WTI (Apr) $67.16 +26c, Brent (May) $70.78 +22c, Diff -$3.62 -4c

USNG (Apr) $4.25 +20c, UKNG (Apr) 106.65p +2.41p, TTF (Apr) €43.59 +€1.355

Oil price

Oil is another dollar better today, whilst the inventory figures were not ideal they do show that stocks are still quite low and products drew again.

PetroTal Corp

PetroTal has reported its operating and financial results for the three months and year ended December 31, 2024. All amounts herein are in United States dollars unless stated otherwise.

Key Highlights

- Average Q4 2024 sales and production of 19,087 and 19,142 barrels of oil per day (“bopd”), respectively, including volumes from the acquisition of Block 131, which closed in late November;

- Average FY 2024 sales and production of 17,558 bopd and 17,785 bopd, respectively, slightly above the guidance range (16,500 to 17,500 bopd), and an increase of approximately 25% relative to 2023 average production;

- Group production has averaged approximately 23,200 bopd in 2025 YTD;

- Generated EBITDA(1) of $40.2 million ($22.86/bbl) and $237 million ($36.87/bbl) in Q4 2024 and FY 2024 respectively, near the high end of annual guidance ($200 to 240 million);

- Development capital expenditures (“capex”) totaled $50.6 million in Q4 2024 and $163 million in FY 2024, near the midpoint of the annual guidance range ($150-175 million);

- Annual free funds flow(1) was $74.1 million, prior to returns of capital to shareholders, representing a yield of approximately 21% relative to our year-end 2024 market capitalization;

- Available cash increased to $103 million at year-end 2024 (from $91 million the prior year);

- On March 14, PetroTal paid a dividend of $0.015/share, associated with Q4 2024 results. This was PetroTal’s eighth consecutive quarterly dividend, bringing total return of capital under the Company’s dividend program to $116 million ($0.14/share);

- PetroTal paid total dividends of $0.06/share and repurchased 11.3 million common shares in 2024, representing approximately $65 million of total capital returned to shareholders (compared to $62 million in 2023).

- Successfully completed seven new oil wells in 2024. During 2024, six of these oil wells produced just over 2 million bbls of oil and generated approximately $85 million in net operating income(1), which amounts to a 100% return of investment as of year-end 2024.

Selected financial and operational information outlined above should be read in conjunction with the Company’s unaudited consolidated financial statements and management’s discussion and analysis (“MD&A”) for the three and twelve months ended December 31, 2024, which are available on SEDAR+ at www.sedarplus.ca and on the Company’s website at www.PetroTal‐Corp.com.

(1) Non-GAAP (defined below) measure that does not have any standardized meaning prescribed by GAAP and therefore may not be comparable with the calculation of similar measures presented by other entities.

Manuel Pablo Zuniga-Pflucker, President and Chief Executive Officer, commented:

“PetroTal reported strong financial and operational results in 2024, increasing our production by an average of 25% over 2023, while returning more than $65 million to shareholders through dividends and share buybacks. The Company also successfully managed a period of record low river levels during the dry season, on our way to exceeding annual production guidance.

2025 is off to an excellent start, with the results of our development drilling campaign and facility investments supporting year-to-date average production of more than 23,000 bopd. We are also excited to commence development on our new asset at the Los Angeles field, along with the greater Block 131 region, with a new drilling rig expected to arrive around mid-year.

Over the past eight months, PetroTal has been actively hedging its 2025 production volumes and has no long-term debt or significant drilling commitments. We are committed to our ongoing capital program which prioritizes a material dividend in tandem with strategic initiatives that include Block 131 development and the erosion control project. I would like to thank shareholders for their continued support, as well as PetroTal’s board of directors and the rest of the PetroTal team for their continued valuable contributions to our success”

The PetroTal story is in very good shape, these annual figures provide very little new for investors and the con call this afternoon wizzed by with few questions. With strong production and capital efficiency that easily beats its peer group, the best asset in the region in the Bretana field it is the model of which its top quality management should be rightly proud.

