WTI (May) $60.70 -$1.29, Brent (June) $64.21 -$1.37, Diff -$3.51 -8c

USNG (May) $3.66 -29c, UKNG (May) 89.6p +4.2p, TTF (May) €36.5 +€2.165

Oil price

After the pain of the last few days since Liberation Day, oil has rallied just a touch today, markets are hoping that Tariffs might be subject to negotiation.

Zephyr Energy

Zephyr has provided an update on completion and production testing operations on the State 36-2 LNW-CC-R well at its project in the Paradox Basin, Utah, U.S.

Over the last two weeks, the lateral portion of the well was successfully perforated with 98 cuts across a total of 16 stages targeting optimised sections of the reservoir. As part of the operations, the Company deployed a wellbore perforating technology developed by Halliburton which used a mix of sand and water to cut cavities through the casing and into the reservoir in order to maximise the reservoir’s connectivity.

Pressure response during the cutting operations suggests the wellbore has good connection to the highly pressured Cane Creek reservoir. After perforations were completed, the well was treated with acid, as planned, to maximise near-wellbore formation permeability.

The Company will shortly commence production testing. As part of the operation, a fibre optic cable is planned to be deployed alongside the production tubing to gather pressure and temperature data so that the production rate of each individual stage may be assessed. This will allow Zephyr’s team to further understand the production capacity of the reservoir and to optimise stimulation techniques for future operations.

The Company continues to anticipate that initial production test results will be available by the end of April 2025, subject to weather and vendor schedules.

Colin Harrington, Zephyr’s Chief Executive, said:

“We are highly encouraged by operations to date and are excited about the imminent commencement of the production testing.

“We look forward to providing further updates in due course.”

Although the comments above from CEO Colin Harrington are brief in the extreme I feel that this news is just about as good as it could get at this stage. The lateral has been perforated across 16 stages using the best possible kit.

With the well bore having an acid frac which will improve flow rates in what we know is a highly pressurised reservoir and to be treated with great care. Next stop production testing to get an idea of the capacity of the reservoir and how to use stimulation techniques when the time comes.

The drip feed nature of the newsflow from the Paradox may be frustrating but I think that it is necessary given the nature of the well, so far the news is about as good as it could get, the next few weeks will of course determine the contents of the Paradox Basin, I remain a huge fan.

Prospex Energy

Prospex has provided an operational update on its production, development and drilling schedules across its portfolio of three producing natural gas assets onshore Europe: Viura, Selva and El Romeral.

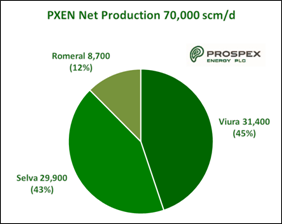

The net production across Prospex’s portfolio of investments is now at ≈70,000 scm/d (≈2.5 MMscfd ≈424 Boe/d). There has been a reduction of the flow rates achieved from the Viura production facility since the initial high rates seen in January 2025. Despite this reduction, Prospex’s net production rates have increased by 187% since January 2024. Net revenues have also risen year on year assisted also by the rise in energy prices. For the ownership of each of the assets in the Company’s investment portfolio, please refer to the notes section below.

Prospex Energy Net Production

Viura Production (45% of Net Production)

Gross gas production from the Viura field averaged ≈217,000 scm/d (≈7.7 MMscfd) for the months of February-March 2025, which net to Prospex was ≈31,400 scm/d (≈1.1 MMscfd). The original producing well on the Viura field known as Viura-1 ST3 was not in production during this period.

The Viura-3 well was worked over to convert it into a water injection well in December 2024/January 2025. However, it was determined that Viura-3 is not a candidate for water injection. Consequently, the Viura plant is continuing current water abatement procedures, and the Viura-3 well has been capped and suspended.

Viura Project Drilling Schedule Update

As advised in the RNS of 20 March 2025, the schedule for the commencement of drilling operations at the Viura gas field in northern Spain, operated by HEYCO Energy, has been pushed back by 6 to 8 weeks. For operational reasons, the operator has advised that drilling on the Viura project is now expected to start in Q2 2025, commencing with the Viura-3B well which was permitted first in 2024.

The procurement of long lead items and the necessary equipment required for drilling has been secured from production income.

Selva Production (43% of Net Production)

Gross gas production from the Selva field averaged ≈79,800 scm/d (≈2.8 MMscfd) for the months February-March 2025, which net to Prospex was ≈29,900 scm/d (≈1.1 MMscfd). Production operations continue to run smoothly from this asset which has achieved gross flow rates of between 78,000 – 80,000 scm/d throughout 2024.

