WTI (May) $71.48 +$2.12, Brent (June)* $74.77-17c, Diff -$3.29 -98c

USNG (May) $4.12 +5c, UKNG (May) 97.44p +0.68p, TTF (May) €41.0 +€0.025

*Denotes Brent May contract expiry

Oil price

It is Liberation Day -1 and with peace everywhere in tatters what might the Donald tell us all tomorrow afternoon? Oil remains firm with geopolitical uncertainty all over the place and tariffs abound.

Serica Energy

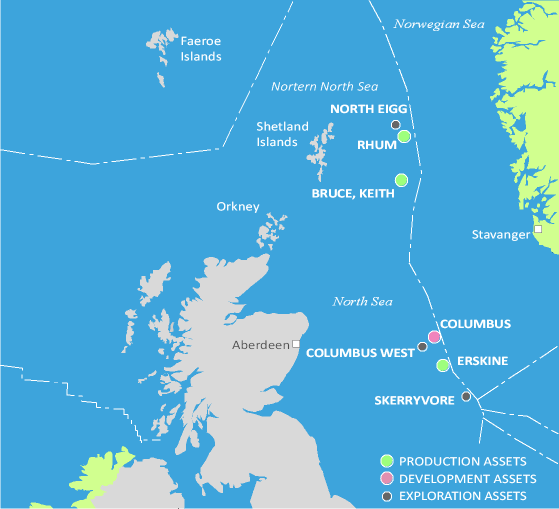

Serica Energy, a British independent upstream oil and gas company with operations in the UK North Sea, today announces its audited financial results for the year ended 31 December 2024.

Chris Cox, Serica's CEO, stated:

"The highly positive results of the drilling campaign at Triton are not yet being reflected in our production and cashflow due to ongoing issues at the Triton FPSO. Our frustration is exacerbated by the fact that the Triton area alone could be delivering up to 30,000 boepd net to Serica with the addition of the wells already drilled.

We are confident, after detailed discussions with the Operator, Dana, of the work required to fix the issues, and we are pleased that the joint venture has agreed a plan to take advantage of the current downtime to bring forward the maintenance work scope originally scheduled for July. This removes the need for a summer maintenance shutdown, which combined with the activities undertaken should significantly increase uptime going forward.

I have previously stated my confidence in the excellence of the Serica subsurface team and the potential of the rocks across our portfolio, and we have increasing clarity on the work needed to convert that potential into shareholder value. Ongoing analysis has seen a small decrease in our 2P reserves but materially increased our 2C resources – and there is more to come as work continues. This indicates the strength of our organic pipeline, with a clear route to converting resources to reserves – the Kyle redevelopment looks particularly attractive, and multiple infill drilling opportunities around the Bruce Hub have been identified.

With the above in mind, we have elected to implement a prudent rebalancing of our capital allocation approach, giving us increased flexibility over the medium-term to allocate capital to the areas where it will deliver best value for shareholders. This adjustment will allow us to invest in the exciting drilling and development programmes in our portfolio and be opportunistic in accretive M&A, all while retaining our highly competitive shareholder distributions.”

Results summary ($ million unless stated)

| 2024 | 2023 | |

| Average realised Brent oil price ($/bbl) | 75 | 67 |

| Average realised gas price (pence per therm) | 76 | 94 |

| Production (boepd)(1) | 34,600 | 40,100 |

| Revenue(1) | 727 | 917 |

| Operating costs | 330 | 273 |

| EBITDAX | 379 | 475 |

| Cash Tax paid | 153 | 348 |

| Adjusted CFFO less tax | 403 | 250 |

| Capital expenditure(2) | 260 | 97 |

| Free cash flow | (1) | 16 |

| Cash | 148 | 335 |

| Total debt | 219 | 271 |

| Adjusted Net (debt) / cash(3) | (83) | 99 |

| Final dividend declared (pence per share) | 10 | 14 |

| Attributable shareholder returns(4) | 114 | 112 |

(1) 2023 figures are pro forma following the completion of Tailwind acquisition on 23 March 2023

(2) Includes pre-FID expenditure on E&E assets

(3) Net of unamortised fees; See Reconciliation of non-IFRS measures

(4) Attributable shareholder returns reflects Interim and Final Dividends in respect of the relevant year plus quantum of share buybacks

Highlights

Working to deliver more reliable and predictable production

- Production of 34,600 boepd in 2024 (2023 pro forma: 40,100 boepd), of which 64% was gas, impacted by unscheduled downtime at the Triton FPSO

- Production of c.27,600 boepd in Q1 2025, at a reduced level due to the shutdown of the Triton FPSO in February and March

- Following discussions with Dana Petroleum, the operator, the Triton joint venture partners have decided to bring forward the summer maintenance period, integrating it into the current work programme

- This will deliver increased uptime for the remainder of the year versus previous expectations

- Production from Triton is now expected to resume in June, with no further planned shutdowns in 2025

- The availability of the second compressor upon resumption will also mitigate the cause of instability that impacted 2024

Positive subsurface results set to boost production

- With our ongoing drilling programme, Serica was one of the most active operators of development drilling in the UK North Sea last year and remains so in 2025

- Initial results from this drilling activity have been encouraging, and the Triton FPSO produced over 25,000 boepd net to Serica on 23 January 2025, the day prior to production halting in the aftermath of Storm Éowyn, boosted by production from the first two wells in the five well Triton drilling campaign, Bittern B6 and Gannet GE05

