Viaro Energy was established by its CEO Francesco Mazzagatti, who has operated in the oil and gas sector since 2012, for the purpose of focusing on the North Sea basin.

Viaro Energy’s aggregated working interests in UKCS fields with JV partners contribute to 9% gross and 3% net of the total daily gas production, with current annual production up to 25,000 boepd.

UK Southern North Sea

Through its operating subsidiary RockRose Energy, Viaro has interests in several producing fields in the Southern Gas Basin of the UK North Sea. Interests in Tors, Grove, and Seven Seas were purchased from Sojitz Energy in 2017. In 2021, Viaro Energy acquired SSE E&P gas assets, which included interests in the Bacton Catchment Area, the Easington Catchment Area, and the Sean Field System. In 2023, Viaro Energy completed a farm-in agreement with Hartshead Resources Ltd., whereby subsidiary RockRose Energy will be the operator of the Anning and Somerville fields.

Bacton Catchment Area (BCA)

The BCA comprises 11 gas fields operated by Perenco UK, 7 of which are producing fields. The 2 main fields in the BCA are Leman and Indefatigable, which began production in 1969 and 1971, respectively. The development of smaller associated fields began in 1993 and is largely conducted through the 2 main fields. RockRose Energy holds non-operated interests in the Bell, East and South Leman, Indefatigable (including Indefatigable SW), Davy and North Davy, Boyle, and Browne fields.

Out of the 6 smaller fields produced through the Indefatigable facility, the gas from the 4 RockRose assets (Davy, North Davy, Browne, and Boyle) is delivered via the Davy platform and flowed back to Indefatigable. Gas from Bell is produced via the abandoned Bessemer platform and flowed back to Indefatigable. The Indefatigable field has been developed with 4 platforms and 40 wells, and its gas is transported to the Leman 27B platform via a pipeline. Leman gas is produced through the Leman facilities and transported to the Bacton Terminal via a pipeline.

Equity: 35.10% (Bell); 21.70% (Leman fields); 23.10% (Indefatigable fields); 27.78% (Davy fields); 27.80% (Boyle); 27.50% (Browne); 22.19% (Bacton Terminal); 9.84-13.67% (Inde/Leman Joint Compression Pipeline)

Easington Catchment Area (ECA)

RockRose Energy has interests in 6 gas fields that comprise the ECA and include Apollo, Minerva, Whittle, Eris, Wollaston, and Mercury. All fields are operated by Perenco UK, except Eris, whose operator is Spirit Energy. Gas from these ECA fields, as well as several other non-equity fields, is combined at the Cleeton Platform and exported via a 36-inch gas pipeline to the Dimlington Gas Terminal.

Equity: 50% (Apollo, Minerva, Mercury); 46% (Eris); 33.70% (Whittle); 33.50% (Wollaston)

In July 2024, Viaro Energy reached an agreement with Shell and ExxonMobil for the acquisition of a 100% working interest in the Shell-operated UK Southern North Sea assets owned by the two supermajors;

The acquisition consistes of 11 operated offshore assets and one exploration field (Shamrock; Caravel; Corvette; Brigantine; Leman; Galleon; Skiff; Carrack Main, Cutter, Carrack East; Barque; and Clipper), all tying back to the Shell-operated onshore Bacton Gas Processing Terminal via the Leman and Clipper fields. In 2023, production was around 28,000 boepd (c. 5% of UK total gas production) and the assets possess strong growth potential through identified near field exploration opportunities.

With a strong record of reliable production and around 90% production efficiency reported, the natural gas fields of the Southern North Sea and the Bacton gas terminal have been part of the UK’s energy foundation for 56 years. The tight gas development ongoing in the Galleon and Barque fields and strong potential for tight gas opportunities and near field exploration already identified in the Greater Sole Pit area are both indicative of the fields’ lasting importance for the UK’s energy security.

Viaro estimates place the 2P volumes of these assets at 58 million barrels of oil equivalent (“boe”), with a projected potential to extract over 120 million boe of net 2C resources. Viaro intends to maximise the economic return of these assets and, by working to ensure the extraction is conducted to reach their fullest potential, to increase low-emissions production of gas in the area through a redevelopment with an existing infrastructure.

Sean Field System

The Sean area consists of the Sean North, Sean South, and Sean East fields, operated by ONE Dyas. The fields are part of the BCA and consist of 3 surface-breaking structures through Sean Papa: 2 bridge-linked platforms – a wellhead and compression platform (PD) and a production and accommodation platform (PP) – and Sean Romeo (RD), a Not Permanently Attended Installation (NPAI). RD is connected to PP through a 20-inch infield duplex flowline (PL310). The Sean Field System has produced gas from 10 wells on Sean PD and 6 wells on Sean RD. Gas from Sean is transported through a 106.502 kilometre-long and 30-inch-wide gas export pipeline to the Bacton Terminal (PL311 trunkline).