With a superb record on shareholder payments, (the company paid back total capital of over $65m last year) the shares reward investment with a substantial yield, but the shares should now reward being held with a decent rise giving a capital return to add to that, at 36p a multiple of 5 would not be out of kilter.

Diversified Energy Company

Diversified has announced details regarding the parameters of a Share Buyback Program.

As previously approved at the 2024 Annual General Meeting held on May 10, 2024, the Company has the authority to buy back the Company’s ordinary shares of 20p each (the “Shares”). Under the Program, the Company, at its discretion and on occasion, may (subject to applicable law) purchase its Shares in open market transactions depending on market conditions, share price, trading volume, and other factors.

The Company intends to conduct the Program concurrent with the following parameters:

- The maximum number of Shares repurchased shall not exceed 4,756,842 Shares

- The total consideration of Shares repurchased under the Program shall not exceed an aggregate market value of £52.3 million.

- The Program will expire at the earlier date of the 30 June 2026 or the Company’s 2026 Annual General Meeting of its Shareholders.

The purpose of the Program is to reduce the issued share capital of the Company. The Board believes that this Program will take advantage of a capital allocation opportunity as the Board is of the view that the shares are trading at a substantial discount to net asset value and is an appropriate use of the Company’s cash resources.

Diversified will execute the Program on the London Stock Exchange within the limitations of the shareholder authority granted at the 2024 AGM and the 2025 AGM (if approved) and within the parameters of the Market Abuse Regulation 596/2014/EU and the Commission Delegated Regulation 2016/1052/EU (in each case, as it forms part of UK law pursuant to the European Union (Withdrawal) Act 2018) and Chapter 9 of the Financial Conduct Authority’s Listing Rules. The Company will hold as treasury shares any Shares repurchased in accordance with the provisions of the Companies Act 2006 and will cancel the Shares thereafter. Diversified will make appropriate disclosures during the buyback period of the number of Shares that the Company has repurchased.

As expected and mentioned in the last results call, herewith details of the new share buyback programme. Designed to narrow the discount to net asset value and to be a good use of the company’s cash it should help in market terms.

Touchstone Exploration

Touchstone has reported its operating and condensed financial results for the three months and year ended December 31, 2024. Selected financial information is outlined below and should be read in conjunction with our December 31, 2024 audited consolidated financial statements and related Management’s discussion and analysis, both of which are available under our profile on SEDAR+ (www.sedarplus.ca) and on our website (www.touchstoneexploration.com). Unless otherwise stated, all financial amounts presented herein are in United States dollars, and all production volumes disclosed herein are sales volumes based on Company working interest before royalty burdens.

Paul Baay, President and Chief Executive Officer, commented:

“In 2024, Touchstone maintained its growth trajectory, achieving record annual production and delivering net earnings, driven by a full year of Cascadura production. We successfully drilled, completed, and brought online two wells at the Cascadura C pad, alongside the installation of a new natural gas separator. With most infrastructure now in place, we are well-positioned to accelerate the transition from drilling to production for future wells.

We continued expanding our Trinidad onshore acreage and announced a strategic acquisition, which we are actively working to finalize. The amended loan agreement and related security documents are in progress, with completion expected in the second quarter of 2025. Looking ahead, we will strategically evaluate growth opportunities, factoring in natural gas pricing dynamics while leveraging our extensive land portfolio and infrastructure to enhance efficiency and reduce costs. Above all, safety remains our top priority, ensuring the well-being of our people and the integrity of our operations.“

Nothing new in today’s news, after the CMD and the reserves update it would be unusual to be surprised, even the numbers were in line with expectations. Production last year was 5,734 boe/d up 44% giving revenue up 19% at $57.47m driven by a full year of Cascadura production.

Net earnings were $8.27 million ($0.04 per basic share, $0.03 per diluted share), compared to a net loss of $20.60 million ($0.09 per basic share) in 2023, which included $21.39 million in net non-financial asset impairment expenses.

Apart from that the most important detail is the proposed acquisition of a 65% operating WI in the onshore Central Block e&p licence which comes with four producing natural gas wells and importantly an 80 MMcf/d processing plant. I expect this deal to be completed imminently and only then will the company be able to offer up guidance for 2025 numbers.

