreetMap contributors, TomTom, Garmin, FAO, NOAA, USGS, RPS, FGS

Two PSA blocks were selected, 129/130 in the northern Mid Somalia High (MSH) area, and 192 in the Central Mogadishu Deep Basin.

Holding acreage in the two areas exposes SOMA to a portfolio of opportunities and diverse risk profile with access to the carbonate play in the somewhat shallower water and target depths of the MSH and the deeper water, deeper targets of the clastic play of the Mogadishu Deep.

SOMA leverages its proprietary data and cutting-edge interpretations to maintain a competitive edge in the region.

Key datasets include:

- Seabird (2014) aquisiton of major regional 2D dataset

- RPS (2015 – 2017) interpretation of regional 2D dataset

- U3 Explore (2022 – 2023) revamping of 2D, 3D Planning, Environmental Impact Study, Oil Seep Study in MSH, New plate tectonic model

SOMA’s comprehensive knowledge base ensures we are best positioned to secure exploration rights in two of the basin's most promising PSAs.

SOMA's unwavering dedication to the basin is demonstrated through continuous and strategic initiatives, ensuring sustained growth and industry leadership.

- Pioneering seismic acquisition: Leading efforts to gather essential data

- Major studies: Conducted in 2015-2017 and 2022-2023

- Quality acreage control: Consistently acquiring the best land in the basin

SOMA's persistent and consistent approach has cemented SOMA's position as a knowledgeable and influential player in the region, driving long-term success and value.

Pioneers like SOMA, equipped with the right knowledge and a willingness to accept the risks inherent in unexplored exploration territory, become preferred partners for later entrants. By controlling an acreage position, they can leverage a diverse portfolio of opportunities to maximize value creation and minimize risk. The diversity of physical conditions (water depth, depth-to-target) and geology (reservoir type, fluid phase, trap type) across PSA 129 & 130 and PSA 192 exemplify these favorable conditions.

For SOMA, careful analysis determined that the Jubba Deep basin presented higher technical risks and less commercial potential in the short to medium term. By deprioritizing this area, SOMA can concentrate investment capital and efforts on PSAs with greater value and potential, ensuring a more efficient allocation of resources and maximizing the prospects for successful exploration.

The Mid Somalia High Basin

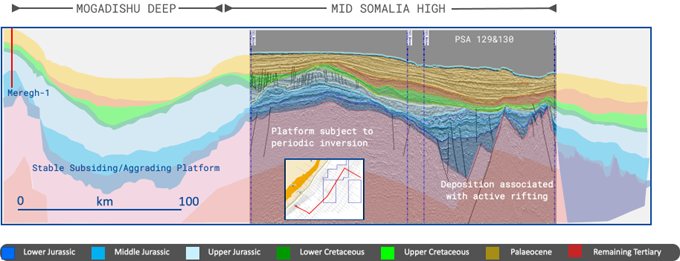

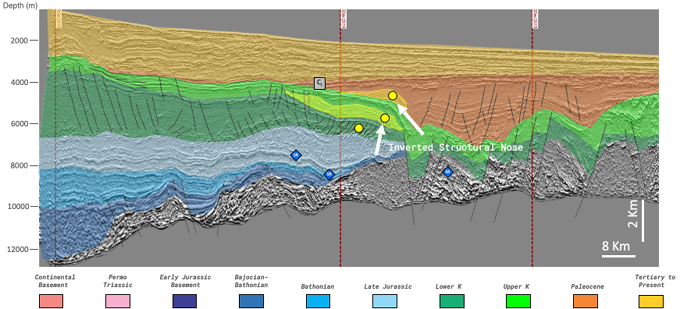

The carbonates in PSA 129/130 in the MSH are the highest priority and lowest risk exploration targets, with large tilted fault-block structures easily mapped on the seismic data where reservoirs occur adjacent to oil-generating source rocks.

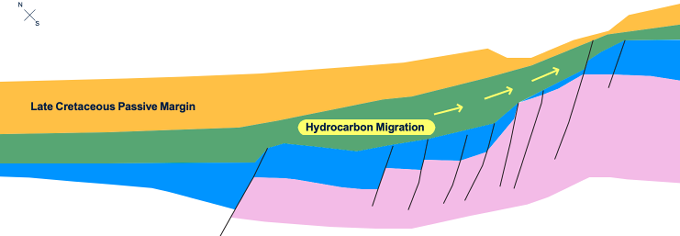

In the Mid Somalia High on PSA 129 & 130, carbonate reservoirs were deposited adjacent to the source rocks in the deeper part of the basin