Equity: 50%

Anning and Somerville Fields

Anning and Somerville are gas development fields acquired by Viaro Energy in 2023, as part of a farm-in agreement with Hartshead Resources. Viaro Energy will assume operatorship of the fields prior to first gas, marking the company’s first operator role. The Concept Select determined that 2 x NUIs will be installed (1 at each field) utilising a low-emission power generation technology with a tie-back to an existing host platform.

Equity: 60%

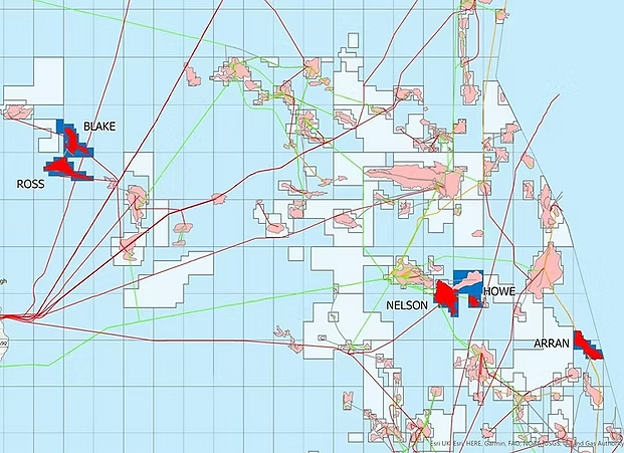

UK Central North Sea

Viaro Energy currently holds non-operated interests in 6 UK Central North Sea oil and gas fields. Its assets include the producing Arran, Nelson & Howe, and Blake & Ross fields.

Arran Field

The Arran gas condensate field is operated by Shell as a 60-kilometre subsea tie-back to the Shearwater platform. Hydrocarbons are processed on and then exported from the platform, with gas joining the SEGAL system and condensate the Forties pipeline system. Discovered in 1985 as two separate structures, Arran came onstream in 2021.

Equity: 30.43%

Nelson & Howe Fields

The Nelson & Howe oil fields are operated by Shell. Developed with a fixed platform, Nelson produces light oil from a reservoir at a depth of approximately 2,200 meters. The smaller Howe field was brought onstream as a single-well subsea tie-back to the Nelson platform. The oil from the platform is transported by pipeline to the Forties field and then to shore via the Forties pipeline system.

Equity: 7.48% (Nelson); 20% (Howe)

Blake & Ross Field

The Blake & Ross oil fields, operated by Repsol Sinopec, produce into the Bleo-Holm Floating Production, Storage & Offloading (FPSO) vessel via subsea infrastructure. The Ross field is currently offline, while oil from the Blake field is produced via a subsea manifold and dual flowlines to the Ross FPSO. Blake is divided into two areas – the Blake Channel and the Blake Flank. The two were developed separately, with 6 production wells and 2 water injection wells drilled into the Blake Channel, and 2 production wells drilled into the Blake Flank.

Equity: 30.82%

UK Northern North Sea

Viaro Energy acquired a 15% non-operated interest in the Bressay oil field, located in the UK Northern North Sea, and a 15% interest in the EnQuest Producer Floating Production Storage and Offloading (FPSO) unit from EnQuest in late 2023.

Bressay Field

In December 2023, Viaro Energy's wholly owned subsidiary, RockRose Energy, signed a Sales and Purchase Agreement (“SPA”) with EnQuest to acquire a 15% interest in the Bressay field and its EnQuest Producer FPSO for a total consideration of £46 million. The early production facility development under review has capital expenditure estimated at £600 million, with £90 million being RockRose’s net share.

Bressay is considered one of the largest undeveloped oil fields in the UK Continental Shelf (“UKCS”) with more than 115 MMbbls of net 2C reserves and with an estimated potential to extract around 200 million boe. Discovered in 1978, Bressay lies in UKCS Blocks 3/28a, 3/27b, 3/28b, 9/2a, and 9/3a of the Northern North Sea, east of the Shetland Islands.

Equity: 15%

West of Shetland

Viaro Energy’s operations in the West of Shetland consist of non-operated interests in the Greater Laggan Area, following Viaro Energy’s successful acquisition of the SSE exploration and production gas assets in 2021.

Greater Laggan Area (GLA)

RockRose Energy has interests in the GLA, the first gas development in the West of Shetland, UK area, operated by Total Energies. The GLA comprises 4 producing gas condensate fields (Laggan, Tormore, Edradour, and Glenlivet) and the Shetland Gas Plant, with associated offshore and onshore pipelines. Production from Laggan and Tormore began in 2016, while Edradour and Glenlivet were brought onstream in 2017.

All 4 fields are developed as a subsea tie-back to the TEPUK-operated Shetland Gas Plant through two 18-inch production flowlines. Gas is transported onwards into the SIRGE system and subsequently into the NSMP-operated FUKA system, delivering gas and natural gas liquids to the UK mainland at St. Fergus. The condensate is separated at the SGP and delivered to the neighbouring Sullom Voe terminal.

