WTI (Apr) $67.58 +40c, Brent (May) $71.07 +49c, Diff -$3.49 +9c

USNG (Apr) $4.02 -8c, UKNG (Apr) 101.42p -1.03p, TTF (Apr) €41.31 -€0.20

Oil price

With the Fed meeting today and tomorrow announcing its latest moves, no change according to watchers as the US economy is too hard to read. But oil has rallied a bit further after last weeks gains, this is primarily down to military activity from the US against the Houthi rebels and last night’s attacks by Israel against Hamas targets in Gaza.

Genel Energy

Genel has announced its audited results for the year ended 31 December 2024.

Paul Weir, Chief Executive of Genel, said:

“In 2024, we demonstrated further progress on our journey of building towards delivering resilient, diversified cash flows. Our shift from cash outflow in 2023 to cash generation in 2024 has been important, and in 2025 we expect the cash generated by the Tawke PSC to continue to cover our costs. We are delighted to have established a footprint in the Sultanate of Oman, through our award of an interest in Block 54. This is the first step on our roadmap to diversification.

For 2025, we remain focussed on three principal objectives: maintenance of a strong balance sheet; resilient cash generation from the core business; and the addition of new assets.

For new assets, we will seek both to increase that footprint in Oman, and also acquire assets in other preferred jurisdictions that we have identified as attractive to Genel, with a focus on adding production assets that increase the cash generation and resilience of the business, and provide potential for further growth.

In the Kurdistan Region of Iraq (‘KRI’) we continue to work with our peers and the Regulator towards the restart of exports on the right terms to ensure our contracts are honoured and we are paid what we are due.”

I’m as confident about where Genel is now as I’ve been for a while, with a strong balance sheet, exciting new territory and at least some visibility in Kurdistan the future is evidently positive. Now, admittedly the pipeline is not yet open yet but my read of the situation is that everyone with an interest in it has a good reason to make it happen.

The frequency of the meetings concerning the pipeline has increased, if it’s not either Government in the region it might be the US or someone lobbying for the IOC’s concerned. To me it seems that one way or another parties want to get something done, not just a contract but a proper payment process and with agreement between Baghdad and Erbil, watch this space.

Readers know that I am a very big fan of Oman as a venue for investment in the Middle East and I congratulate Genel on their getting into Block 54, my contacts out there confirm the view that getting in at all is not easy but they have made a cracking start. I think that the big takeaway from the deal is that it’s not just a quick grab and see what happens, I see it as a genuine investment which ideally can become a major part of Genel’s portfolio with fantastic long term appeal.

As part of the M&A process, the company has launched a new bond issue, quite how much they raise is unknown, around $100m would be enough to give a bit of a boost to expansion plans but they aren’t going mad, just enough to de-risk the debt balance and no one wants to be over exposed at the wrong time in these markets…

I have not mentioned production or pricing, it’s been well documented and whilst the company has done remarkably well under the circumstances, it may just be that when the pipeline is open again there remains a local market selling crude to refineries nearby.

I have no hesitation in keeping Genel in the Bucket List, I’m really confident that management are right on the case with the day to day but looking further out with regards M&A and in dealings with the KRG which I think bodes well for the company.

Results summary ($ million unless stated)

| 2024 | 2023 | |

| Average Brent oil price ($/bbl) | 81 | 82 |

| Average realised price per barrel | 35 | 47 |

| Production (bopd, working interest) | 19,650 | 12,410 |

| Revenue | 74.7 | 78.4 |

| Production costs | (17.6) | (18.0) |

| EBITDAX(1) | 1.1 | 33.3 |

| Operating loss | (52.4) | (10.3) |

| Cash flow from operations | 66.9 | 55.1 |

| Capital expenditure | 25.7 | 68.0 |

| Free cash flow | 19.6 | (71.0) |

| Cash | 195.6 | 363.4 |

| Total debt | 65.8 | 247.8 |

| Net cash | 130.7 | 119.7 |

| Basic LPS from continuing operations (¢ per share) | (22.5) | (6.1) |

- EBITDAX is operating loss adjusted for the add back of depreciation and amortisation, exploration expense, net write-off/impairment of oil and gas assets and net ECL/reversal of ECL receivables

Highlights

- Working interest average production increased by 58% to 19,650 bopd (2023: 12,410 bopd)

