Genel Energy issues the following trading and operations update relating to Q1 2025, ahead of the Company's Annual General Meeting, which is being held today.

Paul Weir, Chief Executive of Genel, said:

“In line with expectations, the Tawke PSC continues to deliver consistent, reliable production and generate significant cash flow even at the discounted domestic sales prices. The operational performance delivered from the Tawke and Peshkabir fields, together with the significant cost efficiency, continues to set these fields apart from others in the region.

Our entry into Block 54 in Oman is expected to complete in the coming weeks, with first substantial work programme activity commencing around the end of the year.

We continue to work towards diversifying our production, both through expansion of our footprint in Oman as well as the purchase of new assets in other preferred jurisdictions. We addressed the maturity of our bond debt by calling the old bond and issuing a new $100 million bond, thereby increasing available cash and putting in place a capital structure that can provide funding towards delivery on our strategic objectives, regardless of whatever uncertainties may face the business at the macro-economic level.”

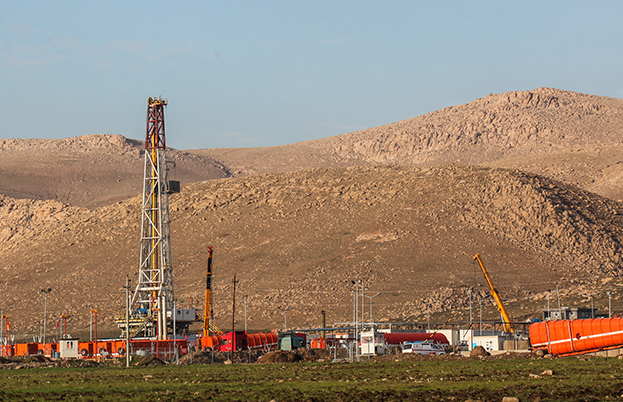

KURDISTAN

- Gross production of 82,081 bopd in Q1 2025 (Q4 2024: 74,140 bopd) from the Tawke licence where performance continues to be robust and domestic sales demand reliable

- Working interest production of 20,520 bopd (Q4 2024: 18,540 bopd)

- Q1 2025 sales price has been consistent with the previous quarter around $35/bbl

- Exit from the Sarta and Qara Dagh licences has now been approved by the KRG, in the form of relinquishment and termination agreements with minimal residual potential liabilities

OMAN

- As previously announced, we are delighted to have entered Oman through the award of an interest in Block 54

- Royal Decree is expected in the coming weeks and we are working with OQEP, the operator, on planned activity for the second half of the year

SOMALILAND

• On SL10B13 in Somaliland, we continue to work towards achieving conditions that support drilling of the highly prospective Toosan-1 exploration well

MOROCCO

• We have informed ONHYM that we will not be extending beyond the Initial Period of the Lagzira licence to the First Extension Period, and consequently will be abandoning the licence in June 2025

FINANCIAL

Net cash of $135 million at 31 March 2025 (YE2024: $131 million)

Q1 2025 free cash flow of $5 million (Q4 2024: $1 million free cash outflow)

Ahead of guidance due to higher production and some timing differences on spend

Tawke free cash flow expected to cover organisational costs this year

No spend to date on Oman

Cash of $201 million at 31 March 2025 (YE2024: $196 million)

In April the Company called $66 million of bonds maturing October 2025 and issued a new $100 million bond maturing April 2030

Balances with KRG

- Both receivable and payables have reduced as a result of the exit from Sarta and Qara Dagh

- Gross reported nominal receivables of $99 million, reduced from $107 million at YE2024

- Payables of around $40 million, reduced from around $50m million at YE2024

- The arbitration costs award made by the Tribunal for amounts owed to the KRG by Genel Energy Miran Bina Bawi Limited (“GEMBBL”) is circa $27 million, reduced from the circa $36 million claimed by the KRG

- GEMBBL has appealed this costs award to the High Court on the grounds that, because the KRG did not provide any breakdown of the amounts claimed by reference to any items of work, the Arbitration Tribunal was unable to assess the reasonableness and proportionality of the recoverable costs and consequently did not have jurisdiction to make an award

OUTLOOK

- Tawke free cash flow at current production and prices is expected to continue to cover organisational costs, with net cash at year-end expected to be about the same as the start of the year

- Following our entry into Oman, there will be some direct capital investment this year as we work towards testing previously discovered resource

- Talks between the Kurdistan Regional Government and Federal Government of Iraq and Ministry of Oil regarding the Iraq-Türkiye Pipeline are ongoing, but no material progress has been made since March and the timing of the resumption of exports remains uncertain

KeyFacts Energy: Genel Energy Iraq country profile

KEYFACT Energy

KEYFACT Energy