The Mogadishu Deep Basin

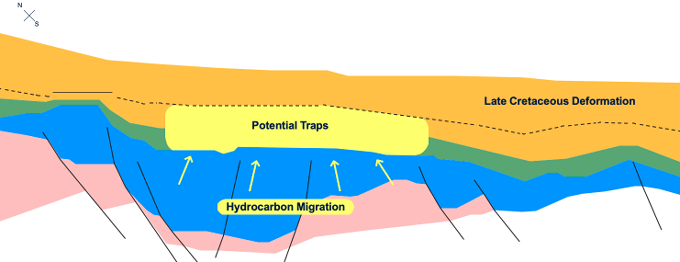

In the Mogadishu Deep in PSA 192 potential reservoirs (yellow) occur in the Lower and Upper Cretaceous and the Palaeocene with migration of hydrocarbons from the deeper Jurassic

Offshore Somalia is a Frontier Basin

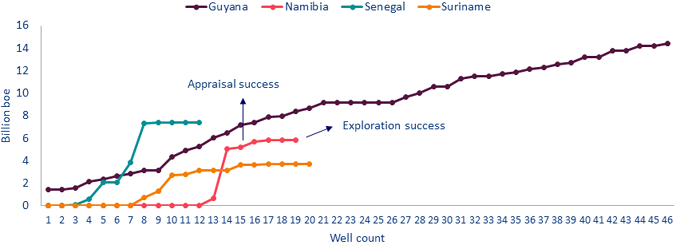

The history of exploration in a basin can be graphically illustrated by constructing a “Deepwater Creaming Curve”, which charts the volumes discovered in a basin against a measure of the exploration effort, usually time elapsed or number of wells drilled. In immature or frontier basins the very largest opportunities are usually drilled first because they are literally the easiest ones to map even on sparse data, and because only very large discoveries can overcome the financial hurdles of developing a discovery in an area without infrastructure. For this reason, typical creaming curves kick off from the time axis very steeply, and flatten over time as smaller opportunities become viable targets.

DEEPWATER CREAMING CURVE (CUMULATIVE RESOURCES DISCOVERED PER EXPLORATION WELL

Source: Wood Mackenzie Lens Upstream

The above illustrates this phenomenon in a number of basins that have been successfully drilled in the past decade.

In common with Offshore Somalia, these are typical deepwater Frontier Basins where technical and commercial success depends on establishing as comprehensive an understanding as possible of the evolution of the basin and its petroleum systems before wells are drilled.

Only two wells have been drilled Offshore Somalia in over forty years. Since the second of those in 2008, the data that has been collected and studies that have been undertaken have generated a sufficient level of understanding that the basin is ripe for the curve to “kick off”. This is the best time to enter the basin, which makes SOMA’s position very valuable.

Size Matters in Frontier Basins

SOMA's PSA129 &130 encompasses approximately 6,000 km², and 192 with 5,000km².

The PSAs are in water depths of between 2,500m and 3,500m, so are considered "ultra-deep" exploration areas

This area is equivalent to the size of one quadrant in the UK North Sea, a rift basin like Offshore Somalia featuring Jurassic source rocks and reservoir rocks from the Jurassic to the Palaeocene.

In Quadrant 211 of the North Sea's Brent Province, over ten billion barrels of oil in place have been discovered since blocks were first licensed in the 1970s.

Only two wells have been drilled Offshore Somalia in over forty years. Since the second of those in 2008, the data that has been collected and studies that have been undertaken have generated a sufficient level of understanding that the basin is ripe for the curve to “kick off”. This is the best time to enter the basin, which makes SOMA’s position very valuable.

In frontier basins the area of blocks is often significantly larger than in more mature basins where data density and the availability of infrastructure allows governments and companies to target smaller opportunities. This makes it more likely that early entrants, holding acreage with 100% interest, will control large drillable opportunities 100%.

Value Creation in a Frontier Basin

In January 2024, Galp Energia SGPS SA announced the Mopane discovery in the 9,800km2 PEL 83 in the rapidly emerging Frontier Orange Basin of Namibia, where they hold an 80% stake. This discovery highlights the potential for value creation in frontier basins.

An article published in the Oil Business periodical "World Oil" on May 21st 2024, quoting an article originally published online by Bloomberg, noted that several major oil and gas corporations are evaluating bids for a stake of up to 40% in the block. This interest from major players underscores the significance of the discovery.

The report provided insight into the potential value of the discovery. Based on Galp's recent "in place" estimates for 10 Billion barrels of oil equivalent in place in the Mopane complex, the entire discovery could be worth around $20 billion. This valuation demonstrates the substantial economic potential of successful exploration in frontier basins.

GALP said in an April filing that the oil estimate is before drilling additional exploration and appraisal wells. This suggests that there may be potential for even greater value as further exploration and appraisal activities are conducted in the area.