- All production sold into the domestic market at average $35/bbl consistent with prior year (2023: $47/bbl, which included export sales prices in Q1)

- Free cash flow of $20 million, compared to free cash outflow of $71 million last year

- Tawke free cash flow generation from domestic sales was over $70 million (2023: $28 million), benefiting from some offsetting and also positive working capital movements of around $30 million

- Organisation cost reductions were offset by non-repeating costs on arbitration, closing out unprofitable licences at Taq Taq and Sarta, and finalising exit from Qara Dagh

- Closing net cash of $131 million, an increase from $120 million at the start of the year

- Cash of $196 million (2023: $363 million), with bond debt reduced from $248 million at the start of the year to $66 million at year-end from buybacks and partial exercise of call option

- $107 million (under KBT pricing and excluding interest) remains overdue from the Kurdistan Regional Government (‘KRG’) to the Genel subsidiary Genel Energy International Limited (‘GEIL’) for sales made in previous years. The Company owes the KRG around $50 million. We continue to work towards a plan for payment or settlement of amounts owed, and appropriate adjustment for price and interest

- We were disappointed that in December 2024 the subsidiary, Genel Energy Miran Bina Bawi Limited (‘GEMBBL’), lost the arbitration case brought against it by the KRG regarding the Miran and Bina Bawi gas assets. As previously announced, the KRG is seeking a costs award of over $36 million against GEMBBL

- Last week, the Company announced its award of an interest in Block 54 in the Sultanate of Oman. This new country entry is an important first step towards strategic diversification of our business

- Average portfolio carbon intensity again expected to be under 14 kgCO2e/bbl, remaining below the current target for industry average

- Climate rating: maintained a CDP Climate score of B for a third consecutive year

OUTLOOK

- With domestic sales demand at similar levels to last year and year to date this year, the Company expects cash generation from the Tawke PSC to cover its organisational costs

- The Company continues to progress towards building a business with a strong balance sheet that delivers resilient, reliable, repeatable and diversified cash flows that supports a dividend programme. The Company objectives for the year on the path to building that business include:

- acquisition of new assets in Oman and other targeted jurisdiction to add reserves and diversify our cash generation

- restart of exports to access international pricing

- recovery of net amounts owed by the KRG

- further progress towards drilling Toosan-1

- The Company has engaged Pareto Securities AS as Manager and Bookrunner to arrange fixed income investor meetings. Subject to market conditions and acceptable terms, a new senior unsecured bond issue with a tenor of five years may follow.

Genel has engaged Pareto Securities AS as Manager and Bookrunner to arrange fixed income investor meetings. Subject to market conditions and acceptable terms, a new senior unsecured bond issue with a tenor of five years may follow. The purpose of the bond issue is to refinance the remaining outstanding senior unsecured bonds with maturity in October 2025 (ISIN NO 0010894330) and general corporate purposes.

Seascape Energy Asia

Seascape has announced it has completed the farm-out of a 42.5% participating interest in the Block 2A Production Sharing Contract (the “PSC” or “Block 2A”) to INPEX CORPORATION.

Seascape retains a 10% participating interest in Block 2A (the “Retained Interest”) through its wholly owned subsidiary, Topaz Number One Limited (“TNOL”) providing its shareholders with material exposure to the Kertang prospect (gross ~1.7 billion boe) at nil cost.

Following completion of the Transaction, the Company estimates that at end Q1-25 it will have unaudited cash balances of approximately US$12 million (£10 million).

New business activity remains a priority for the Company and Seascape is actively pursuing growth opportunities through both ground-floor initiatives and potential M&A with an ambition of materially expanding its portfolio during the year.

Investor Meet Company

Nick Ingrassia (CEO) and James Menzies (Executive Chairman) will host a live presentation for investors via Investor Meet Company at 10:00 AM GMT on Wednesday19 March 2025.

The presentation is open to all existing and potential shareholders. Questions can be submitted pre-event via your Investor Meet Company dashboard up until 9:00 AM GMT on Wednesday 19 March 2025, or at any time during the live presentation.

Investors can sign up for free via: https://www.investormeetcompany.com/seascape-energy-asia-plc/register-investor. Investors who follow Seascape Energy on the Investor Meet Company platform will automatically be invited.

