W&T Offshore reports operational and financial results for the fourth quarter and full year 2024.

Key highlights for the fourth quarter of 2024, the full year 2024 and since year end 2024 include:

Delivered production in full year 2024 of 33.3 thousand barrels of oil equivalent per day (“MBoe/d”) (43% oil), or 12.2 million barrels of oil equivalent (“MMBoe”). This production was within the Company’s guidance range despite impacts from three hurricanes in the Gulf of America (“GOA”) and other downtime which was mainly related to the Cox acquisition (as defined below);

- Achieved mid-point of the guidance for annual oil production and increased it by 4% year-over-year;

- Produced 32.1 MBoe/d (43% oil) or 3.0 MMBoe in fourth quarter 2024, within W&T’s guidance range;

- Announced the Main Pass 108 and 98 fields as well as the West Delta 73 field are expected to come back online in the second quarter of 2025;

- Increased year-end 2024 proved reserves at SEC pricing to 127.0 MMBoe, with oil reserves increasing 39%;

- Reported a standardized measure of discounted future net cash flows of $740.1 million and a present value of estimated future oil and natural gas revenues, minus direct expenses, discounted at a 10% annual rate (“PV-10”) of $1.2 billion, a 14% increase compared to PV-10 for year-end 2023, despite lower SEC pricing;

- Benefited from acquisitions totaling 21.7 MMBoe, along with positive well performance and technical revisions of 5.0 MMBoe, partially offset by 10.5 MMBoe of negative price revisions and 12.2 MMBoe of production for the year, resulting in replacement of 219% of 2024 production with new reserves

Tracy W. Krohn, W&T’s Chairman of the Board and Chief Executive Officer, commented,

“We delivered solid results in 2024 thanks to our continued commitment to executing on our strategic vision focused on free cash flow generation, maintaining solid production and maximizing margins. We generated strong Adjusted EBITDA of $153.6 million and Free Cash Flow of $44.9 million for full year 2024. This was achieved despite limited contribution from the Cox acquisition as we continued to work on enhancing long-term value for these assets at the expense of deferring some near-term production. Some of this benefit is already reflected in our year-end reserves, which saw a 39% increase in oil reserves, and our PV-10 increased by almost $150 million, despite lower SEC pricing compared to year end 2023. We replaced production by over 200% with our positive revisions and acquisitions. Our focus on cost control and capturing synergies associated with our asset acquisitions contributed to our LOE coming in at the bottom end of our reduced guidance range. In addition, we are expecting further production uplift associated with the remaining fields from the Cox acquisition coming online in the second quarter of 2025 that have been shut in so that we could improve the facilities and transportation of production to enhance safety and efficiency of operations in the future.”

“In early 2025, we strengthened our balance sheet by closing the new 10.75% Notes, entered into a new revolving credit facility and added material cash through a non-core disposition and an insurance settlement. The new 10.75% Notes have an interest rate 100 basis points lower than our 11.75% Notes and received improved credit ratings from S&P and Moody’s, had a broad distribution including international investors and were significantly oversubscribed. We also received a $58.5 million cash insurance settlement payment related to a well loss event. Finally, we sold our non-core interests for $11.9 million after customary closing adjustments in Garden Banks 385 and 386 at over $60,000 per flowing barrel which is highly accretive to W&T. This further demonstrates the value of our assets and our ability to divest our properties at attractive multiples.”

Mr. Krohn concluded,

“As we progress through 2025 with a stronger balance sheet, we remain poised to take advantage of potential acquisitions that will be accretive to our stakeholders. We remain committed to enhancing shareholder value and returning value to our shareholders through the quarterly dividend in place since November 2023. Our strategy has proven to be sustainable over the past 40 plus years, and we are well-positioned to continue to successfully execute it in the future.”

