AIM listed Europa Oil & Gas has announced its unaudited interim results for the five-month period ended 31 December 2024.

Financial Performance

- Revenue £1.2 million (5 months to 31 December 2023: £1.0 million)

- Gross profit £0.3 million (5 months to 31 December 2023: £0.2 million loss)

- Pre-tax loss of £0.3 million (5 months to 31 December 2023: pre-tax loss £0.9 million)

- Net cash used in operating activities £0.1 million (5 months to 31 December 2023: £0.3 million)

- Cash balance at 31 December 2024: £1.0 million (31 July 2024: £1.5 million)

Operational Highlights

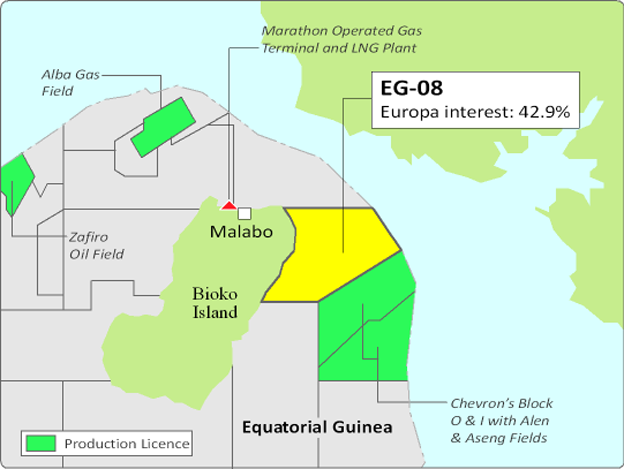

Equatorial Guinea

- Antler began a farmout process in Q4 2024. There has been significant interest in the asset and discussions continue with a number of potential farmin partners. Europa is aiming to receive offers to provide Antler with a full carry on an exploration well targeting the c.900BCF Barracuda prospect in H1 2025

- EG-08 is a highly prospective licence which has three drill-ready prospects, with internally estimated Mean Prospective Resource of 1.48 TCF of gas equivalent with an additional 0.72 TCF prospectivity from a further 6 leads and prospects, resulting in a Mean Prospective Resource of 2.2 TCF of gas equivalent, Chance of success is high (estimated at 80% for Barracuda), due to direct hydrocarbon indications on the seismic.

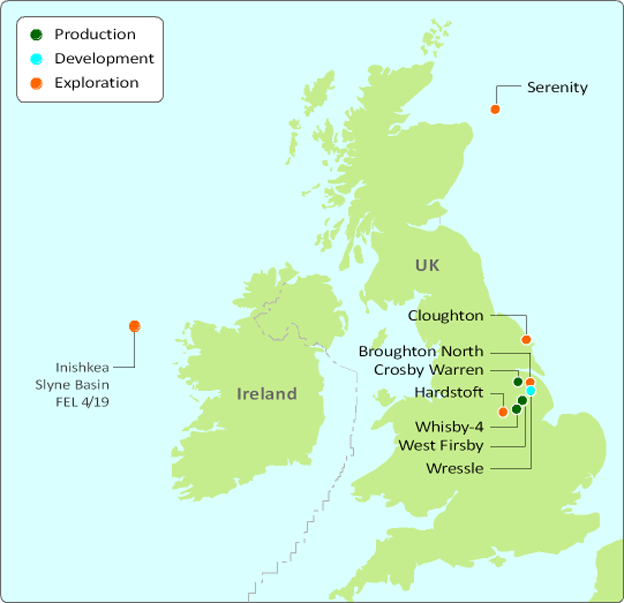

Offshore Ireland - lower risk / very high reward infrastructure-led exploration in proven gas play in the Slyne Basin

- Following the licence extension to 31 January 2026, a farm-out process has recommenced with the aim of bringing in a partner to assist with the drilling of the prospect which has generated interest from a number of parties

- Licence FEL 4/19 contains the Inishkea West gas exploration prospect, which has been mapped as a large four-way closure with a prospective resource Pmean of 1.5 TCF of recoverable gas. Inishkea West is within easy tie-back range of the Corrib gas field situated some 18 kilometres to the southeast

- With compelling economics, which Europa believes will result in a post-tax NPV10 of US$2.0 billion, and a carbon emission intensity of 2.8 kilograms per boe, compared to 36 kilograms per boe for UK imported gas during 2022, the prospect provides a farminee with a very attractive risk reward proposition

- The new Irish government has acted quickly since being elected approving plans to develop a state-led floating LNG terminal. The new minister for energy is seeking to reduce Ireland's exposure to potential disruption of gas supplies and as such it is hoped that the new government will be supportive of the domestic upstream sector

Onshore UK - Cloughton Planning Permission lodged for gas appraisal well, net production increased 18% to 116 barrels of oil per day ("bopd") (5 months to 31 December 2023: 98 bopd) following planned downtime in 2023 offset by natural decline on the Wressle oilfield

- Cloughton gas field appraisal

- The Company continue to progress its Cloughton asset to determine if commercial rates can be obtained using modern completion techniques so that the 192 BCF (Pmean) GIIP potential can be monetised. The planning application for an appraisal well was submitted post period and was recorded by North Yorkshire Council as "duly made" on 5th March 2025. The Company expects to drill the appraisal well in 2026, once all necessary permits have been acquired. Given the proximity to the UK gas network and quality of the natural gas contained within the reservoir, a successful appraisal well could be quickly brought online, displacing LNG imports and reducing global emissions.