Nick Ingrassia, CEO of Seascape, commented:

“I would like to express my gratitude towards MPM and our partners, INPEX CORPORATION, PETRONAS Carigali and Petros for moving the farm-out of Block 2A to completion so quickly. We believe the world-class Kertang prospect remains one of the largest, undrilled structures in Sarawak and we look forward to supporting the partnership in moving the prospect forward towards drilling.

“Proceeds from the Transaction provides Seascape with funding to pursue exciting growth opportunities in Malaysia and wider Southeast Asia and highlights the vital role that nimble, forward thinking, independent E&P companies have to play in the regional upstream ecosystem.”

It is good to see the completion of this excellent deal, given that the company are presenting tomorrow I will comment further after that.

Chariot

Chariot has announced that Etana Energy, the South African electricity trading platform, has secured a US$55million (R1billion) guarantee finance facility alongside an equity investment of up to US$20million (R372million) from Standard Bank and Norfund. Standard Bank is the largest bank in Africa and Norfund is a Norwegian state investment fund focused on developing countries.

Etana is owned by Chariot (49%) and H1 Holdings (Pty) Limited (51%) and is focused on providing competitive, sustainable end-to-end energy solutions through the connecting of power generation projects to commercial and industrial users by wheeling electricity across South Africa’s national grid.

Transaction highlights:

- US$55million of guarantee finance from Standard Bank on behalf of Etana, in addition to the US$100million secured from British International Investment and GuarantCo, previously announced on 4 December 2024, unlocks new renewable projects by providing developers with the revenue certainty needed to reach financial close and commence construction

- Up to US$20million equity investment to support Etana’s growth and working capital requirements through to its first revenues

- Standard Bank and Norfund, in return for the guarantee and equity finance, are to be issued preference share capital in Etana which will give them an effective economic interest of 10% and 20% respectively. The preference share capital is redeemable at the option of the Ordinary Shareholders

- Funding package has enabled the first financial close of a solar generation project, the Mulilo 75MW Du Plessis Dam, with further renewable projects anticipated to close in the near term

Adonis Pouroulis, CEO of Chariot, commented:

“With this financing we welcome two further significant institutions, Standard Bank and Norfund, into the Etana business, a company which we co-founded. This transaction provides balance sheet support, combined with an equity investment which will unlock further generation projects, fund rapid, scalable growth and lead to material revenues from both Etana and potential future direct participation in generation projects. This clearly endorses the value that we see within the electricity trading platform which is looking to provide much needed long term, cleaner and competitive energy across South Africa.”

Chariot has also announced that Etana Energy (Pty) Limited, the South African electricity trading platform has signed a 20-year Power Purchase Agreement for the entire supply from the 75MW (105MWDC installed capacity) Du Plessis Dam PV2 solar project. This project has now reached financial close and will be constructed by Mulilo, a leading renewable energy developer and independent power producer in South Africa. Etana, owned by Chariot (49%) and H1 Holdings (Pty) Limited (51%) is focused on providing competitive, sustainable end-to-end energy solutions through the connecting of power generation projects to commercial and industrial users by wheeling electricity across South Africa’s national grid.

- Du Plessis Dam PV2 is the first solar generation project to reach financial close as part of Etana’s larger renewable power offtake portfolio

- Construction of this project, which is located in South Africa’s Northern Cape, will commence in Q2 2025

- Guarantee finance of US$155m, as separately announced, has underpinned Etana’s bankability and enabled this transaction

Adonis Pouroulis, CEO of Chariot, commented:

“Construction starting on the Du Plessis 75MW solar project marks a key milestone for Etana, our joint venture energy trading business, which will start generating meaningful revenues once this project is in production. This is the first solar generation project within Etana’s initial offtake portfolio with others progressing to financial close. There has been oversubscribed demand from industrial and commercial customers looking for long term, sustainable supply and we believe we have a very scalable business that is at the forefront of helping to resolve the energy situation in South Africa. I would like to thank all the partners and stakeholders involved in this transaction and we look forward to providing further updates on Etana’s growth and expansion, and also to updating shareholders on Chariot’s participation in other projects.”

A good view today from Chariot with regard to its US$75m financing from Standard Bank and Norfund into its Etana business, its South African electricity trading joint venture, making it a seriously substantial company in its own right and becoming an electricity utility with funding by these ‘significant’ institutions meaning it is now fully funded.

Going forward the company gets ‘balance sheet support, combined with an equity investment which will unlock further generation projects, fund rapid, scalable growth and lead to material revenues from both Etana and potential future direct participation in generation projects’.