Finally, to fund this acquisition cost of $23m and ‘subsequent development activity’ the company is in advanced negotiations with its current lender on two new six-year Term Loan facilities totalling $38.2m. I will update my numbers after the Central Block completes but remain confident that TXP is in good shape and remains a firm favourite, I am meeting management soon for an update so lot’s of good news in the pipeline.

Annual 2024 Financial and Operating Highlights

- Record Production: Achieved annual average production volumes of 5,734 boe/d, a 44 percent increase from 3,981 boe/d in 2023. Production consisted of 1,220 bbls/d of crude oil, 132 bbls/d of NGLs, and 26.3 MMcf/d of natural gas.

- Revenue: Petroleum and natural gas sales totaled $57.47 million, up 19 percent from $48.10 million in 2023. The increase was driven by a full year of Cascadura production, with natural gas sales rising 77 percent, partially offset by a 3 percent decline in crude oil and NGL sales.

Financial Performance:

- Funds flow from operations: $16.75 million, representing a year-over-year increase of 22 percent from $13.73 million recorded in 2023.

- Operating netback: $32.89 million or $15.68 per boe (2023 – $26.22 million or $18.04 per boe).

- Net earnings: $8.27 million ($0.04 per basic share, $0.03 per diluted share), compared to a net loss of $20.60 million ($0.09 per basic share) in 2023, which included $21.39 million in net non-financial asset impairment expenses.

- Capital Program: Invested $23.68 million in development and infrastructure, including four gross (3.6 net) development wells and key upgrades to the Cascadura natural gas processing facility.

- Financial Position: Ended the year with cash of $6.7 million and net debt of $29.11 million, resulting in a net debt-to-funds flow from operations ratio of 1.74 times.

Strategic Portfolio Optimization:

- Divested three non-core properties and acquired the Balata East block, which supports Cascadura NGL marketing.

- Expanded onshore Trinidad acreage by approximately 103,000 working interest acres, securing exploration and production licences within the Herra Formation fairway.

- Safety: Maintained a strong focus on responsible operations, with one lost-time injury recorded in 2024.

- Proposed Acquisition: In December 2024, we signed an agreement to acquire full ownership of a Trinidad-based private entity (the “Proposed Acquisition”), which holds a 65 percent operating working interest in the onshore Central Block exploration and production licence, along with four producing natural gas wells and an 80 MMcf/d gas processing plant in Trinidad.

Fourth Quarter 2024 Financial and Operating Highlights

- Production: Average quarterly production increased to 5,287 boe/d (73 percent natural gas), compared to 5,211 boe/d (75 percent natural gas) in the third quarter of 2024. The increase reflected incremental output from the Cascadura-2ST1 and Cascadura-3ST1 wells brought online in November 2024, partially offset by natural declines in Cascadura field production.

- Revenue: Petroleum and natural gas sales totaled $13.54 million, consistent with the $13.25 million recorded in the previous quarter.

- Crude oil sales: $7.53 million from average production of 1,310 bbls/d at a realized price of $62.50 per barrel.

- NGL sales: $0.7 million from average production of 121 bbls/d at a realized price of $62.05 per barrel.

- Natural gas sales: $5.32 million from average production of 23.1 MMcf/d (3,856 boe/d) at a realized price of $2.50 per Mcf.

- Operating Netback: Generated $6.89 million in operating netback, down 7 percent from the third quarter of 2024. Quarterly operating netbacks averaged $14.17 per boe, an 8 percent decline from $15.46 per boe in the prior quarter, primarily due to a 41 percent increase in operating expenses driven by revised crude oil field historical head licence expenses.

- Funds Flow from Operations: Increased to $3.61 million from $3.02 million in the previous quarter, as lower operating netbacks were offset by reductions in general and administrative and transaction expenses.

- Net Loss: Recorded a net loss of $542,000 ($0.00 per basic share), primarily due to $2.31 million in pre-tax Ortoire exploration asset impairment expenses and higher depletion expenses following Cascadura reserves reductions.

