Talos Energy announces its operational and financial results for the three and twelve months ended December 31, 2024. Talos also announced its year-end 2024 reserves figures and 2025 operational and financial guidance.

Fourth Quarter 2024 and Recent Highlights

- Production of 98.7 thousand barrels of oil equivalent per day ("MBoe/d") (70% oil, 79% liquids).

- Net Loss of $64.5 million, or $0.36 Net Loss per diluted share, and Adjusted Net Income of $15.2 million, or $0.08 Adjusted Net Income per diluted share.

- Adjusted EBITDA of $361.8 million.

- Upstream capital expenditures of $133.2 million, excluding plugging and abandonment and settled decommissioning obligations.

- Net cash provided by operating activities of $349.3 million.

- Adjusted Free Cash Flow of $164.0 million.

- Paid off the balance of Talos's credit facility, bringing leverage to 0.8x (Net Debt / Pro Forma LTM Adjusted EBITDA)*.

- Successfully drilled Katmai West #2 well a month faster than expected and under budget.

Full Year 2024 Highlights

- Production of 92.6 MBoe/d (71% oil, 80% liquids).

- Net Loss of $76.4 million, or $0.44 Net Loss per diluted share, and Adjusted Net Loss of $26.2 million, or $0.15 Adjusted Net Loss per diluted share, excluding Talos's Carbon Capture & Sequestration ("CCS") business.

- Adjusted EBITDA of $1,297.7 million, excluding CCS.

- Upstream capital expenditures of $489.5 million, excluding plugging and abandonment and settled decommissioning obligations.

- Net cash provided by operating activities of $962.6 million.

- Adjusted Free Cash Flow of $511.2 million, excluding CCS.

- Year-end 2024 proved reserves of 194.2 million barrels of oil equivalent ("MMBoe") with a PV-10 value of $4.2 billion.

Talos Interim Chief Executive Officer, Co-President and General Counsel William Moss stated,

"Talos had a strong fourth quarter and a solid finish to 2024, with our operations performing well and achieving key objectives for the year. We look forward to Paul Goodfellow joining Talos as our President, Chief Executive Officer and member of the Board in the next few days. The Talos Board is confident that Paul's extensive expertise in oil and natural gas, especially in deepwater operations, combined with his strategic judgment and proven track record, will play a vital role in advancing Talos. Under Paul's leadership, we expect to remain focused on leveraging our strengths in deepwater exploration and production to deliver value for all shareholders."

Production Updates:

Katmai West: In December 2024, Katmai West #2 well was drilled under budget and a month faster than expected, encountering over 400 feet of gross hydrocarbon pay with excellent rock properties. First production is expected later in the second quarter 2025. The strong performance from Katmai West #1 well, and the successful appraisal from Katmai West #2 well, have nearly doubled the proved estimated ultimate recovery ("EUR" )(1) of Katmai West field to approximately 50 MMBoe gross, which further affirms Talos's estimated gross resource potential of approximately 100 MMBoe. The greater Katmai area is estimated to contain up to a total resource potential of 200 MMBoe. Talos, as operator, holds a 50% working interest ("W.I."), with entities managed by Ridgewood Energy Corporation holding the other 50% in Katmai West field.

Sunspear Completion: Talos recently commenced completion operations on Sunspear with the West Vela deepwater drillship and expects first production late in the second quarter 2025. Talos projects production to be approximately 8-10 MBoe/d gross. Sunspear will be tied back to the Talos operated Prince platform. Talos holds a 48.0% W.I., an entity managed by Ridgewood Energy Corporation holds a 47.5% W.I., and an undisclosed partner holds a 4.5% W.I.

Exploitation and Exploration Updates:

Daenerys: Talos anticipates focusing on drilling operations on the Daenerys well in the second quarter 2025. Talos holds a 30% W.I.

Monument Discovery Farm-in: Talos recently agreed to increase its interest in the Monument discovery to a 29.76% W.I., up from 21.4% W.I. Monument is a large Wilcox oil discovery in Walker Ridge blocks 271, 272, 315, and 316. It will be developed as a subsea tie-back to the Shenandoah production facility in Walker Ridge. First production is expected between 20–30 MBoe/d gross by late 2026 under restricted flow due to facility rate constraints. There is an additional 25–35 MMBoe drilling location adjacent to the discovery that could extend the resource. Other partners include Beacon as operator with a 41.67% W.I. and Navitas Petroleum with a 28.57% W.I.

Other Business Developments

Chief Executive Officer Transition: Paul Goodfellow will become Talos's President and Chief Executive Officer and a member of the Talos Board of Directors, effective March 1, 2025. Mr. Goodfellow has over 30 years of domestic and international experience in the oil and natural gas industry, having led Shell's global deepwater business and overseeing Shell's internal audit function.

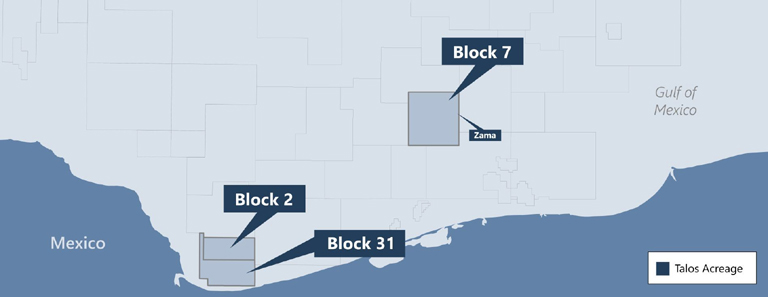

Sale of Mexico Interest: In December 2024, Talos entered into an agreement to sell an additional 30.1% interest in Talos Mexico to a subsidiary of Grupo Carso, S.A.B. de C.V. ("Carso") for $49.7 million in cash, with an additional $33.1 million due upon first oil production from the Zama Field, for an aggregate price of $82.7 million (the "Pending Transaction"). Upon consummation of the sale, Talos Mexico will be owned 20.0% by Talos Energy and 80.0% by Carso. Talos Mexico holds a 17.4% interest in the Zama Field. The Pending Transaction is expected to close during 2025 upon satisfaction of customary closing conditions and the receipt of all regulatory approvals. Upon achievement of commercial production from the Zama Field, Talos anticipates receiving $82.9 million in cash contingent considerations, comprised of approximately $33.0 million relating to the Pending Transaction and $49.9 million from the sale of a 49.9% equity interest in Talos Mexico to Carso which occurred in September 2023.

(1) EUR is calculated as the sum of proved reserves remaining as of a given date and cumulative production as of that date. EUR is not a measure of "reserves" prepared in accordance with SEC guidelines

Production

Production for the fourth quarter and full year 2024 was 98.7 MBoe/d ( 70% oil, 79% liquids) and 92.6 MBoe/d (71% oil, 80% liquids), respectively. For the full year 2025, production is expected to range from 90.0 to 95.0 MBoe/d, consisting of 69% oil and 79% liquids.

Reserves

As of December 31, 2024, Talos had proved reserves of 194.2 MMBoe, comprised of 74% oil and 81% liquids.

Upstream Capital Expenditures

Upstream capital expenditures for the fourth quarter and full year 2024, excluding plugging and abandonment and settled decommissioning obligations, totaled $133.2 million and $489.5 million, respectively.

KeyFacts Energy: Talos Energy US Gulf of Mexico country profile l Talos Energy Mexico country profile

KEYFACT Energy

KEYFACT Energy