The way that the deal is structured with the guarantee financing investment alongside equity cash puts Chariot in a very strong position and it also creates a look through valuation for Etana which suggests it is higher than the current market cap. As CEO Adonis Pouroulis states, ‘this clearly endorses the value that we see within the electricity trading platform which is looking to provide much needed long term, cleaner and competitive energy across South Africa’.

Jadestone Energy

Jadestone has announced that it has submitted a field development plan for the Nam Du/U Minh (“NDUM”) discoveries offshore southwest Vietnam to Petrovietnam, commencing the regulatory approval process.

The FDP sets out a phased development concept for NDUM, which is based on unmanned wellhead platforms at each of the Nam Du and U Minh fields tied back to an FPSO, with processed gas exported onshore through a 34 km pipeline tied into an existing trunkline to the Ca Mau industrial complex in southwest Vietnam. The first phase of the FDP envisages the Nam Du field initially being brought onstream, accelerating first gas to Vietnam and revenues to Jadestone to help fund the development of U Minh production in the second phase. The FDP contemplates drilling two wells from each platform to support a plateau rate of 80MMscf/d. Following receipt of Petrovietnam’s endorsement, the FDP will be considered for approval by the Ministry of Industry and Trade.

The next steps in the development process include finalising the gas sales agreement, which is well advanced with the gas buyer, to formalise the heads of terms agreed in January 2024. A financing plan, which could involve bringing in development partners, would be progressed in parallel with major contract tenders (including the EPCI contract and FPSO), with both finalised prior to project FID and any significant expenditure.

The Nam Du and U Minh fields are located offshore southwest Vietnam in shallow waters of 50-60 meters. The fields are located on the Block 46/07 and Block 51 PSCs respectively, which Jadestone operates with 100% working interests. Nam Du and U Minh have been independently assessed to contain gross aggregate 2C resources of 171.3 Bscf of gas and 1.6 MMbbls of liquids.

Adel Chaouch, Executive Chairman of Jadestone, commented:

“Our Vietnam gas assets are fundamental to Jadestone’s investment case and are central to our strategic aim of being the leading Asia-Pacific upstream independent. Development of the discovered resource base will drive significant organic growth and value creation for our shareholders, with further material upside possible from additional prospects and leads across our licence position.

Submission of an FDP is therefore a major milestone in the commercialization of the Nam Du/U Minh discoveries and demonstrates real momentum in our engagement with the Vietnam government. The development of Nam Du/U Minh would be a win-win for both Jadestone and Vietnam, delivering affordable gas supplies with a lower GHG intensity to the southwest of the country, creating and sustaining jobs and economic benefits.”

I’m a big fan of Vietnam and have always liked this particular asset so the fact that they are prioritising them is welcome news. Gas demand is high, as are prices and this home bred winner should create more value than bought in items…

Afentra

Afentra has noted the recent press speculation in African Intelligence and confirms that Afentra, and another of its joint venture partners, is in discussions to acquire the interests in Blocks 3/05 (10%) and 3/05A (13.5%) held by Etu Energias.

There can be no certainty that the transaction to acquire the Etu Interests will proceed. Should any such acquisition proceed, Afentra would utilise existing cash resources to fund the transaction and the transaction would be subject to a number of customary closing conditions, including regulatory and government approvals. Further updates will be made as appropriate.

Afentra continues to work with the Block 3/05 and 3/05A operator, Sonangol, and our joint venture partners on an ongoing redevelopment plan for the assets which is delivering both increased production and reserves. We are pleased with the collaborative progress being made alongside Sonangol as operator and remain focused on supporting the joint efforts to unlock further value from these assets.

This RNS has just come through so no opportunity to catch Paul McDade who will be busy doing this typically very smart deal. Lots of bidders apparently and if Afentra are in with Maurel & Prom a deal which my spies tell me would be accretive which I like very much indeed.

My spies also tell me that there may be higher bids around, but that Afentra has a good reputation for being dependable and has history in closing deals professionally and the relationship with Sonangol is of the highest order.

On a recent call with Paul I asked him about buying in any spare pieces of these blocks as they clearly make a great deal of sense, this is in line with managements’s long term plans and building through cash, accretive deals like this which add reserves and production are no-brainers..

