Africa Energy Corp. has received governmental approval and closed the previously announced transactions to acquire an effective 4.9% interest in the Exploration Right for Block 11B/12B offshore South Africa.

Garrett Soden, Africa Energy's President and CEO, commented,

"We are excited to partner with Total, Qatar Petroleum and CNRI on Block 11B/12B in South Africa. This is a unique opportunity for us to explore with majors in one of the most prospective areas offshore the African continent. We look forward to spudding the Brulpadda-1AX well this month."

Africa Energy holds 49% of the shares in Main Street 1549 Proprietary Limited ("Main Street 1549"), which has closed separate farmin transactions with Total E&P South Africa BV ("Total"), a wholly-owned subsidiary of Total SA, and CNR International (South Africa) Limited ("CNRI"), a wholly-owned subsidiary of Canadian Natural Resources Limited, to acquire 5% from each for an aggregate 10% participating interest in Block 11B/12B (4.9% net to Africa Energy).

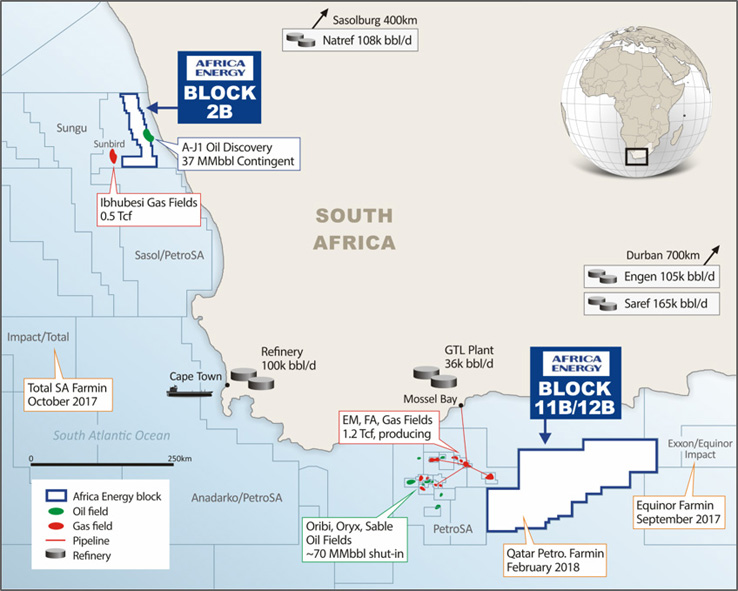

Africa Energy assets in South Africa Source: Africa Energy

Block 11B/12B is located in the Outeniqua Basin approximately 175 kilometers off the southern coast of South Africa. The block covers an area of 18,734 square kilometers with water depths ranging from 200 to 2,000 meters. After closing, Total, as operator, will have a 45% interest in Block 11B/12B, while Qatar Petroleum and CNRI will have 25% and 20% interests, respectively.

The Brulpadda-1AX exploration well will be drilled in 1,432 meters of water by the Odfjell Deepsea Stavanger semi-submersible rig to a total depth of 3,420 meters subsea. The well will test the oil potential in a mid-Cretaceous aged deep marine fan sandstone system within stratigraphic closure. Drilling and evaluation of the well is expected to take approximately 85 days.

At closing, Africa Energy paid an aggregate of US$16.5 million for its share of the Main Street 1549 transactions. The closing payment included past exploration expenditures, interim period costs, an agreed carry amount for Brulpadda-1AX well costs and the applicable Value Added Tax, which is expected to be recovered.

KEYFACT Energy

KEYFACT Energy