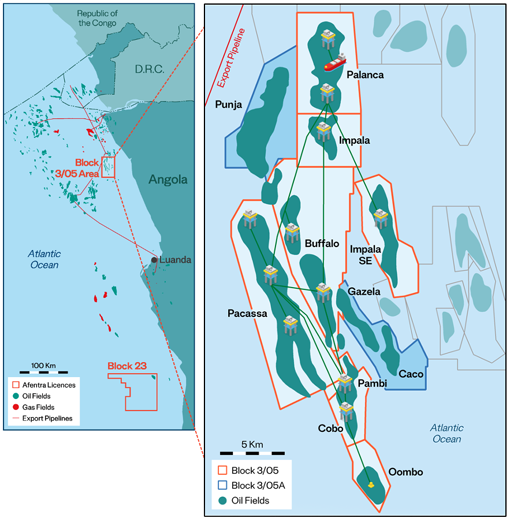

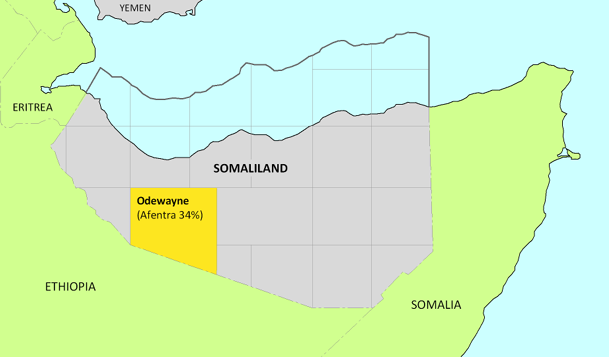

Afentra’s portfolio is comprised of an 30% non-operated interest in the long-life, offshore production Block 3/05 in Angola, and a 21.33% interest in the adjacent Block 3/05A offering additional development potential. In addition, Afentra has a 40% non-operated interest in the highly prospective Block 23 in Angola. Onshore Angola, Afentra has a 45% non-operated interest in both the exploration Blocks KON 19 & 15 located in the western part of the Onshore Kwanza Basin. Afentra also holds a 34% non-operated (carried) interest in the Odewayne Block, onshore Somaliland.

Afentra’s entry into Angola in May 2023 saw the Company establish a foothold in a key target geography with a wealth of future growth opportunities. Afentra is acquiring interests in quality assets with scope to enhance and extend production alongside improving environmental performance, while positioning itself as a key stakeholder to support state-owned Sonangol with its transition strategy.

ANGOLA

3/05

Block 3/05, operated by Sonangol, is a material shallow water production asset with the potential to deliver significant upside value. The long-life asset benefits from existing infrastructure across the portfolio of 8 fields and holds in excess of 3 billion barrels of light oil in place. As of end 2022 c. 1.35 billion barrels has been produced (~42% recovery factor). Afentra’s 30%* interest in Block 3/05 provides certified 2P reserves of 32.9 mmbbls and 2C resources of 13.1 mmbbls net to Afentra (CPR estimates as of 1 January 2023) and net production in excess of 6,500 bbl/d on a gross average production of 20,180 bbl/d for the year 2023.

Importantly, in the next few years, sustaining current production levels relies on re-instating and sustaining the waterfloods in tandem with integrity, maintenance and existing well stock optimisation projects. These activities are all low cost, rapid capital return activities.

Afentra sees significant additional value creation potential in Block 3/05 with a portfolio of projects identified to potentially increase production. This will consist of, but not be limited to, the following:

Integrating near term asset integrity revitalisation and infrastructure upgrades.

Production optimisation and debottlenecking opportunities.

Optimisation of the existing well stock including workovers, access to behind pipe oil pools and optimisation of artificial lift applications.

Longer cycle brownfield development opportunities such as in-fill drilling and the tie-in of undeveloped discoveries.

Further upside not included in ERCE’s resource case have been identified and are under review, including additional infill drilling at the Bufalo, Pacassa and Oombo Fields, alongside potential access to shallower reservoirs.

The asset maintains a strong safety track record and the JV is working to improve ESG characteristics, including decreasing emissions in line with zero flaring by 2030 and gas utilisation opportunities.