- Capital Investments: Invested $3.11 million in the quarter, primarily focused on the completion of the flowline from the Cascadura C site to the Cascadura natural gas processing facility and pre-drill expenditures relating to the Cascadura-4 well spudded in January 2025.

- Land Expansion: Continued to expand our Trinidad onshore acreage with the execution of an exploration and production licence for the Rio Claro block.

Post Period-end Operating Highlights

- Drilling Update: Drilling at the Cascadura-4 development location resumed on March 12, 2025. We are currently preparing to run intermediate casing.

Production Update: In February 2025, we delivered average net sales volumes of 4,274 boe/d, comprising:

– average net natural gas sales volumes of 18.5 MMcf/d (3,083 boe/d); and

– average net crude oil and natural gas liquid sales volumes of 1,191 bbls/d.

- Cascadura-3ST1 Optimization: Since coming onstream in November 2024, the well has been flowing through 3.5-inch tubing at various wellhead choke sizes. In February 2025, Cascadura-3ST1 produced approximately 90 gross bbls/d of total fluid with a 47 percent oil cut. A workover is planned to install a bottom-hole pump and optimize production in the second quarter of 2025. As of February 2025, the well has produced approximately 11,900 gross barrels of crude oil.

- Acquisition Debt Financing: Touchstone and its lender are in advanced negotiations to secure funding to finance the acquisition and development of the Proposed Acquisition through two additional six-year term loan facilities totaling $38.2 million. An amended loan agreement and related security documents are currently being drafted.

2025 Outlook and Guidance

We remain focused on financial discipline and maximizing value from our development and exploration assets. Our near-term strategy is to increase cash flow through the development of the Cascadura field, leveraging the processing capacity established in 2024.

On December 9, 2024, Touchstone issued a news release announcing the approval of our preliminary financial and operating guidance for 2025. Given the material nature of the Proposed Acquisition, we intend to provide updated guidance following its expected closing, which the Company continues to anticipate occurring in the second quarter of 2025.

Europa Oil & Gas

AIM listed Europa Oil & Gas has announced its unaudited interim results for the five-month period ended 31 December 2024.

Financial Performance

- Revenue £1.2 million (5 months to 31 December 2023: £1.0 million)

- Gross profit £0.3 million (5 months to 31 December 2023: £0.2 million loss)

- Pre-tax loss of £0.3 million (5 months to 31 December 2023: pre-tax loss £0.9 million)

- Net cash used in operating activities £0.1 million (5 months to 31 December 2023: £0.3 million)

- Cash balance at 31 December 2024: £1.0 million (31 July 2024: £1.5 million)

Operational Highlights

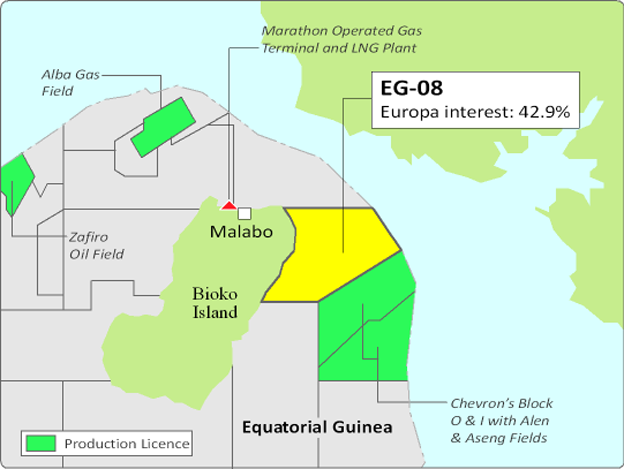

Equatorial Guinea

- Antler began a farmout process in Q4 2024. There has been significant interest in the asset and discussions continue with a number of potential farmin partners. Europa is aiming to receive offers to provide Antler with a full carry on an exploration well targeting the c.900BCF Barracuda prospect in H1 2025

- EG-08 is a highly prospective licence which has three drill-ready prospects, with internally estimated Mean Prospective Resource of 1.48 TCF of gas equivalent with an additional 0.72 TCF prospectivity from a further 6 leads and prospects, resulting in a Mean Prospective Resource of 2.2 TCF of gas equivalent, Chance of success is high (estimated at 80% for Barracuda), due to direct hydrocarbon indications on the seismic.