Source: Nair, Dinesh & Crowley, Kevin: Exxon, Shell Are Said to Weigh Bids for Galp Namibia Stake. Bloomberg, May 21 2024

RPS Volume Estimate 192

Unrisked STOOIP is approximately 5.38 billion barrels on PSA 192.

U3 Study

The U3 study recognized these structures as a single closure on the depth-converted seismic but did not assign prospect status due to the sparse data grid. It also noted potential for further stratigraphic trap prospectivity in Block 192 in both the Upper Cretaceous and Palaeocene intervals, pending 3D seismic acquisition.

A Success - Case

By analogy with GALP's success in Namibia in a scenario where PSA 129 & 130 and PSA 192 both prove to be successful more than 30 billion USD of value will potentially be created.

So what about Madagascar

In a good news vs. bad news story, source rocks of Jurassic and Cretaceous age have been sampled Offshore and Onshore in Madagascar (good news for the presence of source rock in Somalia), but while where there are also abundant oil seeps and an onshore tar-sand belt in Madagascar, there have been no commercially significant oil discoveries. Is that bad news for Somalia?

MADAGASCAR

The 2022/23 U3Explore study explained why Somalia and Madagascar are different. The predominant crustal deformation involved in the formation of the rift basin is downward tilting in an extensional tectonic regime. The complex forces in play in the rift as the plates of the Sechelles and India moved away, however, resulted in the application of compressive forces on the Somalian margin which resulted in uplift in some regions, a process known as Inversion.

SOMALIA

The result of this uplift on the Somali margin was the formation of a large arch and trough in the Mogadishu Deep, and also uplift in the MSH. This uplift focused migration of fluids onto the highs/traps. This phase of inversion did not affect the margin in Madagascar, where the passive margin retained a consistent slope out of the basin, no large traps formed, and much of the generated hydrocarbon migrated out into surface seepage and formed the tar belt.

Opportunities

SOMA Oil and Gas Ltd's operations in offshore Somalia represent an exciting venture into one of the world's most promising oil frontiers. By securing key PSA blocks in the Mid Somalia High (MSH) and the Central Mogadishu Deep Basin, the company is poised to tap into multi-billion barrel opportunities, diversifying its risk while boosting its potential rewards.

Timeline of Progression

1980-1991:

- Leading oil companies, including ExxonMobil, Chevron, BP, Conoco, Shell, and Eni, secured exploration rights in Somalia

1991-2008

- 1991: Outbreak of Civil War leading to significant upheaval until 2008.

- 1991-2008: Loss of all historical regional oil and gas geological & geophysical data due to the civil war.

2008 - 2014

- 2008: Establishment of a transitional government which remained until 2012.

- 2012: In September, the Federal Parliament elected Hassan Sheikh Mohamud as the President, initiating the opening of the oil and gas sector.

- 2014: Comprehensive exploration with the 20,552 km 2D seismic survey, leading to the discovery of unexplored deep-water resources. TGS (Spectrum) completed an additional 20,583 km of 2D offshore seismic surveys.

- 2014: Efforts by the US, UK, and EU to reduce piracy resulted in no piracy attacks on merchant vessels off Somalia since 2017.

2017-2020

- 2017: Mohamed Abdullahi Mohamed (Farmaajo) elected President.

- 2018: Soma Exploration established, acquiring rights to a 20,552 km 2D seismic data set from 2014.

- 2020: On February 8, the Petroleum Law and Revenue Sharing Agreement were approved and ratified by the President.

- 2020: The Somali Petroleum Authority was established in July, with appointments from both the Federal Government and each member state. This period also saw negotiations with Soma over PSA terms.

2020 - 2022

- 2022: From February to October, Soma signed several PSAs and made significant progress with the government's full support.

- 2022: In May, Hassan Sheikh Mohamud is re-elected as President, emphasizing the oil and gas sector as crucial for Somalia's growth and encouraging foreign investment.

2023 - 2024

- 2023: Soma Oil & Gas BVI, a founding shareholder of Coastline Exploration, acquired PSA 129 & 130 and PSA 192 and all underlying data, consolidating its stake in the exploration projects.

- 2024: The Federal Republic of Somalia ratified the deal, officially recognizing Soma Oil & Gas Ltd (BVI) as the new sole 100% operator. Subsequently the Subsidiaries were transferred and formally acknowledged by the Federal Government of Somalia (FGS).

Soma Oil & Gas - Registered Office

21 Arlington Street, St James’s

London, SW1A 1RD

United Kingdom

KeyFacts Energy: SOMA Oil & Gas Somalia country profile l KeyFacts Energy: Company Profile

KEYFACT Energy

KEYFACT Energy