Block 3/05A

Block 3/05A, operated by Sonangol, contains 3 appraised light oil discoveries with a combined STOIIP in excess of 300 mmbbls from which only 2.4 mmbbls has been recovered to date (c. 1% recovery factor). The existing Block 3/05 infrastructure and synergies with the application of fit for purpose technology provides the opportunity for production growth potential via tie backs. Our multi-disciplined team is taking a holistic view of Block 3/05A and Block 3/05 together, working with the operator and contractor group to progress these opportunities towards value generating appraisal and development.

Afentra sees significant further value in the Block 3/05A asset in tandem with the Block 3/05 asset that it surrounds, consisting of but not limited to the following:

An integrated gas management plan across both Blocks 3/05A and 3/05 to develop these resources responsibly given the high gas oil ratio of the Punja field reservoirs.

Long term testing of the Gazela field is underway providing valuable data to inform the next steps for the Caco-Gazela Field development.

Progression of Punja and Caco-Gazela will be carried out in a phased approach to gain appraisal data, reduce uncertainty and generate cash flow through monetising early production.

Screening and ranking multiple development concepts to reach an optimised FID.

Block 23 (working interest 40%)

Block 23 is a 5,000 km² exploration and appraisal block located in the Kwanza basin in water depths from 600 to 1,600 meters and has a working petroleum system. Whilst the large block is covered by modern 3D and 2D seismic data sets, with no outstanding work commitments remaining, much of the block remains under-explored. The block contains the Azul oil discovery, the first deepwater pre-salt discovery in the Kwanza basin. This discovery made in carbonate reservoirs has oil in place of approx. 150 mmbbls and tested at flow rates of approx. 3,000 – 4,000 bbl/d of light oil.

The block contains the Azul oil discovery, the first deepwater pre-salt discovery in the Kwanza basin. This discovery made in carbonate reservoirs has oil in place of approx. 150 mmbbls and tested at flow rates of approx. 3,000 – 4,000 bbl/d of light oil.

Block KON 19 & 15

Afentra has a 45% non-operated interest in both the exploration Blocks KON 19 & KON 15 located in the western part of the Onshore Kwanza Basin.

Both KON 19 & KON 15 are high graded by Afentra as they have good signs of a working petroleum system and contains wells that were drilled on salt structures with light oil recovered to surface in one and oil shows in others from post and pre-salt reservoirs. There is limited 2D Seismic data. The blocks are adjacent to legacy oil fields that are currently being appraised for potential re-development and existing infrastructure allowing rapid commercialisation.

The Onshore Kwanza Basin, covering 25,000 Sqkm is an under-exploited, over-looked proven hydrocarbon basin and has numerous oil fields and discoveries dating back to 1955. The basin produced over 15,000 bopd in the 1960’s and 1970’s from post-salt traps.

SOMALILAND

Somaliland offers one of the last opportunities to target an undrilled onshore rift basin in Africa. The Odewayne block, with access to the Berbera deepwater port less than a 100km to the north, is ideally located to commercialise any discovered hydrocarbons. This large, under-explored, frontier acreage position covers 22,840 km², the equivalent of c. 100 UK North Sea blocks.

Afentra inherited its carried interest in Odewayne from its previous form as Sterling Energy, and through its wholly owned subsidiary (Afentra East Africa Limited), holds a 34% working interest in the PSA. Afentra is fully carried by Genel Energy Somaliland Limited for its share of the costs of all exploration activities during the third and fourth periods of the PSA.

Recent activity on the Block includes the re-interpretation of seismic data and seep analysis in order to develop an appropriate forward work program to further evaluate the licence prospectivity.

LEADERSHIP

Paul McDade Chief Executive Officer

Ian Cloke Chief Operating Officer

Anastasia Deulina Chief Financial Officer

CONTACT

Afentra plc

10 St. Bride Street

London, EC4A 4AD

info@afentraplc.com

KeyFacts Energy: Afentra Somaliland country profile l Afentra Angola country profile

KeyFacts Energy: Company Profile

KEYFACT Energy

KEYFACT Energy