Thunder Said Energy are going to boldly predict a sea change is coming in North Sea oil and gas policy, as Europe backtracks on recent kamikaze energy policies. And could this halve the UK's incentive gas price from $13.5/mcf to $7/mcf?

The UK's domestic gas production has now halved from 6bcfd in 2009 to a new 50-year low of 3bcfd in 2024. Also since 2009, LNG imports have doubled from 1bcfd to 2bcfd in 2023, and piped imports ran flat at 4bcfd.

Sacrificing self-sufficiency is not a great strategy in an adversarial world.

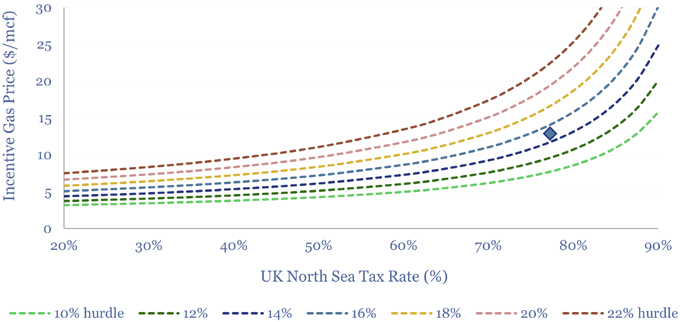

So what incentive price would an investor need, to go out, lease some acreage, shoot some seismic, drill exploration wells, and develop a relatively decent new 250Mboe UK gas discovery, with an F&D cost of $7/boe and life-cycle opex of $7/boe? Our answer is $13.5/mcf, as is charted above.

The current UK tax rate is one reason, at 78% (up from 62% half a decade ago, thanks to a Windfall Tax that runs through 2030). This policy makes sense for a government looking to maximize rents from a declining resource, while sourcing incremental gas needs from $8-10/mcf imports.

Environmental mood music is another reason, as a growing focus on decarbonization warrants a 15-20% hurdle rate. For example, Greenpeace just won a court case in January-2025, blocking the in-progress Jackdaw and Rosebank developments, because of their Scope 3 emissions.

This just in. Russia does not care about Scope 3 emissions, but it does have a domestic gas price of $1.8/mcf, which it uses to produce cheap explosives/drones, in order to kill Ukrainians. The US apparently no longer cares about Scope 3 (or about Russia), but enjoys a $2-3/mcf wellhead price. China does not care about Scope 3 emissions, as it burns 5GTpa of coal.

"So why are a relatively small number of relatively small countries futilely going it alone in reducing emissions, at economic and geopolitical costs to their competitiveness and populations", voters will increasingly be asking.

If UK policymakers ever became serious about lowering import reliance, and bolstering domestic production, then the exact same 250Mboe resource above could be unlocked for a $6-7/mcf incentive price, at a 60-65% tax rate and a 12% WACC. It may not be a 2025 event. But we increasingly think that more pragmatic policies are coming to Europe...

KeyFacts Energy Industry Directory: Thunder Said Energy

KEYFACT Energy

KEYFACT Energy