Equity: 20% Laggan, Tormore, Edradour, Glenlivet, and Shetland Gas Plant

Acquisition

In June 2025, Deltic Energy agreed to a recommended cash offer from Rockrose Energy, a subsidiary of Viaro Energy, valuing the company at £6.9m.

Deltic’s portfolio represents a natural fit with Viaro’s existing assets and strategic focus in the North Sea.

The Selene discovery is a key driver for this acquisition, which forms an important component of Viaro’s recently announced transaction with Shell and ExxonMobil, as well as within the broader basin context.

The Netherlands

RockRose Energy entered the Dutch oil and gas exploration & production sector through the 2018 acquisition of Dyas BV which included its interests in the A&B Blocks, the K4b-K5a area, and the Hanze oil field. With Viaro Energy’s 2021 acquisition of Hague and London Oil (HALO) BV portfolio, the company gained assets in the Joint Development Area partnership. RockRose Energy also has interests in several other offshore and onshore assets in the Netherlands, including the Rijn field, F15AB, the Greater Markham Area, the Bergen Concession, and the strategic gas store Alkmaar PGI.

A&B Blocks

RockRose Energy has non-operated interests in the A&B Blocks, made up of 6 gas fields operated by Petrogas. Five of the fields A12, A18, B13, B10 and A15 are onstream. The producing fields were brought onstream using a Central Processing Platform (CPP), with compression facilities to address the low pressure of the Pleistocene-age reservoirs. B10 and A15 the latest to be development, came online in 2024. Due to capacity constraints at the CPP, a phased development approach has been pursued in the area. Gas is exported via a spurline to the A/6-F/3 pipeline, which in turn links to the NOGAT pipeline for transportation to Den Helder.

RockRose Energy acquired interests in the A&B Blocks gas fields in 2018, which began production in 2007. With investments to secure the full potential of existing fields through infill drilling, and the development of new gas such as B16, along with exploration potential, the A&B Blocks resources are estimated to last for several years to come.

Equity: 14.63% (AB Unit); 27.64% (A15 Unit)

Germany

In December 2024, Viaro Energy, signed an SPA for the acquisition of Evoterra, the integrated transition energy company with onshore assets in the UK and Germany. The deal marked Viaro’s entry into the production of renewable energy, as well as the traditional energy market in Germany.

Viaro’s entry into Germany includes a 100% working interest in the Mullheite commercial licence in the Molasse basin in Bavaria, south of Munich. There is proven Tertiary (Rupel) oil and gas on the licence and plans are underway to drill a well to evaluate the gas anomalies mapped out through a 3D seismic survey. The licence also holds prospectivity in the Holzkirchen area, which produced over 6 million barrels of oil per day prior to close of production, and where there is potential for a redevelopment of this reservoir.

Acquisition / Renewable

In December 2024, Viaro Energy, signed an SPA for the acquisition of Evoterra, the integrated transition energy company with onshore assets in the UK and Germany. The deal marks Viaro’s entry into the production of renewable energy, as well as the traditional energy market in Germany.

The deal will see Viaro acquire 100% of Evoterra’s assets, including its subsidiary MicroEnergy Generation Services Limited, which contains a wind turbine fleet located mainly in East Anglia, and subsidiary Terrain Energy, which operates one onshore oil and gas exploration licence in the Molasse basin in southern Germany and holds interests in four onshore oil and gas licenses in the UK.

Viaro will also acquire a non-operating stake in four onshore licenses in the UK, namely Whisby Oil Field and Duke’s Wood in East Midlands, as well as the Brockham and Lidsey oil fields in the Weald Basin. Viaro will work with the Operators of each of the licences to progress various opportunities to increase production at each of the sites and allow them to reach full potential.

At Whisby, plans are already underway to conduct workovers on two of the existing wells, with an infill well also being matured for execution in 2025. Duke’s Wood will be evaluated for geothermal potential, rather than further oil and gas production. At Brockham, production has been restored from one well following a successful workover earlier this year, with options being evaluated to restore production from a second well. The Lidsey oil field is currently shut-in, with the Operator evaluating options to restore production in early 2025.

LEADERSHIP

Francesco Mazzagatti Chief Executive Officer

Francesco Dixit Dominus Chief Financial Officer

Alistair Buchan Chief Operating Officer

Steve Jenkins Non-Executive Chairman

Orlando Vaca Non-Executive Director

Lieutenant-General Sir Simon Mayall Non-Executive Director

LOCATIONS

England

20-23 Holborn, Viaro House

London, EC1N 2JD

+44 203 826 4800

Scotland

37 Albyn Place

Aberdeen, AB10 1YN

+44 122 480 3000

The Netherlands

Schiphol Boulevard 127 G4.26 1118BG Schiphol

Amsterdam, Nederland

KeyFacts Energy: Viaro Energy UK country profile l Viaro Energy Netherlands country profile

KEYFACT Energy

KEYFACT Energy