- Europa has launched a community engagement website dedicated to its Cloughton gas field appraisal project to provide local residents and stakeholders with information on the project and how the project partners intend to work with local communities. Visit the website via the following link: www.cloughton-community.co.uk

- Total average net production of 116 bopd was produced from Europa's UK onshore fields during the 5-month period with Wressle contributing roughly 84% of this and the remainder coming from the two older fields. Despite higher production levels than the comparative period a weaker average oil price of US$75 (5 months to 31 December 2023 average was US$82) constrained the increase in revenues compared to the prior period

- Wressle production

- Gross production averaged 323 bopd throughout the period (5 months to 31 December 2023: 226 bopd), with Europa's net share equating to 97 bopd (5 months to 31 December 2023: 68 bopd)

- Higher production than the comparative period was a result of a jet pump installation on the Wressle-1 well in 2023 that took three months to complete and resulted in interrupted production between mid-August through to early November 2023. The W1 well continues to produce at the top end of the CPR forecasted production profile

- The Wressle field development plan continues to be progressed. This includes a development well planned to be drilled for the Penistone horizon in H2 2025 and preparation for a second Penistone well and Broughton North exploration well to be drilled in 2026. The Wressle production is complemented by a gas monetisation solution that will be developed in parallel with the Penistone well. The gas monetisation solution is expected to enhance production from the field and substantially increase revenues, as well as eliminate routine flaring. Planning consent was received for the project in September 2024, however the North Lincolnshire Council's decision to grant planning permission was subsequently rescinded following a third party challenge in light of the Finch Supreme Court judgement. The Wressle Joint Venture subsequently completed the newly required scope three emissions report such that the planning application could be approved. The wells will be drilled at the earliest opportunity, once the necessary consents and regulatory approvals have been received

- Termination of the Whisby 4 net profits agreement

- The royalty agreement associated with the Whisby 4 well with BritNRG, the Whisby field operator and licence holder, (the "Agreement") was terminated in December 2024. Recently, the Agreement has not generated any income for the Company and further investment is required to potentially return the Agreement to a cash generating arrangement. Given the technical risks associated with any further investment, it was decided that the Company's capital is better spent on the other assets held by Europa

- The carrying value of the Agreement had been written down to nil in the Company's accounts in previous periods. Upon termination of the Agreement, there are no remaining associated liabilities, since these have been written off by the parties to the Agreement. Derecognition of net accrued liabilities and cash consideration of £28,000 resulted in a £170,000 net gain to the Company

Board changes

- Bo Krøll was appointed to the Board as Non-Executive Director on 12 December 2024 and was subsequently appointed Chairman on 11 February 2025

- Alastair Stuart resigned from the Board on 12 December 2024 but continues to perform the role of Chief Operating Officer

- Brian O'Cathain resigned from the Board on 11 February 2025

Will Holland, CEO of Europa, said:

"With material progress delivered on our Cloughton and Equatorial Guinea assets, the past period has been busy at Europa. The independent reports submitted as part of the planning application for the Cloughton appraisal well highlight that the chosen site is ideal for the well and I look forward to updating the market on the progress with the planning application. In EG, our work has highlighted the quality of the asset and this is understandably generating interest from potential farminees. It was disappointing, although not surprising, to have the Wressle development planning application retrospectively rescinded, but I'm confident that the additional independent emissions report will satisfy the new planning requirements and that the development plan can go ahead as planned.

Despite the lower oil price resulting in a constrained increase in revenues during the interim period, we expect to continue generating meaningful cashflow from our UK assets. This, and the planned activities for the year, sets Europa up well for the future and will allow us to work up our well-balanced portfolio and deliver value for shareholders.

Finally, I'd like to thank Brian O'Cathain. I have very much enjoyed working with Brian over these last years and thank him for the substantial contribution he has made to Europa during this time and the considered guidance he has provided as Chairman. I am confident that he will continue to be one of Europa's active supporters. I wish him every success in his future endeavours."

KeyFacts Energy: Europa Oil & Gas UK country profile

KEYFACT Energy

KEYFACT Energy