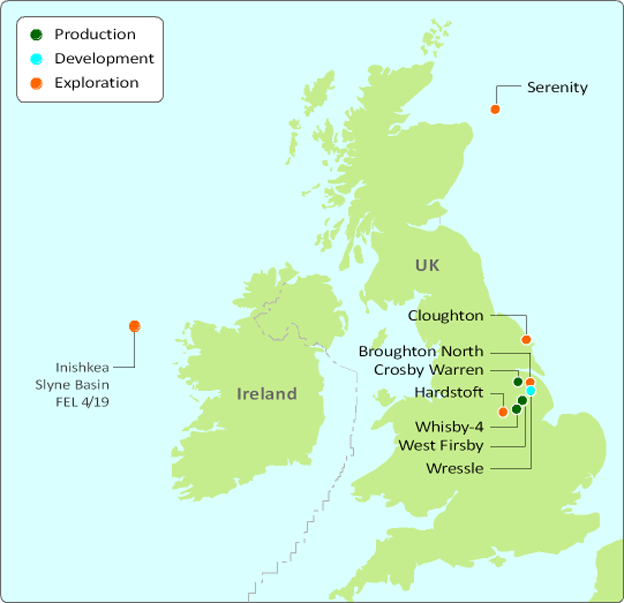

Offshore Ireland - lower risk / very high reward infrastructure-led exploration in proven gas play in the Slyne Basin

- Following the licence extension to 31 January 2026, a farm-out process has recommenced with the aim of bringing in a partner to assist with the drilling of the prospect which has generated interest from a number of parties

- Licence FEL 4/19 contains the Inishkea West gas exploration prospect, which has been mapped as a large four-way closure with a prospective resource Pmean of 1.5 TCF of recoverable gas. Inishkea West is within easy tie-back range of the Corrib gas field situated some 18 kilometres to the southeast

- With compelling economics, which Europa believes will result in a post-tax NPV10 of US$2.0 billion, and a carbon emission intensity of 2.8 kilograms per boe, compared to 36 kilograms per boe for UK imported gas during 2022, the prospect provides a farminee with a very attractive risk reward proposition

- The new Irish government has acted quickly since being elected approving plans to develop a state-led floating LNG terminal. The new minister for energy is seeking to reduce Ireland's exposure to potential disruption of gas supplies and as such it is hoped that the new government will be supportive of the domestic upstream sector

Onshore UK - Cloughton Planning Permission lodged for gas appraisal well, net production increased 18% to 116 barrels of oil per day ("bopd") (5 months to 31 December 2023: 98 bopd) following planned downtime in 2023 offset by natural decline on the Wressle oilfield

- Cloughton gas field appraisal

- The Company continue to progress its Cloughton asset to determine if commercial rates can be obtained using modern completion techniques so that the 192 BCF (Pmean) GIIP potential can be monetised. The planning application for an appraisal well was submitted post period and was recorded by North Yorkshire Council as "duly made" on 5th March 2025. The Company expects to drill the appraisal well in 2026, once all necessary permits have been acquired. Given the proximity to the UK gas network and quality of the natural gas contained within the reservoir, a successful appraisal well could be quickly brought online, displacing LNG imports and reducing global emissions.

- Europa has launched a community engagement website dedicated to its Cloughton gas field appraisal project to provide local residents and stakeholders with information on the project and how the project partners intend to work with local communities. Visit the website via the following link: www.cloughton-community.co.uk

- Total average net production of 116 bopd was produced from Europa's UK onshore fields during the 5-month period with Wressle contributing roughly 84% of this and the remainder coming from the two older fields. Despite higher production levels than the comparative period a weaker average oil price of US$75 (5 months to 31 December 2023 average was US$82) constrained the increase in revenues compared to the prior period

- Wressle production

- Gross production averaged 323 bopd throughout the period (5 months to 31 December 2023: 226 bopd), with Europa's net share equating to 97 bopd (5 months to 31 December 2023: 68 bopd)