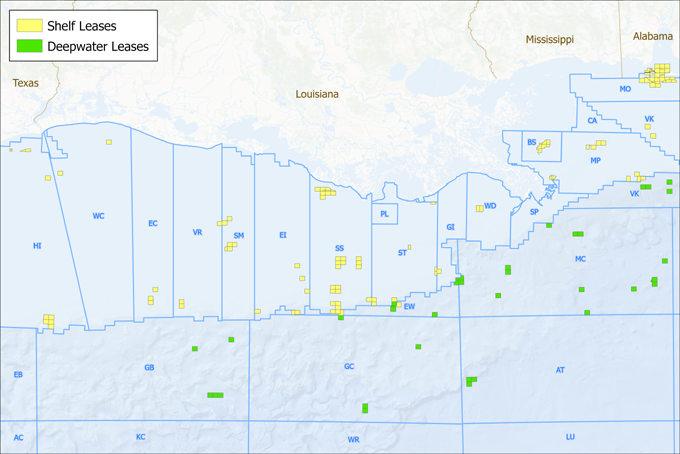

W&T acreage in the Gulf of Mexico

Production, Prices and Revenue: Production for the fourth quarter of 2024 was 32.1 MBoe/d, within the Company’s fourth quarter guidance and up 4% compared with 31.0 MBoe/d for the third quarter of 2024 and down compared with 34.1 MBoe/d for the corresponding period in 2023. Production in the second half of 2024 was temporarily reduced mainly due to multiple named storms and third-party downtime. Fourth quarter 2024 production was comprised of 13.7 thousand barrels per day (“MBbl/d”) of oil (43%), 3.0 MBbl/d of natural gas liquids (“NGLs”) (9%), and 92.4 million cubic feet per day (“MMcf/d”) of natural gas (48%).

W&T’s average realized price per Boe before realized derivative settlements was $39.86 per Boe in the fourth quarter of 2024, a decrease of 5% from $41.92 per Boe in the third quarter of 2024 and a decrease of 4% from $41.55 per Boe in the fourth quarter of 2023. Fourth quarter 2024 oil, NGL and natural gas prices before realized derivative settlements were $68.71 per barrel of oil, $24.59 per barrel of NGL and $2.85 per Mcf of natural gas.

Revenues for the fourth quarter of 2024 were $120.3 million, which were slightly lower than the third quarter of 2024 revenues of $121.4 million driven by lower realized prices for oil. Fourth quarter 2024 revenues were approximately 9% lower than $132.3 million of revenues in the fourth quarter of 2023 due to lower average realized prices and lower production volumes.

Lease Operating Expenses: LOE, which includes base lease operating expenses, insurance premiums, workovers and facilities maintenance expenses, was $64.3 million in the fourth quarter of 2024, which was 12% below the low end of the previously provided guidance range of $73.0 to $81.0 million. LOE came in lower than expected as the Company continued to realize synergies from asset acquisitions in late 2023 and early 2024. LOE for the fourth quarter of 2024 was approximately 11% lower compared to $72.4 million in the third quarter of 2024 primarily due to favorable audit adjustments, an increase in royalty credits and lower repairs and maintenance costs. LOE for the fourth quarter of 2024 was essentially flat compared to $64.6 million for the corresponding period in 2023. On a component basis for the fourth quarter of 2024, base LOE and insurance premiums were $53.5 million, workovers were $0.9 million, and facilities maintenance and other expenses were $9.9 million. On a unit of production basis, LOE was $21.76 per Boe in the fourth quarter of 2024. This compares to $25.37 per Boe for the third quarter of 2024 and $20.61 per Boe for the fourth quarter of 2023, reflecting a decrease in production in the periods.

Full Year-End 2024 Financial Review

W&T reported a net loss for the full year 2024 of $87.1 million, or $(0.59) per diluted share, and Adjusted Net Loss of $67.6 million, or $(0.46) per diluted share. For the full year 2023, the Company reported net income of $15.6 million, or $0.11 per diluted share, and Adjusted Net Loss of $21.7 million, or $(0.15) per diluted share. W&T generated Adjusted EBITDA of $153.6 million for the full year 2024 compared to $183.2 million in 2023. The year-over-year decrease was primarily driven by lower oil and natural gas prices and decreased production. Revenues totaled $525.3 million for 2024 compared with $532.7 million in 2023. Net cash provided by operating activities for the year ended December 31, 2024 was $59.5 million compared with $115.3 million for the same period in 2023. Free Cash Flow totaled $44.9 million in 2024 compared with $63.3 million in 2023.