Selva 3D Seismic Acquisition and Drilling Schedule

The 3D seismic acquisition on the Selva Malvezzi concession is anticipated in Q3 2025 with the required permitting for the equipment mobilisation and execution of the project proceeding according to plan. The 3D seismic acquisition is scheduled to be completed within a three-week period and the data processing and interpretation will be completed immediately following acquisition.

The permit applications to drill the four new wells on the Selva Malvezzi concession were officially lodged with the central Italian Ministry in Rome on 24 December 2024. The current estimate of the commencement of drilling once full permits are received and the necessary equipment has been procured is Q4-2025/Q1-2026. The Environmental Impact Assessment (“EIA”) has been submitted and the statutory consultation process is underway. Discussions with landowners for access to the required sites is underway and is expected to take several months in parallel with the EIA process.

El Romeral Production (12% of Net Production)

Gross gas production from the El Romeral concessions for the months February-March 2025 averaged ≈17,300 scm/d (≈0.6 MMscfd), which net to Prospex was ≈8,700 scm/d (≈0.3 MMscfd). All the gas was converted into electricity and sold on the hourly spot market generating an average of ≈1,700MW throughout the quarter (≈850MW net to Prospex). When the acquisition of 100% of Tarba completes later this month, Prospex’s net production from this asset will double.

El Romeral Drilling Schedule

The 30-working day Statutory Consultation period of the Environmental Impact Assessment (“EIA”) for the application to drill the five new natural gas wells ended on 4 April 2025. The Junta de Andalucía now reports back to MITECO (the central Ministry in Madrid) which will then collate and review the final EIA evaluation and all reports from the public and statutory consultees. MITECO then produces its final review before issuing the approval resolution granting the permits to drill the wells. This process can take between 90 and 180 days. As long as no significant objections are received, the earliest that permits to drill the 5 wells on the El Romeral concessions are received would be Q4 2025, but MITECO is under no obligation to adhere to these time frames.

A new Corporate Presentation for Q2-2025, which contains the latest estimate of these drilling schedules in a GANTT chart is available on the Company’s website. https://prospex.energy/investors/corporate-documents

Appointment of Hannam & Partners (‘H&P’) as Joint Corporate Broker

The Company is also pleased to announce the appointment of H&P as Joint Corporate Broker to the Company. Alongside their broking services, H&P, will, among other things, initiate research on Prospex (currently expected late April), with periodic updates on corporate developments and assist with the Company’s market communications. Their research will be available to all shareholders via both their own and the Company website.

Mark Routh, Prospex’s CEO, commented:

“Operations continue to make solid progress across our portfolio of assets. As an investing company rather than an operator, we do not control on-the-ground activities or the timeframes associated with permitting. However, our deep sector knowledge and subsurface expertise combined with our understanding of the growing energy demand across Europe, has helped drive a net production increase of over 187% since the same period in 2024. This has led to a commensurate increase in net revenues in line with that increase in production. This growth has enabled us to make strategic acquisitions, including the Viura asset last August and the proposed acquisition of Tarba, funded from production income, which should complete later this month. I remain confident in our ability to continue delivering sustainable growth for the benefit of all shareholders.

“To this end, I am extremely pleased to announce the appointment of Hannam & Partners as our joint corporate broker. Hannam & Partners is a specialist in the natural resources sector and will provide the Company with an enhanced package of services including the preparation of an analyst’s research note on the Company for our existing and potential investors.

“I am excited to be working closely with the team at Hannam & Partners in the coming months as we increase our natural gas production and cash flow from our asset portfolio in both Italy and Spain.”

After the January ’25 peak, production has fallen away despite being better than a year ago. It is difficult to know whether Prospex has any operational input, they claim to have no control as mere investors but their ‘expertise has helped drive a net production increase…’

With the Viura 3B well spudding in this quarter and permitting underway things should rise again but it is unclear quite how much, news will come later in the year I guess. With a strong market out there the outlook is good albeit somewhat quiet in the short run, that shouldn’t be held against them.

I don’t often comment on advisor appointments but the bringing on board of Hannam & Partners has got to be excellent news for Prospex and its shareholders, they will bring an added quantum to the process, not least a decent piece of research.

Original article l KeyFacts Energy Industry Directory: Malcy's Blog

KEYFACT Energy

KEYFACT Energy