- Higher production than the comparative period was a result of a jet pump installation on the Wressle-1 well in 2023 that took three months to complete and resulted in interrupted production between mid-August through to early November 2023. The W1 well continues to produce at the top end of the CPR forecasted production profile

- The Wressle field development plan continues to be progressed. This includes a development well planned to be drilled for the Penistone horizon in H2 2025 and preparation for a second Penistone well and Broughton North exploration well to be drilled in 2026. The Wressle production is complemented by a gas monetisation solution that will be developed in parallel with the Penistone well. The gas monetisation solution is expected to enhance production from the field and substantially increase revenues, as well as eliminate routine flaring. Planning consent was received for the project in September 2024, however the North Lincolnshire Council's decision to grant planning permission was subsequently rescinded following a third party challenge in light of the Finch Supreme Court judgement. The Wressle Joint Venture subsequently completed the newly required scope three emissions report such that the planning application could be approved. The wells will be drilled at the earliest opportunity, once the necessary consents and regulatory approvals have been received

- Termination of the Whisby 4 net profits agreement

- The royalty agreement associated with the Whisby 4 well with BritNRG, the Whisby field operator and licence holder, (the "Agreement") was terminated in December 2024. Recently, the Agreement has not generated any income for the Company and further investment is required to potentially return the Agreement to a cash generating arrangement. Given the technical risks associated with any further investment, it was decided that the Company's capital is better spent on the other assets held by Europa

- The carrying value of the Agreement had been written down to nil in the Company's accounts in previous periods. Upon termination of the Agreement, there are no remaining associated liabilities, since these have been written off by the parties to the Agreement. Derecognition of net accrued liabilities and cash consideration of £28,000 resulted in a £170,000 net gain to the Company

Board changes

- Bo Krøll was appointed to the Board as Non-Executive Director on 12 December 2024 and was subsequently appointed Chairman on 11 February 2025

- Alastair Stuart resigned from the Board on 12 December 2024 but continues to perform the role of Chief Operating Officer

- Brian O'Cathain resigned from the Board on 11 February 2025

Will Holland, CEO of Europa, said:

"With material progress delivered on our Cloughton and Equatorial Guinea assets, the past period has been busy at Europa. The independent reports submitted as part of the planning application for the Cloughton appraisal well highlight that the chosen site is ideal for the well and I look forward to updating the market on the progress with the planning application. In EG, our work has highlighted the quality of the asset and this is understandably generating interest from potential farminees. It was disappointing, although not surprising, to have the Wressle development planning application retrospectively rescinded, but I'm confident that the additional independent emissions report will satisfy the new planning requirements and that the development plan can go ahead as planned.

Despite the lower oil price resulting in a constrained increase in revenues during the interim period, we expect to continue generating meaningful cashflow from our UK assets. This, and the planned activities for the year, sets Europa up well for the future and will allow us to work up our well-balanced portfolio and deliver value for shareholders.

Finally, I'd like to thank Brian O'Cathain. I have very much enjoyed working with Brian over these last years and thank him for the substantial contribution he has made to Europa during this time and the considered guidance he has provided as Chairman. I am confident that he will continue to be one of Europa's active supporters. I wish him every success in his future endeavours."

No surprise here for Europa, a new five month interim will enable a change of year end. But although I’m happy that Equatorial Guinea is progressing well and that Cloughton is on the move there is an inevitable hiatus until something moves. Having said that there is optimism that the future holds enough to remain excited about…

Gulf Keystone Petroleum

Gulf Keystone has announced its results for the full year ended 31 December 2024.

Jon Harris, Gulf Keystone’s Chief Executive Officer, said:

“2024 was a year of strong operational and financial delivery for Gulf Keystone. We have sustained our positive momentum into 2025, with year to date gross average production of c.46,400 bopd, strong local sales demand and a disciplined expenditure programme supporting continued free cash flow generation. As a result, we are pleased to announce today the declaration of a $25 million interim dividend as we reiterate our 2025 operational and financial guidance. We remain focused on facilitating a solution to restart oil exports as we continue to seek fair and transparent agreements regarding payment surety, the repayment of receivables and the preservation of current contract economics.”