- Drilling on the subsequent two wells, the W7Z well on the Guillemot North West field (Serica: 10%) and the EV02 well on the Evelyn field (Serica: 100%), is now complete, with both wells showing encouraging results

- W7Z is set to be hooked up for production shortly after the restart of production, with EV02 to then follow

- The COSL Innovator rig has now relocated and drilling has begun on the BE01 well on the Belinda field (Serica 100%), the final well of the campaign, with first production expected in early 2026

Material increase in 2C resources

- 2P reserves of 117.5 mmboe as at end-2024 (140 mmboe at end-2023), broadly evenly split between oil (55.1 mmboe) and gas (62.4 mmboe), following production of 12 mmboe in 2024

- Rigorous subsurface reassessment of the portfolio, focused on identifying deliverable opportunities, has resulted in a material increase in 2C resources to 88.7 mmboe at end-2024 (30.3 mmboe at end-2023), with the potential to convert significant resources into reserves in the medium-term

- Work is continuing across the portfolio to high-grade the identified opportunities, with capital allocation to focus on those projects that can deliver maximum value to shareholders

Profitable and cash generative despite active investment programme

- Profit before tax of $160 million (2023: $380 million) with reduction largely reflecting lower volumes sold and slightly reduced realised pricing largely driven by lower realised gas prices and increased gas mix (2024 61% gas as compared to 2023 pro forma 51%)

- Profit after tax of $92 million (2023 $128 million) reflecting a lower P&L tax rate benefitting from the combined impact of loss pool and active capital investment programme

- Adjusted CFFO less tax increased on the prior year to $403 million in 2024 (2023: $250 million), as a result of a significantly lower current tax charge in 2024 due to group relief effects resulting from the Q4 Triton performance

- Cash tax paid in 2024 of $153 million (2023: $348 million)

- Group relief in 2024 led to an overpayment of cash tax under the Instalment Payment Regulations. This will result in a $71 million cash tax rebate in 2025

- No cash tax payment was made in the January 2025 instalment, and Serica expects significantly reduced cash tax payments in 2025

Robust balance sheet and continued tax losses shelter supports investment in growth and returns

- Peer leading Balance Sheet strength with year-end leverage (Adjusted Net Debt to EBITDAX) of 0.2x (2023: Net Cash)

- No near-term expenditure on decommissioning activities, with year-end decommissioning provision of $146 million maintaining Serica's position as having the lowest decommissioning liability per 2P boe compared to all our UK and wider North Sea peers5

- As at 31 December 2024, Serica retained over $1 billion of recognised ring fence tax losses resulting in a year end Deferred Tax Asset of $577 million; upon completion of the Parkmead (E&P) Limited ('Parkmead') acquisition Group tax losses will be increased by c.25%

- Cash of $141 million as at latest practicable date of 27 March 2025 (31 December 2024: $148 million), with borrowings of $219 million, essentially flat Net Debt from year end notwithstanding the continued capex programme and lack of Triton production in February and March

- Final dividend declared today of 10 pence per share (2023: 14 pence per share) subject to approval at Serica's 2025 AGM

- The final dividend is payable on 25 July 2025 to shareholders registered on 27 June 2025, with an ex-dividend date of 26 June 2025

- Final dividend equates to an estimated $50 million6, bringing total shareholder returns in respect of 2024 to $114 million (including interim dividend of $45 million and $19 million of share buybacks), consistent with the comparable figure for 2023 of $112 million

- The Company has elected to adjust the final dividend as part of a prudent rebalancing of the capital allocation mix

- This rebalancing enhances flexibility to allocate capital to those areas where it will deliver best value for shareholders, combining a highly competitive level of shareholder returns with investment in exciting growth opportunities and retaining a resilient financial frame

- Serica additionally retains capacity within its shareholder authorities to carry out further share buybacks as part of its capital allocation strategy and will look to renew these authorities at its 2025 AGM

Focused and disciplined value accretive M&A strategy

- Acquisition of Parkmead announced in December, providing optionality regarding future projects and bringing with it carried forward tax loss balances. The deal is moving towards completion, with NSTA consent now received

- The Company continues to be very active in screening cash-generative and value accretive M&A opportunities in both the UK North Sea and other geographies. Serica will remain disciplined and will only conclude transactions with a demonstrable investment case and potential to deliver material value to shareholders

Outlook and guidance

- Following operational issues at Triton in Q1, production guidance for 2025 has been amended to 33,000-37,000 boepd

- With maintenance work at the Triton FPSO set to complete in June, and no summer shutdown to then follow, portfolio production in H2 is forecast to be materially ahead of the full-year 2025 guidance range

- Capital expenditure and opex guidance unchanged, at $220-250 million and c.$330 million respectively

- Poised for material cash flows, supporting Serica's strategy and track record of delivering direct returns of capital to investors through a mixture of a material dividend and, selectively, share buy backs

- Work is ongoing regarding a potential move from the AIM to the Main Market of the LSE in 2025

(5)Serica defines its peers as listed independent E&P companies with material asset positions in the UK, Norway and Denmark

(6) Approximated based on 10p per share and TVR ex Treasury shares as of 7 March and US$:GBP FX rate of 1.29

Angus Energy

As previously announced, commissioning of the new booster compressor at the Saltfleetby Gas Field is underway. Due to a minor delay on delivery of the last items of equipment, now scheduled to arrive today, start-up is confidently expected to occur before the end of the week.

Good news that the minor delay is over and that production will be underway later this week, I’m very happy with Angus at the moment.

Original article l KeyFacts Energy Industry Directory: Malcy's Blog

KEYFACT Energy

KEYFACT Energy