Map source: InfraStrata

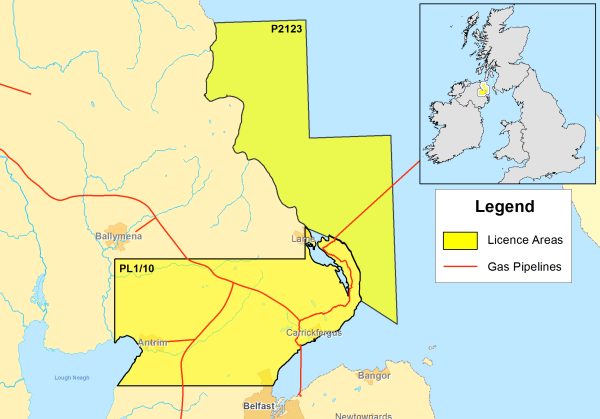

InfraStrata plc (AIM: INFA), the UK quoted company focused on the development of natural gas storage capacity, provides an update on project equity funding for its Islandmagee gas storage project in Northern Ireland.

In order for the FID (Final Investment Decision) to be taken there are several key elements that must be aligned: Project equity funding, debt funding, EPC (Engineering, procurement and construction) contractor, capacity offtake partner and, as completed in November 2018, a FEED (Front End Engineering Design) study for the Project.

With respect to the eventual Project equity funding, the Company has been working through several term sheets, having due diligence completed upon its Islandmagee project Phase 1 (2 caverns) and Phase 2 (6 additional caverns) and discussing potential long-term working relationships with such potential Project equity partners. The Company has been diligently undertaking this work in order to ensure it selects the right Project financing partner and enters into an agreement that will provide long-term value for shareholders on the initial Project and beyond. The Company remains on track to undertake the FID by the end Q2 of 2019.

A further Project equity funding offer was presented to the Company during the week commencing 17 December 2018. In order to fully assess and evaluate this offer the Board has decided to delay entering into any formal arrangements in Q4 2018, with a view to concluding its review and negotiations early in 2019. The Company remains in negotiations with various parties and although approaches have been made to enter into exclusive arrangements, the Board has rejected these advances at this point in time.

All potential Project equity funding partners consider a phased investment commencing with phase 1 (2 caverns) to be the most appropriate way forward. Initially, financing arrangements will be provided for enabling works, with the majority of the funds being provided to facilitate development of Phase 1 after a successful FID. All potential project funding partners plan to take equity in the Project at this point.

Debt funding will naturally follow an agreement on Project Equity funding and the Company is well advanced with discussions but will only request a firm proposal once the equity/debt preference is known from its selected Project equity funder. The ITT (Invitation to Tender) for the EPC contract has been released, as announced on 21 December 2018, with the tender returns being due by 28 February 2019. The Company continues to progress with numerous interested partners on the capacity offtake agreement front and expects to focus its attention on a short list in Q1 2019.

John Wood, Chief Executive Officer commented:

"Our goal was to have identified our preferred long-term Project equity partner in Q4 2018, in order for us to commence the enabling works early in 2019. With a new offer being presented to us last week we have considered our position and it is our duty to fully evaluate this offer as it may add value for our shareholders over and above the other offers on the table; this bodes well for our future endeavours.

"Whilst it may be frustrating for our shareholders that the Board has decided to extend our decision-making process, we must ensure we deliver the best proposal for our shareholders. We are extremely encouraged that several credible investors remain in advanced negotiations with us, demonstrating the quality of our initial Project and the level of preparedness of InfraStrata to progress. With this offer in mind, we remain on schedule to conclude all matters and undertake the FID by end Q2 2019."

KeyFacts Energy Industry Directory: InfraStrata

KEYFACT Energy

KEYFACT Energy