In the Bucket list for a reason, Afentra has a target price of 100p, I am highly confident that it will have been increased before long, top management, great assets first class returns…

Sintana Energy

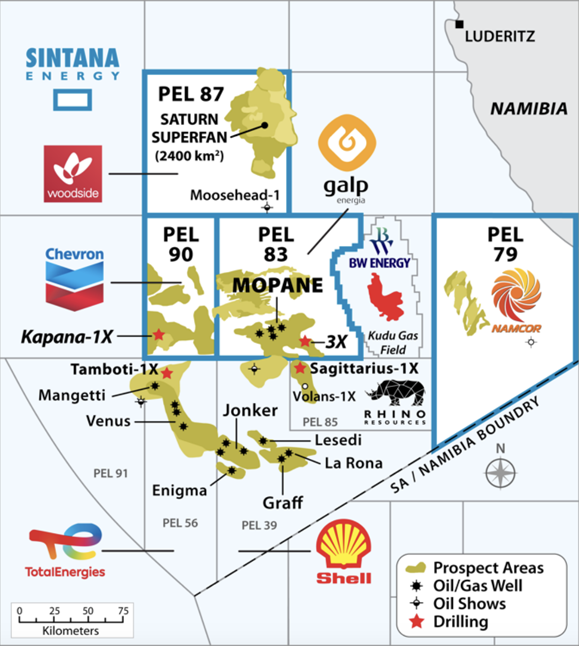

Sintana Energy provides the following update regarding developments associated with blocks 2713A and 2713B located in Namibia’s Orange Basin. The blocks are governed by Petroleum Exploration License 87 (“PEL 87”) which is operated by Pancontinental Orange Pty Ltd., a subsidiary of Pancontinental Energy, who maintains a 75% interest in PEL 87. Additionally, Custos Investments maintains a 15% interest and NAMCOR maintains a 10% interest. Sintana has a 49% indirect interest in Custos.

Pancontinental has received notification from Woodside Energy (GOM) Inc. that Woodside has elected not to exercise its option to farm-in to the PEL 87 project. This notice has been received in advance of the long stop date of May 18th, 2025, after which Woodside's option was due to expire.

A process is underway to secure an alternate farm-in partner to fund exploration drilling within PEL 87 at the earliest opportunity.

Significant prospectivity has been identified by the high quality 6,593 km² 3D seismic dataset that was fully funded by Woodside. Subsequent interpretation and evaluation has returned an inventory of intra-Saturn leads and prospects which are estimated to be consistent in size and scale to the discoveries made to date in the Orange Basin. Pancontinental, together with the Joint Venture partners, is continuing to mature and refine a growing inventory on PEL 87.

“We look forward to deploying our portfolio of relationships with operators including the supermajors to bring forward the potential of PEL 87.” said Knowledge Katti, Chairman and Chief Executive Officer of Custos and a director of Sintana.

“The extensive dataset arising from the seismic acquisition campaign funded by Woodside, together with the continuing work to define and refine a significant inventory of leads and prospects, position the PEL 87 partners to expedite farm-in discussions.” added Robert Bose, CEO of Sintana. “PEL 87 is an integral part of our Orange Basin portfolio.” he added.

This is a very interesting situation but not one that is a great surprise, the scale and complexity of the Saturn complex has only recently become apparent and whilst there is a ‘significant prize’ here the scale and scope of which will require a material commitment of time and resources to unveil.

Accordingly it has become clear, even to me, that Woodside are simply not in a position to fund their share of the development on their own. This is particularly as they have been increasingly focusing on the LNG and gas development side of the business, these tend to carry IRR and payback targets of 15%+ and 5 years, the latter being hard to fit here. Accordingly they were unlikely to be able to stay with PEL 87 given the required commitment, a decision that I hear went right to the top…

The other thing that is becoming obvious is that Pancontinental has been developing ‘some fatigue’ on what has become a somewhat protracted process. Given that in recent months there has been a lot of activity, a great deal of progress in the basin and independent work which has resulted in a world class asset in both size and quality.

Finally, having seen all this activity it seems that given the red hot nature of the Basin, bringing with it the best companies with the fattest wallets, and indeed smartest partners, other conversations are taking place. I think that going forward this is good news for the partners, although it may be short term pain the long term gain is ‘huge’ according to my expert inside the tent.

Original article l KeyFacts Energy Industry Directory: Malcy's Blog

KEYFACT Energy

KEYFACT Energy