Highlights to 31 December 2024 and post reporting period

Operational

- Zero Lost Time or Recordable incidents in 2024, well below the relevant Kurdistan and international peer benchmarks, with safety track record extended to over 790 LTI-free days as at 18 March 2025

- 2024 gross average production of 40,689 bopd, an 86% increase versus the prior year (2023: 21,891 bopd)

- Reflects a full year of local sales in 2024 following the impact of the suspension of pipeline exports in March 2023

- Despite temporary disruptions to truck availability during regional holidays and elections and the impact of the planned PF-1 shutdown in November 2024, strong local market demand from Q2 2024 onwards enabled the return to production at full capacity in several months

- Average realised price for 2024 sales of $26.8/bbl, with prices stabilising in a range of c.$27-$28/bbl in H2 2024

- 2025 year to date (to 18 March 2025) gross average production of c.46,400 bopd:

- Continued strong local market demand, with realised prices averaging between $27-$29/bbl

Shaikan Field estimated reserves

- The Company estimates gross 2P reserves of 443 MMstb as at 31 December 2024, reflecting the Company’s year end 2023 internal estimate of 458 MMstb reduced by gross production of 15 MMstb in 2024

Financial

- Strong financial performance, with a full year of robust local sales combined with capital and cost discipline underpinning a return to free cash flow generation and the restart of shareholder distributions

- Adjusted EBITDA increased 52% to $76.1 million in 2024 (2023: $50.1 million) as higher production more than offset the decline in realised prices related to the transition from exports to discounted local sales

- Revenue increased 22% to $151.2 million (2023: $123.5m) as the increase in 2024 volumes more than offset the 34% decline in average realised price to $26.8/bbl (2023: $40.9/bbl)

- Gross operating costs per barrel decreased 21% to $4.4/bbl (2023: $5.6/bbl), primarily reflecting higher production and a continued focus on efficient operations

- Net capital expenditure of $18.3 million (2023: $58.2 million), reflecting the Company’s disciplined work programme comprised of safety critical upgrades at PF-1 and production optimisation expenditures

- 2024 monthly average net capital expenditure, operating costs and other G&A of $6.8 million, below the Company’s guidance of c.$7 million

- Free cash flow generation of $65.4 million, relative to a $13.1 million outflow in 2023, funding the restart of shareholder distributions and preservation of a robust, debt-free balance sheet:

- $45 million of shareholder distributions in 2024 consisting of $35 million of dividends and $10 million of share purchases completed under the buyback programme launched in May 2024

- 2024 year-end cash balance of $102 million (31 December 2023: $82 million)

- Cash balance as at 19 March 2025 of $115 million

Outlook

- 2025 operational and financial guidance reiterated:

- Gross average production of 40,000 – 45,000 bopd:

- Subject to local market demand remaining at current strong levels

- Continues to reflect assumptions regarding the planned PF-2 shut-in, truck availability during regional holidays and field declines

- Should there be any significant unforeseen disruptions to demand or the restart of pipeline exports, the Company will update its production expectations as appropriate

- Net capital expenditure of $25-$30 million:

- c.$20 million: Safety and maintenance upgrades at PF-2, scheduled for Q4 2025 and expected to require the shut-in of the facility for c.3 weeks, similar to PF-1 in 2024

- $5-$10 million: Production optimisation programme consisting of low cost, quick payback well interventions

- Continue to explore range of additional plant initiatives to enhance production, including water handling, with planned reviews later in 2025 based on the Company’s liquidity position and operating environment

- Operating costs of $50-$55 million and other G&A expenses below $10 million

- Gross average production of 40,000 – 45,000 bopd:

- $25 million interim dividend announced today, the first semi-annual dividend to be paid under the shareholder distributions framework announced on 8 October 2024

- The dividend will be paid on 23 April 2025, based on a record date of 4 April 2025 and ex-dividend date of 3 April 2025

- USD and GBP rate per share to be announced ahead of the payment date based on the Company’s latest total issued share capital