Production for 2024 averaged 33.3 MBoe/d for a total of 12.2 MMBoe, comprised of 5.3 MMBbl of oil, 1.2 MMBbl of NGLs and 34.3 Bcf of natural gas. Full year 2023 production averaged 34.9 MBoe/d or 12.7 MMBoe in total and was comprised of 5.1 MMBbl of oil, 1.4 MMBbl of NGLs and 37.6 Bcf of natural gas.

For the full year 2024, W&T’s average realized sales price per barrel of crude oil was $75.28 and $23.08 per barrel of NGLs and $2.65 per Mcf of natural gas. While the realized pricing for oil and natural gas were down year-over-year, the production mix was more weighted toward oil in 2024, thus the equivalent sales price for 2024 was $42.23 per Boe, which was 3% higher than the equivalent price of $41.16 per Boe realized in 2023. For 2023, the Company’s realized crude oil sales price was $75.52 per barrel, NGL sales price was $22.93 per barrel, and natural gas price was $2.93 per Mcf.

For the full year 2024, LOE was $281.5 million compared to $257.7 million in 2023. While LOE increased year-over-year in 2024 due to increased workover and facility investments, higher oil production and costs from the acquisition of additional properties in January 2024 and September 2023, W&T’s LOE for 2024 was 10% below the midpoint guidance for LOE as the Company was able to mitigate some of these increased costs through synergies from the asset acquisitions.

Gathering, transportation, and production taxes totaled $28.2 million in 2024, an increase from the $26.3 million in 2023.

For the full year 2024, G&A was $82.4 million, which was a 9% increase over the $75.5 million reported in 2023. The increase year-over-year is primarily due to increased salary and benefits costs and non-recurring legal fees that were somewhat offset by lower accruals for short-term incentives. On a per unit basis, G&A per Boe was $6.76 in 2024, up from $5.93 per Boe in 2023. G&A increased on a per Boe basis primarily due to lower production.

OPERATIONS UPDATE

Well Recompletions and Workovers

During the fourth quarter of 2024, the Company performed two workovers and two recompletions that positively impacted production for the quarter. W&T plans to continue performing these low cost and low risk short payout operations that impact both production and revenue.

Year-End 2024 Proved Reserves

The Company’s year-end 2024 SEC proved reserves were 127.0 MMBoe, compared with 123.0 MMBoe at year-end 2023. In 2024, W&T recorded positive performance revisions of 5.0 MMBoe, and acquisitions of reserves of 21.7 MMBoe, which were offset by 10.5 MMBoe of negative price revisions and 12.2 MMBoe of production for the year. During 2024, W&T continued to focus on reducing Net Debt while identifying and executing attractive acquisitions. Successful workovers, operational excellence and acquisitions allowed W&T to replace 219% of production with new reserves.

The SEC twelve-month first day of the month average spot prices used in the preparation of the report for year-end 2024 were $76.32 per barrel of oil and $2.13 per MMBtu of natural gas. Comparable prices used for the prior year report were $78.21 per barrel of oil and $2.64 per MMBtu of natural gas. The PV-10 of W&T’s proved reserves at year-end 2024 increased 14% to $1.2 billion from $1.1 billion at year-end 2023, driven primarily by an increase in oil reserves due to the acquisition in January 2024 and by positive reserve performance revisions which were somewhat offset by lower SEC pricing.

Approximately 51% of year-end 2024 proved reserves were liquids (41% crude oil and 10% NGLs) and 49% natural gas. The reserves were classified as 52% proved developed producing, 31% proved developed non-producing, and 17% proved undeveloped. W&T’s reserve life ratio at year-end 2024, based on year-end 2024 proved reserves and 2024 production, was 10.4 years.

2025 Capital Investment Program

W&T’s capital expenditure budget for 2025 is expected to be in the range of $34.0 million to $42.0 million, which excludes potential acquisition opportunities. Included in this range are planned expenditures related to asset integrations as well as ongoing costs related to the acquisitions for facilities, leasehold, seismic, and recompletions.

Plugging and abandonment expenditures are expected to be in the range of $27.0 million to $37.0 million. The Company spent approximately $40 million on these costs in 2024.

KeyFacts Energy: W&T Offshore US Gulf of Mexico country profile

KEYFACT Energy

KEYFACT Energy