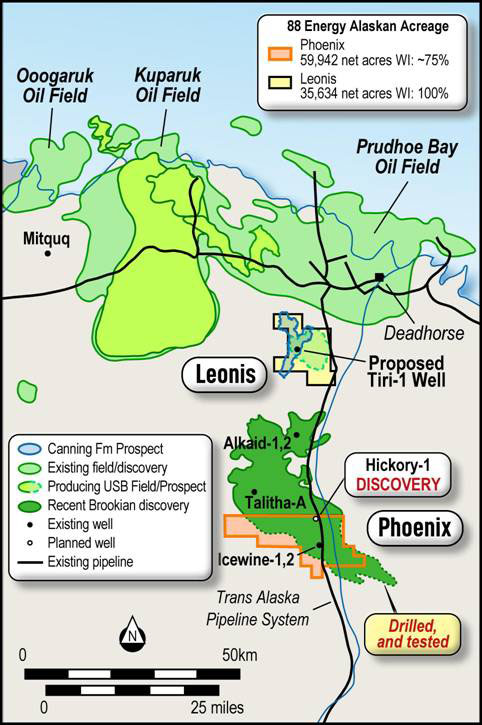

88 Energy has entered into binding terms for a Farmout Participation Agreement (PA) with Burgundy Xploration LLC (Burgundy) in relation to Project Phoenix, located on the North Slope of Alaska. Under the agreement, 88 Energy's wholly owned subsidiary, Accumulate Energy Alaska, will be provided with a full carry for all costs associated with the upcoming horizontal well programme, including an extended flow test currently scheduled for H1 CY26.[1]

Transaction Highlights

- Burgundy to fully fund up to US$39 million (approx. A$60 million) of Project Phoenix's total gross future work programme costs in exchange for up to an additional 50% Working Interest (WI) in Project Phoenix from 88 Energy.

- Provides a clear funding avenue to advance Project Phoenix towards a final development decision via a two-phase farm-in arrangement.

- Phase 1: Burgundy to fund US$29 million (approx. A$45 million) for CY25/26 work programme, including drilling of a horizontal well and production testing scheduled for H1 CY26 (88E fully carried, 88E WI post Phase 1 farmout 35%)

- Phase 2: Upon Phase 1 Success; Burgundy to fund up to US$10 million (approx. A$15 million) for an additional well or other CAPEX programme (88E carry up to US$7.5 million, based on the current 75%, with 88E WI post Phase 2 farmout to 25%).

- Upon completion of the PA, Burgundy will assume the role of operator, allowing 88 Energy to focus on the advancement and de-risking of Project Leonis.

- The PA remains subject to conditions precedent customary for transactions of this nature, including Burgundy securing necessary capital during CY25.

Managing Director, Ashley Gilbert, commented:

"We are delighted to announce that we have reached a mutually beneficial agreement with our long-term joint venture partner, Burgundy, to advance Project Phoenix towards future production. Burgundy's commitment to the project recognises 88 Energy's accomplishments since 2022 and value added to the acreage during this time, as well as validation of the broader region and the opportunity presented on the Alaskan North Slope.

Today's announcement crystalises a funding pathway for the asset, enabling critical production testing at the Hickory-1 multi reservoir discovery - a key step in proving the project's economics and potential future commerciality. To have achieved a work-programme carry in just two years of exploration and advancement since the drilling of Hickory-1, underscores the implied value of the asset and serves as a blueprint for our strategy moving forward. We look forward to our continued work with Burgundy as they progress towards assuming operatorship of the project ahead of the scheduled CY26 drilling programme."

Detailed Transaction Terms:

The Farmout Participation Agreement (PA) is structured in two phases, under which Burgundy will provide a full financial carry for 88 Energy's share of costs for the CY25-27 work programme at Project Phoenix, funding up to US$29.5 million (approx. A$45 million) of 88 Energy's future share costs to earn up to an additional 50% working interest (WI).

Phase 1:

- Burgundy to provide a carry of ~US$22 million (approx. A$33 million) of 88 Energy's share (based on current WI of ~75%) of the budgeted CY25/26 work programme (gross cost of US$29 million).

- The Phase 1 programme includes lease costs, drilling a horizontal well, and completing an extended flow test from the existing Franklin Bluffs gravel pad.

- In return, Burgundy will initially earn an approximately 39.3% WI in Project Phoenix.

- Upon completion of Phase 1, Burgundy's WI will increase to 65% (from 25%), while 88 Energy's WI will decrease to 35% (from 75%).

Phase 2 (Contingent of Phase 1 Results):

- Burgundy will provide an additional financial carry to 88 Energy of up to US$7.5 million (approx. A$11.6 million, based on 88E's 75% WI) to fund the costs associated with drilling an additional well or an alternative capital programme.

- In return, Burgundy may earn an additional 10% WI, increasing its total ownership to 75%, while 88 Energy's WI could decrease to 25%.

- 88 Energy retains the option to reduce the carry by US$3.75 million, limiting the WI earn-in to 5%, allowing 88 Energy to retain a 30% WI in Project Phoenix.

Conditions and Approvals:

The PA is subject to relevant government and other approvals, as well as customary conditions precent for farm-out transactions.

The PA including a long-stop date of 31 December 2025 for Burgundy to secure Phase 1 funding, unless extended by mutual consent.

88 Energy and Burgundy have agreed on a payment arrangement for the remaining balance of outstanding cash calls, with Burgundy initiating a US$1 million payment prior to signing the PA and the residual balance, which includes interest and fees, to be settled in conjunction with Burgundy's funding activities.

[1] Burgundy's ability to provide a full carry to 88 Energy is contingent on Burgundy successfully completing their fund-raising program during CY25.

KeyFacts Energy: 88 Energy US Alaska country profile l KeyFacts Energy: Farm-in agreements

KEYFACT Energy

KEYFACT Energy