- The recent share buyback programme of up to $10 million, expiring 20 March 2025, has not been renewed in light of the interim dividend declaration and the strength of the Company’s share price

- Share buybacks will continue to be considered opportunistically by the Board

- The Company continues to proactively engage with government stakeholders regarding a solution to enable the restart of Kurdistan crude exports through the Iraq-Türkiye Pipeline:

- Several recent meetings held with the Kurdistan Regional Government and Federal Government of Iraq

- The Company remains ready to resume oil exports provided we have agreements on payment surety for future oil exports, the repayment of outstanding receivables and the preservation of current contract economics

Unfortunately, not being anymore invited to GKP analysts calls etc I find myself unable to make a realistic comment, I normally do this after meeting with the company in one shape of form.

Coro Energy

Coro has announced that it has signed a further addendum to the existing Power Purchase Agreement with Mobile World Group to deliver power at the next 46 MWG solar sites in Vietnam with an aggregate capacity of c.0.8MW. Construction of the sites subject to the PPA Addendum will commence immediately.

As previously announced, the Company signed a Memorandum of Understanding (“MoU”) in Vietnam with MWG granting Coro exclusivity on an initial 900 MWG company sites in the central and southern regions of Vietnam where solar irradiation is the highest in the country. Coro will build, own, and operate each rooftop solar system and sell all generated electricity directly to each Mobile World Investment Corporation location under a 14-year Power Purchase Agreement, extendable in certain circumstances.

The Power Purchase Agreement (“PPA”) was signed on 8 March 2024, and the Company now has 84 sites with MWG currently operational in Vietnam (circa 2.6 MW) with an estimated annual run-rate cash flows to Coro of approximately US$350,000.

The PPA Addendum terms include a variable price with a floor of VND 2,703 per kilowatt hour, an extended term in certain circumstances and are consistent with those previously announced by the Company.

A further addendum for a further 4 sites in Ho Chi Minh City (circa 0.26MW), potentially including a pilot of a co-located battery energy storage system is also expected to be signed shortly. Subject to agreement, this further addendum would bring the total contracted capacity to 3.7MW across 134 sites.

It seems odd that Coro has put out an RNS on this news but yet again not added a comment by the CEO or other director, if that’s the case I’m not sure why I should….?

Prospex Energy

Prospex has announced that it has signed a binding agreement to become the sole shareholder of Tarba Energía S.L. by purchasing the entire shareholding that Warrego Energy Ltd holds in Tarba. Tarba is the company through which Prospex holds its investment in the El Romeral production concessions and associated El Romeral gas-to-power plant situated near Carmona in southern Spain and in the Tesorillo and Ruedalabola exploration permits (currently suspended) in the Cadiz province in southern Spain.

Highlights

- On completion, Prospex will own a 100% indirect working interest in both the El Romeral asset and the Tesorillo and Ruedalabola exploration permits

- Total consideration of €652,725

- Acquisition is being funded entirely by the Company’s capital resources

- Competitive acquisition price equating to US$0.016/mcf or US$0.092/Boe

- Potential to significantly increase production and revenues on the El Romeral concession once the permits to drill the five new wells are approved

- This transaction demonstrates further momentum in building the Company’s investment strategy in European gas and production

Mark Routh, Prospex’s CEO, commented:

“I am extremely pleased to announce the increased ownership in Tarba, the El Romeral concessions and the related gas-to-power plant in Carmona. Importantly the acquisition is being made using accumulated cash reserves from our investment portfolio and is expected to lead to significantly increased production revenue once the permits to drill the five new wells on the EL Romeral concessions are approved.

“In terms of prospective gas resources acquired in the El Romeral asset alone, the equivalent price of US$0.092/Boe is an excellent price by almost any measure. Prospex sees further upside in the concessions with further mapped structures to evaluate and drill once the first five wells have been permitted and drilled.”

A useful deal this for Prospex although increased production and thus revenues from the concession await permits to drill which shouldn’t take very long. Its not an expensive way in and gives Mark and his team carte blanche once all is sorted.

Original article l KeyFacts Energy Industry Directory: Malcy's Blog

KEYFACT Energy

KEYFACT Energy